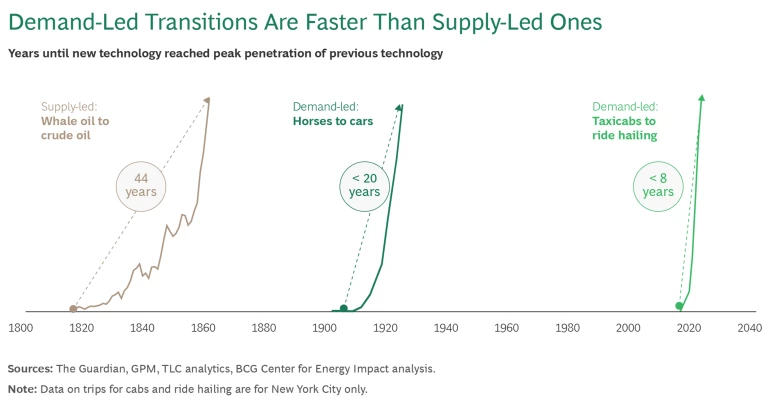

What can the decline in use of whale oil in the late 19th century and the rapid takeoff of ridesharing 150 years later teach us about how to save the world? Turns out, quite a bit.

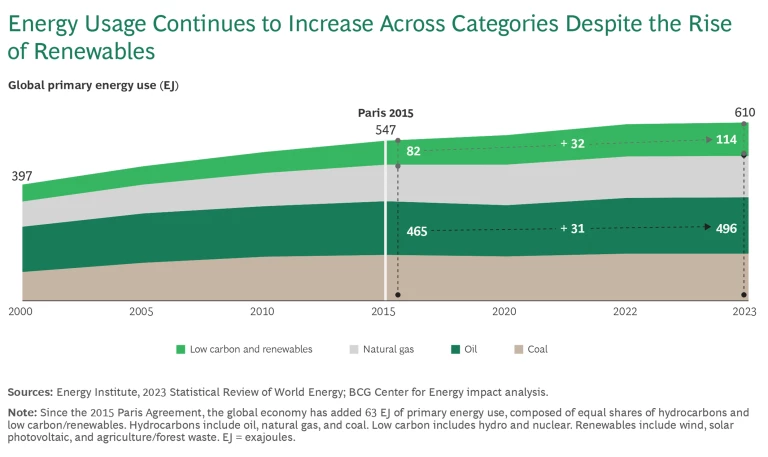

Efforts to advance the shift toward green energy and avoid the worst impacts of climate change have largely focused on taking steps to replace high-carbon energy supplies with low- or zero-carbon alternatives. Such steps, designed to help drive what is known as a supply-led transition, might include restricting the supply or increasing the price of hydrocarbons—for example, through adoption of a global, comprehensive carbon price. But while some countries have made encouraging moves in this direction, the prospects for adoption of a global carbon price still seem remote at present.

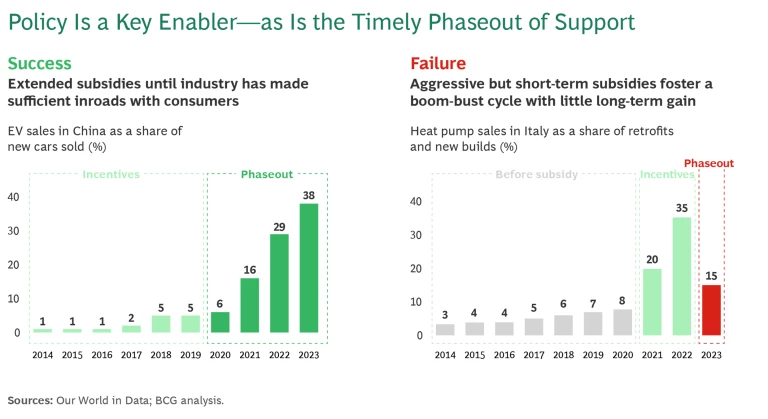

Supply-side interventions such as regulations and incentives clearly have a vital role to play in achieving a comprehensive and balanced transformation that satisfies global climate goals. Nevertheless, although supply-focused steps are having a positive impact, fossil fuel use is not yet declining, despite the fact that renewable energy is ramping up. What could further accelerate the transition? Companies and governments can make significant progress by focusing equally on the demand side of the equation. History shows that a customer-centric approach can unlock a demand-led transition that is faster and has more staying power than a transition predominantly driven by supply-side actions.

The Power of a Demand-Led Transition

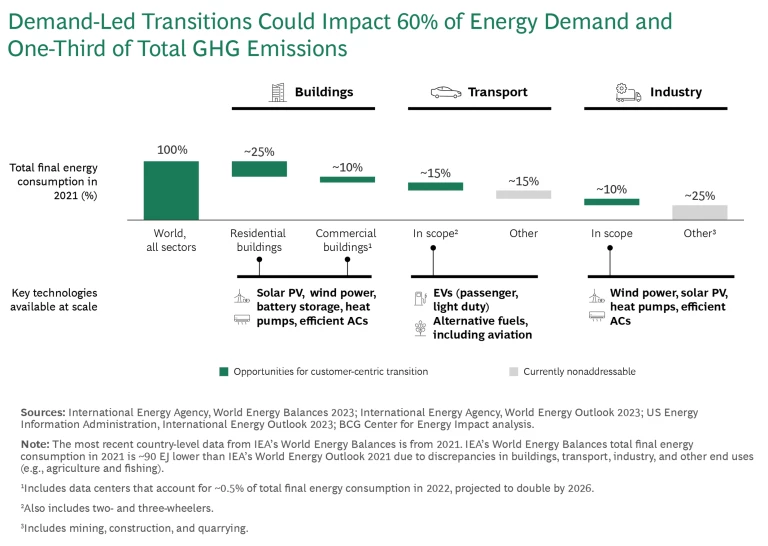

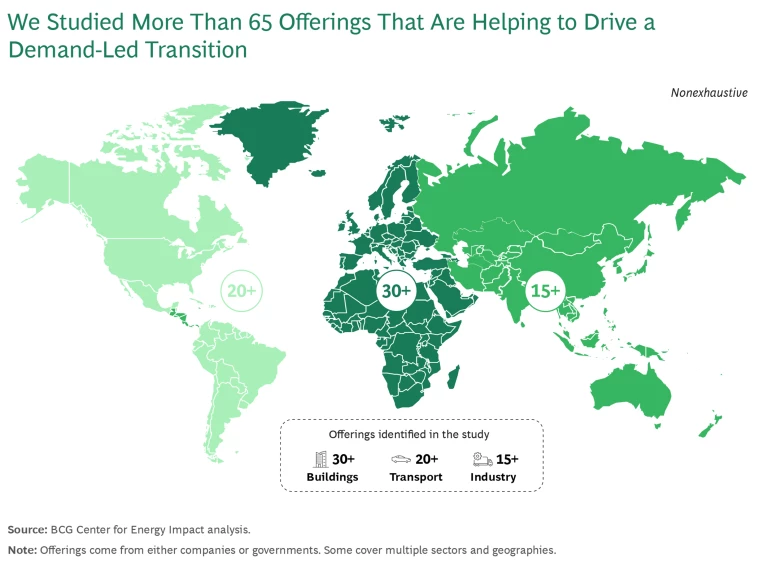

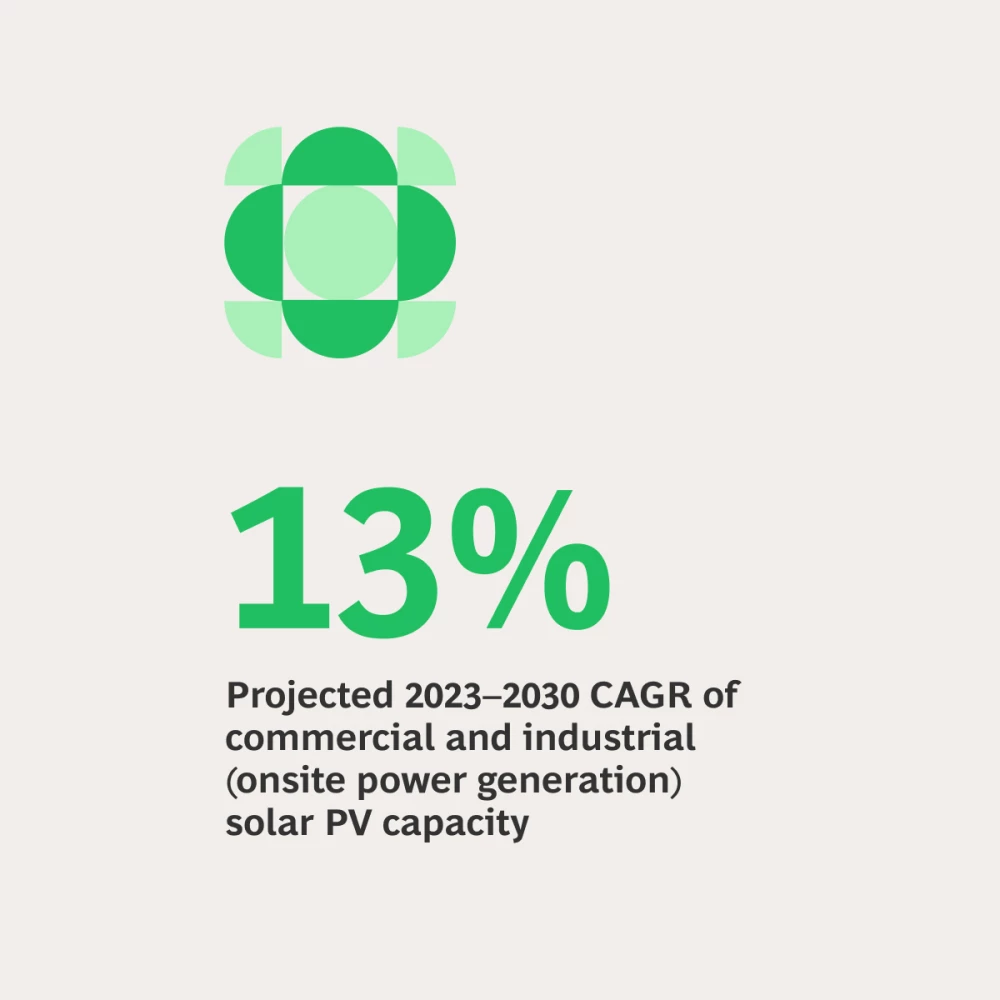

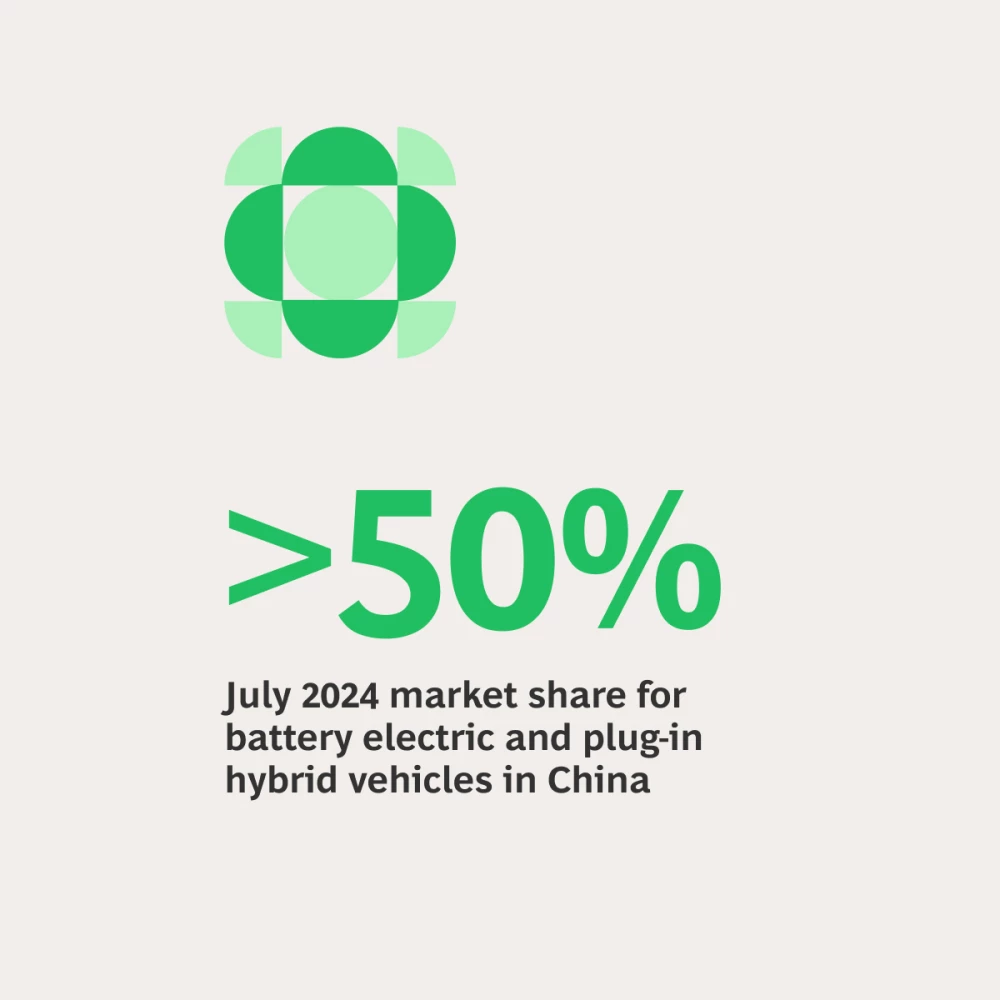

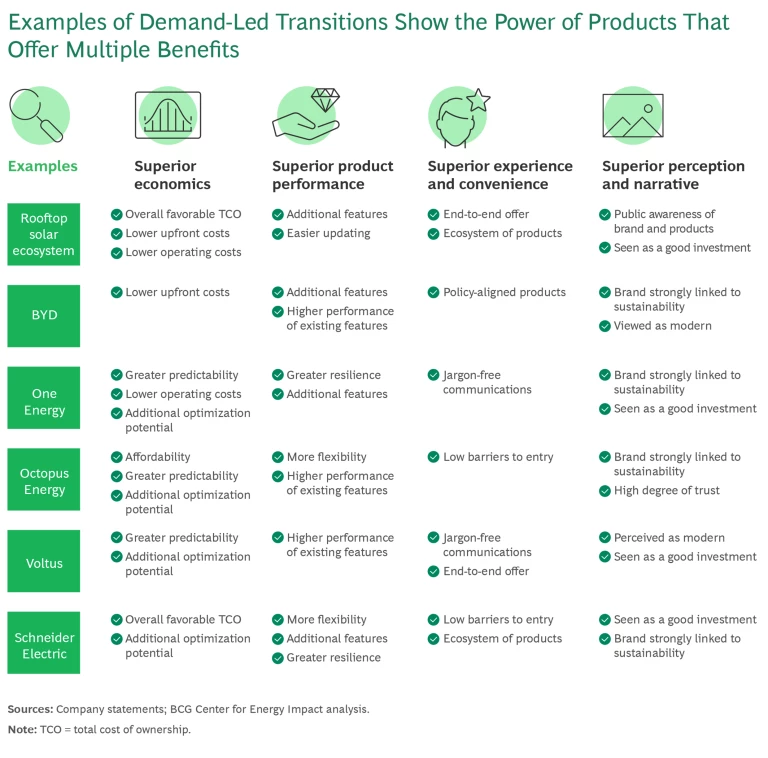

BCG’s Center for Energy Impact (CEI) partnered with the firm’s marketing, sales, and pricing experts to identify concrete ways to drive a demand-led transition. We studied more than 65 innovative energy-related offerings from companies and governments (out of hundreds that we identified worldwide) that are successfully driving a demand-led shift toward more sustainable products or services. Our research found that demand-led transitions can have a rapid positive impact in three large sectors: residential and commercial buildings (including data centers), transportation (most parts), and industry (primarily certain types of

- The requisite technologies to drive decarbonization are developed and at commercial scale today.

- Established government policies and incentives are in place in most geographies to drive the change.

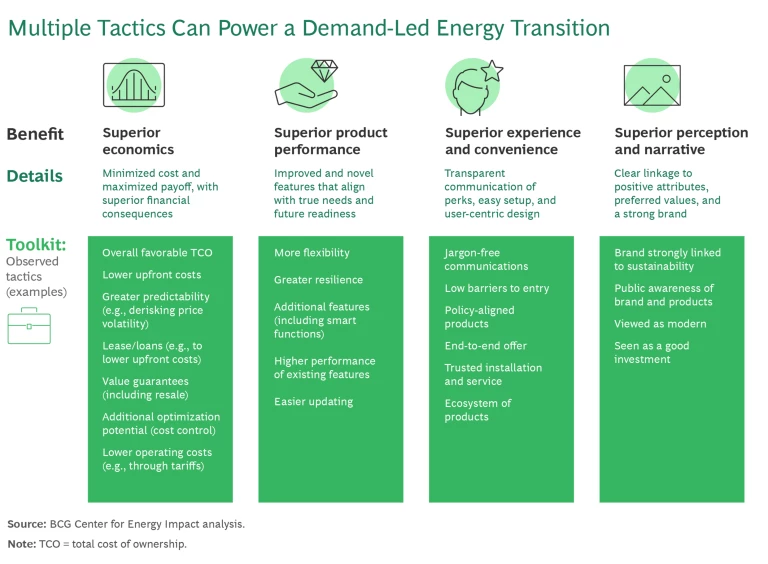

- There is a clear path to create compelling products and services with winning attributes beyond a competitive price.

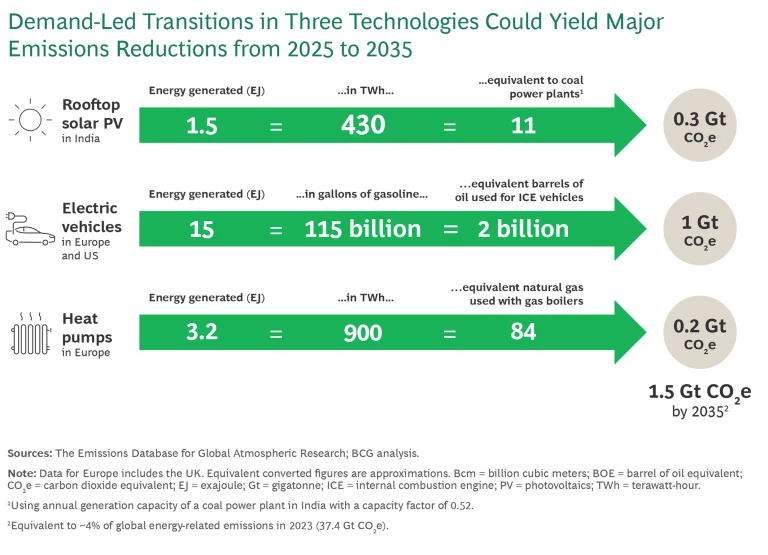

Fully leveraging the power of energy customers can change the trajectory of emissions reductions. But by how much? We assessed the impact of key technologies in select regions—residential solar photovoltaics (PVs) in India, electric vehicles (EVs) in Europe and the US, and heat pumps in Europe—and found that a customer-centric transition could reduce emissions by 1.5 gigatons of CO2 equivalent over the period from now to 2035, compared to the current trajectory.

Real-World Examples of Demand-Led Transition

A close look at the experience of companies in the buildings, transportation, and industry sectors underscores the potential for demand-led change.

Stay ahead with BCG insights on energy

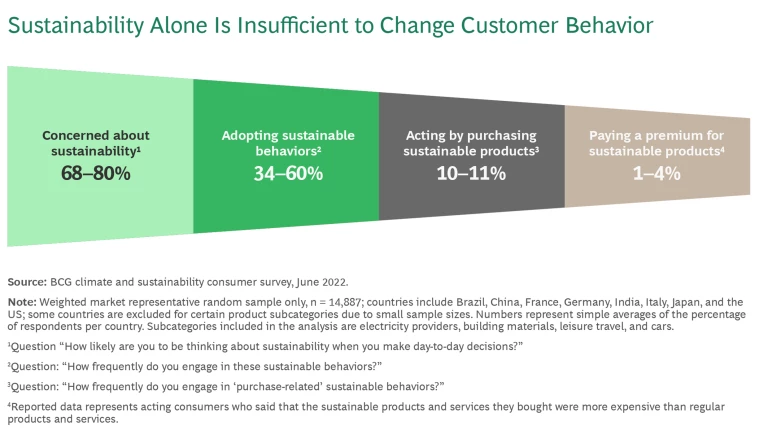

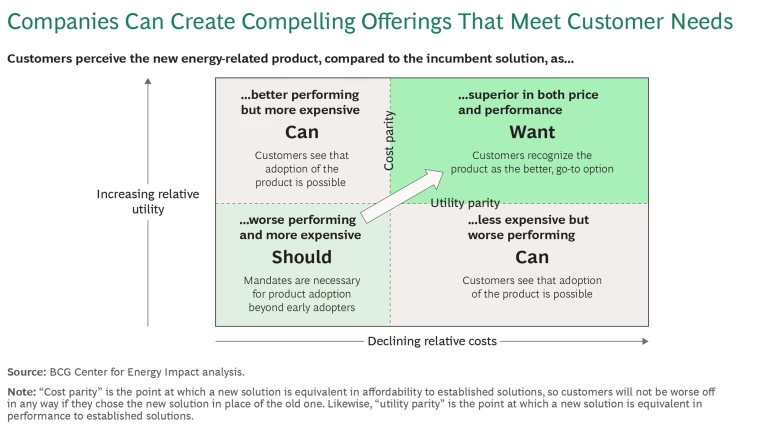

Getting Customers to Want

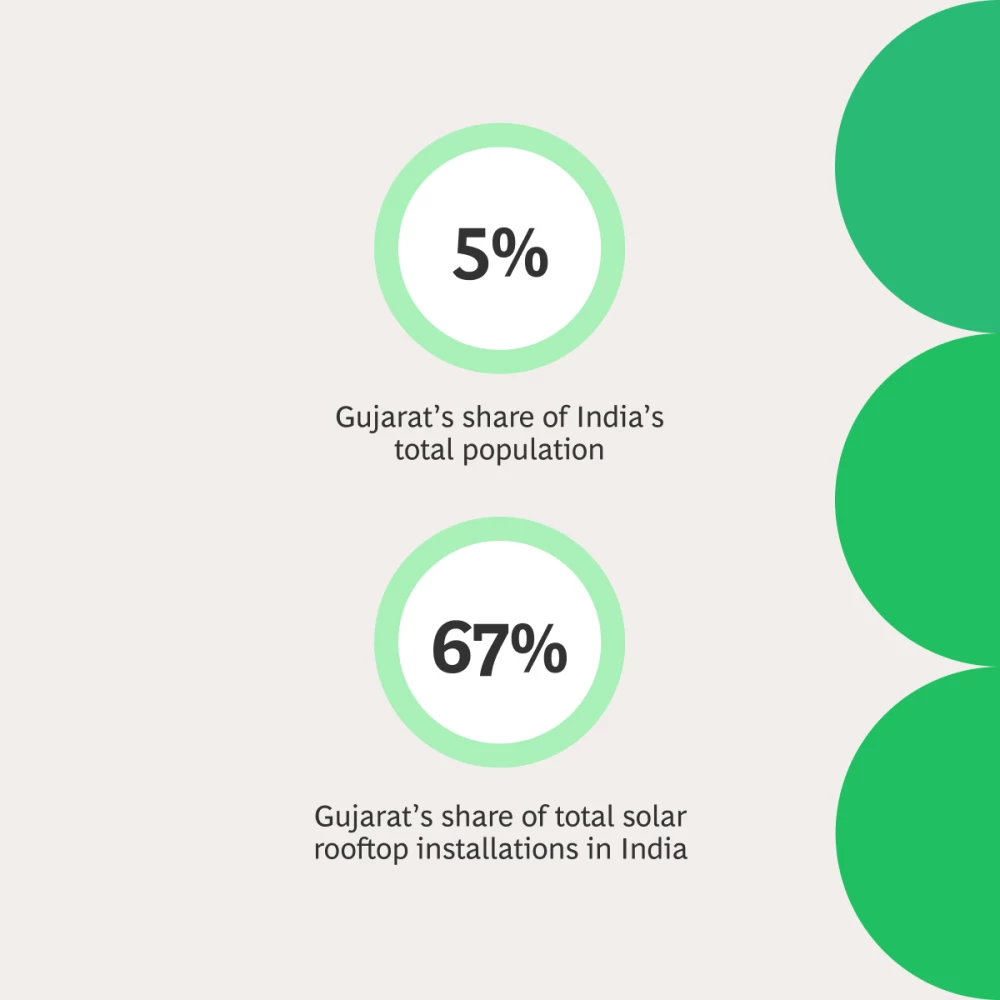

Unfortunately, much of the potential influence that energy customers could wield in the market remains untapped. In looking specifically at consumers, BCG research has found that upward of 80% of them express concern about sustainability, but very few translate these concerns into decisions to purchase sustainable products. To replicate the success of companies like One Energy and BYD, it helps to understand customers’ needs, the factors that drive their purchasing decisions, and the supportive role that policy can play.

In some cases, companies can design offerings that not only give customers superior economics or performance, but also address technical issues that may be complicating the energy transition. (See “Easing Pressure on the Grid.”)

Easing Pressure on the Grid

Part of this change involves investing in robust electrical grids. For more than 100 years, planners have chiefly designed power grids to transport power from a relatively small number of large generating stations, often across long distances, to end users. In the future, this will change as the grid becomes more distributed, with smaller, more numerous power stations generating energy from renewable sources. This arrangement will require a physical change in the design of the grid and a revision of the rules that govern it. Companies that develop strategies and business models to help balance the grid and enable customers to manage volatility from variable power sources and reduce costs can capture share in a sizable new value pool.

Some companies have developed customer offerings that help manage demand by incentivizing a shift in the timing of consumption or by storing power for later use. These products yield cost savings for customers and can also ease pressure on grid infrastructure and reduce the need for costly investment in additional grid capacity and more flexible generation.

One company embracing this approach is retail power utility Octopus Energy US, a subsidiary of UK-based Octopus Energy. Based in Houston, Texas, the company provides electricity services to residential and commercial building customers at sharply lower prices in exchange for users’ modifying the timing of their usage. The company leverages AI and machine learning to optimize customer electricity consumption. The more customers allow Octopus to remotely manage their consumption, the greater the savings. For example, under a basic plan, customers pay 17.6 cents per kWh for electricity. But if they connect to a smart thermostat or leverage the company’s app to manage the timing of EV charging, the rate drops to 12.7 cents per kWh, with an additional $40 credit.

The company also provides a superior experience compared to traditional energy providers, giving customers greater control by enabling same-day switching through its app as well as the ability to overrule remote management. Taken together, the company’s offerings can lower consumer peaks in demand, reducing the chance of blackouts and increasing end-user resilience.

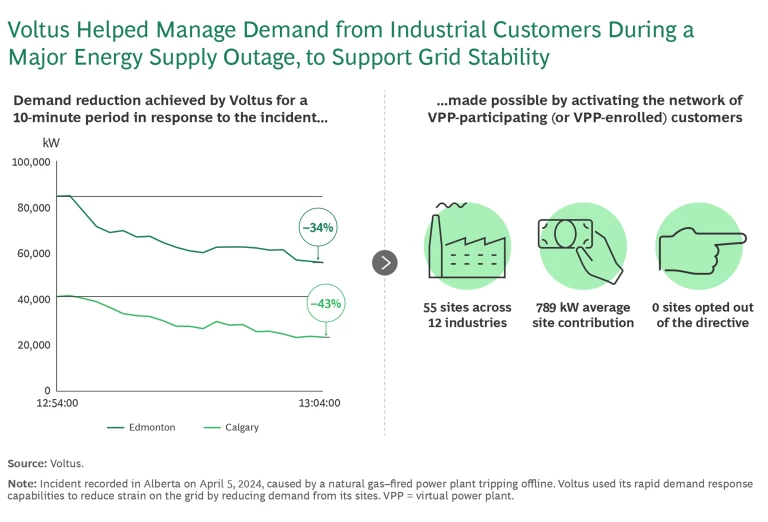

California-based Voltus, meanwhile, manages nearly 7 GW of its customers’ distributed energy resources across commercial, industrial, residential, and transportation sectors in the US and Canada. The company aggregates these resources into “virtual power plants” that provide the same grid services as traditional power plants. Grid operators pay Voltus and its customers for flexing their power demand (for example, by changing the timing of air conditioning or by switching use to backup generators or batteries), thereby reducing load on the grid during critical periods. When a natural-gas-fired power plant went offline unexpectedly in 2024, Voltus used its rapid demand response capabilities to temporarily reduce energy demand from its customers in Edmonton and Calgary by 34% and 43%, respectively. (See the second exhibit.)

Charting the Course for Demand-Led Change

Companies that adopt a customer-centric approach as they develop sustainable offerings will capture a large share of rapidly expanding value pools. To succeed, they must take five key actions:

- Identify markets that are ripe for demand-led change. Not all markets are equally ready for demand-led transitions, but many markets are shifting quickly. And there’s no one-size-fits-all approach to value proposition development. Consequently, companies must invest in understanding the context and customer needs of each specific market.

- Adopt a new mindset. Many companies, particularly in the energy industry, are accustomed to having government mandates drive change. Energy companies also tend to view their offerings as a commodity rather than a solution that can compete on the basis of offering a superior value proposition. Furthermore, some companies operate at a distance from end users. Adopting a customer-centric approach requires a shift in thinking—up and down and across an organization—that focuses on understanding what different customers want, what innovation is required to meet customer needs, and how to design a smooth and direct customer journey to drive adoption.

- Engage with government to advance a demand-led transition. It is not enough to understand government policy and factor it into product development. Companies can engage constructively with policymakers, gaining insight into government objectives and providing input on policies that can advance those objectives and support the development of compelling sustainable consumer offerings.

- Be data driven, with a digital platform. Companies should hone the ability to understand the disparate customer segments they serve. This requires data on what drives customer choices, expectations, and tradeoffs—for example, what functional needs are most important to customers, what types of features they want, and how much they value those features. Leading-edge digital capabilities are a must for companies that aim to capture value in a more flexible and volatile market. For example, only companies with strong digital capabilities will be able to capture a portion of the growing value pool tied to managing customer energy demand. Companies should also develop capabilities to remotely update products and harness AI so that they can pivot in response to market changes as available data signals that these changes are occurring.

- Seek flywheels and positive feedback loops. It is critical to continuously improve products and, where possible, create ecosystems of product lines. This approach gives customers flexibility even as it deepens ties between companies and those customers. And as more customers directly experience the benefits of the transition, support for additional legislative action can grow, further accelerating the flywheel effect.

Governments can create the right regulatory environment for a demand-led transition by taking five steps:

- Focus on a positive narrative. Responding to climate change with policies that emphasize the costs of inaction—but not the benefits of action—is insufficient. Messages centered on scarcity or fear will move the needle only so far. While not ignoring the cost of inaction, governments should redirect the focus of their narrative to the positive case for change, including superior technologies, local jobs, health advantages, better features, and lower costs.

- Zero in on enablers of progress. Incentives and policies should aim to overcome critical roadblocks. Potential initiatives include supporting financing options that lower upfront costs for energy customers, developing a workforce with the right skills, building out necessary infrastructure, establishing standards, and, where appropriate, providing access to data needed to create certain applications.

- Smooth the customer journey. Policies and incentives must have a customer-centric orientation to enable consumers and companies to use them frictionlessly. For example, if information on how to tap subsidies for heat pumps or solar panels is complex and difficult to decipher, customer uptake will be limited.

- Foster industries and ecosystems. Government’s objective should be to support the development of thriving, sustainable industries. Accordingly, it should create policies that help companies move customers from should and can to want—and then reduce support in a way that promotes robust competition for market share. A healthy and open dialogue with companies that are developing customer-centric business models is important to ensure that new policies will have their desired effect in the market.

- Keep public perception in mind. Appealing to the public’s sense of fairness and providing visible evidence of the positive impact of policies, incentives, and subsidies are important to maintaining and increasing popular support.

The global community must pull every lever at its disposal today to speed up the transition to green energy. Action on the supply side remains essential and cannot lose momentum. At the same time, though, companies and governments have an opportunity to tap more fully into the power of energy customers to accelerate progress. Most energy customers care deeply about sustainability but need compelling offerings to translate their commitment into action. Meeting that demand could change the trajectory of progress in addressing the preeminent challenge of our time.

About the Center for Energy Impact

Our deep expertise spans markets and economics, carbon and technology, capital and investors, the macrodynamics of geopolitics and resilience, and the microdynamics of politics and specific policies. We offer nuanced, constructive ideas and solutions covering the future availability, economics, and sustainability of the world’s energy sources—and the implications for energy companies, industries, investors, consumers, and governments. The CEI team is committed to facilitating informed, innovative discussions to make our world sustainable.