The global shipping industry carries 80% to 90% of global trade, yet the industry has not yet begun to decarbonize in any meaningful way. While sea transport is relatively efficient compared to air or road transport, the shipping industry still emits roughly 1 billion tons of CO2e annually. Meanwhile, trade tonnage is set to grow as much as 130% by 2050, according to the International Maritime Organization (IMO). About 99% of the industry’s energy needs are still filled by fossil fuels, despite intense pressure from customers, policymakers, and society at large to accelerate decarbonization.

Efficiency improvements can help reduce the shipping sector's greenhouse gas emissions. Yet it is widely acknowledged that the largest reduction must come from replacing fossil fuels with low-carbon alternatives such as e-fuels (made with captured biogenic CO2 and clean hydrogen), biofuels, or battery-electric propulsion. Choosing the optimal low-carbon alternative for a given route depends on many factors beyond cost and emissions intensity, such as fuel availability, performance, safety, and supply security. The shipping industry's future is expected to include a tapestry of different fuels.

The global shipping industry carries 80% to 90% of global trade and is only in the initial stages of taking meaningful action to decarbonize.

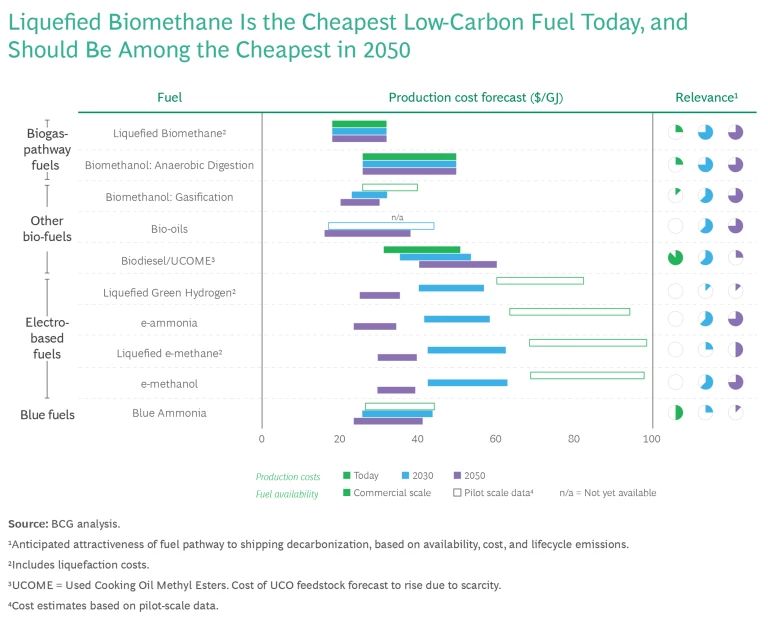

Many low-carbon alternatives to current marine fuels exist (see “Power to Spare”). While e-ammonia and e-methanol have garnered most of the attention from shipping players seeking to decarbonize, we make the case for biogas-pathway fuels, which include biomethane (called renewable natural gas, or RNG, in North America) and biomethanol derived from biogas. These two fuels are the most mature and affordable low-carbon alternatives today and we believe they represent the best near-term decarbonization options for many in the shipping industry. Under the right conditions, biogas-pathway fuels have the potential to decarbonize up to 15% to

Power to Spare

We zoom in on e-fuels here.

- e-Ammonia. Offering the potential for near zero-emission shipping with no feedstock constraints beyond the need for cheap renewable power, e-ammonia is the favored low-carbon fuel of many in the shipping industry. However, enabling the broad use of ammonia as bunker fuel will require major updates to health and safety equipment and protocols on vessels and in ports to protect human and aquatic life. Currently two to four times more expensive than heavy fuel oil, its affordability depends on the broad availability of low-cost renewable power and green hydrogen.

- e-Methanol. Like e-ammonia, e-methanol can deliver near zero-emission shipping, but methanol is easier to handle than ammonia and is less toxic to humans and aquatic life. There are now over 100 methanol-ready vessels on order. The first vessel was recently delivered to shipping giant Maersk, which recently announced the formation of a new company to develop e-methanol projects to supply green fuel for its fleet. However, e-methanol itself will be difficult to scale affordably due to the limited availability of the sustainable CO2 needed to produce it. Like e-ammonia, e-methanol also depends on cheap renewable power and green hydrogen to reach the forecast 2030 cost of between $40 and $60 per GJ.

- Liquefied e-Methane. As a drop-in replacement for fossil LNG, liquefied e-methane can leverage existing LNG transport and storage infrastructure. CMA CGM is rapidly building vessels equipped with dual-fuel engines and plans to have 77 ships capable of using either bio- or e-methane by 2026 (and recently hedged its bet with a large order book of 24 methanol-powered ships). However, due to dependence on scarce sustainable CO2 and a more expensive production process, the fuel is forecast to be consistently more expensive than the other two favored e-fuels.

- Blue Ammonia. Blue ammonia is derived from blue hydrogen, made from a process using natural gas and capturing the resulting CO2, rather than through electrolysis powered by renewable energy. Although the carbon intensity of blue ammonia is higher than the green variety, it can still deliver meaningful reductions in well-to-wake emissions compared to heavy fuel oil. And its affordability does not depend on rapid improvements in the cost of renewable power or electrolyzers. However, it is not clear whether regulators will allow long-term use of blue ammonia due to its inferior carbon intensities.

- Other Biofuels. These fuels, which include biodiesel, bio-oils and biomethanol derived from biomass gasification, are generally more affordable than e-fuels today but face challenges regarding their sustainability credentials and available supply. Biodiesel is commercially available today but still releases between 20% and 40% of the emissions of equivalent fossil fuels; moreover, supplies are likely to be constrained due to competition from other sectors. Bio-oils can be produced with a broad range of carbon intensities and is likely more affordable than biodiesel, but the production process is not yet mature and feedstocks also face supply limitations. Biomethanol from gasification is promising but faces similar technical and supply hurdles.

If use of biogas-pathway fuels is to reach its potential, industry stakeholders must work together to overcome several hurdles. These include the availability of sustainable feedstocks, lack of production and transport infrastructure, competition with other sectors, and the potential for fugitive emissions from upstream and onboard leakage. Such challenges can be overcome and biogas-pathway fuels can play a meaningful role in the effort to decarbonize the marine shipping industry.

The Case for Biogas-Pathway Fuels

Biogas is a mixture of methane and CO2 that is produced via the anaerobic digestion of biomass. It can be further processed into biomethane or biomethanol, which we refer to as biogas-pathway fuels. Liquified biomethane (LBM) can directly replace liquefied natural gas in suitable marine engines, while biomethanol is a liquid at room temperature that can be used interchangeably with e-methanol.

Biogas-pathway fuels offer several advantages as low-carbon alternatives for the shipping industry:

- Maturity. The production process for these fuels is fully mature and useful quantities are already available. Between 0.3 and 0.4 exajoules

(EJ)2 2 Consistent with Cedigaz “Global Biomethane Market 2022 Assessment” (7.4 bcm or 0.3 EJ in 2022) of biomethane are currently produced and used for a variety of applications, and the supply could potentially grow to between 2 and 5 EJ by2030.3 3 Lower and upper range represent Stated Policies and Sustainable Development Scenarios, respectively, as cited in IEA “Outlook for biogas and biomethane” (2020). These volumes are significantly larger than other low-carbon fuel supplies and could help considerably in meeting the global shipping sector’s 13EJ4 4 Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping “Position Paper: Fuel Option Scenarios.” final energy demand. - Feedstock availability. Compared to other biofuels, a broad range of feedstocks can be used. Anaerobic digestion is a suitable waste treatment method for feedstocks as diverse as corn husks, sewage sludge, and everyday trash. It provides a larger pool of feedstock supply (up to 40 EJ from waste and residues

alone)5 5 The Sixth Assessment Report of the Intergovernmental Panel on Climate Change (IPCC AR6) cites a range of bioenergy potential of 5-50 EJ from wastes and residues, while IRENA estimates a total potential from wastes and residues of approximately 45 EJ, in 2020. Excluding forestry residues, the energy potential relevant for anaerobic digestion is estimated at up to 40 EJ, excluding sustainable purpose-grown crops. than feedstocks for other biofuels such as biodiesel, which can only be produced from a narrow set of oils and fats (estimated at just 2 EJ). - Emissions reductions. Biogas-pathway fuels offer the potential for reductions greater than 100% in well-to-wake emissions compared with typical fuel oil. This is because in the production of biogas, GHG emissions that would have occurred from the natural decay of organic material are captured and diverted. Materials that naturally emit large amounts of methane during decay, such as animal manure, offer the largest reductions in GHG emissions when used for biogas—assuming the successful management of fugitive emissions.

- Lower toxicity. Biogas-pathway fuels are far less toxic to humans and aquatic life than ammonia. Ammonia is toxic to aquatic life at concentrations of 0.07 mg/liter, making it 1,000 times more deadly than current heavy fuel oil, and raises major concerns about the environmental impact of spills. Methane is of similar toxicity as heavy fuel oil to fish, and methanol is much safer. To reach the same toxicity to fish as a spill of heavy fuel oil, it would require 200 times as much methanol.

- Affordability. Finally, these two fuels are the most affordable low-carbon fuels. Liquefied biomethane costs between $17 and $31 per gigajoule (GJ)

today6 6 Values represent average global production costs, not sales prices. No taxes or incentives are assumed. and biomethanol from anaerobic digestion can be produced for between $25 and $45 per GJ. By comparison, the production cost of e-ammonia is forecast to fall only to between $30 and $55 per GJ by 2030, while e-methanol costs are forecast at between $40 and $60 per GJ in 2030. Furthermore, the long-term affordability of these two e-fuels is contingent on the broad adoption of low-carbon hydrogen over the next 20 to 30 years.

Biogas-pathway fuels offer several advantages as low-carbon alternatives for the shipping industry.

Many low-carbon fuels will likely play a role in the effort to decarbonize the shipping industry. The Maersk Mc-Kinney Møller Center estimates that the deep sea shipping sector in 2050 will use four different main fuel types (produced from multiple production pathways), and no matter which low-carbon fuel becomes dominant, the most commonly used fuel will account for no more than 54% of the total. By then, biogas-pathway fuels could account for 19% to 37% of the overall

Four Obstacles

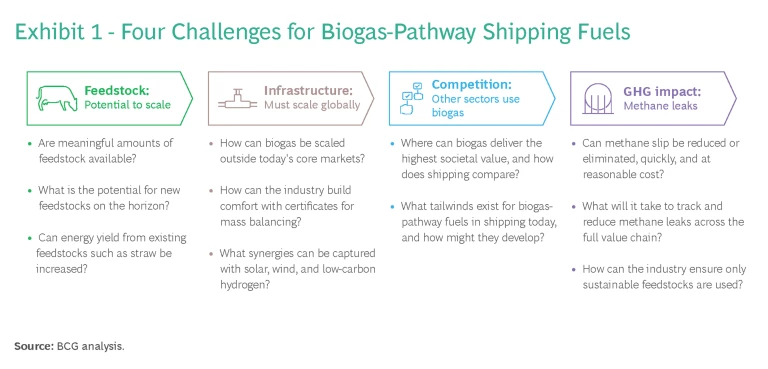

If biogas-pathway fuels are to reach their full potential as low-carbon alternatives for the shipping industry, shipping companies, policymakers and industry associations will need to work together to overcome four obstacles to their broader adoption (see Exhibit 1).

Feedstock Availability. Will there be enough biomass feedstock available? It depends. The most optimistic estimates of the energy potential of today’s global stock of sustainable biomass relevant to biofuels are approximately 50

Biogas-pathway fuels could account for 19% to 37% of the overall mix of fuels by 2050.

Only about 3

Several actions can be taken to boost the global supply of sustainable biomass. In the near term, developing markets such as Brazil offer tremendous potential to capture under-utilized feedstocks and encourage the sustainable treatment of organic

Technological innovation will also be needed to increase the energy potential of existing feedstocks, such as straw, and to optimize the energy yield from the anaerobic digestion process by customizing reactor conditions to the feedstock mix. Finally, there is additional longer-term potential from new technology-enabled feedstocks such as sustainable and ecologically safe purpose-grown crops, and even algae.

Production and Transport Infrastructure. Today as little as 6% of relevant feedstock is being captured for biogas production. Only around

In Europe and North America, companies are already making use of the most easily accessible feedstocks. Getting more will require improvements and expansions to infrastructure and innovations to the feedstocks themselves (such as briquetting straw to enable more efficient transport). The industry must also support investments outside of Europe and North America, where there is often an additional unmet need for natural gas. LNG facilities and pipelines can also be used to transport biogas.

Modern biogas production facilities should build synergies with other emerging low-carbon infrastructure, specifically those where the waste stream of CO2 from biogas production can be used in the production of e-methanol and e-hydrocarbon fuels. These include solar, wind, green hydrogen, and e-fuel production facilities. This is particularly relevant where low-carbon fuel production is being subsidized, as it is in the US through the Inflation Reduction Act.

Governments and industry associations must work together to create fundamental policy mechanisms to transport biogas-pathway fuels to where they are most needed. To ensure that the final fuels have been sustainably produced and thus meet their GHG abatement goals, global systems for guaranteeing their origin and certifying their low-carbon status must be developed. Existing schemes are limited by country or regional boundaries and hampered by legitimate local requirements and complexities.

Mass balancing lets biomethane producers sell their fuel into existing natural gas grids and allows fuel consumers to purchase this biomethane from the grid via a certificate, much like renewable energy certificates in the energy sector. It is essential if existing infrastructure is to be used to connect buyers and sellers. As mass balancing becomes available more broadly, industry associations can encourage shipping companies to take part through endorsement and education. Together, these policies enable ships sailing in international waters to buy certified low-carbon fuels at any port they visit.

Competition with Other Sectors. In addition to being a promising fuel for shipping, biomethane is a flexible fuel that can be used as a drop-in replacement for any existing use of natural gas. Like natural gas, most biomethane today is used to produce power and heat. Even in the most optimistic case, supplies of biomethane will fall well short of satisfying all existing demand for natural gas and new demand from transport applications, including shipping and heavy-duty transport. To maximize its societal benefits, biomethane should flow towards applications that offer a strong fit and few promising decarbonization alternatives.

Heating, for example, accounts for a massive 50% of global final energy consumption, according to the International Energy Agency (IEA). Natural gas is the most common heating fuel, meeting 42% of demand in 2021. Most of the demand for heat, however, is addressable today with electric heat pumps, which can generate heat three times more efficiently than gas-based assets. Some demand for heat cannot be electrified today, such as high-temperature heat for industrial processes. However, this can also be met using low-carbon hydrogen or, in the near future, with emerging electrified solutions such as electric furnaces. Hastening the adoption of these alternative decarbonization technologies will make more biomethane available to the shipping industry.

As societies around the globe work to decarbonize, biomethane (either compressed, or liquefied to be delivered as bio-LNG) is also attracting interest for use in heavy-duty transport. However, low-carbon hydrogen is also an attractive fuel for this sector. In addition, as batteries improve, electrification is becoming a feasible solution for a broader set of on-road vehicles, which could potentially include heavy-road trucking in years ahead.

Biomethane is particularly good for shipping because of its energy-dense portability, affordability, maturity compared to other low-carbon fuel options, and compatibility with existing LNG infrastructure. Yet very little biomethane or biomethanol is used in the shipping sector today. Raising awareness of the benefits of these fuels for shipping is a necessary first step towards increasing their adoption. Policymakers could ensure that biogas-pathway fuels receive the same support as other low-carbon fuels, subject to sustainability requirements and the treatment of shipping as a favorable end use for these fuels. This may require updating existing legislation such as REPowerEU, which does not include transport applications in its 2030 target for EU biomethane demand.

The shipping industry can generate further momentum for the adoption of biogas-pathway fuels by integrating upstream and producing the fuel themselves. An integrated supply chain would eliminate the need to compete with other sectors for biogas. It would also reduce the complexity of developing and marketing green shipping products, which in turn could generate additional revenue to fund the development of fuel supply chains.

Greenhouse Gas Impact. Methane is a potent greenhouse gas. Its warming impact is 30 times greater than CO2 over a 100-year period, and 85 times greater over a 20-year period. Due to its potency, even small methane leaks must be avoided. The beneficial GHG impact of biogas-pathway fuels could be seriously eroded by methane leaks during their production, transport, or use onboard ships.

Concrete actions can be taken to mitigate the risks of methane leaks. When preparing regulations, policymakers could consider the full lifecycle emissions of biomethane and biomethanol, including their 20-year global warming potential, and require measurement and tracking of methane leaks along the entire value chain. Shipping players should implement methane tracking and visualization tools to find and plug leaks onshore and onboard their ships. Finally, engine technologies that reduce methane slip—methane that escapes unburned from engines—such as hybridization and exhaust gas recirculation, should be developed.

Concrete actions can be taken to mitigate the risks of methane leaks.

Five Actions

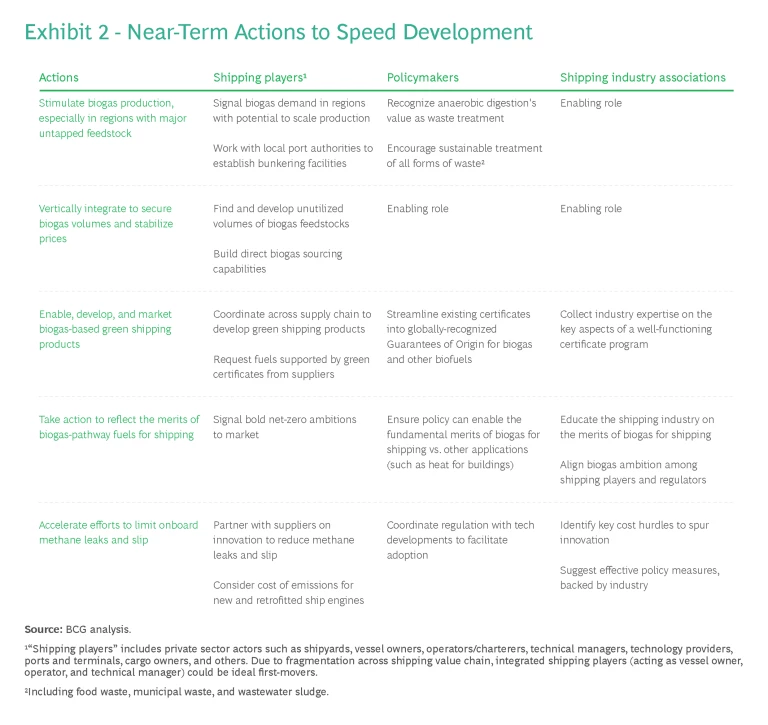

Maritime industry stakeholders should immediately pursue five key actions to accelerate the adoption of biogas-pathway fuels in the shipping industry:

- Stimulate biogas production development, especially in regions with large amounts of untapped feedstock.

- Vertically integrate biogas production development to ensure volume security and price stability.

- Use globally-recognized certificates or guarantees of origin to enable development and marketing of biogas-based green shipping products.

- Educate the shipping industry and ensure that policy can enable the fundamental merits of biogas.

- Invest in innovation and use regulation to speed adoption of technologies to limit onboard methane leaks and slip.

Exhibit 2 offers specific activities for shipping players, policymakers, and shipping industry associations to promote the use of biogas-pathways fuels today.

Conclusion

Despite little progress until recently, the shipping industry is finally building momentum towards decarbonization. With the IMO’s recent agreement to achieve net-zero emissions by or around 2050, and the publication of the final FuelEU Maritime legislation, the legislative framework supporting decarbonization has never been stronger. Increased investment in low-carbon fuels and supporting infrastructure is sure to follow, with renewed debate regarding the merits of each low-carbon option.

Promoting biogas for investment and development will accelerate progress towards the full decarbonization of the sector. And it need not slow investment and development in other green fuels, all essential to the future of the shipping industry. Moving towards net zero must be a collective pursuit.

Like all fuel pathways, there are challenges to be overcome for biogas-pathway fuels to realize their full potential. But solutions are available and achievable, through the concerted effort of all stakeholders.

The authors would like to thank Roberta Cenni, Head of Biofuels at the Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping, and Mike Tupy, Principal Engineer at Cargill, for their contributions to this article.