Reporting is a pain. At most companies, a lot of effort goes into generating, reconciling, and compiling management reports. Recipients are swamped with data, oftentimes with little impact on decision-making and action. Finance does not have the time (or capability) to create real insight from pure data.

Too many finance functions still muddle along, making only incremental improvements. Decluttering your reporting is always helpful. Building a value driver tree for the business and focusing reports accordingly will improve usefulness. Moving from descriptive hindsight to explanatory insight and prescriptive foresight is great, as is building automated reporting dashboards to avoid manual efforts. All these tactics are well known—though not always applied.

CFOs can, however, extend the art of what’s possible and achieve a quantum leap in reporting. Doing so requires systematic reframing, approaching reporting from new perspectives.

How to Achieve a Quantum Leap in Reporting

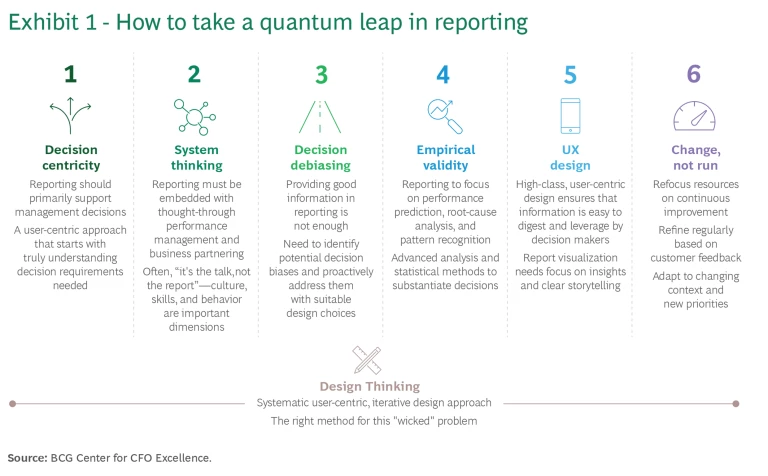

The future of reporting needs to be totally different from what it is today. Reporting can take a quantum leap by systematically incorporating the following six next-level tactics. (See Exhibit 1.)

1. Decision centricity

Contrary to conventional wisdom, the primary objective of reporting is not to inform; it is not to provide data. Reporting only has an impact if it influences management decisions. Thus, it is essential to fully understand which decisions need to be supported. Which questions need to be answered to make a certain decision? Which information is really needed, and what can be left out? Answers to these questions help to focus reporting on really adding value.

A pharmaceutical client turned the reporting design process upside down by starting with the questions that really mattered to its business. Defining them gave way to a much more relevant set of KPIs, a board-ready reporting structure, and a focused performance meeting agenda. As a result, the company eliminated 40% of reports and associated non-value-adding reporting efforts.

2. System thinking

In the end, it’s the talk, not the report that drives performance. Reporting must be embedded in thought-through performance management. It requires clear roles for all participants—including those of finance business partners. It requires a structured process with systematic preparation and follow-up. And it also requires engineering the context for a constructive discussion culture.

The CFO of a major utility company we partnered with adopted this approach. He not only overhauled the reports, but also transformed performance sessions—from reviewing outcomes to discussing actions. Working closely with business leaders, the CFO redefined the sessions’ purpose, aligned on a new agenda and content focus, and established a disciplined follow-up process. Business partners received targeted training to support their evolving roles. As a result, new reports not only informed but also drove measurable business impact.

3. Decision debiasing

We all know that human decisions are subject to significant decision biases. Confirmation bias, for example, makes managers neglect contradictory evidence. Anchoring prevents reversing views even in the face of a changing environment. Due to group think, dissenting views are not considered. Some managers suffer from overconfidence in planning, with an unfounded hope for the best.

Future finance needs to identify relevant biases in a certain context and address them proactively with suitable design choices. This might require adjusting reporting formats or a different preparation process or actively preventing identified potential biases.

A burgeoning tech company noticed significant over optimism in its revenue forecasts. Its finance team started to provide regular feedback on forecasting quality, which helped to adapt, calibrate, and improve the forecasting process.

4. Empirical validity

Finance leadership faces an environment that is becoming more and more uncertain and complex. Yet, most reporting still resembles the same double-entry bookkeeping method that was invented in the 13th century.

In the future, reporting must be multi-dimensional and account for probabilities. What is the pattern in all this noise (or is it just noise)? Do we see a trend or is this normal volatility? Which performance drivers are statistically and economically significant for leadership decisions? What is the probability of success for a particular decision relative to the typical base rate?

This shift in reporting will require a huge step up in empirical methodology and corresponding capabilities in the finance function. Finance will need to learn to handle big data and advanced analytics. Generative AI is just the most recent advancement in this toolbox. This is not only a capability challenge for finance, but also a challenge in communication and change management. Highly complex statistical analysisneeds to be communicated in such a way that leaders do actually leverage them to make decisions.

BCG Lighthouse, for example, is an advanced data and analytics platform that integrates vast amounts of data from companies’ various internal and external sources, allowing them to identify trends, forecast outcomes, and optimize operations. Combining different data sets and employing AI and similar analytics can unlock significant improvements in inventory optimization, marketing, or sales force effectiveness.

5. User experience (UX) design

Designing reports involves more than simply providing information. Great design not only adheres to design best practices, but even more importantly, it also takes the users’ perspective. The information has to be intuitive to digest for a designated user group. Therefore, future finance must really understand when and how decision makers leverage reports, their individual starting points, and their needs. This might require telling a story in a particular way, or adjusting a data display to user preferences and embedding it in intuitive and interactive tool solutions.

This requires having design capabilities, in addition to soft skills like user empathy. This is a huge learning requirement for finance, and also an interesting opportunity to attract finance talent. Future reporting design is not a dull automation problem, fighting to take long-cherished reports away from managers. It is an opportunity to make a difference in terms of management decisions by reporting on what matters in a way the user can understand quickly, instead of reporting what is available in an accounting-centric way.

6. Change, not run

Situations change, people change, and we all learn. Once reports are automated, finance should embark on a continuous improvement journey, refining dashboards based on customer feedback and adapting to changing business needs.

Consequently, CFOs need to shift capacity. Today, frequently 80% of reporting capacity is focused on report generation and only 20% on analysis. In the future, 80% of reporting capacity needs to be focused on advanced analytics, with the remaining 20% on systematic and continuous improvement. Put differently, CFOs need to shift from “run” to “change.” Client examples show rigorous decluttering, digitization of processes, and clear directions for alignment meetings to be quick wins to free up time to embark on a holistic reporting transformation journey.

Leveraging Design Thinking

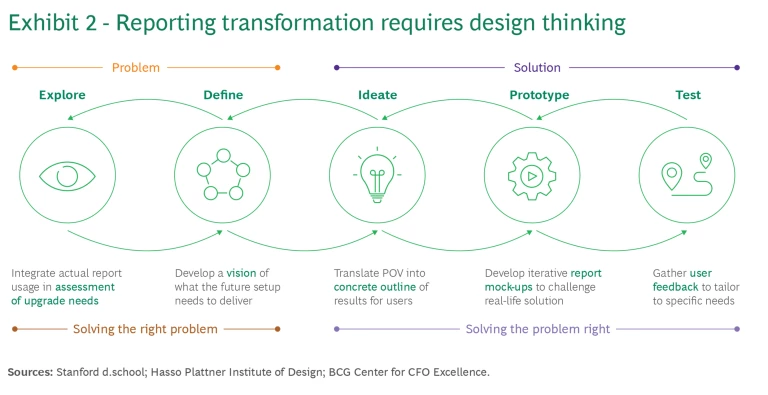

Most of the above quantum-leap tactics put the human element front and center. That’s why future reporting rework should follow a design thinking approach. (See Exhibit 2.) Design thinking is a method developed at Stanford’s d.school for solving “wicked problems” in a people-centered way. Reporting redesign is a classic “wicked problem”: customers cannot clearly articulate what they need, the requirements are not easily understood, and the solution is best developed in an iterative way.

For instance, a pharmaceutical company used design thinking to redesign its reporting system, starting by gathering input from users about their frustrations and needs. It then prototyped and tested new reporting formats, refining them with ongoing feedback, transforming its reports from cumbersome data dumps to user-friendly, insight-packed tools. The inclusion of the user in the process created strong buy-in and lasting results.

Reimagining Reporting to Drive Value

Revamping your reporting isn’t a side task; rather, it’s a key method through which CFOs can deliver immense value to a business, offering the crucial insights that influence managerial decisions.

Designing future reporting incorporating next-level tactics is more art than craft. It is a challenge worthy of finance’s best talent, worthy of hiring designers and number wizards, and worthy of dedicating significant finance effort. Doing so will pay for itself via more data-backed and value-oriented decisions throughout your company.

A giant leap in your reporting isn’t just a dream—it’s a reality well within your grasp!