Consumers are increasingly voicing their concerns about climate change and environmental sustainability through the purchases they make every day. Out of 15 product categories examined in two recent BCG surveys, the food category is one where such concerns are quite strong.

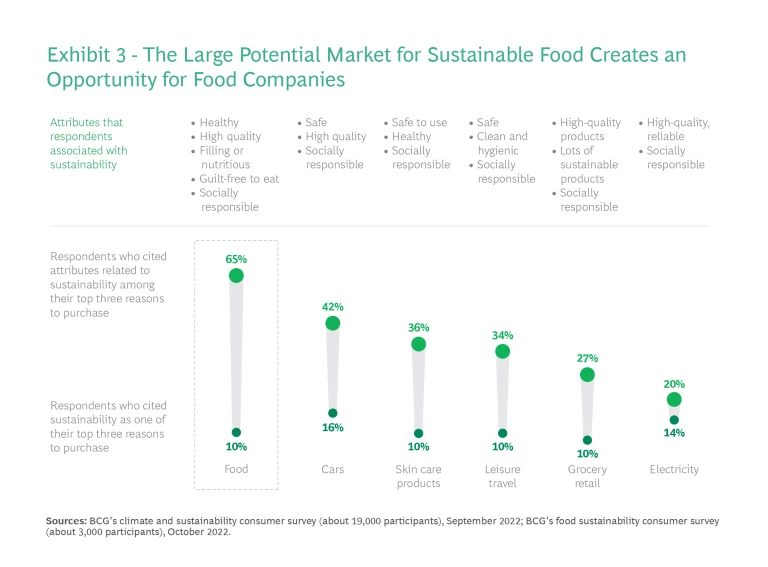

Yet, we also found that only 10% of respondents make sustainability a top priority when they are buying food, and an even smaller percentage are paying a premium for it. By contrast, 55% of respondents prioritize other attributes that they strongly associate with sustainability, especially healthfulness, high quality, and nutritiousness.

Companies that leverage these insights have an opportunity to grow their market for sustainable products. To encourage the core 10% to make sustainable food a greater proportion of their food purchases, brands should market their products in ways that emphasize what’s most relevant to these consumers. And to win over the mainstream 55%, companies should ensure that their products have the sustainability-connected attributes that these consumers prize. In addition, companies should remove barriers that deter the 55% from purchasing sustainable foods. This means addressing the issue of affordability; many consumers are increasingly aware of food prices in today’s inflationary environment.

Understanding Consumers’ Purchasing Behaviors

Over the past eight years, consumers’ interest in green products has grown rapidly as the impacts of climate change and other events damaging to the environment have become better known. According to the NYU Stern Center for Sustainable Business, from 2015 through 2021, the sales of products that were marketed as sustainable grew 2.7 times faster than those of conventionally marketed products. In 2022, products marketed as sustainable had a 17% market share, up 3.3% since 2015.

Consumers’ appetite for green products is also clear from the findings of a 2022 BCG survey on consumers and sustainability. Posing questions to approximately 19,000 participants about products and services in 14 categories, we found that up to 80% of respondents consider sustainability in their day-to-day decision making. But few are making sustainable choices.

To understand consumers’ attitudes and behaviors around sustainable food specifically, we conducted a follow-up survey of about 3,000 participants that focused on different types of food. (See the sidebar “About Our Research.”) We defined sustainable food as food that is produced, processed, distributed, and disposed of in ways that avoid harming plants, animals, natural resources, and the climate.

About Our Research

About Our Research

The Four Stages of Sustainability Maturity

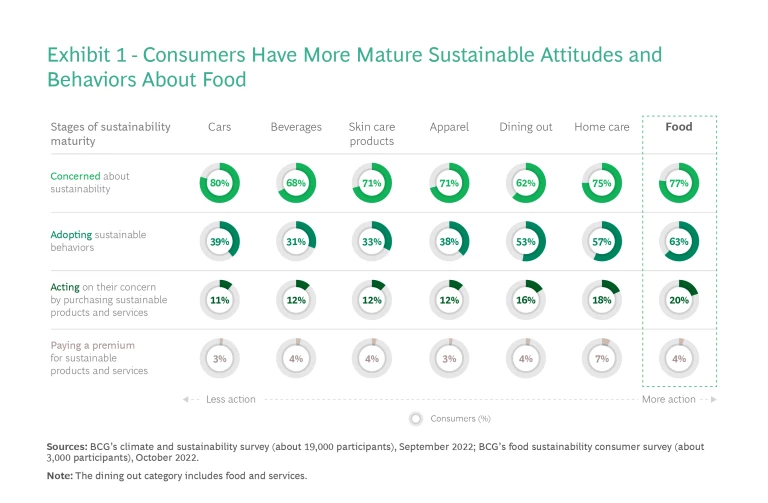

BCG’s analysis revealed that of all the product categories assessed, food is where respondents exhibited the greatest interest in sustainability and follow-through today. Their interest became evident when we assessed the categories in terms of BCG’s four stages of sustainability maturity. The food category is among the most mature, meaning that a higher percentage of respondents have mature attitudes and behaviors about sustainability. (See Exhibit 1.)

Concerned. Consumers who are at this stage are concerned about sustainability when making day-to-day decisions about food. Seventy-seven percent of the respondents to the food survey fit in this group. Of all the product categories we surveyed, food has one of the highest percentages of respondents who are concerned about sustainability.

Adopting. Consumers who are at this stage adopt sustainable behaviors, such as buying food directly from a farmer (although it is not necessarily sustainable food) and recycling empty food containers (at least some of the time). Sixty-three percent of the respondents to the food survey are in this group. This means that the food category has the highest percentage of stated adoption of all the categories surveyed.

Acting. Consumers are at this stage when they act on their sustainability concerns by exhibiting a sustainable behavior, such as purchasing sustainable food or limiting food quantities to avoid creating waste. Twenty percent of the respondents to the food survey belong to this group. The food category thus has the highest proportion of respondents who act on their sustainability concerns by purchasing sustainable products.

Paying a Premium. Consumers who are at this stage are willing to pay a higher price for sustainable food. A very small number of the respondents—4%—paid a premium the last time they bought sustainable food. We can infer that proportionately, many more food survey respondents care about sustainable food than actually purchase it, especially at a premium.

Why Consumers Buy Sustainable Food—Or Not

To better understand consumers’ thinking, we asked the food survey participants their reasons for purchasing sustainable food. Only 10% of respondents said that sustainability was one of their top three criteria when they made their last purchase.

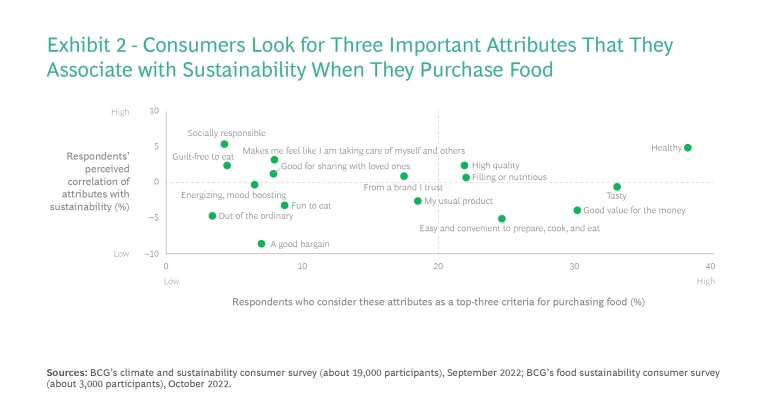

To learn more about the priorities of the remaining 90%, we analyzed the food attributes that respondents look for when buying food. We assessed the attributes along two dimensions—the percentage of respondents who said a particular characteristic was one of their top three purchase criteria and how strongly they associate (or correlate) a particular attribute with sustainability. (See Exhibit 2.)

There are three food characteristics that consumers prioritize when making food choices and associate with sustainability: health, high quality, and filling or nutritious. Significantly, 55% of respondents said that at least one of these three attributes was a top-three criterion for their last purchase.

The 55% represents a large market that remains untapped—one that is larger than the potential market for green cars, apparel, and other products. (See Exhibit 3.) We can infer that food brands that innovate and position their products as healthy, high quality, and filling or nutritious will get a greater share of wallet from the 55%.

Barriers and Tradeoffs

Our findings suggest that some important barriers and tradeoffs are stopping the mainstream 55% from purchasing sustainable food.

Barriers. Food survey respondents most frequently cited affordability (48%) as a top-five barrier to purchasing sustainable food. Accessibility, or how easily respondents could find sustainable food, is also a top-five barrier at 46%.

The affordability barrier exists on two levels, real and perceived. Sustainable food, whether organic or processed, is often more expensive. And inflation is making such food even more so.

At the same time, buyers’ perceptions vary about sustainable food prices. The respondents who don’t typically purchase sustainable food expected it to cost 5% more than nonsustainable options, whereas those who typically buy sustainable food reported it to be 4% cheaper. Clearly, affordability can be a matter of perception.

The accessibility barrier also is real and perceived. Sometimes sustainable food is not available. Other times, it is indeed available, but consumers are not knowledgeable about the differences among competing products and, therefore, perceive that sustainable food isn’t accessible.

Affordability and accessibility are not the only barriers. Respondents also said that awareness and habits prevent them from purchasing sustainable food. Thirty-six percent said that they don’t buy sustainable food because they don’t know enough about it. The same percentage said that they are just too accustomed to their regular food products. And 26% said that they don’t think about sustainability when shopping for groceries.

The affordability and accessibility barriers to purchasing sustainable foods are both real and perceived.

Tradeoffs. Some respondents indicated that they perceive sustainability to be at odds (or negatively correlated) with some of their most important criteria for making food purchases. The more negative the correlation, the bigger the tradeoff they think they will have to make.

For example, 25% of respondents said that a top criterion for buying food products is that they are easy and convenient to prepare, cook, and eat. However, this attribute is very negatively correlated with sustainability, so it reflects a large tradeoff in consumers’ minds.

The convenience tradeoff may loom large because people dislike any extra work involved in food preparation. Still, we can infer that many consumers think that purchasing sustainable food won’t meet their top needs because it requires giving up at least one benefit that is highly valued. They feel that the tradeoff is simply not worth it.

The Opportunity

Food brands clearly have an opportunity to help consumers advance their stage of sustainability maturity and expand their audience for sustainable food. On the basis of our findings, we recommend taking one approach for the core 10% of consumers who consider sustainability a top-three criterion for purchasing food and a different approach for the mainstream 55% who represent the greatest growth opportunity.

Make Products Locally Relevant

To win a larger share of the core 10%’s wallet, companies need to offer sustainable food products with attributes that these consumers are looking for and emphasize these attributes in marketing efforts. This is no small task, given that consumer preferences vary widely around the globe. (See the sidebar “Global, Regional, and Local Perspectives on Food Sustainability.”)

Global, Regional, and Local Perspectives on Food Sustainability

Global, Regional, and Local Perspectives on Food Sustainability

When it comes to specific characteristics, no pesticides, additives, or preservatives, as well as animal welfare, are among respondents’ top-three purchase criteria worldwide. And whether a product can be used for carbon offsetting is among their bottom three criteria.

Otherwise, views on specific criteria vary from country to country. For respondents in the US and Germany, among their top three criteria to buy sustainable food is that it is locally grown in their region or country. By contrast, that is in the bottom three for respondents in China, but not because the Chinese aren’t concerned about sustainability. They are, in fact, very concerned about sustainability across many product categories. The issue with locally grown food is that it’s likely not considered as safe as imported products.

Similarly, respondents in Brazil consider it very important to protect forests and biodiversity and to use recyclable, compostable, or biodegradable packaging, while respondents in France and Italy consider these factors only moderately important. To a large extent, Brazilians' responses likely stem from their concern about the deforestation of the Amazon, one of the world’s largest carbon sinks.

To succeed, companies will need to make sure that both the food product and the language used to describe it are locally relevant. For example, marketing sustainable food products from China to US consumers is unlikely to win credibility and trust among the core 10% because they look for food that is sourced locally.

Broaden the Dialogue with Consumers

To expand their share of the mainstream 55%, companies’ marketing messages should highlight the relevant components of the three characteristics that these consumers want the most and that they associate with sustainability—healthy, high-quality, and filling or nutritious food.

For example, Upfield, a plant-based consumer products company, markets its Becel margarine as both sustainable and healthy, using a logo of petals to form a heart and the tag line “Becel takes your health to heart.” The brand’s website emphasizes that plant-based eating is good for people and the planet, conveying that consumers don’t need to choose between themselves and the environment.

However, the 55% do not necessarily want their top criteria all at the same time or even all of the time. BCG’s research shows that consumers make choices in the moment, at the point of purchase or consumption, and their purchase criteria vary across occasions.

There are still likely to be consumers in the 55% who, because of certain barriers and tradeoffs, won’t buy sustainable food. So, companies need to find ways to reduce or even eliminate these issues. Affordability, in particular, could present an opportunity for alternative-protein producers to attract consumers who are unable to afford the rising cost of meat, for example.

Innovate. Brands need to give customers other reasons for buying besides sustainability, such as taste. When a product doesn’t have the attributes that consumers want and are willing to pay for, innovation may be in order. For example, Blue Diamond launched Almond Breeze Extra Creamy Almondmilk, promoting it as tastier than the original product.

Educate. Consumer education may also be a solution for perceived barriers. Again, consider affordability. If consumers perceive pricing to be a barrier when it is not, companies can make the true costs clearer and more understandable.

For example, to reduce food waste, Misfits Market sells organic food products that do not meet supermarkets’ specifications (such as vegetables that are considered ugly). This model allows the company to sell them at a discount, demonstrating that sustainable food products can truly be cheaper than alternatives.

Food companies can also use marketing to highlight the sustainability of products that consumers may not think of as sustainable, such as fruits and nuts that grow on trees. By providing this information, companies can enable consumers to choose sustainable food anywhere they shop.

Another strategy is to highlight the attributes that consumers care about, above and beyond the ones that they associate with sustainability. For example, ads for Alpro, Danone’s plant-based dairy product, say nothing about the environment, only that it tastes good.

Food attitudes and behaviors have long been a major concern of those seeking to address climate change. Transitioning consumers to more-sustainable food habits is vitally important for reducing carbon emissions. The sooner sustainable food becomes mainstream, the more the planet will benefit.