To date, nearly all spending on climate change—about 95%—has been on prevention and mitigation. But as the effects of climate change become more severe and the goal of keeping global warming to below 1.5°C slips out of reach, governments and industries are pivoting to focus more on long-term adaptation. These projects to improve resilience will take huge amounts of capital and present an opportunity for banks to open new avenues of growth.

Adaptation Spending to Skyrocket

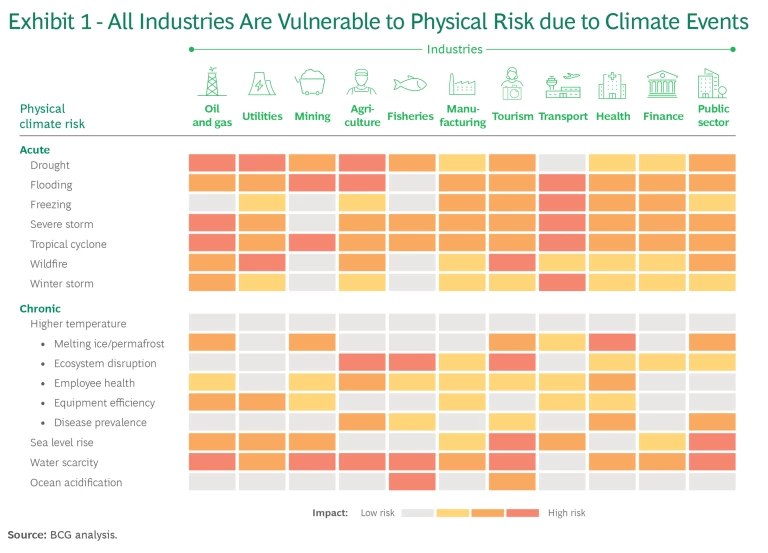

As the planet grows warmer, no industry will be spared from increasingly frequent supply chain disruptions, operational interruptions, and reduced productivity. (See Exhibit 1.)

Since 2020:

- The number of companies reporting that they expect climate risk to affect their financials has increased 3.6 times.

- Corporate investment in adaptation and resilience has grown by 200%, and we expect that spending to accelerate.

In 2023, the 5% of global investments spent on climate adaptation (as opposed to the 95% spent on prevention and mitigation) amounted to $65 billion. By 2030, BCG estimates the private sector globally will spend $2 trillion to $3 trillion annually.

While companies might be tempted to avoid spending such huge sums, that would be shortsighted. We estimate that the cost of inaction will be 7 to 15 times greater ($20 trillion–$45 trillion) than the investments made to improve climate resiliency. Companies mainly expect impacts on their:

- Revenue (42% of total financial impact—mostly from production interruptions)

- Assets (30% of total financial impact—from asset write-off, impairment, and early retirement of assets)

- Costs (28% of total financial impact—from direct and indirect damages to operations and supply chains)

In parallel, banks and financial institutions mainly expect impact from increased credit risk (70% of the financial impact), reduce profitability of investment portfolio (17%), and increased insurance claims (13%).

Banks Are Uniquely Positioned to Advise

With this reality sinking in, companies are increasingly seeking a range of solutions to better understand climate risks, identify solutions, and finance these myriad projects. In the commercial real estate industry, for example, companies will need to retrofit buildings. Logistics companies must refashion routes and supply chains. Food and agriculture companies need to invest in new methods for growing food. Construction companies need to develop new building materials.

Banks are uniquely positioned to help companies advise on and fund such projects. This is not just because they are lenders but because they have been assessing the physical impacts of climate change for years as part of their own investing and lending decisions. Until now, it’s been mostly the credit risk teams taking a close look at this data. Now, lenders need to pivot and start using this valuable information to partner with companies to help make them more resilient. Banks bring:

- Unrivalled capabilities in physical risk assessment

- A great ability to structure financial products

- A unique vantage point working across the public and private sectors

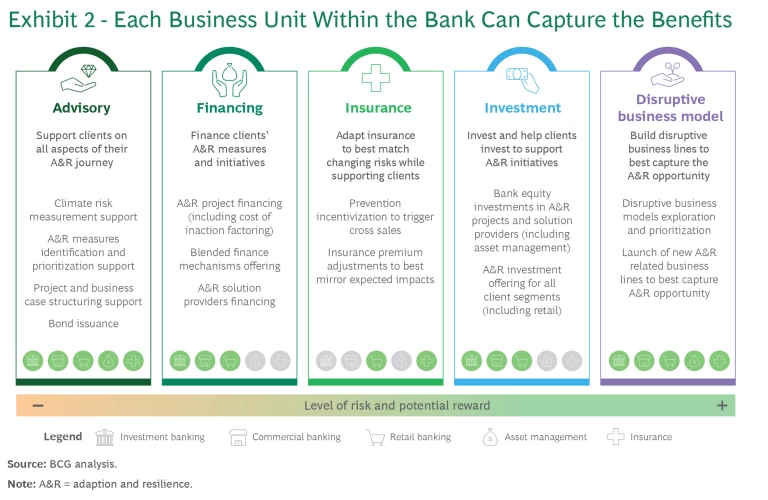

This creates opportunities for corporate investment banks, asset managers, commercial banks, and retail banks. (See Exhibit 2.)

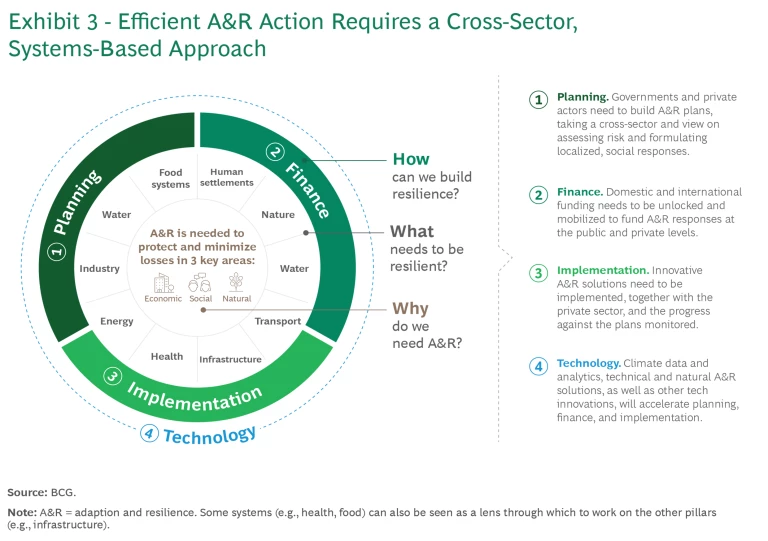

The bottom line is that it is important for banks to not just assess climate change but to address it—and the benefits for banks go beyond growing the business. A systematic approach to adaption and resilience (A&R) financing will make their own portfolios more resilient from a climate physical risk perspective. It will also help them comply with regulatory requirements, which increasingly include monitoring and managing this type of risk. Efficient A&R action requires a cross-sector, systems-based approach, including the planning, financing, and implementation of A&R solutions. (See Exhibit 3.)

Overcoming Funding Barriers

Even though companies need financing for adaptation and resiliency projects, and even though banks have the expertise and resources to help, certain barriers must be overcome.

Information Gaps. Information on climate risks , the benefits of adaptation, and the cost of inaction is lacking. Often the metrics simply do not yet exist. Without this common language both banks and companies struggle to understand how the physical impacts of climate change affect a company’s bottom line.

Difficulty with Prioritization. The lack of information and common metrics make it difficult to prioritize which measures to pursue now versus later, and how to assess the costs and benefits of pursuing measures with high up-front costs and longer-term payoffs.

Lack of Solutions. Companies often believe that adaptation projects offer low or non-existent revenue benefits, largely because formulas do not account for the cost of inaction. And since these A&R loans often don’t generate cash flows—but might instead preserve asset values and hence stabilize revenue flow—banks can struggle to underwrite them using current products.

Project Complexity. Projects can cut across sectors and are site-specific. They often require complex structures and coordination involving several stakeholders (public and private) with different risk-return-impact expectations.

Five Critical Enablers

To overcome these barriers and capture the full value of A&R initiatives to fund climate adaptation and resiliency, we have identified five critical enablers.

Internal Capabilities. Review and complement existing processes to support the A&R journey—such as physical risk assessment and A&R deal assessment. Upskill the workforce to better understand the levers that impact A&R, which will build credibility with clients.

Data and Tooling. Build or acquire robust tools to identify and quantify climate risk across the portfolio, backed by a strong data strategy. Data sourcing should include asset-level data, hazard data, and client data.

Go-to-Market Strategy. Turn the A&R opportunity into a business reality by strategically initiating business discussions with clients early on. Hone the engagement pitch to become the go-to bank.

Partnership Ecosystem. Connect the bank to an ecosystem of potential public and private partners, including multilateral development banks, development finance institutions, solution providers, insurance companies, and governments and local authorities.

Seat at the Table. Become a thought leader on the A&R topic and shape the landscape by engaging with all stakeholders through working groups and roundtables, seminars and key events, and reports.

As industries across the globe will feel the effects of climate change and work to adapt their operations to build resiliency, banks have a critical role to play in this effort. Those that apply their data and evolve their products and services to help companies address climate change stand to benefit in what is shaping up to be a multitrillion dollar market.