To keep up with the rapidly evolving cloud industry, BCG will be publishing the Cloud Cover series: regular snapshots of this dynamic area. Our goal is to share the latest cloud data, insights, and news, with a particular focus on three major cloud service providers (CSPs): Amazon Web Services (AWS), Microsoft’s Azure, and Google’s Cloud Platform. With well over half of the industry’s market share by revenue, these three CSPs significantly influence cloud trends in terms of services, sustainability commitments, global coverage, and growth and penetration.

In this inaugural snapshot, we will share our findings in these key areas of activity and also introduce the Nimbus Pricing Index (NPI), a rigorously standardized index designed to help executives answer some essential and vexing questions, including: What is the average list price per head for a basic cloud package? How do costs vary by region? What is the highest-priced location to operate in? What is the lowest priced? The NPI will finally allow companies to make real price comparisons over time and across geographies.

More on the NPI

The NPI is a packaged index, indicating the global average price of a standard cloud setup across the cloud vendors referenced above. The NPI provides a deep dive into cost variation over time and across locations, driven by factors such as tax rates, regulation, and costs of labor and infrastructure. The index

- Usage of Intel processors, four cores, and 16 GB of RAM, with a price term length of one year, no upfront payment, and shared tenancy, running on a Linux operating system

- 1 TB of standard non-archived storage, frequently accessed (at intervals of fewer than 30 days)

- 50 GB of data egress each month out of the CSP’s network to the Internet, and 50 GB of data egress to other regions using interregional ISP data exchanges

A few caveats: the pricing is indicative of the cost of a basic workload per head; it does not include additional or specialist services that would be compiled and charged at the enterprise level, nor does it reflect discounts built into overall contracts. Also, the index does not attempt to normalize for differences between vendor offerings outside of the factors specified above. For this reason, we avoid drawing conclusions between CSPs.

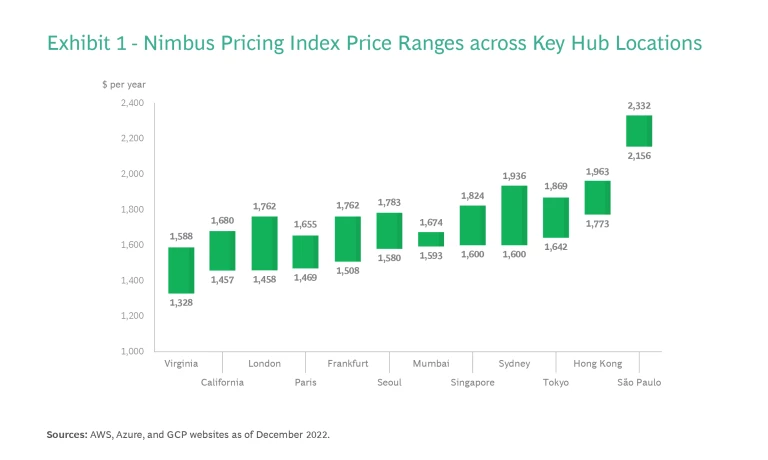

The NPI has already revealed some surprising, even counterintuitive, pricing insights that could influence cloud strategies . For example, in regions where all three vendors have a presence, the most affordable region is Virginia, which has a price point ranging from $1,328 to $1,588 a year. (See Exhibit 1.) But in Washington and Arizona, where only Azure has offerings, a cheaper option of $1,291 a year is available. That’s because Azure’s headquarters are in Washington, and Arizona offers exceptionally cheap storage. Meanwhile, the most expensive region where all three vendors have an offering is São Paulo, Brazil, where the price ranges from $2,156 to $2,332 a year. But an even pricier offering is available in Rio de Janeiro, where only Azure has an offering, at $2,745 a year.

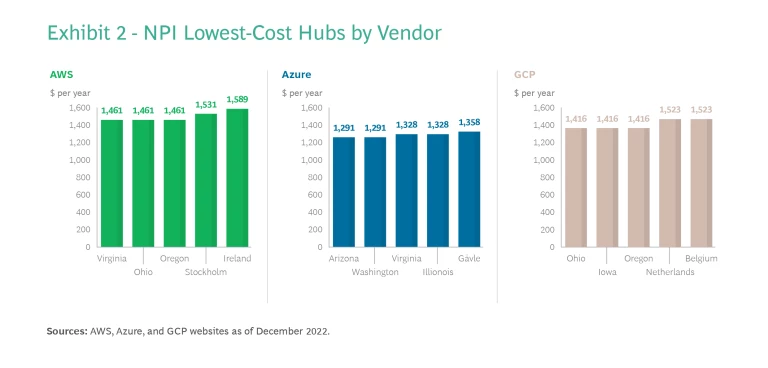

We also identified the five lowest-priced regions for each vendor. (See Exhibit 2.) It turns out that 10 of the 15 most affordable hubs are in the US. Sweden appears twice (Stockholm and Gävle), and Ireland, the Netherlands, and Belgium all appear once.

It’s significant that pricing for the new-generation cloud infrastructure has declined about 9% over the past five years as economies of scale and maturity have improved while pricing for the old-generation infrastructure has remained flat. Newer-generation machines offer higher energy efficiency, better performance, and cheaper storage, and cloud providers have passed some of these savings on to customers. Given these benefits, it behooves organizations to incorporate an infrastructure upgrade into their IT operations strategy.

New Cloud Services Fill Gaps

CSPs are collaborating with industry partners to address gaps in their cloud offerings and help organizations adopt services that improve innovation, agility, and scalability. These improvements can help organizations derive value faster and future-proof the business. As one of our survey respondents put it: “We want to build as little as we can. I really need good turnkey solutions on new AI workloads that work well on day one.” A few key areas where CSPs are looking to fill gaps include:

- Domain- and Industry-Specific Services. CSPs are collaborating with industry partners to build specialized cloud solutions that help customers accelerate time to value. These solutions include Amazon HealthLake, Google Cloud Healthcare API, and Azure Health Data Services.

- Next-Generation Data-Management Capabilities. CSPs are enhancing data-management tools so companies can easily ingest data from multiple, fragmented sources—for example, on-premise, multi-cloud, and edge.

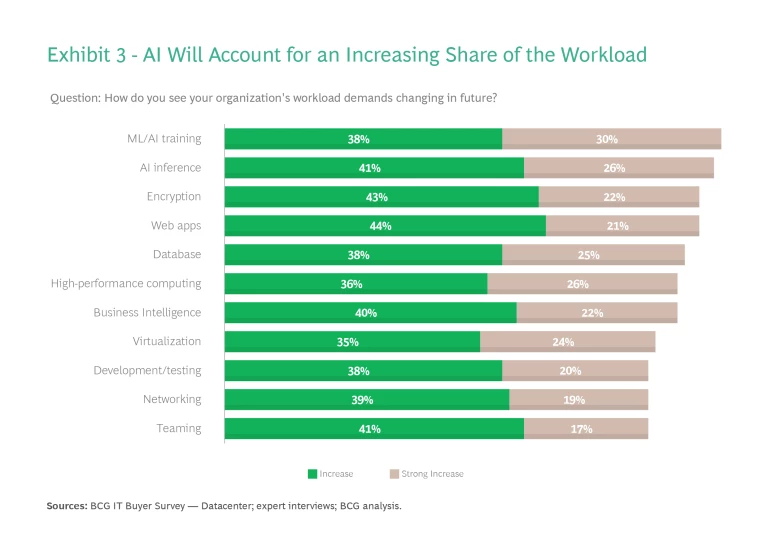

- Integrated Platforms and Processes for AI and Machine Learning. The demand for AI is growing quickly. (See Exhibit 3.) CSPs are investing to build innovative, out-of-the box AI capabilities that can reduce model training requirements, speed deployment, simplify and improve decisionmaking, and accelerate time to value. Such offerings include AI Launchpad and machine learning operations (MLOps).

Commitments to Sustainability

The three CSPs all claim to support customers’ sustainability and climate goals. Because running on-premise data centers consumes large amounts of power, cloud is cited as a powerful tool to reduce carbon footprints. Drivers of this improved level of sustainability include higher levels of server utilization, less idle infrastructure, and the use of more optimized hardware. Below is a roundup of CSPs’ recent sustainability commitments.

AWS plans to:

- Power operations with 100% renewable energy by 2025

- Achieve net-zero carbon emissions by 2040

- Become water positive by 2030 (that is, replenish more water than it consumes)

Azure plans to:

- Power operations with 100% renewable energy by 2025

- Become water positive by 2030

- Obtain zero-waste certification by 2030

- Become carbon negative by 2030

- Remove, by 2050, all the carbon Microsoft has released into the atmosphere since its founding in 1975

Google Cloud Platform plans to:

- Run all data centers on carbon-free energy by 2030

- Replenish 120% of the water it consumes by 2030

- Maximize the reuse of finite resources (for example, send zero waste to landfills from data centers)

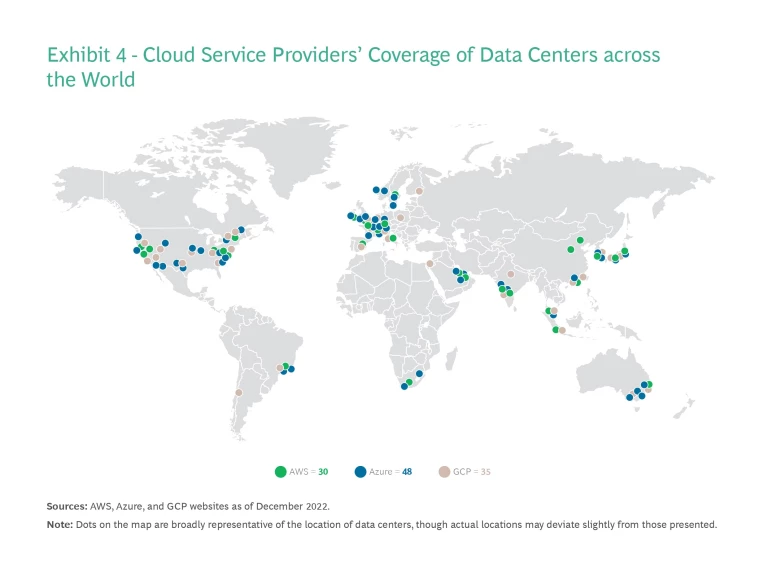

Global Coverage Expands

Cloud coverage is now comprehensive in critical commercial centers worldwide. (See Exhibit 4.) CSPs offer high bandwidth, optimized performance, compliance with local regulations, and robust disaster recovery. And because edge-computing use cases are on the rise, CSPs are extending their coverage closer to the data sources. (That said, it’s worth noting that not all cloud services are available in all regions.)

The race to open new data centers is occurring in three phases, with most cloud providers nearing the end of the second phase:

- Phase 1. Build out foundational hubs within regions that are either currently, or have a history of being, continental technology centers (for example, Virginia, London, and Singapore).

- Phase 2. Establish additional hubs in Europe, North America, and Asia—improving connectivity and incorporating hubs across all continents.

- Phase 3. Establish hubs in localized settings away from city centers (for military bases or research parks, for example) and in emerging markets and noncore regions, such as Africa and South America.

Growth and Penetration Slows

Annualized revenue growth among the three CSPs fell from about 40% in mid-2021 to about 28% in the third quarter of 2022. Their total quarterly revenue reached about $50 billion—with AWS accounting for the most revenue, at $20.5 billion. At that rate, the CSPs should have total revenue of about $1 trillion by 2030. (Google Cloud is growing the fastest, at 38%, though its revenues are roughly a third of AWS’s.)

Tech + Us: Monthly insights for harnessing the full potential of AI and tech.

Between now and 2030, it’s unlikely that the CSPs’ growth will be uniform. Rather, in the tradition of previous technology adoptions, growth could follow an S-curve. If this is the case, then the CSPs are still in the early stages of this S-curve, and there’s a significant revenue gap to close with traditional on-premise data infrastructure.

The next issue of Cloud Cover will aim to develop the NPI and address key questions on cloud services and pricing, including insights on specialist offerings, other CSPs, and price evolution over time.

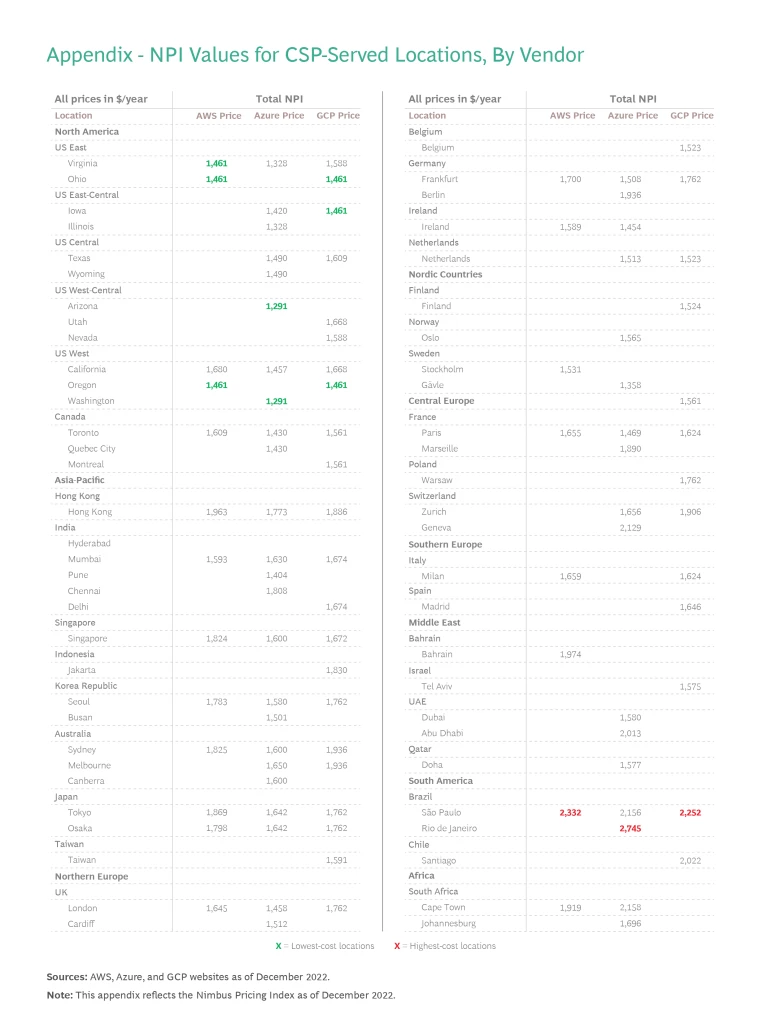

Appendix: NPI Data Tables

Below are the NPI values for CSP-served locations, by vendor. Lowest-cost locations for each vendor are highlighted green, while highest-cost locations are highlighted in red.