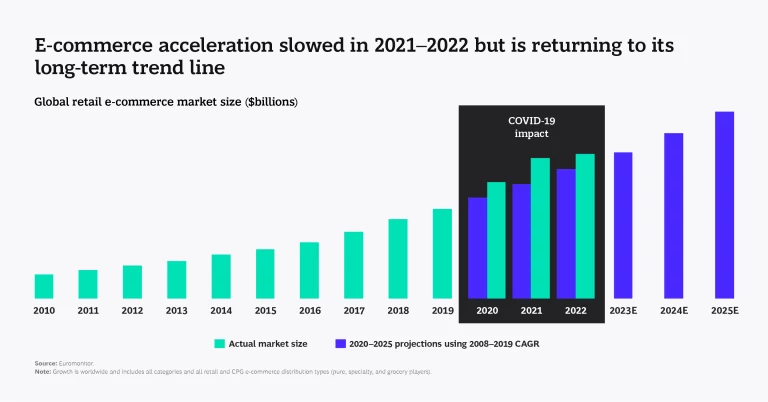

Many retail and CPG companies today are fighting the e-commerce blues. And no wonder: 2022 brought a marked slowdown of online sales growth—after tremendous acceleration during the first years of the pandemic. Yet, despite consumers returning to brick-and-mortar shops and malls following the pandemic-driven e-commerce surge of 2020, e-commerce growth hasn’t stopped. Retail and consumer packaged goods (CPG) companies are progressively moving back toward their pre-COVID long-term e-commerce trajectory—looking healthy across most categories globally and still outpacing physical retail growth.

E-commerce dynamics, however, are not moving back to their pre-COVID status. Competition in the e-commerce space has intensified starting 2021, with emerging players and business models challenging established incumbents. In Europe, the share of the top ten e-commerce players—mostly large multi-brand platforms—fell from 70% in 2019 to 62% in 2022, eroded by CPG players building their direct-to-consumer business, traditional specialty retailers catching up (such as H&M), and the rapid growth of newcomers (such as Shein).

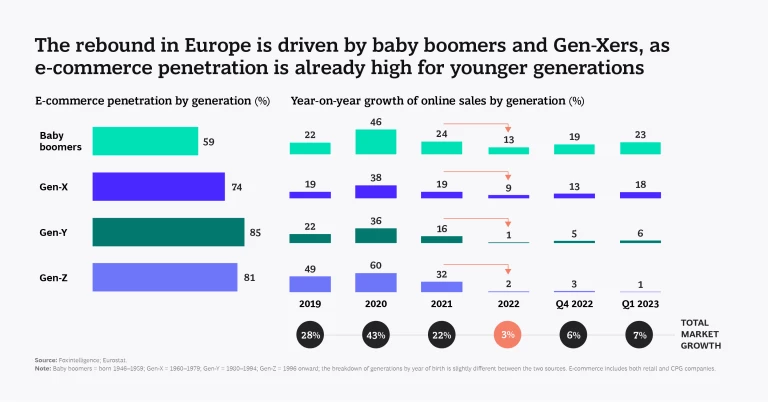

In addition, digital shopping habits have planted deeper roots across consumer segments, most notably in the non-digital-native generations. In fact, baby boomers and Gen-Xers account for a significant portion of today’s sales growth.

BCG’s new survey of 825 retail and CPG C-suite, e-commerce , and digital marketing executives spanning 11 markets around the world explored these businesses’ e-commerce growth, approaches, and attitudes toward the future. (See “ About Our Survey .”)

Drawing on these findings, we offer a view on how companies’ winning formulas are changing, along with several key ingredients for success.

Continuing E-Commerce Growth

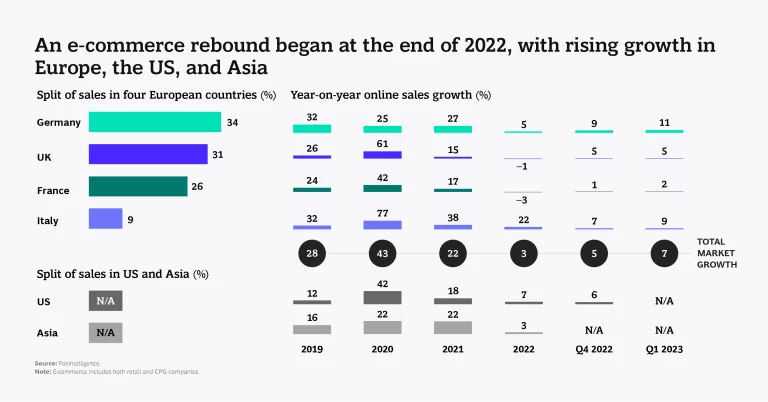

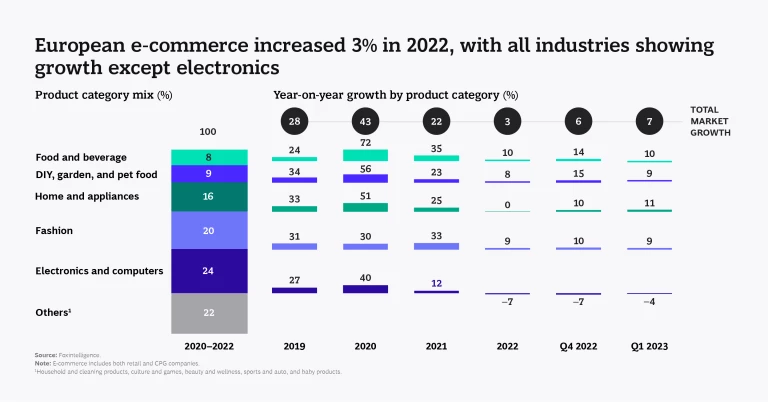

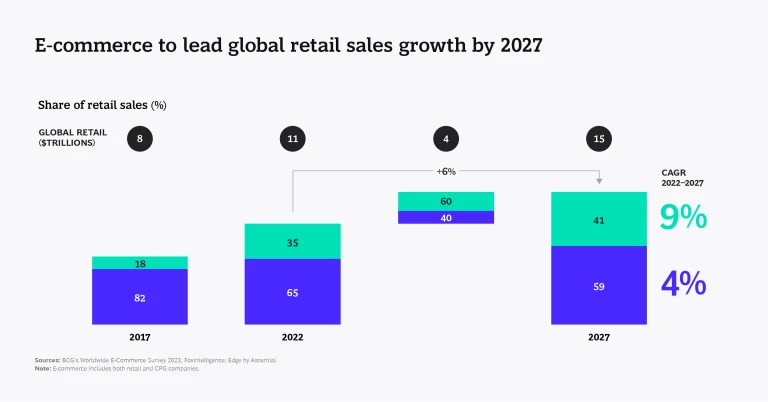

Even as growth is gradually reverting to pre-pandemic levels around the world, e-commerce sales increased by 3% in Europe and 7% in the US and Asia in 2022, and global growth is expected to achieve a 9% CAGR through 2027—not fully achieving the 12%–14% pre-COVID trend but still above projected brick-and-mortar retail growth of a more moderate 4%. As a result, e-commerce is forecasted to constitute 41% of global retail sales by 2027, a significant increase from its share of just 18% in 2017.

Notably, growth is expected to vary by region and category, as Europe already shows with a contrast between the acceleration in the food and beverage and DIY, garden, and pet food categories vis-à-vis the 7% contraction in 2022 in electronics.

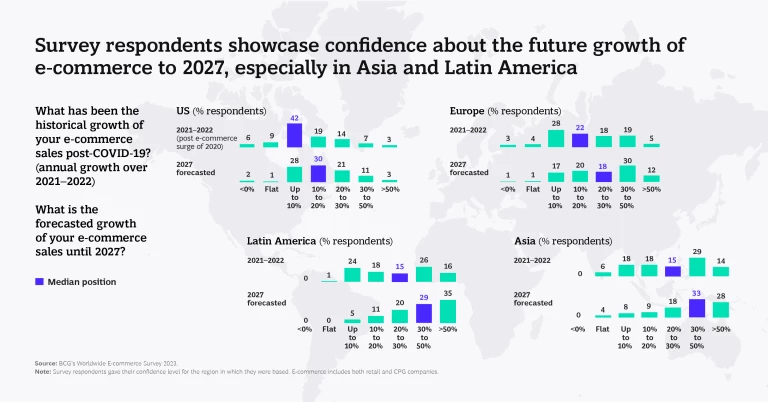

Our analysis shows e-commerce professionals share the positive outlook reflected by our data—in particular in Asia and Latin America. (See Slideshow 1.)

Retail and CPG Winners and Laggards

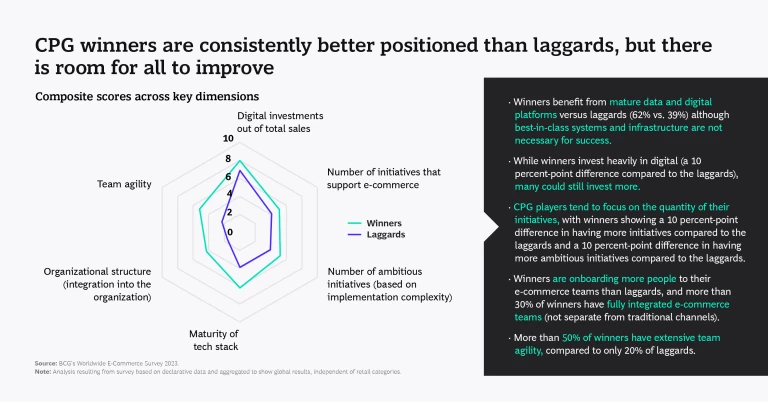

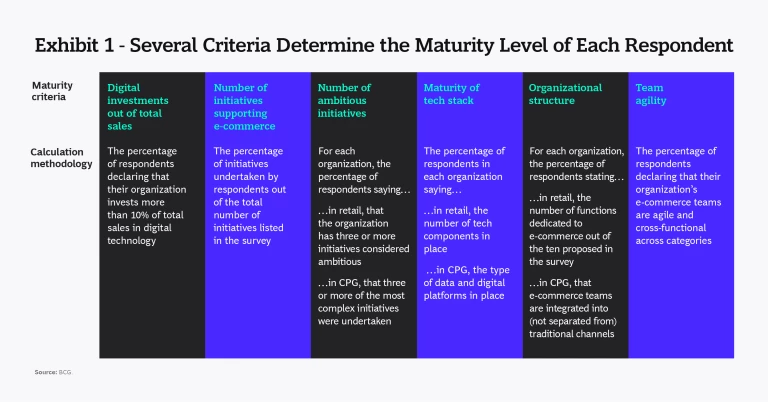

We conducted an in-depth analysis to clarify the ingredients of the winning formulas those professionals are using or plan to use. The survey placed its primary focus on six distinct e-commerce criteria that can serve as leading indicators of the maturity level of each participating organization. These criteria range from factors such as the proportion of sales dedicated to digital investments to the sophistication of the technology infrastructure and the extent and ambition of e-commerce initiatives. (See Exhibit 1.)

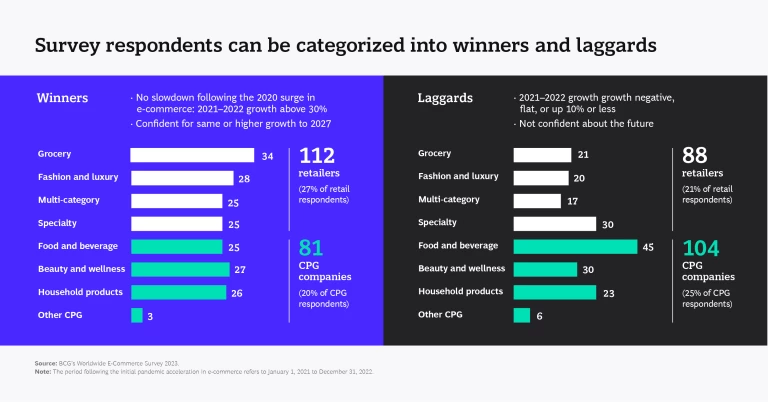

We analyzed the way that CPG and retail respondents performed along these six dimensions and then split them into groups of CPG and retail “winners” and “laggards” based on their performance. We define winners as those businesses that did not experience a slowdown following the big pandemic surge for e-commerce in 2020—reporting post-surge (2021–2022) growth above 30% per annum—and are confident of seeing the same or higher growth to 2027. They make up about a quarter of those surveyed in each group—27% of retailers and 20% of CPG companies. We define laggards, in turn, as organizations reporting post-surge growth of 10% or less per annum and lacking confidence about their future e-commerce growth. They make up about 21% of the retailers and 25% of the CPG businesses in the survey.

Formulas for Success

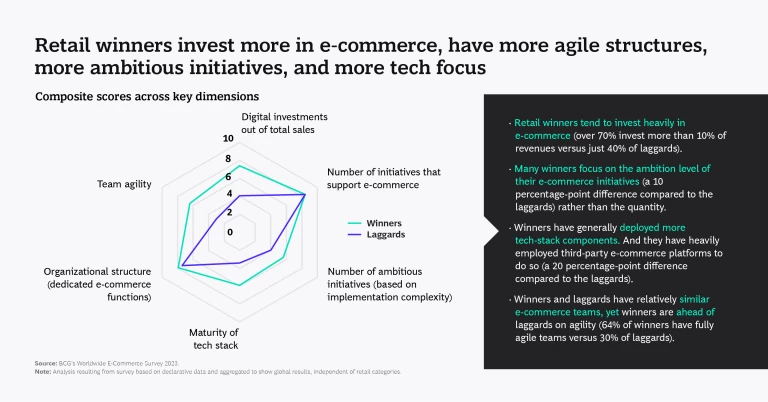

Our findings reveal clear distinctions between the way that winners and laggards approach their e-commerce efforts. (See Slideshow 2.)

The winning retail formula includes four key ingredients:

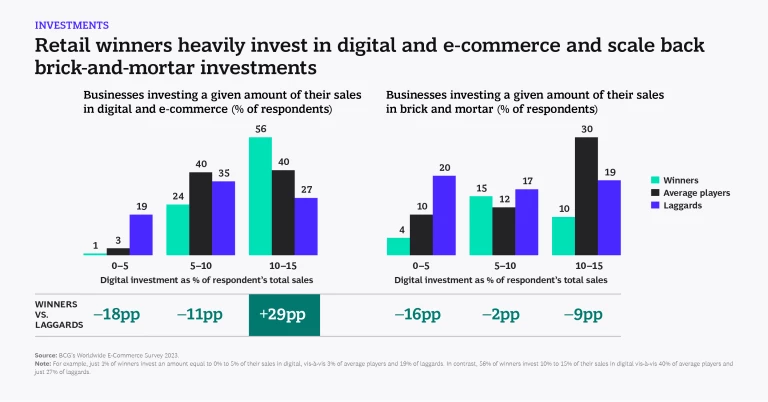

- Greater investments in digital technologies and e-commerce, with over 70% of winners investing more than 10% of their revenues

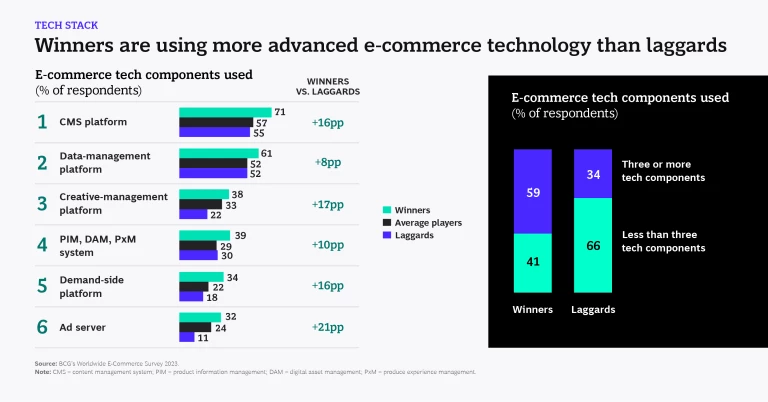

- More mature technology stacks, heavily employing third-party e-commerce platforms

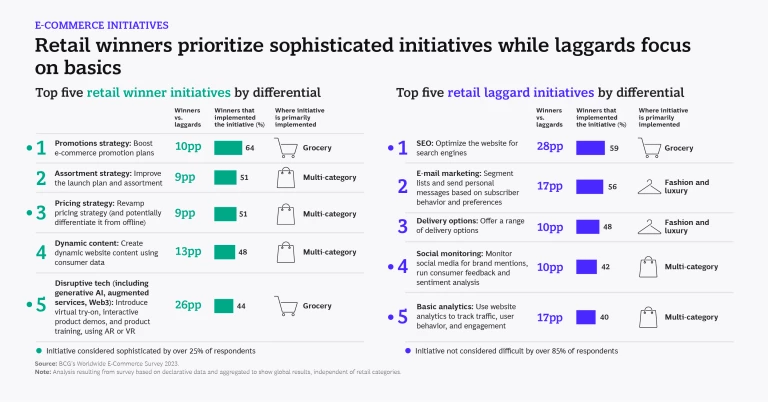

- Many more ambitious e-commerce initiatives, including promos, assortment, pricing, and disruptive technologies

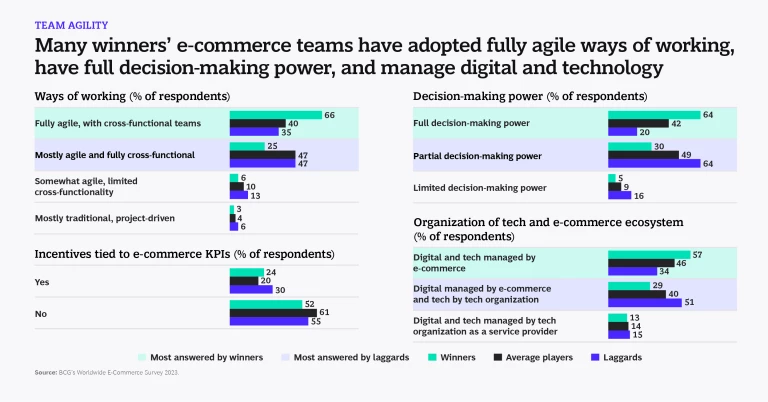

- Teams that work in more agile, cross-functional, and autonomous ways—with 64% of winners having fully agile teams versus just 30% of laggards

The winning CPG formula revolves predominantly around three key ingredients:

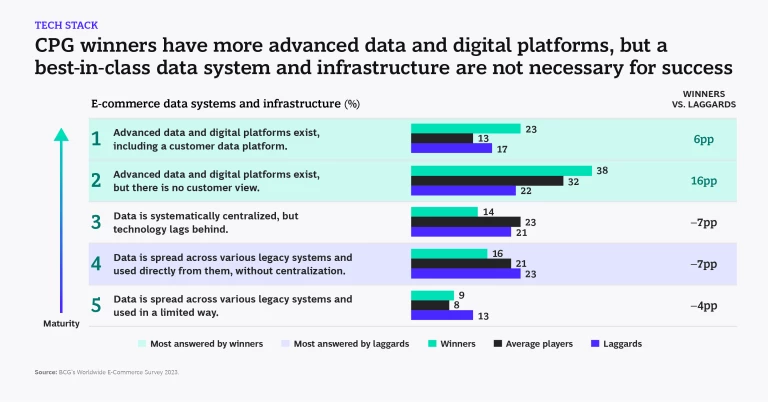

- More mature technology stacks than those of laggards, including more advanced digital and data platforms

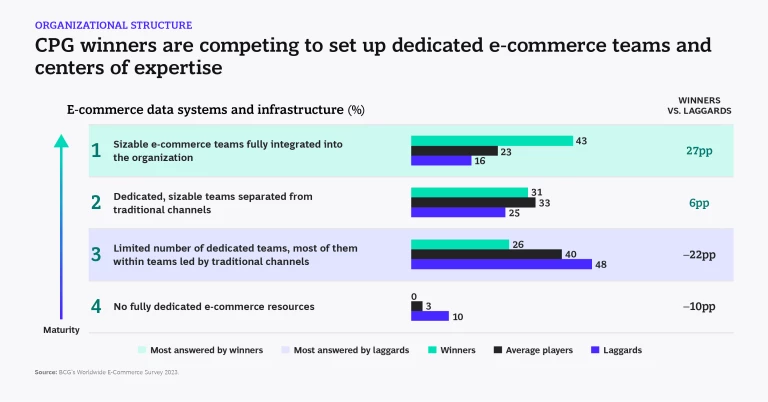

- An organizational structure that strongly supports e-commerce, with winners onboarding greater numbers of people to their e-commerce teams and fully integrating them into the broader organization

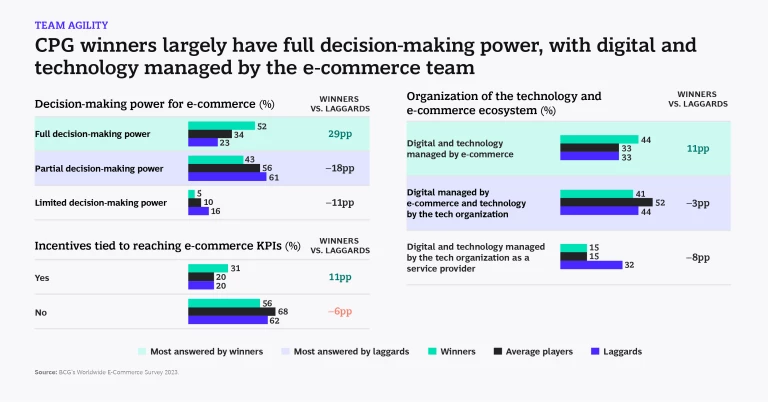

- Greater agility—with more than 50% of winners saying they have extensive team agility, compared to only 20% of laggards

The Gap Is Not Unbridgeable

In both retail and CPG, the gap between winners and laggards is marked. However, it is not unbridgeable. Winners and laggards already seem to be on par in some areas, such as top management’s visibility to and alignment with the e-commerce team. This is a necessary, if insufficient, prerequisite for laggards to catch up, as these areas foster the establishment of appropriate priorities and strategy.

In addition, gaps in the tech stack and broader digital investments are, by definition, fillable. The challenge there is on the business case and speed of execution, which are typically specific discussions, as each company has its own set of strategic priorities, market dynamics, and legacy systems to cope with. To some extent, this is also true for the way companies should pursue autonomy and agility for their e-commerce teams, factoring in their own organizational and strategic specificities. The complexity of removing silos and enhancing cross-functional work varies greatly, for example, between businesses with a narrower geographic or business model scope (for example, food retail) and multi-continent, multi-division CPG players where even within e-commerce there are several distinct layers, starting from direct versus indirect.

Winners, too, have room to further improve their leadership.

Retail winners are already well organized and churning through an impressive number of ambitious projects. Yet, they are still identifying technology and strategic initiatives on which to double down. In particular, over 40% of these winners still have to work toward adding or revamping critical tech components, such as product information management or digital asset management software or their monetization stack, where relevant. While already distinctively ahead of laggards on strategic initiatives such as e-commerce commercial and communications planning or testing disruptive technologies, they still have a significant way to go. Some winners still have yet to revamp their e-commerce communications plan, and a majority have not consistently begun testing disruptive technologies.

For winning CPG companies, there are also critical initiatives that have yet to be started. While supply chain topics such as better e-commerce demand forecasting and operations planning are distinctively “winner” traits; most CPG respondents still have not embarked on those initiatives. Equally, although winners and losers have embraced digital marketing at similar levels, winners have yet to initiate advanced digital media initiatives, such as e-retail media tactics, retailer search optimization, and retailer media monitoring.

Companies in both retail and CPG should look to the medium term in e-commerce with confidence—and plan accordingly. Many markets and categories are still years away from full e-commerce maturity, with tailwinds strong enough to justify investing greater capital and resources into winning capabilities and organizations.

ABOUT OUR SURVEY

ABOUT OUR SURVEY

The companies surveyed ranged from $50 million to over $10 billion in revenues, with over 40% of the companies having revenues of more than a $1 billion. The survey was aimed at exploring e-commerce trends from the beginning of the pandemic to today.

Note that we supplemented the results of our survey with a consumer data set from Foxintelligence to provide a finer reading of the evolution by consumer segment as the pandemic progressed.

The authors would like to thank Arnaud Bassoulet and Guillaume Triclot for their contributions to this article.