The auto industry is in the midst of a full-scale transformation driven by electrification, autonomous driving, sharing, and software-defined vehicles. (See “Four Trends Reshaping the Auto Value Chain.”) Among auto distributors (wholesalers to car dealers) and importers (specialized distributors contracted by overseas car companies), specifically, the industry’s transformation is disrupting the sales model, retail infrastructure, and aftersales business. These developments demand a clear response in order to seize new opportunities and avoid losing the ability to add value.

Four Trends Reshaping the Auto Value Chain

- Electrification. In 2019, electric vehicles accounted for only 2% of new-car sales. We expect that to rise to 59% globally by 2035—and to 93% in Europe. Concurrently, the share of vehicles with petrol- and diesel-powered internal combustion engines will decrease considerably over the next 10 to 15 years. Electric vehicles require considerably less maintenance and spare parts because there are fewer built-in components. This will eat into dealers’ aftersales business.

- Autonomous Driving/Advanced Driver Assistance Systems. By 2035, about 20% of new cars sold will have at least level 3 autonomy. The collision rate of these vehicles is expected to be about 70% lower than that of vehicles without driver assistance systems. Fewer accidents will also curtail dealers’ aftersales business.

- Sharing/Mobility. The percentage of urban trips using on-demand mobility solutions—such as ride hailing, car sharing, and micromobility sharing—will more than double to 15% by 2035. At the same time, consumers around the world are increasingly choosing to share vehicles when needed rather than own them.

- Software-Defined Vehicles. Cars today already rely on more than 100 million lines of software code. That will grow even further as software rather than hardware increasingly drives autonomous innovation. Additionally, over the next 10 to 15 years, almost every car will have access to the internet, enabling communication with outside parties. This will unlock many possible business models, such as remote diagnostics and preventive-maintenance services.

We have identified a number of crucial areas in which auto distributors and importers can act immediately to leverage their full potential and build a solid foundation for success in an industry that is undergoing a dramatic evolution.

The Role of Auto Distributors and Importers

Today, the 20 largest auto markets account for more than 80% of global new-car sales. Automotive OEMs focus their national sales companies (NSCs) on these countries, while relying on distributors and importers to serve the remaining markets. (See Exhibit 1.)

Distributors and importers help manage the complexity of smaller markets and deal with local regulations, language requirements, billing, import duties, and logistics. Perhaps most important, they act as local entrepreneurs. They understand the dynamics of the different markets and their cultural peculiarities and customer preferences, which can differ greatly from place to place. They have the expert knowledge needed to optimize sales volume and cost of sales (that is, discounts) in the retail channel.

Over the past few years, distributors and importers have opportunistically expanded their presence into new markets, often building significant retail businesses in order to control more of the value chain. Some have paired that push with a strategy of developing areas in which large investments are needed, including direct and online sales and innovative retail formats, such as aftersales services and mobile test drives.

There’s also been a good deal of consolidation among distributors and importers to improve economies of scale and update their networks. Larger distributors and importers have more resources to invest in specialized network branches, such as service factories and battery centers, and in innovative retail formats in urban locations. They can also devote more resources to improving the efficiency of internal functions, such as finance, HR, and IT.

Trends Impacting Distributors and Importers

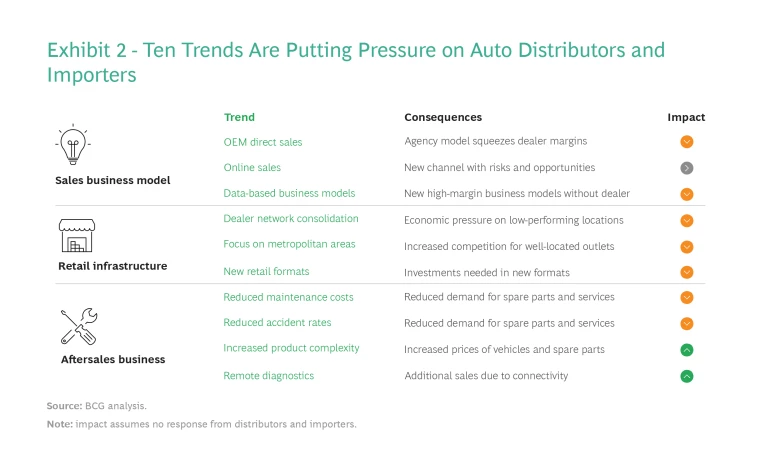

But these strategies, which have served distributors and importers well in the past, are coming under threat. Ten trends that will force changes in the sales model, retail infrastructure, and aftersales business will eventually create severe profitability headwinds, but also some opportunities. (See Exhibit 2.) Going forward, companies will need to make the investments required to cope with and benefit from these changing industry dynamics.

The sales business model is being affected by OEMs’ shift to direct sales, which is squeezing dealer margins. In addition, rising consumer demand for online sales is creating both the risk of disintermediation and opportunities to innovate in sales formats. Finally, new data-based business models (such as functions on demand) are threatening to cut dealers out from an emerging high-margin business.

The economics of the retail infrastructure are also under threat. Pressure on low-performing locations is leading to the consolidation of retail networks. Meanwhile, customer expectations for modern retail formats and a new focus on large cities will increase competition and investment in well-located urban outlets. As a result, existing infrastructure could become less and less profitable.

The aftersales business is also being buffeted, but some developments are actually positive for growth prospects. Battery-electric vehicles have fewer built-in components and demand less maintenance, and vehicles equipped with advanced driver assistance systems have fewer accidents. Therefore, demand for spare parts and service will diminish in the future. But increased product complexity and higher prices for spare parts could potentially offset some of these declines. Moreover, as vehicles become more connected to the internet, it will be possible to offer new services such as remote diagnostics.

OEM Direct Sales Are a Game Changer

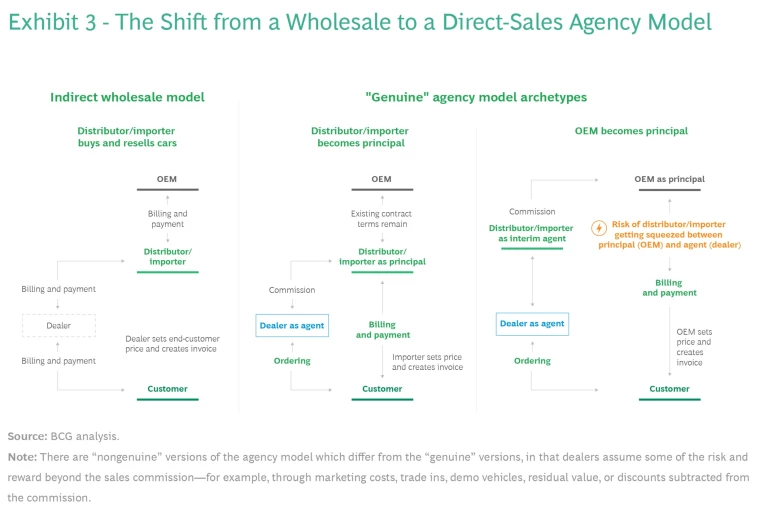

All of these trends deserve attention, but perhaps most significant is the OEM shift away from an indirect, wholesale operating model using a dealer network. Here, dealers buy cars from distributors and importers and sell them to consumers at a price that they, the dealers, determine. (See Exhibit 3, left side.) Today, multiple OEMs are replacing this traditional setup with a direct-sales approach using an agency model. So far, the shift is occurring mostly in NSC markets, but some OEMs have begun to introduce pilot agency models in other markets as well. This will create both opportunities and peril for distributors and importers.

There are two “genuine” agency model archetypes. In the first, distributors and importers are in the driver’s seat. (See Exhibit 3, center.) The OEM allows them to become principals, taking over price setting, end-customer invoicing, vehicle inventory management, trade-ins, the used-car business, and warranties for all new-vehicle sales in their markets. Indeed, distributors and importers with retail arms are better positioned than most OEMs to execute these customer-facing tasks.

The second genuine agency archetype, in contrast, puts distributors and importers at grave risk. (See Exhibit 3, right side.) Today, multiple OEMs are replacing this traditional setup with a direct-sales approach using an agency model. So far, the shift is occurring mostly in NSC markets, but some OEMs have begun to introduce pilot agency models in other markets as well. This will create both opportunities and peril for distributors and importers.

It’s still a developing environment, however, and in practice several OEMs have introduced "nongenuine" variations of the agency model. Here, regardless of whether the OEM or the distributor/importer is the principal, the agent assumes some of the risk and reward beyond the sales commission—for example, through marketing costs, trade-ins, demo vehicles, residual values, or discounts subtracted from the commission.

Subscribe to our Automotive Industry E-Alert.

While the shift to direct sales is a general trend, the approach taken by automakers (new and incumbent) often differs by region. In Europe, many incumbent OEMs are in the process of defining their direct-sales models and building up the required capabilities. In the US, on the other hand, incumbent OEMs are more hesitant because of strong dealer franchise laws prohibiting direct sales. In some markets, distributors and importers are held back from launching new initiatives owing to exclusivity clauses with OEMs or concerns that they will offend them. Over time, these challenges to investment in growth areas could pose a threat to their viability.

How Importers Can Respond Now

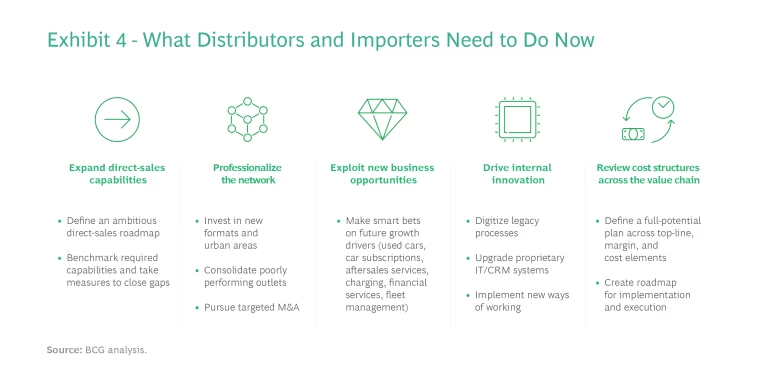

Given the scale of change, tomorrow's automotive industry will not look the same as today's. For players across the value chain, this is a critical moment to define their paths forward. Auto distributors and importers can act immediately in five areas to leverage their full potential. (See Exhibit 4.)

Expand direct-sales capabilities. Customer ownership is one of the surest ways to stay relevant to OEMs. Distributors and importers therefore need an ambitious, well-defined roadmap for direct sales . By using industry benchmarks, they can identify the capabilities needed, assess their own capabilities against those benchmarks, and take measures to close any gaps.

Consolidate and professionalize the network. To get the most out of their networks, distributors and importers need to invest in new retail formats, consolidate poorly performing outlets, and pursue very targeted M&A. In order to consolidate wisely, they will need to analyze individual branch performance and determine optimal branch density. To professionalize the network, they should focus more on metropolitan regions, creating innovative retail formats and securing strategic locations.

Exploit new business opportunities. As consumer expectations change, advanced technologies materialize, and new business models emerge, distributors and importers need to place smart bets on how to grow their business. In the past, adjusting to changing consumer preferences meant offering new vehicle models. In the future, sales partnerships with electric-vehicle brands could boost growth—for example, by positioning them in the top 20 global auto markets. Unlike traditional OEMs that have shut distributors and importers out of these markets, makers of electric vehicles lack significant infrastructure and might want to leverage that of distributors and importers. Emil Frey is already the corporate partner and importer into Europe for Great Wall Motor, and BYD Auto recently announced that Hedin Mobility Group will be its importer for Germany and Sweden.

Meeting changing consumer preferences may unlock new profit potential in new digital-mobility business models, such as car subscriptions , aftersales services, charging, financial services , and fleet management. For distributors and importers, these provide major opportunities to engage customers proactively with offerings they develop in-house or through venturing activities.

Drive internal innovation. Digitizing years-old legacy processes and upgrading proprietary IT/CRM systems are not easy tasks, but they will be critical. Opportunities such as online sales will require a high level of tech savviness and advanced digital capabilities . To accelerate this digital transition, distributors and importers must commit resources and implement new ways of working. For example, they’ll need to build advanced analytics capabilities and digital and data platforms to move from selling cars to managing the entire customer and asset life cycle.

Review cost structures across the value chain. Investment demands and margin pressures constitute a double whammy. To manage both, distributors and importers need to reassess their entire P&L and design their own full-potential plan, which should be built upon a bold ambition, a focus on high-impact levers, the right talent, and rigorous tracking. This review and design across top-line, margin, and cost elements can unlock the full potential of their core as well as new business opportunities.

The challenges faced by distributors and importers as the automotive industry transforms to electrification, autonomous driving, sharing, and software-defined vehicles are game changers. A rapid, strategically grounded response is critical to establishing a sure business footing in this new reality.