Extending payment terms is an effective way for companies to generate and preserve working capital and cash flow. But to truly maximize enterprise value, companies must avoid the hidden costs of this strategy. By taking a pragmatic approach, CFOs can enable their company’s procurement teams to make informed tradeoffs that optimize both cash flow and earnings.

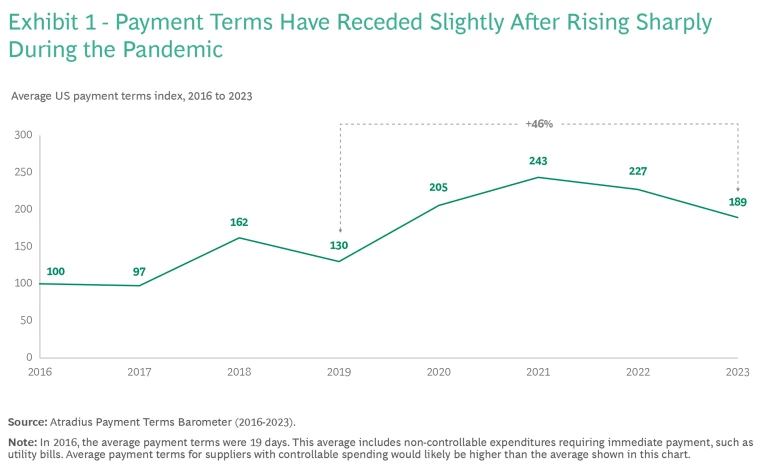

During the pandemic, many CFOs asked their procurement colleagues to prioritize payment term extensions to conserve cash in the volatile economy. Indeed, Atradius Payment Practices Barometer confirms that the average duration of US payment terms nearly doubled from 2019 to 2021. In the current environment of sharply higher interest rates that began in 2022, payment terms have continued to be a vital tool for relieving pressure on companies’ working capital. Although payment terms have receded from their pandemic highs, they are still nearly 50% longer, on average, than prepandemic levels. (See Exhibit 1.)

Some suppliers have responded to payment term extensions with price increases, either overtly or discreetly. This has placed procurement professionals in the difficult position of deciding when to ask suppliers for extensions in order to improve cash flow and when to push back on the resulting price increases to maintain earnings. Such decisions frequently rest with category managers or commodity buyers who may lack the clear guidance or robust tools required to make informed tradeoffs. Instead, many procurement organizations depend on blanket policies that fail to consider the subtleties of individual supplier relationships or the arbitrage opportunities arising from differences between the parties’ marginal cost of capital.

To help procurement teams decide how hard to push for payment term extensions, CFOs must define tailored targets and strategies that consider supplier and category nuances. Companies must also equip these teams with the tools, insights, and training needed to negotiate longer terms while limiting reciprocal price increases.

The Value and Tradeoffs of Extending Payment Terms

To justify extension of payment terms, many CFOs would argue that cash is king. But if a company is operating with adequate cash levels, the value of holding an additional dollar of cash for 30 days may not outweigh a subsequent price increase from suppliers.

The true payoff from improving cash flow is the opportunity to redeploy capital in order to deliver value for the organization. This may include investing in internal projects that generate returns, placing the money in a market account and earning interest, or receiving a discount by paying off debt or other suppliers early. Maintaining adequate cash levels also allows the company to avoid violating debt covenants and jeopardizing credit ratings.

All of these actions deliver real value. For instance, paying down debt early may provide 1% to 2% savings based on the weighted average cost of capital (WACC), while paying suppliers early could lead to a 2% to 3% discount on the original price.

For suppliers, on other the hand, extending terms could have a negative financial impact. A supplier still must pay its vendors and employees within their agreed-upon terms. If those terms are shorter than its terms of payment with customers, the supplier incurs costs. It may be charged late-payment fees by its vendors or be required to take out a short-term loan (at a hefty interest rate) to pay employees on time.

To compensate for these tangible costs, suppliers raise prices. In some cases, they may do so overtly through direct price increases. In other cases, they may increase prices discretely, such as via surcharges, additional labor hours in the cost estimate, or more change orders during the project. (See “Circumstances That Carry the Highest Risk of Hidden Costs.”)

Circumstances That Carry the Highest Risk of Hidden Costs

- Transactional Spot Buys. These one-time purchases usually entail short-duration contracts without established terms and conditions, thereby enabling suppliers to adjust prices in real time. Buyers also tend to lack the capabilities to ensure granular visibility and tracking.

- Custom or Project-Based Purchases. The scope changes from project to project, making it difficult to benchmark and compare costs across similar purchases.

- Inadequate Category Management or Supplier Engagement. Limited oversight allows suppliers to increase prices.

- Sole-Source Environments. Suppliers may have more power in the relationship while purchasers may find it harder to identify and deploy levers to influence suppliers.

During a recent client engagement, we conducted a double-blind survey across the client’s industry to gauge how suppliers would respond to requests for extending payment terms. The majority of suppliers stated that they would not increase prices if the payment terms remained within industry norms. However, if terms were extended 15 to 30 days beyond those norms, suppliers said they would consider raising their prices by 5% to 8%, either directly or through various subtle mechanisms.

It can be difficult for a buyer’s procurement teams to make immediate tradeoffs between payment terms and prices. The tradeoffs are especially risky for companies that must manage a large number of low-volume suppliers—a situation that became more common during the pandemic. Having such a “long tail” of suppliers can complicate the monitoring of price adjustments related to extended payment terms. Moreover, many companies do not possess the sophisticated analytics needed to track and measure price increases or a process for scrutinizing every purchase. Without detailed insights, procurement teams find it challenging to negotiate optimal payment terms with suppliers.

Companies should also consider the potential nonfinancial downsides of extending terms. For example, requesting payment term extensions could have a detrimental impact on supplier relationships, and gaining a reputation for taking a hard line on payment terms could deter other vendors from doing business with a buyer. In addition, devoting too much attention to payment terms could distract procurement teams from focusing on other critical value-adding activities, such as negotiating prices.

Best Practices for Extending Terms While Limiting Price Hikes

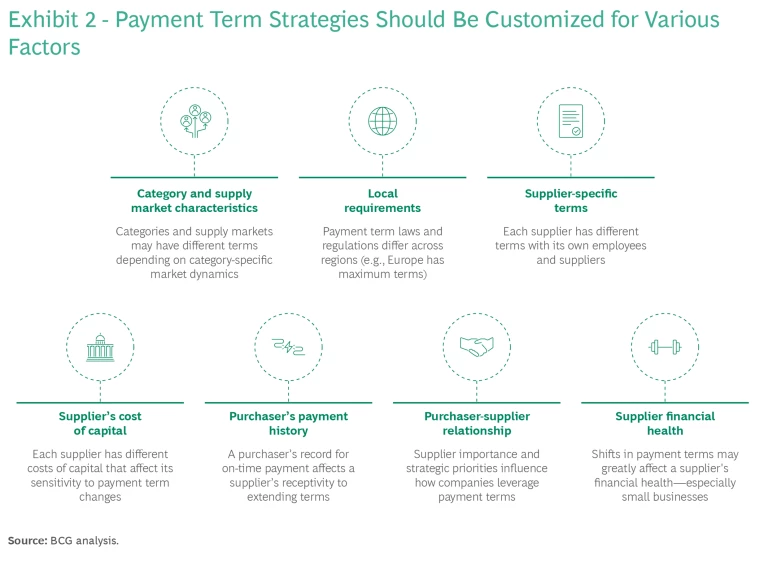

Many CFOs have set clear mandates for procurement teams to extend their payment terms beyond regional or industry norms, and many companies that have already extended terms seek to maintain or further increase them. However, most companies have exhausted the blunter levers to increase terms, such as a standard letter to all suppliers or organization-wide mandates for buyers. CFOs now need to explore more nuanced and tactical strategies that account for the differences among categories, regions, and suppliers. (See Exhibit 2.)

For example, when developing their payment terms strategy, companies should apply a de-averaged approach that considers the buyer-supplier power dynamics. This means treading carefully with suppliers that may have more leverage or are strategic partners. It also entails avoiding sudden shifts in terms that could cause financial instability for suppliers, such as those that depend on the buyer for a large share of their revenue. To assist in analyzing these and other risks, companies can use GenAI tools, such as BCG’s Savings Radar .

By deploying the following set of best practices, CFOs can ensure that their company extends payment terms thoughtfully.

Establish governance and targets. Form a cross-functional team to set a clear strategy, mandate, and targets for payment terms applicable to the broader organization. The team should include procurement, contracting, finance, and business unit leaders.

Develop tailored strategies. Customize payment term strategies for specific supplier segments. Identify which segments and suppliers may be off-limits for term extensions because of supplier power or risk. Prioritize extending terms for those suppliers with which you have the greatest influence. Consider excluding at-risk suppliers, such as small and diverse businesses, from term extensions, or implement extensions in ways that avoid a financially harmful cash crunch. For example, a financing program can help suppliers overcome cash flow constraints. (See “Combining Payment Term Extensions with a Financing Program.”)

Combining Payment Term Extensions with a Financing Program

Alongside the term extensions, we designed a supply chain financing program to aid suppliers with constricted cash flow. The program provides reliable funding at a lower interest rate.

Subsequent phases will expand the program to suppliers in Asia and Europe, the Middle East, and Africa. The company will also broaden its outreach to smaller suppliers by utilizing scalable digital solutions.

In tailoring a strategy, it’s important to consider where the supplier is positioned in the value chain. Suppliers further upstream often face more financial risk and, consequently, higher WACC. The key reasons include less predictable demand (for example, large batch orders versus continual demand); more fixed assets, which require significant capital investments; less flexibility to adjust near-term prices in response to market changes (for example, rigid long-term contract pricing); and susceptibility to bullwhip effects from sudden demand changes downstream, which can cause major inventory fluctuations.

Find creative ways to structure terms. Devise ways to structure terms that offer flexibility in addressing current business needs. For example, negotiate early-payment discounts, such as 2% off for paying within ten days. This allows the finance function to either take savings via early payment or improve cash flow through later payment. Consider nonstandard approaches to extending terms without overtly changing the number of days. For example, maintain a 30-day term but stipulate that all invoices due and payable will be settled on the first Tuesday of each month.

Leverage best-in-class tools. Set up systems and processes to take full advantage of the extended terms. For example, don’t start the payment clock too early, and ensure that the accounts payable system can handle nonstandard terms.

Equip negotiators with digital tools and spend analytics that enable informed decisions, create transparency, and optimize payment terms. Such tools can, for example, identify companies with outlier payment terms that should be harmonized. Utilize GenAI to improve supplier outreach and increase the time buyers can spend on value-adding activities. For example, the technology can assist in extracting payment terms from contracts and harmonizing them across suppliers.

Develop robust analytics and a regular governance forum that enable leadership to track progress and resolve issues, including the identification and removal of any barriers.

Elevate negotiation tactics to reduce resistance. Negotiate payment terms after agreeing to the price. This sequencing minimizes supplier pushback and facilitates quantifying the impact if the supplier responds by increasing costs. Adjust payment terms in small increments over time, rather than pushing for a large increase. For example, request annual increases of 10 to 15 days for two to three years, and build progressive increases into long-term contracts.

Although CFOs can improve cash flow by extending the duration of payment terms, they must be mindful of the associated costs—whether overt or hidden. To avoid hurting the bottom line, CFOs must equip procurement teams to make informed payment term decisions. This requires tailoring targets and strategies to the nuances of each supplier and category, as well as supporting teams with best-in-class tools, insights, and training. By making the right tradeoffs, companies can optimize payment terms and achieve the best outcomes for both cash flow and earnings.