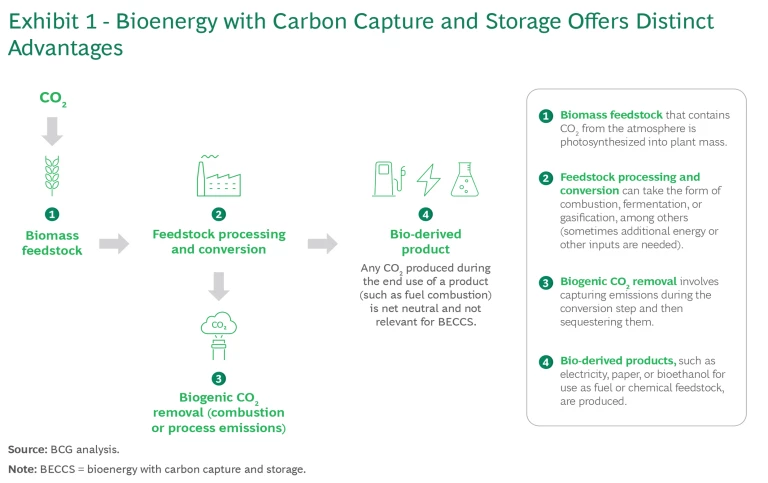

Companies in multiple carbon-intensive industries have a double-barreled business opportunity. If they replace fossil fuels with sustainably sourced biomass for energy, they make progress toward their net zero goals. They can also employ carbon capture and storage (CCS) technologies to remove the carbon dioxide released from the combustion or decomposition of the biomass (biogenic CO2) from the atmosphere. As a result, they deliver a bioderived product that is carbon neutral while generating biogenic carbon that can be used or sold as carbon removal credits in the carbon markets. The process of combining bioenergy with CCS, known as BECCS, can provide a big boost to companies looking to meet tightening emissions regulations and avoid high fees.

The approach is nascent, but companies with biogenic emissions that do not explore the use of BECCS as part of their sustainability and business strategies are potentially leaving both emissions reduction and big money on the table.

BECCS is a complex but affordable carbon removal approach that is gaining traction in industries such as pulp and paper, electricity generation, ethanol, and cement because it helps companies progress toward their net zero commitments while creating profitable carbon credits per ton of CO2 removed. There is a lot of room for expansion. The International Energy Agency’s (IEA’s) Net Zero Emissions by 2050 Scenario estimates that 190 million metric tons (MMmt) of CO2 per year (the equivalent of emissions from more than 40 million cars) needs to be removed through BECCS by 2030 to reach net zero emissions by 2050. Currently, only about 2 MMmt of CO2 per year are captured from biogenic sources, with about 90% captured from bioethanol facilities. Less than 1 MMmt of CO2 is retained in dedicated storage.

The approach is nascent, but companies with biogenic emissions that do not explore the use of BECCS as part of their

sustainability and business strategies

are potentially leaving both emissions reduction and big money on the table.

The Basics of BECCS

Buyers in the carbon markets assess carbon removal credits based on multiple factors, including additionality (the emissions reductions or removals that would not have occurred without the added incentive of carbon credits), transparency, and measurement reporting and verification. (See the sidebar “Getting to Net Zero Requires Both Carbon Reduction and Removal.”)

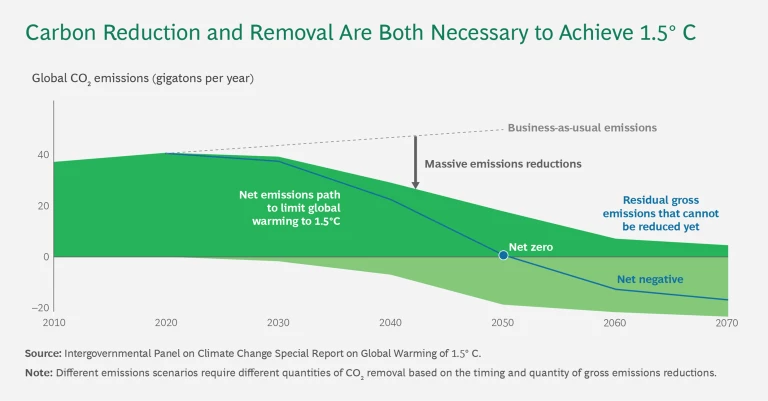

Getting to Net Zero Requires Both Carbon Reduction and Removal

Removal approaches span nature-based methods (such as afforestation) to engineered technologies (such as direct air capture). More removal approaches are being explored, including biochar, enhanced rock weathering, and ocean alkalinity enhancement.

Carbon capture and storage (CCS) has a track record of being successful in such industries as natural gas processing, refining, power generation, and cement production. When CCS is used to capture biogenic emissions, it can be a net removal because the carbon in the biomass came from the atmosphere and ends up sequestered underground.

BCG research conducted in 2022 with support from the Environmental Defense Fund has shown that companies will pay a premium for credits that reflect high-quality carbon removal. Multiple factors determine the level of quality. One of the most important ones for buyers is the ability to prove impact. In particular, buyers prioritize project and program transparency and measurement, reporting, and verification over other dimensions. They identify project or program type, co-benefits, and location as the next most important dimensions of quality after greenhouse gas impact. Buyers are clearly looking for quality on factors that will help them defend their purchase decisions as the voluntary carbon market faces scrutiny from stakeholders.

BECCS can generate high-quality carbon credits that typically demand a premium from buyers. (The website CDR.fyi, which tracks carbon removal transactions and credit prices, recently reported a BECCS carbon removal spot price of $160 per ton of CO2 removed.) Premium levels are generally not as high as those for other carbon removal approaches such as direct air capture (DAC), which has multiple advantages. But BECCS generates energy or another product (such as ethanol or paper), a distinct plus. (See Exhibit 1.) It does have geographic limitations in practical application, however.

The IEA estimates that some 30 MMmt of biogenic CO2 could be captured from heat and power plants by 2030. Leading companies such as Ørsted (power generation), California Hydrogen Hub (hydrogen), International Paper (pulp and paper), Summit Carbon Solutions (ethanol), and BioCirc (biomethane) have BECCS projects in development across a range of carbon-neutral products, such as carbon-free power and low-emissions hydrogen. Brownfield projects, such as retrofitting existing pulp and paper mills or ethanol plants with CCS, are particularly attractive for development in the near term from both a cost and a waste reuse perspective.

Expanded use of BECCS depends substantially on cost. Project economics vary widely—the result of feedstock availability and sustainability, carbon storage availability, and capital expenditure (capex) requirements—but several industries have the potential to produce cost-effective carbon removal.

Feedstock Availability and Sustainability. Feedstock availability and type vary by location, and different sources or classes of biomass are used for different products. Ideally, feedstock should be “second generation” waste material to sidestep concerns over change in land use, especially land used for food. Separate US and UK regulations absolve companies from accounting for emissions associated with land use if the change took place before December 2007 in the UK and January 2008 in the US.

Sources of sustainable feedstock are limited globally and vary by region (trees in the US Pacific Northwest, for example, or switchgrass in the Southeast and corn in the Midwest). They are localized, which results in a constraint on potential BECCS plant size. The biggest exceptions are power generation and biomethane production, which can use almost any biomass. Most project developers will want to focus early on locking in low-cost, second-generation biomass sources for BECCS projects.

Carbon Storage Availability. Like feedstock sources, carbon sinks for storage are geographically limited. The US South (especially Texas and Lousiana) and Midwest are particularly attractive in both instances.

Capex Requirements. BECCS projects may require significant upfront capex for post-combustion applications such as pulp and paper and power generation. It can be on the order of $100 million to retrofit a facility to capture a few hundred kilotons of CO2 a year or more than $1 billion to build a new multimillion-ton facility. Brownfield projects can leverage existing capex and onsite infrastructure to reduce costs.

The Best Industry Fits

While encouraging, current plans for BECCS deployment are insufficient to support the IEA’s net zero scenario, which requires that by 2030, around 45 MMmt per year should be removed in the power sector, around 120 MMmt per year in the fuel transformation sector, and about 25 MMmt per year in heavy industry (primarily cement production through biomass-based fuel switching).

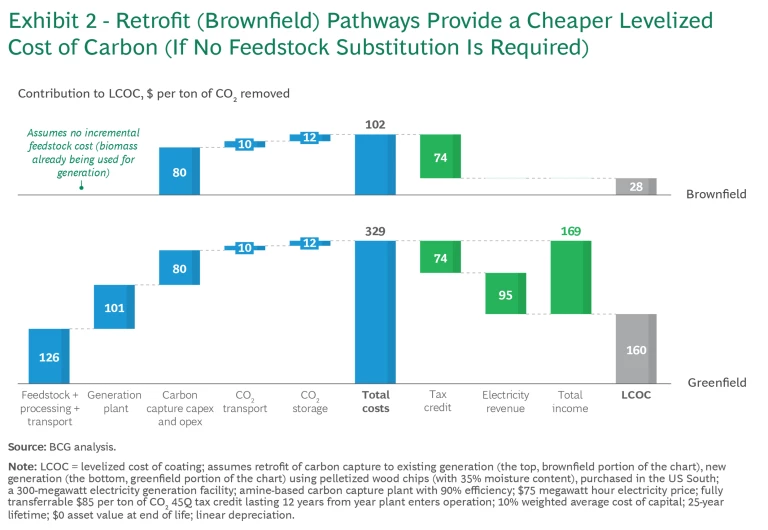

It is in many companies’ self-interest to step up their BECCS efforts. Those with brownfield potential have significant opportunities to capture biogenic carbon and monetize the associated carbon removal. (See Exhibit 2.) A subset of potential BECCS pathways is emerging as lowest cost, for both greenfield and brownfield projects. For example:

- Pulp and Paper and Ethanol. CCS retrofits can be economically attractive because of asset locations close to existing biomass-based feedstock supplies that are already meeting key sustainability criteria. Facilities in these locations have the potential to achieve quality and pricing dynamics on their biogenic CO2 emissions that reflect lower overall CO2 capture costs.

- Electricity Generation. Use of forest and agricultural residue and waste in the US Southeast is technologically and economically feasible at scale because of significant forestry residue and greenfield asset requirements. A 300-megawatt (MW) plant requires an estimated carbon-credit price of more than $160 per ton of CO2, assuming electricity rates of $75 per MW. However, feedstock sustainability concerns persist for large greenfield assets.

- Biomethane Production. Farm and landfill waste is typically found in smaller scale and has high transportation and storage costs, but it also has strong sustainability metrics. Using this type of waste can be attractive despite a lack of specific policy incentives.

- Biomass to Hydrogen Gasification. Active projects are under development in California and the mid-South in the US and will benefit from the high share of biogenic CO2 captured.

Subscribe to our Energy E-Alert.

In general, policy incentives and carbon-offset revenue are critical for success, given the remaining levelized cost of carbon across project types. For example, the US 45Q federal tax credit for captured carbon provides a strong base of $85 per ton of CO2 for most BECCS production pathways. The biomass gasification route produces hydrogen, so it can benefit from the 45V hydrogen production tax credit in the US. The choice between 45Q and 45V depends on a lifecycle assessment and the nature of the project. Carbon offset revenue will depend on the quality assessment of the carbon removal credits and their eventual price in the carbon markets and emerging compliance markets such as Japan’s Green Transformation (GX).

Policy incentives and carbon-offset revenue are critical for success, given the remaining levelized cost of carbon across project types.

Credit Quality Versus Costs

Because of the permanence of the carbon removal they offer, BECCS credits are capturing a premium from buyers in many markets. But projects must still balance a high-quality approach to feedstock and the overall endeavor’s measurement, reporting, and verification while maintaining low operation costs.

CO2 sales aggregator CDR.fyi reported BECCS removal credit sales for three different brownfield projects in 2023 at $300 per ton of CO2, compared with our outside-in cost estimate of about $200, indicating that both brownfield and greenfield sites can create value. Buyers’ willingness to pay depends on BECCS removal credits’ value proposition of verifiability and permanence. Additionality can be harder to demonstrate, especially for brownfield sites, even when they are retrofitted. Prices are likely to remain higher for greenfield sites than for brownfield sites, but project developers with a clear value proposition can expect to achieve robust purchase prices for carbon removal credits.

Because of the permanence of the carbon removal they offer, BECCS credits are capturing a premium from buyers in many markets.

BECCS credits will continue to sell at a discount to DAC credits, however, for which CDR.fyi reports a weighted average price of $700 per ton of CO2. Although DAC and BECCS have similar value propositions, the price difference of $400 per ton indicates the importance of clear additionality as well as land use concerns. BECCS developers can justify higher costs if they provide greater additionality or more sustainable biomass sourcing. Overall, credit pricing will be closely tied to project economics, as value-based pricing goes against the general approach to additionality being upheld by the carbon markets.

Given these market realities, sustainable sourcing of biomass is critical to maximizing BECCS’s long-term impact. There are a range of sustainable biomass standards—such as the SFI Fiber Sourcing standard—with clear methodologies that are specific to each sector. The developers of each project also will need to carefully consider the tradeoffs between co-product pricing and co-product carbon accounting to ensure that there is no double counting of the BECCS premium. Each project will also require site-specific cost analysis coupled with market views on customer demand and willingness to pay.

Developers and Investors Can Accelerate Progress

For BECCS to progress in the marketplace, project developers and other stakeholders need to accelerate their activities while maintaining a laser-sharp focus on sustainable sourcing and operations .

Pulp and paper and ethanol companies can investigate the feasibility of retrofitting existing facilities for CCS to open additional revenue streams and to help scale up the industry. Because many of these companies are already processing biomass and producing CO2, they have the potential to capture biogenic CO2 at a lower cost and be among the early industries to develop viable projects. International Paper, for example, is planning to install CCS at its site in Mississippi, with support from the US Department of Energy.

For BECCS to progress in the marketplace, project developers and other stakeholders need to accelerate their activities while maintaining a laser-sharp focus on sustainable sourcing and operations.

Project developers and investors can identify large-scale sources of low-cost biomass feedstock for greenfield combustion and other projects where there is local demand for bioproducts or existing sites for transport, storage, or other services. Power generation in particular can be attractive for greenfield development near biomass sources, particularly as the need for low-carbon energy increases. Stockholm Exergi is building a combined heat and power plant with CCS in Sweden and has secured Microsoft as a carbon removal offset purchaser.

Technology developers and venture investors can continue to improve earlier-stage technologies such as gasification. Suppliers can reduce risks by selecting one standard and then adopting it consistently. The current lack of uniform standards is a challenge for buyers.

Governments can consider relatively modest policy incentives to help scale up the industry by bringing carbon removal prices to or below $200 per ton of CO2, a level that would unlock significant demand.

BECCS has a big role to play in achieving net zero in multiple industries, and it can provide attractive new company revenue streams in the process. But for the benefits to be realized, producers, investors, technology developers, and government stakeholders need to step up their efforts—starting now—to scale up the technology and its implementation.