As threats to profitability continue to weigh on the banking sector, retail banks are increasingly getting into the insurance business. They are partnering with insurers and selling insurance products that meet a wide variety of customers’ needs, while increasing revenues and improving return on capital.

Yet, despite the tremendous growth potential for the bancassurance channel, many retail banks have either remained on the sidelines or been unable to make the most of this opportunity.

To find sustainable success in bancassurance, a bank needs to forge a robust vision for its insurance business and choose the right partnership model and partners. The bank-insurer partnership must make the insurance business a strategic priority, leverage the assets of both partners to develop a value proposition for each target customer group, and commit to building advanced digital, data, and AI capabilities .

Bancassurance is a big opportunity. Retail banks that make the most of it can increase profits by 15% to 20%, while making important insurance products and services available to the people who need them.

A Winning Proposition

By the end of the decade, the profitability and growth of retail banking could decline dramatically owing to several trends. Among the most significant: rising costs, particularly of IT and support functions; the emergence of new digital challengers (such as Nubank and Revolut) and the rapid expansion of online and mobile banking; the continued commoditization of interest rate-based retail products, such as loans, deposits, and credit cards; and the growing unpredictability of some revenue streams as customers change banks more frequently.

To strengthen the resilience of their bottom line, more and more banks are scaling up their bancassurance business. Bancassurance, in fact, is a winning proposition not only for banks but also for insurance firms and customers.

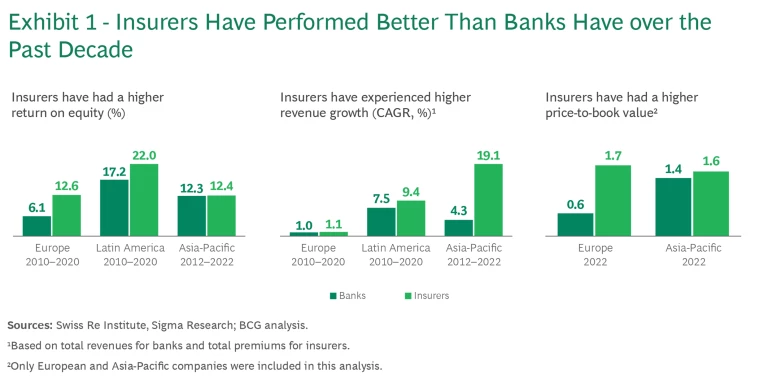

Banks. According to BCG’s analysis, insurers have experienced greater profitability, more revenue growth, and better stock market performance than banks have over the past decade. (See Exhibit 1.)

Given the noncyclical nature of the insurance business, fee-based earnings from insurance sales can improve capital return resilience for retail banks, whose balance sheet typically depends on interest rates. Advisory fees from more-complex insurance products can make the bottom line even more resilient against the commoditization of banking products and margin compression. Furthermore, when customers purchase insurance products from their bank, they are more likely to turn to that bank for other products.

The bancassurance market has ample space to grow, since banks have mainly focused on life insurance and have yet to pursue opportunities in other lines of business, such as property and casualty and health insurance.

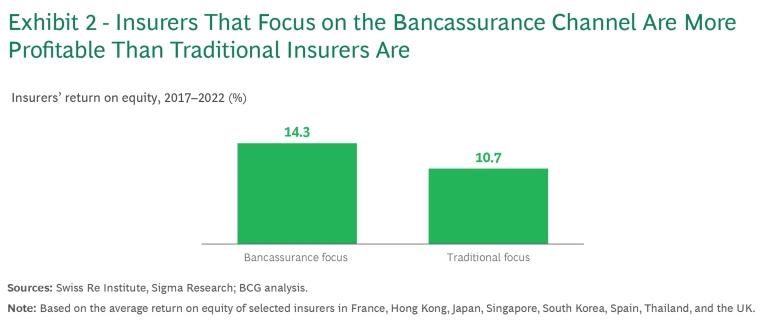

Insurers. Bancassurance is highly attractive for insurance firms as well. BCG has found that from 2017 through 2022, insurers that made bancassurance their primary distribution channel were roughly 40% more profitable than insurers that did not. (See Exhibit 2.)

Insurers that take that step often gain some important advantages as well. First and foremost, insurers get access to their partner’s customer data set. Insurers, therefore, need to expend less effort to identify target customers, assess their needs, and tailor products to meet them. For example, insurers are able to identify customers who have good risk profiles and are likely to be interested in higher-end products. Insurers also have the means to adapt higher-margin products and price them attractively.

Second, insurers can benefit from their partner’s frequent interactions with its customers and from its relationship managers’ client relationships, which are built on trust. Such advantages let insurers identify more opportunities to cross-sell and up-sell insurance products, as well as to sell high-end financial advisory services to wealthier customers.

Customers. Bancassurance is also good for customers. Banks’ ability to leverage their rich transactional data to create more-precise profiles, identify coverage gaps, and proactively reach out to customers means that a wide variety of customers can have access to the kinds of insurance they need. This holds true whether banks offer microinsurance products for the less affluent or more complex insurance products for the more affluent. Many customers also gain access when banks embed insurance in their products and processes, facilitating coverage for key financial actions, such as taking out a home mortgage or planning for retirement.

A Trifecta. Bancassurance can be a win all the way around. It is more profitable than the average insurance business, which is more profitable than banking. That helps to explain why more banks are doubling down on it. At the same time, because bancassurers typically reach a larger cross section of the population than insurers do, bancassurers can greatly mitigate the protection gap for consumers who are underinsured or uninsured.

The Secrets to Partnering Success

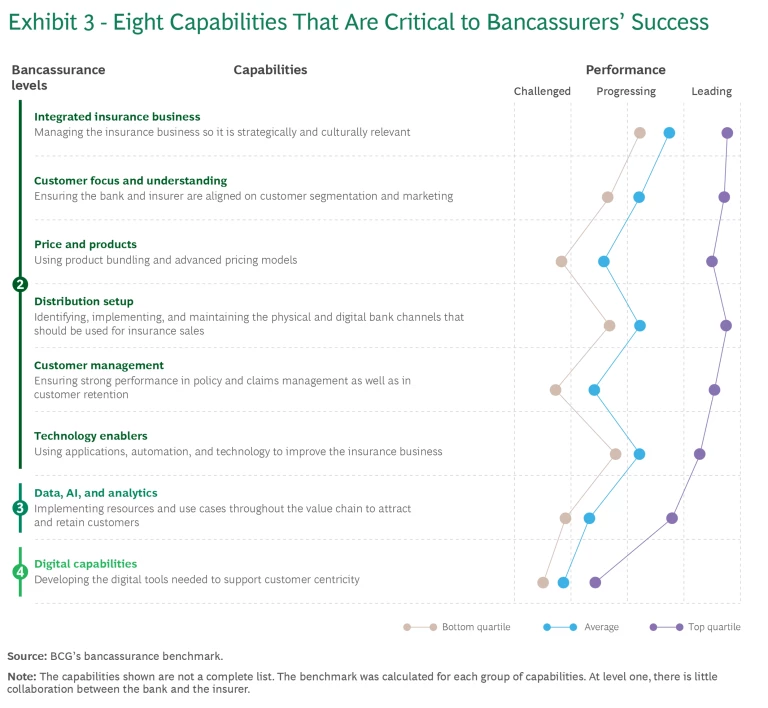

Becoming a leader in bancassurance requires best-in-class partnering on three main levels. Initially, the partners focus on integrating the business and building a truly collaborative relationship. Next, they leverage bank data and analytics to attract and retain customers. Finally, they provide a customer-centric digital experience. (See Exhibit 3.)

Practices of the Leaders

BCG benchmarked approximately 80 bancassurers worldwide and found that the leaders (those in the top quartile) significantly outperformed their peers when assessed by key capabilities. Moreover, leaders have:

- A joint vision and ambition for the bancassurance business that goes beyond sales targets, with the retail bank making insurance a core value proposition and the insurance company making a significant investment in the business

- A suite of insurance products that are tailored to online and offline sales, priced attractively, embedded in bank products, and bundled with other insurance products

- A deep commitment to building digital and data analytics capabilities, with the bank and insurer making significant co-investments

- A fine-tuned omnichannel approach that deploys digital marketing in combination with local advisory centers to contextualize and warm up leads

That said, all bancassurers have room for improvement. Digital and AI capabilities require the most attention; even the top performers need to double down. In the other quartiles, bancassurers should focus on initiatives such as pricing and product offerings and customer management. This is not a business where it’s sufficient to excel in just one area; to succeed, bancassurers need to have a robust operation all around.

Guardrails for Success

The strength of any bancassurance business depends on a bold ambition supported by the right partnership model. Three models are most common, and they are typically structured as a captive company, a joint venture, or an exclusive distribution agreement.

A Single-Partnership Model with Exclusivity for Most Lines of Business. When a bank adopts a single-partnership model, one insurer provides the great majority of products to be sold through the bancassurance channel. The insurer usually makes a substantial financial commitment, paying high commissions and co-investing with the bank to build bancassurance capabilities. A single-partnership model facilitates the development of integrated processes, tailored offerings, and a streamlined customer experience not only in sales but also in service and claims. This model also encourages the insurer to build unique selling propositions, providing differentiated product offerings.

A single-partnership model facilitates the development of integrated processes, tailored offerings, and a streamlined customer experience.

A Multiple-Partnerships Model with Exclusivity by the Line of Business. In this model, a bank has a relationship with one insurance provider in each line of business. That means that a bank may sell, for example, one insurer’s home insurance products and another insurer’s health insurance products. This arrangement allows a bank to offer best-of-breed products in each line of business.

At the same time, however, this model requires a bank to integrate multiple providers into its bancassurance business. Therefore, the potential return on investment for each insurer is going to be smaller than when a bank adopts the single-partnership model. In turn, insurers are less open to tailoring their products and customer journeys for the bank’s customers. As a result, a bank has less influence on the end-to-end customer experience, and partner management typically takes more time.

A Multiple-Partnerships Model Without Exclusivity. When a bank adopts the multiple-partnerships model and has no exclusive relationships, it can set up what’s known as a broker model, and customers can typically find a product that fits their needs. That’s because there usually is an insurer with the risk appetite to serve every customer, regardless of the customer’s risk profile.

Yet this model also has its challenges. A bank needs to devote more effort to maintaining an adequate pool of insurance providers. In addition, a bank typically finds it difficult to hyperpersonalize the sales process and guarantee superior service levels. For these reasons, the broker model is an option for companies in the commercial segment that have a limited risk appetite.

Structures for Partnership Models. Our analysis of partnership models has uncovered some noteworthy trends. In cases where banks think the bancassurance business has long-term potential, they generally use a captive company or a joint venture for their life insurance business, and they use a joint venture for their nonlife insurance business. Both captive and joint venture agreements work well when a bank and an insurer are willing to share the risks and rewards.

Exclusive distribution agreements continue to be somewhat popular across life and nonlife lines of business. This type of agreement is typically used when a bank wants to assume little, if any, profit-and-loss risk or thinks the opportunity is too small to compensate for the higher setup costs of a joint venture.

The Power of Exclusive-Partnership Models

Bancassurance businesses that are built on exclusive-partnership models are best positioned to succeed over the long term. Two banks, one in India and the other in Spain, developed bancassurance channels using exclusive-partnership arrangements and other partnering capabilities. Both bancassurance businesses have seen high revenue growth, with insurance sales contributing considerably to the bank’s earnings. And in both cases, the bank has gone on to build a large-scale, sustainable bancassurance business.

A Giant in a Growth Market. Twenty years ago, a leading private-sector bank in India formed a joint venture partnership with two insurance companies to provide insurance solutions through its network. The bancassurance business has become the bank’s largest annual premium-equivalent contributor.

This performance can be ascribed to various factors: the bancassurer’s ability to leverage the bank’s extensive branch network; digital cross-selling that made it possible to bring the right insurance product to the right customer at the right time; a tightly managed process flow between insurance specialists and relationship managers that ensured that the bank’s staff always had access to high-quality advice; and insurance specialists who were available at all times to handle customers’ queries.

Success in Life and NonLife Insurance. A Spanish bank set up a captive company for a life insurance business and a joint venture with an insurance company for a nonlife insurance business. The combined portfolio covered a wide variety of protection, investment, and savings products, as well as all relevant nonlife products, including those for auto, home, and health insurance. Today, the bank is among the top performers in both life and nonlife insurance in the Spanish insurance market, with an insurance premium volume that is significantly larger than that of other banks in Spain.

This success is due to a few key factors: an attractive value proposition to facilitate sales; innovative insurance solutions, such as a three-year flat premium offering; the use of bank data to target good-risk customers and to price offerings attractively; and a highly effective salesforce, supported by substantial investments in support tools and in proper incentives for bank relationship managers to ensure that they make selling insurance products a priority.

Banks as Market Movers

Some banks think that bancassurance does not have real potential in their market because the insurance distribution channel is dominated by agents or brokers. But management teams that define the right vision and choose the right partnership model can capture the bancassurance opportunity.

Even when an insurance distribution channel is dominated by brokers, management teams can capture the bancassurance opportunity.

Spain is an example. Twenty years ago, the country’s insurance market was predominantly in the hands of agents and brokers; banks did only 9% of the new business in nonlife insurance products. But that changed after banks started to build bancassurance businesses. Currently, banks do more than 25% of all new nonlife insurance business; they also do more than 50% of new home insurance business and more than 30% of new health insurance business.

How to Ensure That a Partnership Lives Up to Its Potential

Banks that wish to build a strong bancassurance business should frequently assess the key elements of their business.

Vision and Ambition. First, it’s important for banks to understand how the bancassurance business can support the overall vision of their retail banking business. With this knowledge, banks can derive a suitable ambition for the bancassurance business.

Partnership Model. Banks then need to assess whether their partnership model supports their vision and ambition. They should consider the business and operational aspects of the partnership model, including the value proposition, the distribution model, and the go-to-market approach, as well as the economic aspects such as financial targets, joint investment budgets, and the duration of the contract.

Key Capabilities. At the same time, banks and insurers need to determine which bancassurance capabilities are critical to capturing the opportunity. They also need to work out which ones should be spearheaded by each partner.

As the underlying economics of retail banking continue to change, banks must adapt quickly to succeed over the long term. Those that start a bancassurance business or double down on one will be best positioned to capture this promising opportunity.