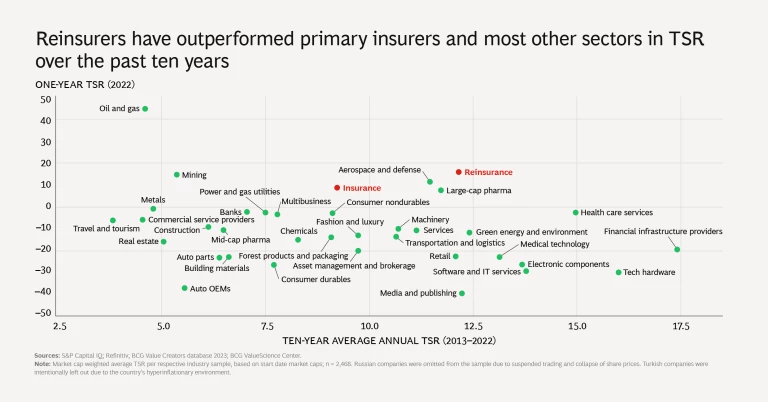

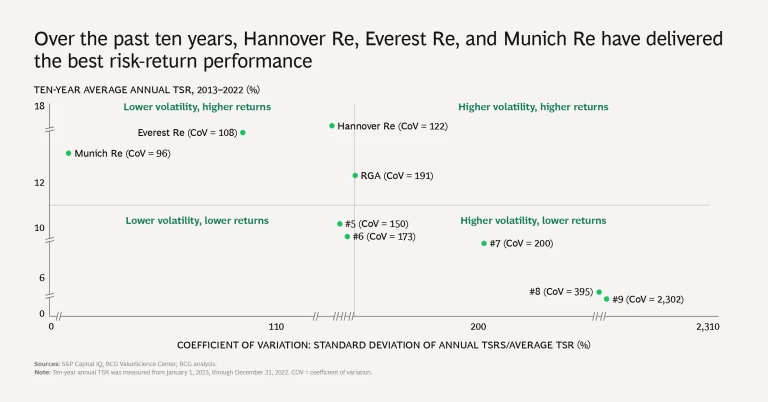

Despite some strong headwinds, reinsurance has delivered top-of-the-pack shareholder returns over the past five and ten years, outperforming the rest of the insurance industry—and, recently, most other sectors as well. Reinsurance annual total shareholder returns (TSR) averaged 10% and 12.2% for the past five and ten years, respectively, compared with 3.9% and 9.4% for the insurance industry as a whole. Across the more than 30 sectors for which BCG tracks value creation, only oil and gas delivered higher TSR over the past year.

Reinsurance’s outperformance is all the more impressive given that the past decade included a long soft-market cycle as well as heavy catastrophe losses in 2017 and 2018. The question now is, can reinsurers maintain their momentum?

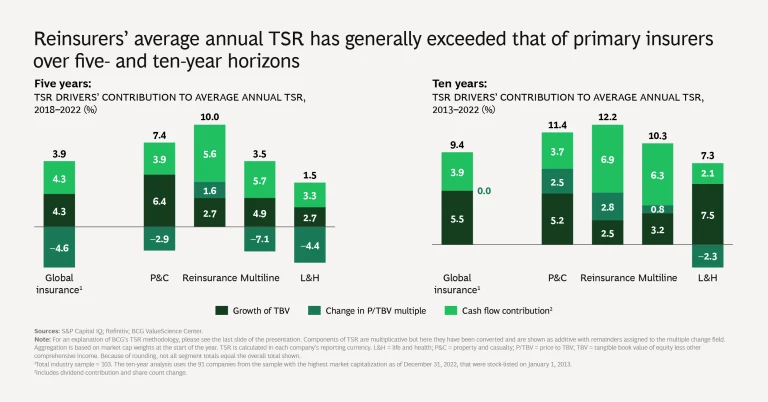

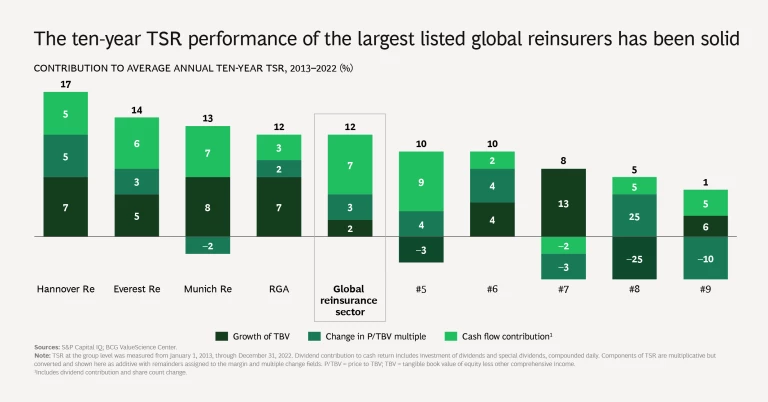

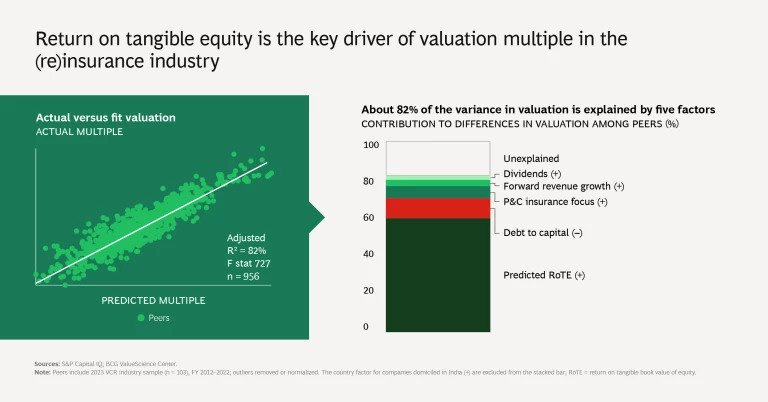

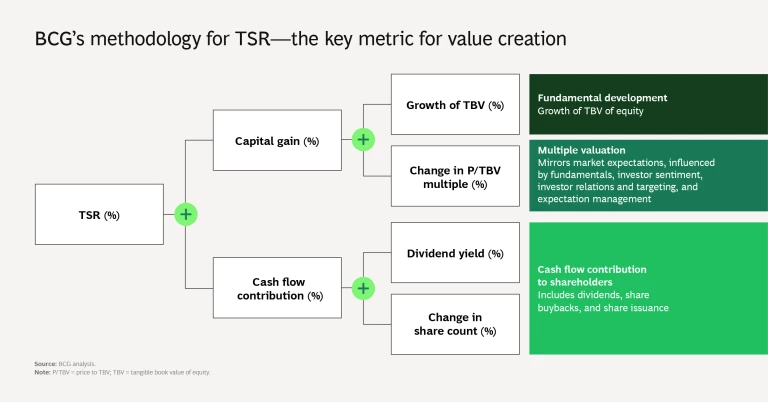

The main driver of reinsurance TSR has been companies’ use of cash flow to sustain high dividends and repurchase shares. Our analysis of ten-year TSR performance in insurance shows that the two most important factors are tangible book value (TBV) growth and cash flow. TBV growth accounts for about 60% of TSR and cash flow 30%. (The other 10% is multiple expansion or contraction.) Reinsurers lag in TBV growth. From January 1, 2013, to December 31, 2022, reinsurance TBV growth was 2.5%, compared with an average of 5.5% for the rest of the industry— property and casualty (P&C) , life and health (L&H), and multiline. Cash flow made up the shortfall. Using cash flow to deliver TSR works well when times are good, and reinsurers in the past have had significant reserve buffers. But a recent run of tough years, particularly 2017 through 2022, has depleted these coffers.

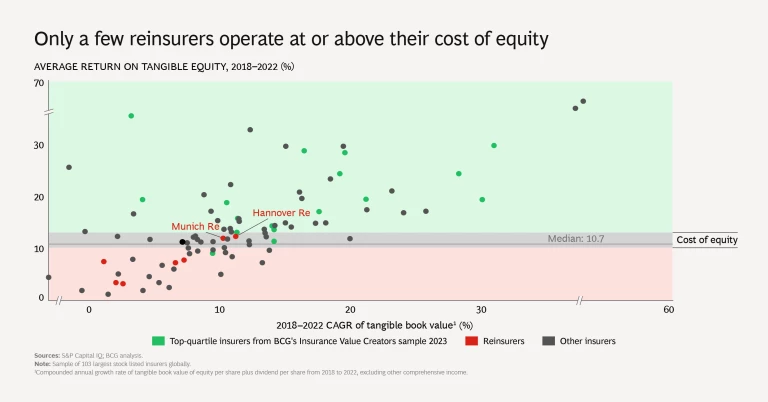

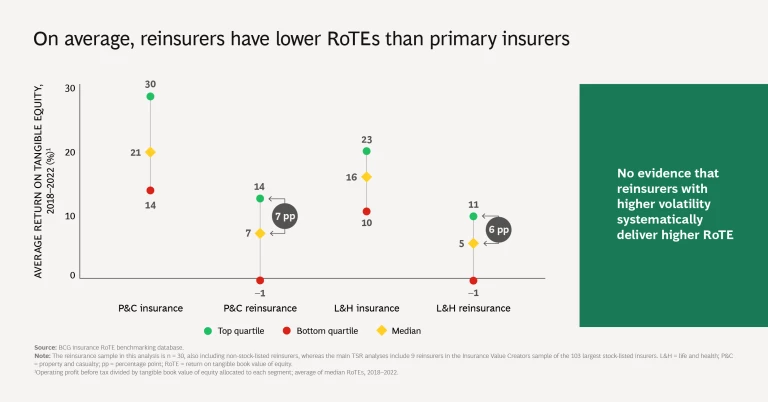

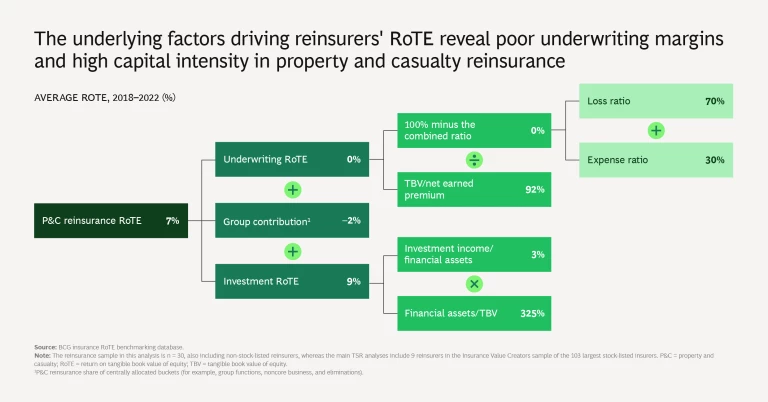

Going forward, operating performance rather than cash flow is likely to drive reinsurers’ shareholder returns—especially growth in TBV, which is largely a function of return on tangible equity (RoTE). The good news is that market trends over the next two to three years appear positive for reinsurers that have the market access, available capital, and product breadth to play in the most attractive reinsurance lines.

The industry has entered a sustained hard market for property catastrophe rates (particularly excess of loss), a result of both an increase in ceded losses and disciplined decisions by reinsurers. Reinsurance rates have accelerated more quickly than primary insurers’ pricing. The attachment points of many treaties have edged up, reducing reinsurers’ risk and supporting RoTEs. Numerous reinsurers have also sharpened contract wording and introduced new exclusions. We expect the hard market to continue until at least 2025.

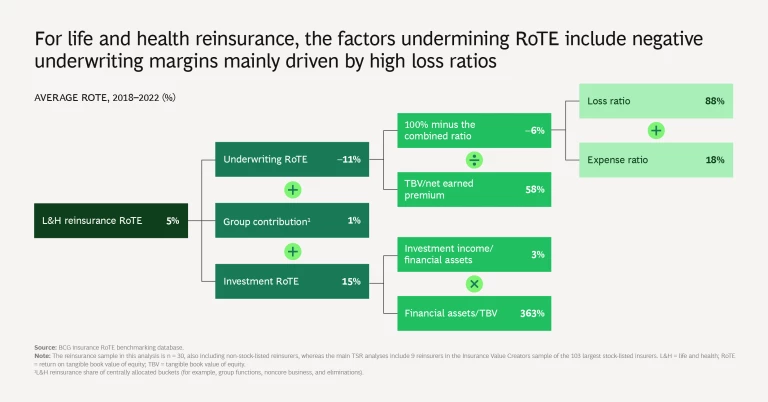

But there are warning signs as well. Pricing in casualty and some other P&C reinsurance lines lags inflation. Although L&H is experiencing a resurgence following three poor post-pandemic years, with most reinsurers reporting positive L&H results over the first half of 2023, there is not yet a clear trend to returned profitability.

Most significantly, a big unknown looms. We do not know yet whether the current “hard” catastrophe rates are truly sufficient for sustained profitability. So far, the current year has been one of the most volatile ever. The spectre of climate change (combined with the sluggishness of remedial response in many markets) spreads. There is no doubt that the threats to lives, infrastructure, assets, and businesses will have an expanding impact on the balance sheets of primary carriers and reinsurers alike. When viewed over a period of several decades, the effects of climate change may appear linear (if also accelerating), but the severity, frequency, and location of the insured events that it produces in a given year are far more random and unpredictable. This increasing uncertainty makes it difficult to determine whether current rate levels are adequate.

Some reinsurers are reacting by stepping away from the risk and reducing their catastrophe exposure, but most remain broadly exposed. Companies in the latter group must answer three key questions:

- Are we in a transitional phase of the historical reinsurance cyclicality, with a hard market solidifying after several years of soft market conditions?

- Do we see a shift in base prices upward to reflect more catastrophe risk, with future volatility oscillating around the higher level? (Note that for several years some observers argued that the recent soft rate environment was the new normal.)

- Is there a real upward shift in pricing? Will the new hard market move returns higher, or, in the face of climate change, is pricing still inadequate and bound to lead to depressed performance?

Many reinsurers’ ability to continue to deliver superior TSR depends on the answers. Companies that have a clear strategic direction and portfolio allocation and can use capital-management tools flexibly are the likeliest to successfully navigate the dynamic and unpredictable market conditions ahead.

The authors are grateful to Martin Link, Felix Tam, Ted Bonanno, Teresa Schreiber, and Nitish Suddhoo for their contributions to this report.