The window of opportunity for initial public offerings slammed shut in 2022 amid heightened volatility and plunging valuations. The global technology sector, in particular, experienced a sharp decline—a 60% drop from 661 IPOs in 2021 to a mere 221 in 2022. So far in 2023, the number of new listings remains stubbornly low.

Counterintuitive as it may seem, today’s adverse market conditions provide an ideal moment for technology startups to lay the groundwork for going public. With preparation typically taking 12 to 18 months, initiating the process now will ensure that companies are positioned at the front of the queue once capital market conditions improve and the IPO window reopens.

Meticulous preparation will be essential to make a splash in the next IPO wave. Tech startups must demonstrate a clear path to profitability, provide industry-specific evidence of robust growth, assemble an experienced management team, and confirm their operational readiness for the public sphere. By addressing these topics, startups can craft a strong business plan and compelling equity story that set them apart from the competition and secure their spot as industry trailblazers.

Economic Headwinds Shut the IPO Window in 2022

Fueled by low interest rates, technology companies enjoyed a period of substantial growth in the years leading up to 2021. Although the pandemic disrupted macroeconomic conditions in 2020 and 2021, many of these companies benefited from the accelerated adoption of digitization and virtual experiences. From 2012 through 2021, the market capitalization of public tech companies grew by a factor of 7.5, compared with 3.75 for the S&P 500, 3.0 for the Dow Jones Industrial Average, and 1.3 for the FTSE 100.

But 2022 marked a downturn. Global equity markets encountered stiff headwinds as central banks tightened monetary policies to combat inflation. Concurrently, the Russia–Ukraine conflict, the European energy crisis, and supply chain disruptions fueled concerns of a worldwide recession. Moreover, in 2023, the collapse of US regional banks that supported many startup fundings added to investors’ anxiety and triggered a sharp decline in bank stocks. These factors led to heightened uncertainty and volatility in global markets.

Against this volatile backdrop, valuations of the top five public technology companies decreased by approximately $2.5 trillion in 2022, representing more than 25% of the sector’s total value loss. The valuations of Apple and Microsoft declined by 25%, while Amazon and Alphabet (Google’s parent company) shed approximately 40% of their value. The top five private tech companies also lost value in 2022, albeit at a lower rate of 15%.

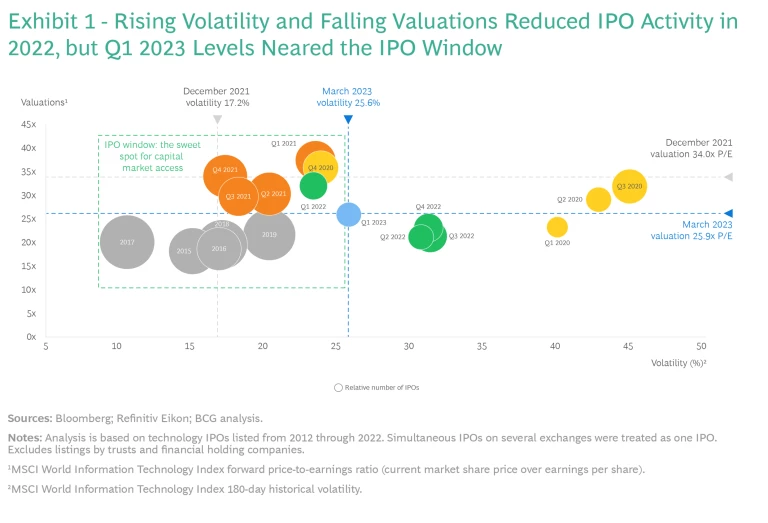

These developments shut the IPO window—that is, the sweet spot for capital market access that occurs when valuations are high and volatility is low. As shown in Exhibit 1, from December 2021 through March 2023, the average 180-day historical volatility of the MSCI World Information Technology Index increased by 50%, and the index’s average valuation (forward price-to-earnings multiple) fell by nearly 25%.

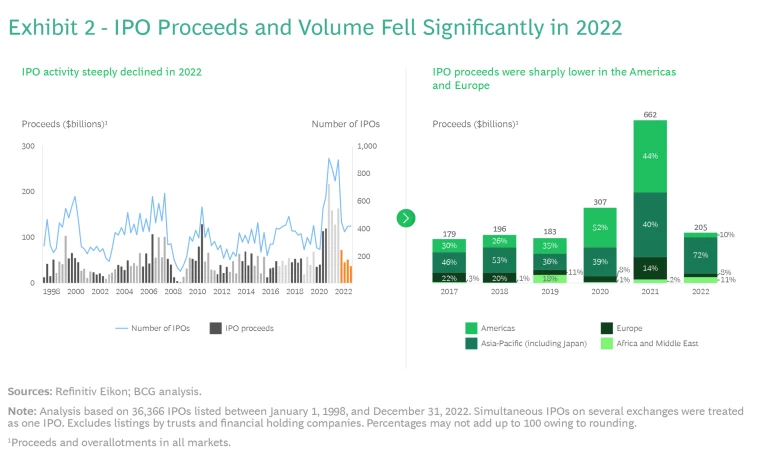

Global IPO numbers plunged in this challenging environment. (See Exhibit 2.) The gross proceeds of IPOs fell by more than 70% compared with 2021. The biggest contributor to the sharp drop was a 90% decline in proceeds in North and South America compared with 2021. European IPO proceeds declined by 70%, despite Porsche's landmark IPO, which raised $16.8 billion (one of the stock launches in BCG’s data set of IPOs; see “About the Study”).

About the Study

About the Study

To arrive at the sample, we performed several data-cleansing steps, such as removing duplicate entries for simultaneous listings on several exchanges and excluding trusts and financial holding companies. Furthermore, we did not consider any secondary issuances—that is, capital increases after an IPO. The proceeds figure includes capital raised in all markets, including any overallotments.

Based on our review of multiple databases, we defined the technology sector and grouped these companies into nine broad categories:

- Hardware and robotics

- Software

- Electronics and semiconductors

- Digital, IT, and technology

- Biotech and medtech

- Fintech

- Cleantech

- E-commerce and marketplace

- Other (including education tech, internet security, search engine, and social media and networking companies)

Although the global volume of technology IPOs declined by 60%, the smaller cohort included some notable companies. These included Mobileye, a developer of autonomous-driving technologies; Technoprobe, a semiconductor producer; and HilleVax, a biotech company.

There was also a sharp decline in the number of startups merging with special-purpose acquisition companies (SPACs) as an alternative route to public markets. (See “SPACs Lose Their Luster.”)

SPACs Lose Their Luster

SPACs Lose Their Luster

But the SPAC frenzy led to heightened regulatory scrutiny and a proposal for more stringent regulations by the US Securities and Exchange Commission. Moreover, many startups experienced disappointing stock performance after going public via a SPAC merger. As a result, investor interest in SPACs has declined and, for most startups, these vehicles are no longer considered a viable alternative to traditional IPOs.

When Will the IPO Window Reopen?

The IPO market’s revival is dependent on several factors:

- Reduced Market Volatility. The high degree of volatility during periods of high uncertainty often causes companies to postpone their IPO listing. They recognize that investors are wary of putting their money into new companies when the market is unpredictable. Instead, investors prefer to retain their capital or channel it into more established companies with a proven track record of success. Additionally, rapid fluctuations in stock prices exacerbate the challenges of pricing an IPO and ensuring a strong debut as a public company. As a prerequisite to reopening the IPO window, companies and investors must gain confidence that market volatility is returning to average levels.

- Investor Sentiment and Demand. Investors’ behavior is primarily driven by investor sentiment: their expectations for future cash flows and potential investment risks. The strength of this sentiment plays a pivotal role in the pricing of IPOs. Positive investor sentiment can stimulate a substantial demand for shares, thereby potentially supporting IPO pricing. Today, sentiment in the broader investor community is unfavorable amid the prevailing macroeconomic uncertainty. Companies contemplating an IPO therefore need to monitor the evolution of investor sentiment when assessing the right time to go public.

- Higher Valuations. A high valuation indicates positive investor sentiment and confidence in the company's prospects. This can attract more investors and generate excitement for an IPO, potentially driving share prices higher. Interest rate decisions by the US Federal Reserve System and other central banks, as well as the potential long-term effects of the recent turmoil in the banking sector, will play important roles in determining when valuations and investor sentiment rebound.

- Companies’ IPO Readiness. Companies' readiness to take advantage of favorable market conditions creates a virtuous circle. A larger supply of IPO-ready companies can stimulate investor interest and demand, which, in turn, promotes IPO activity. Moreover, when multiple companies in the same industry are prepared to go public, it spurs competition among them. This competitive environment could prompt these companies to expedite their IPO plans in order to gain an edge in the race to secure public funding.

Although the timing is uncertain, the historical cyclicality of these factors means they will eventually turn favorable, causing the IPO window to reopen. Tech startups seeking to raise capital in the public market should use the intervening period to prepare, as IPO planning, preparation, and execution typically take 12 to 18 months. This effort is the culmination of a journey that entails multiple funding rounds. (See “The Timeframe for Going Public Varies by Tech Industry.”)

The Timeframe for Going Public Varies by Industry

The Timeframe for Going Public Varies by Industry

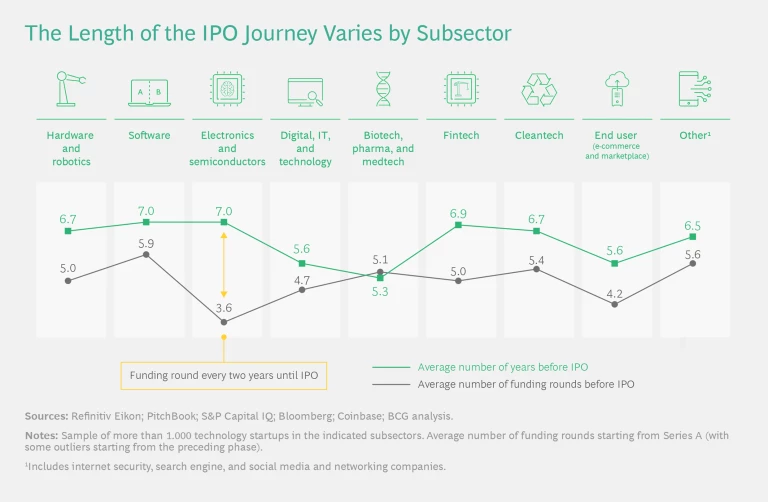

Notably, there are industry-specific variations on the timeline and number of funding rounds. (See the exhibit.) Electronics and semiconductor companies take the longest time to an IPO (approximately seven years) but require the fewest funding rounds (approximately 3.6), with each funding round lasting an average of approximately two years.

In contrast, health care tech companies tend to require a funding round each year before their IPO, with an average of five funding rounds and a five-year timeline for an IPO. This accelerated pace can be attributed to these companies’ high R&D expenses as a percentage of sales, coupled with low revenues during Phase 1 clinical trials, which is typically when they go public. For example, Arcellx, a prerevenue biotech company, raised approximately $140 million in its February 2022 IPO and used the proceeds to advance its Phase 1 study. The IPO occurred 5.4 years after the company’s first funding round, and the company raised six rounds of funding before going public.

What Does it Take to Achieve a Successful IPO?

Embarking on the IPO journey can seem overwhelming, yet there is an encouraging statistic: roughly 90% of tech companies that initiate the IPO process ultimately succeed in going public. More than 60% of these newly listed companies see positive share price performance within the first six months after the IPO. Companies whose share prices rose by approximately 100% within this six-month period include biotech players Vera Therapeutics and Regencell Bioscience and software companies Snowflake and Unity Software.

By carefully preparing for and navigating the IPO process, tech companies can capitalize on the potential for significant growth and shareholder value creation . To succeed, they should focus on a number of best practices. To succeed, they should focus on a number of best practices, some essential for all tech companies and some specific to individual subsectors.

Clearly explain the use of proceeds. The “use of proceeds” section of the prospectus should clearly explain how the company will utilize the funds raised in the IPO. Clarity is essential to helping investors understand the company's future direction and growth strategy. Tech companies typically allocate IPO proceeds to working-capital requirements, capital expenditures to fuel long-term growth, product development , and debt repayment. For example, Airbnb's 2020 IPO raised $3.8 billion, with most of the proceeds earmarked for expanding the business and the remaining portion allocated to debt repayment.

Specify key differentiators. Companies seeking to go public should have compelling sources of differentiation to attract investors and thrive in public markets. Unique products or services, substantial market opportunities, and experienced management teams can help a company stand out and garner investor interest. For example, Coupang, a South Korean e-commerce company that went public in 2021, differentiated itself with fast, reliable delivery services made possible by its proprietary logistics network and innovative technology. The company’s business model is hard to replicate: it has the largest business-to-consumer logistics footprint in South Korea, millions of products, more than 100 fulfillment and logistics centers, and scalable technology.

Demonstrate revenue growth and a path to profitability. Tech companies must showcase a history of strong growth and a clear path to profitability. Many require substantial investments in R&D, marketing, and infrastructure before launching products. In addition, to scale quickly and capture market share, these companies may continue spending heavily after launch to acquire customers. This means that they may not be profitable before the IPO. An unclear path and longer timeframe to profitability add to uncertainty about returns, which could lead investors to apply higher valuation discounts. However, investors will be willing to support companies if they have a robust strategy for long-term growth and profitability. For example, to accelerate its profitability, the Indian food delivery app Zomato concentrated on increasing its commission per order and reducing advertising and sales promotion costs as a percentage of revenues.

Investors will be willing to support companies if they have a robust strategy for long-term growth and profitability.

Appoint experienced leadership. A strong management team instills confidence among investors and enhances a company's attractiveness. Experienced leaders can develop and implement strategic plans, maintain robust relationships with the investment community, and ensure effective financial-management systems. For example, CEO Dara Khosrowshahi and CFO Nelson Chai respectively joined Uber two years and one year before the company’s 2019 IPO. Meal delivery service DoorDash appointed Prabir Adarkar as CFO two years before its 2020 IPO.

Establish operational functions and processes. The importance of preparing the organization to operate as a public company cannot be overemphasized and often goes hand in hand with appointing experienced leadership. Companies must develop functions that may not have been necessary when they were private entities but are crucial when going public. To set up the appropriate organizational structures and processes, companies must take the following measures:

- Adapt corporate governance by appointing the executive board, setting a meeting cadence, and conducting performance reviews. It’s important to appoint independent directors who will provide an objective, outside perspective, as well as deep industry expertise.

- Set up the investor relations function, define the IPO communications strategies, and appoint personnel for the treasury and accounting function.

- Establish the necessary board committees, such as governance, compensation, and audit.

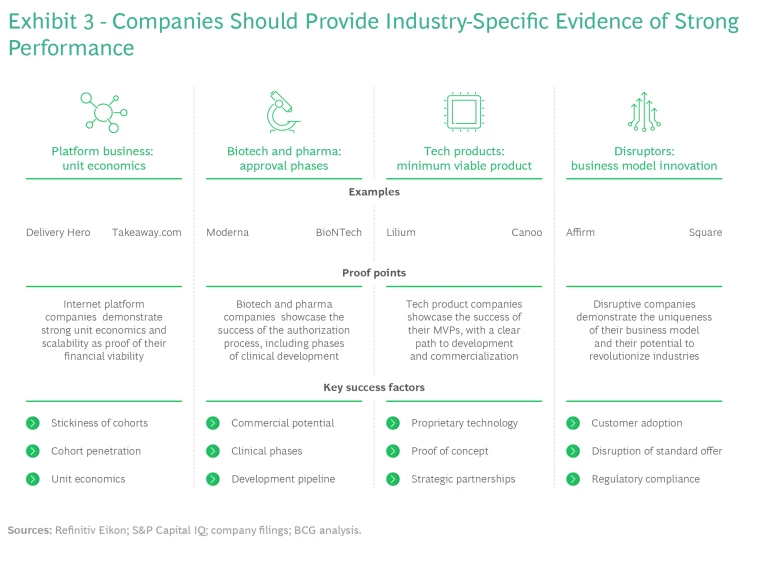

Provide subsector-specific proof points. Companies must present compelling evidence of their strong performance, in line with that of their specific subsector. (See Exhibit 3.) This allows investors to better understand key aspects of the business, such as the following:

- Platform business: describe unit economics and scalability. Internet platform companies need to showcase robust unit economics and scalability potential. For instance, Takeaway.com offered investors insight into its high rate of recurring orders from loyal customers, resulting in predictable revenue streams. The company also shared success stories from profitable pilots, such as in the Netherlands, to illustrate the potential for achieving profitability in other regions and at the overall corporate level.

- Biotech and pharma: highlight approval phases. Biotech and pharmaceutical companies should emphasize their success in the authorization process, including progression through the stages of clinical development. In preparing for its prerevenue IPO, Moderna gave investors details about products in clinical development, including descriptions of trial processes, stages of product development, and overall progress.

- Tech products: demonstrate a minimum viable product. Tech product companies must demonstrate a successful MVP and a well-defined path to further development and commercialization. For instance, Canoo Technologies, an electric-vehicle manufacturer that went public in December 2020, highlighted the unique aspects of its proprietary technology, working prototype, and strategic partnerships.

- Disruptors: showcase business model innovation. Disruptive companies need to underscore their unique business models and potential to revolutionize industries. Affirm, a buy-now, pay-later firm that went public in January 2021, focused investors on how its innovations would radically change the payments industry and reimagine commerce. It also outlined its strategy for increasing customer adoption.

Building a Strong Business Plan

These best practices provide the foundation for creating a robust business plan during the IPO preparation stage. A plan with the right substance and ambition is crucial to the offering’s success, even though securities regulations prohibit companies from fully disclosing the details to investors. The business plan provides the basis for the equity story, including an initial set of investment theses and a clear articulation of the IPO's strategic intent. Because the business plan and equity story are closely interconnected, their consistency is a critical success factor, and the company should therefore develop them in unison. The business plan will also support a strong capital market performance after the company goes public. It provides the financial targets that the management team must regularly review and deliver and that are explained to investors in the guidance statements.

Because the business plan and equity story are closely interconnected, their consistency is a critical success factor, and the company should therefore develop them in unison.

Developing a strong business plan early aids in clarifying a tech company’s competitive position and provides insights into the steps required to improve earnings and, in turn, boost the company’s valuation. For instance, to strengthen its business plan, Uber exited several unprofitable markets, including China, Russia, and Southeast Asia, to escape from intense competition and regulatory challenges. The company sold its operations in China and Southeast Asia to Didi Chuxing and Grab, respectively, and merged its Russian operations with Yandex Taxi.

Crafting a Compelling Equity Story

Crafting a powerful equity story is essential for technology companies as they strive to attract investments and have a successful public market debut. To persuade potential investors to participate in the IPO, this narrative outlines the company's growth prospects, competitive advantages, and potential for future success. An effective equity story is engaging and convincing, showcasing the unique aspects of the company that make it an attractive investment opportunity.

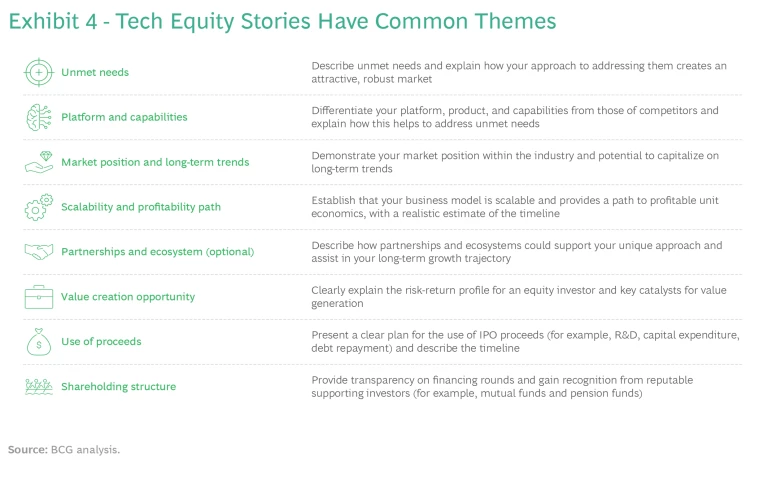

Compelling equity stories for technology companies have several common themes. (See Exhibit 4 for some of these.) Key elements include discussing the company's innovative products or services, proprietary technology, robust market position and long-term trends, and path to scaled operations and profitability. The narrative should provide an unbiased, external investor's perspective on the industry and company while conveying a long-term strategic vision supported by tangible guidance and a track record of successful performance.

Companies can use their strong business plans and equity stories to attract two types of supporting investors : anchor investors that buy a stake before the IPO process begins and cornerstone investors that acquire shares after the process is initiated but before the formal book building. These investors are typically well-known and respected players, such as large corporations or financial investors. Their investment in the IPO provides a stamp of approval that aids in selling the IPO to the broader investor community and promotes a higher listing price.

Featured Insights: BCG’s most inspiring thought leadership on issues shaping the future of business and society

Considering that meticulous IPO preparation requires a minimum of 12 to 18 months, technology startups that want to go public should use the current lull in IPO activity to lay the groundwork for their stock listing. Focus areas include optimizing their go-to-market strategy, refining their product-to-market fit, diversifying their product offerings by entering adjacent businesses, and outlining a path to profitability. To establish the prerequisites for a successful IPO, they must adapt their investor communications, restructure their governance, and prepare their businesses to meet reporting requirements. Thorough preparation and a compelling equity story are essential to presenting the company in the best light and smoothly navigating the intricacies of the IPO process . The IPO window will reopen when market conditions improve—to take advantage of the opportunity, tech startups should begin preparing today.