The outlook for contract research organizations (CROs), which control most clinical development services spending in biopharma , remains robust. In fact, spending on site-specific services is expected to continue to grow at a mid-single-digit rate. Growth in specialized vendor services will likely outpace other areas, with some clinical technology segments seeing annual revenue increases in the high single-digit or low double-digit range. Core CRO services will retain most of the clinical development outsourced spending, with mid-single-digit growth, only slightly below the historical rates that have supported steady shareholder returns over the past five years.

At the same time, the market is evolving. Sponsors are altering sourcing models and making model-changing investments in technology, data science, and artificial intelligence (AI). CROs themselves are targeting clinical technology investments and pushing industry consolidation by acquiring smaller entities and site networks.

CROs also face customer-related challenges. Sponsors register dissatisfaction with CRO performance, citing limited consistency in speed and quality, a lack of the latest technology, and lagging decentralized trial implementation, among other factors. While CROs do not always set themselves up for success, sponsors impose their own constraints on performance through difficult governance and process frameworks and often by leaving CROs out of critical trial design and planning decisions. These factors open opportunities for innovative incumbents and new entrants to win share and possibly develop disruptive offerings.

There are opportunities for innovative CRO incumbents and new entrants to win share and possibly develop disruptive offerings.

On top of these immediate issues, three longer-term trends have the potential to reshape the industry in the next five to ten years:

- Shifting roles and needs of patients and trial sites

- Increased adoption of advanced technologies and AI

- Sponsors changing sourcing strategies

The potential impact of the coming changes is strong enough to warrant the attention of CRO management teams making strategy and investment decisions today. Forward-looking companies can position themselves to accelerate growth by investing in capabilities that will solidify their standing and ensure sustained relevance in the medium to long term. All but the largest and best-resourced players will likely need to make strategic choices about how to focus efforts and investment. The big decision will be between spreading investment across all three trends to keep up in each area and doubling down in one area (such as technology and AI) while taking an investment-light approach to the others.

Here’s how we see the three trends playing out and the challenges each presents for CROs.

Shifting Roles and Needs of Patients and Trial Sites

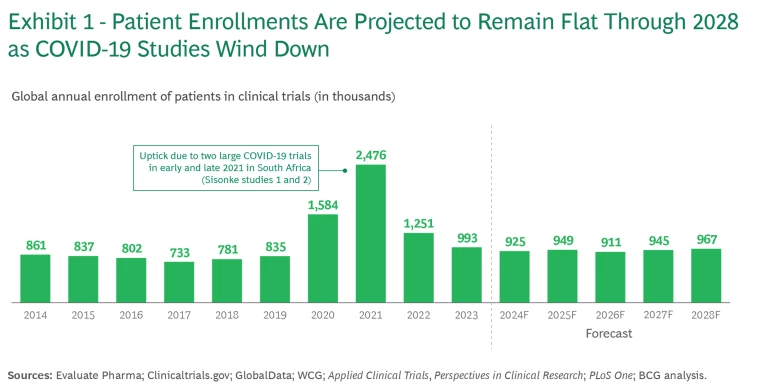

The traditional site-based model for clinical trials will evolve as sponsors and participants try to address longstanding issues that threaten to worsen over time. Examples include rising trial costs, sluggish startups, and low patient enrollment, which slows market entry. The burden on investigators and subjects is high, and the incentives to participate in clinical research remain low. As major COVID-19 studies wind down, overall patient enrollment numbers are returning to the levels they were at ten years ago and are projected to remain essentially flat through 2028. (See Exhibit 1.) Developments in precision medicine, new modalities, increased study complexity, and limited global trial infrastructure exacerbate these issues.

In response, the current site-based paradigm is likely to shift towards a more patient-centric approach that will be shaped by the following factors:

- More agile participation models to expand patient involvement

- Attempts to optimize patient participation and retention by improving patient-trial matching and reducing trial complexity for the patient

- Better-equipped sites that can avoid bottlenecks and enhance trial impact

- An increase in scalable, cost-effective solutions built for speeding up trails and bringing new treatments to market faster

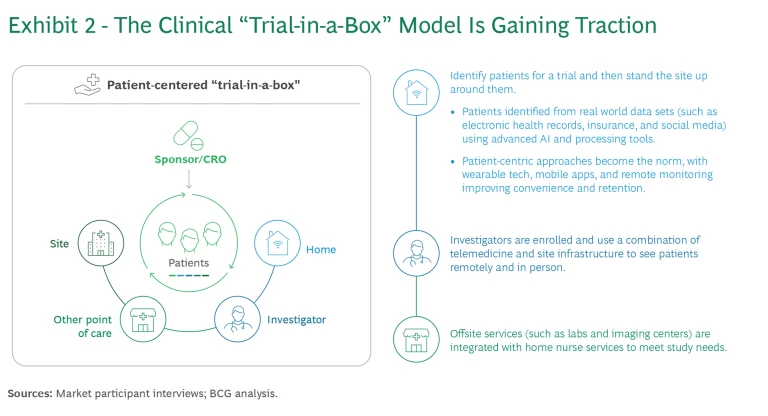

We are already seeing one concrete shift: the rise of the so-called patient-centered “trial-in-a-box” model pushed by the American Medical Association and National Institutes of Health, among others, which involves finding patients first, then setting up trial sites around them. (See Exhibit 2.) Patients are identified from various real-world data sets (such as electronic medical records, insurance, and social media) using advanced analytics and processing tools. Sites employ patient-centric approaches, including wearable tech, mobile apps, and remote monitoring, to improve convenience and retention. Investigators leverage telemedicine and home nursing services to deliver patient care remotely where possible, while still leveraging traditional site-based services (such as labs and imaging centers) when a remote option is not yet viable.

We expect this model to become more prominent. But establishing any new paradigm as a widespread reality requires developing and implementing an integrated set of solutions on a global scale across the following areas:

- Data and analytics, including global patient recruitment databases and real-time integration of electronic medical records and molecular data

- Infrastructure (such as clinical facilities) and integration with imaging, labs, and pharmacies

- Technology and systems, including data capture systems, patient engagement platforms, and new endpoint collection sites closer to the patient

- Trial enablement, which should include implementing standardized site onboarding and training and securing clinical coordinators and staff

The shift to more patient-centered models could lead to the disruption of current value pools that amount to some $4 billion and potential new value pools that could total about $8 billion. The drivers of disruption include efficiencies gained from optimized endpoint collection, automated data collection, integration with other facilities, and site setup. New value will result from accelerating time to market (for sponsors) through faster patient recruitment, improved retention, optimized trial design, and new site setup. There is also additional upside potential with expansion into new geographies with integrated patient data.

Current players must take steps to safeguard against value erosion through stronger integration of clinical operations tech platforms, for example. CROs are well positioned to use advanced technology and patient-centric methods to enhance efficiency, convenience, and retention in any new model. The likely owners and orchestrators of the new solutions will be large sponsors (following an in-house approach), site networks, site management organizations, integrated research organizations, and possibly site- and patient-focused tech players. Many of these organizations have already taken steps toward more patient-centered trials.

Increased Adoption of Advanced Technologies and AI

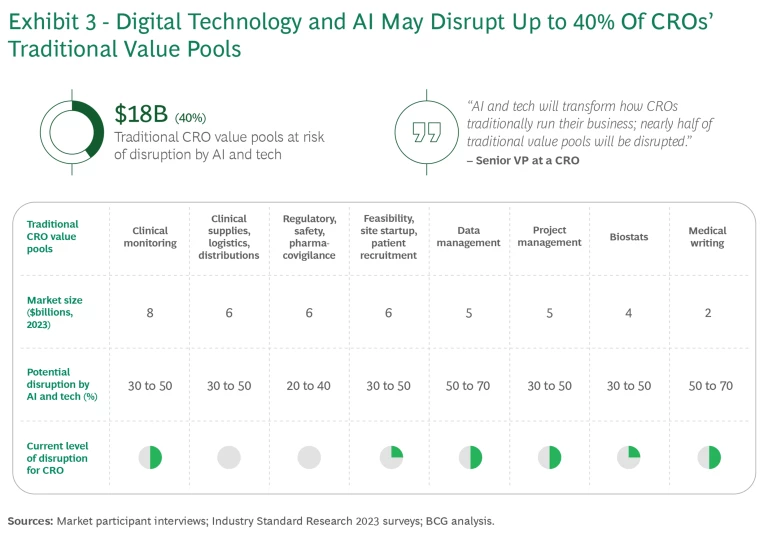

Further disruption of current CRO value pools, such as clinical monitoring, project management, and patient recruitment, is likely through widening adoption of digital technology and AI. The disruption could amount to some $18 billion, or 40% of the total current value for CROs. (See Exhibit 3.)

Much of that disruption will probably come about through shifts from labor-intensive manual to tech-enabled automated solutions in outsourced services. In the process, value may shift from large CROs to smaller contract organizations, tech startups, and sponsors, fostering a more fragmented and competitive market landscape. There is also an opportunity for nimble CROs to defend their turf and capture new sources of value and competitive advantage.

Digital technology and AI will open access to new value pools for CROs—particularly with respect to AI—through three pathways:

- Deploy for productivity improvement. Enterprise-wide productivity improvements will generate about $3 billion in value for CROs. Many companies are already beginning to transform their medical writing functions with generative AI (GenAI), boosting efficiency with accelerated document generation across the clinical study lifecycle.

- Reshape existing operations. Radical speed and quality improvements should lead to an estimated $9 billion in value. For example, many companies are already starting to stand up “clinical control towers” to optimize trial execution using advanced analytics.

- Invent new revenue streams. New services and business models are expected to generate $7 billion to $10 billion in new value. One example is the ecosystem integrator or orchestrator model, under which CROs with the necessary capabilities bring together other participants with distinctive offerings that improve the clinical trial process with more complete end-to-end services. Participants could include data providers, technology partners, and site networks that leverage digital twins of patients based on data from various sources to simulate trial outcomes in silico. In this example, the CRO orchestrates the rules for participation and value exchange in the ecosystem.

To succeed in these new models, CROs must prioritize productivity and growth while systematically upskilling their workforces, controlling costs, developing strategic relationships, and ensuring responsible AI use. Less than 5% of clinical development services companies are currently investing in new revenue streams. This is the most significant disconnect between today’s priority setting and tomorrow’s potential.

Sponsors Changing Sourcing Strategies

Customers of the clinical development services outsourcing market have historically been bifurcated between biotech and large pharmaceutical companies. The former has relied on full-service, or end-to-end, outsourcing vendors because of resource limitations, while the latter has tended toward functional service providers for greater control and what they hope will be better performance.

In the future, though, end-to-end CROs will likely gain the upper hand, benefiting from the maturation of many clinical development services. It will be easier for large CROs to compete with more specialized vendors as quality differentiation dissipates. End-to-end CROs can also expect to benefit from sponsors’ rising focus on operational efficiency. Sponsors may even consolidate vendors to improve efficiency by reducing the capacity required to onboard many different vendors for a particular study, for example.

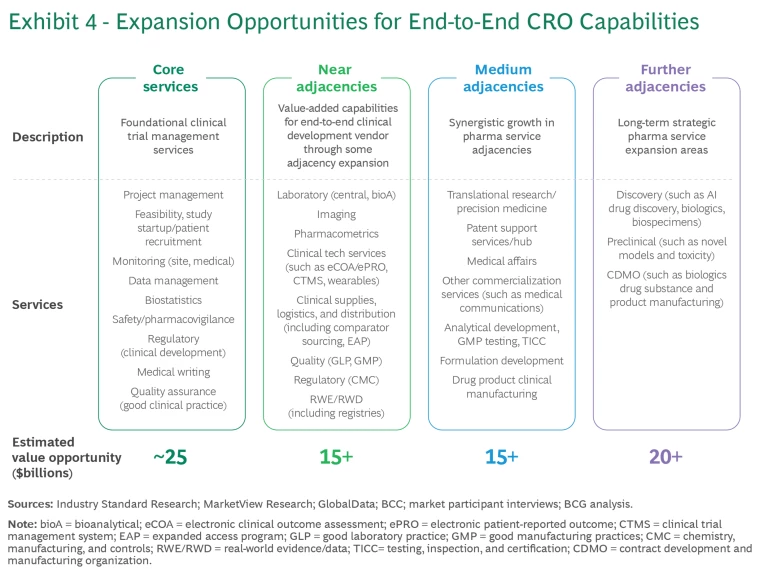

End-to-end CROs can capitalize further by extending their core offerings into high-value adjacent service areas, unlocking an additional $50 billion or more in incremental value pools across pharma service verticals. (See Exhibit 4.) These value pools include more than $15 billion in near adjacencies that build directly off core CRO services, such as pharmacometrics, real-world evidence and data, clinical technology, and bioanalytics, and another $15 billion or more in medium adjacencies with synergies to existing clinical development services, such as translational research, medical affairs, and formulation development.

To fully leverage these opportunities, end-to-end CROs must adopt a customer-centric commercial model. They must also invest in sales and marketing efforts to exploit the full potential of cross-selling, collaboration, and data-driven insights that allow for more targeted and personalized marketing and sales strategies.

Even in an attractive market for CROs, most companies will have to make choices. Only the largest and best-resourced firms can both protect existing value pools and capitalize on new ones. Doing both will require investing across the board in sites and patients, advanced technologies and AI, and portfolio expansion. Other CROs will need to decide where the best opportunities lie in an evolving marketplace, and successful execution will likely require changes to their operating models. Sponsors will benefit from doing their part as well, leveraging CROs as strategic partners across the various stages of clinical development, including the design and planning stages.

The market is already shifting. CROs that want to maintain or acquire leadership positions should move quickly.