The math behind carbon emissions and the need to curtail their impact on the world’s climate is both straightforward and alarming. Even if we deploy a wide range of carbon abatement solutions, there will likely still be a large amount of residual emissions in 2050 that will need to be removed to meet global emission targets. (For this discussion, we define residual emissions as being either overly expensive or infeasible to abate at any cost.)

As our latest report explains, scaling carbon dioxide removal (CDR) enough to reduce as much projected residual CO2 emissions as possible will require combined effort from the world’s governments and regional governing bodies, using a full range of policy drivers including carbon pricing mechanisms, regulatory requirements, and financing incentives. And promoting the most durable forms of CDR—those, like direct air capture and sequestration, that remove CO2 for centuries or more—will be necessary to ensure its permanent removal from the atmosphere.

How could these demand drivers work? And what is required to make sure they will be enough to bring residual emissions down to the fullest extent possible?

A Critical Need to Expand Demand for Carbon Reduction

According to the Intergovernmental Panel on Climate Change (IPCC), the use of CDR to counterbalance hard-to-abate residual emissions is unavoidable if net zero CO2 is to be achieved. Our analysis suggests that between 6 and 10 gigatons per annum (Gtpa) of residual CO2 emissions are likely to remain unabated globally in 2050. Across sectors, residual CO2 emissions are expected to be concentrated in the industrial (~40%), energy supply (~30%), and transport (~20%) sectors.

Since many carbon reduction technologies are still nascent, there is uncertainty whether they will develop and scale to the degree needed. As a result, there is no consensus on the expected volume of residual emissions that will need to be removed for the world to reach net zero emissions on an annual basis. Therefore, CDR will be needed to help close the emissions gap. (See “An Overview of CDR Methods.”)

An Overview of CDR Methods

- Direct Air Carbon Capture and Sequestration (DACCS)

- Biomass with Carbon Removal and Storage (BiCRS)

- Bioenergy Carbon Capture and Storage (BECCS)

- Enhanced Weathering / CO2 Mineralization

Voluntary CDR purchases grew from 600 kilotons (kt) in 2022 to 4.5 megatons (Mt) purchased in 2023, according to CDR.fyi. Last year, BCG estimated that the voluntary market for durable CDR would continue to expand significantly—from around 60 Mt to as much as 750 Mt per annum (Mtpa) by 2040, depending on how CDR costs decline. However, this is far below the multi-gigaton per annum scale that will be needed to limit global temperature rise.

In short, the voluntary market cannot induce enough CDR demand to meet requirements—in part because, unlike other climate technologies such as solar and wind power, CDR produces no product or service that creates its own demand. Instead, CDR could be considered a public good, and it is likely that only changes in government regulation and policy will lift the barriers to scaling the CDR demand needed.

Measures to Drive CDR Demand

Our analysis shows that governments have five primary direct and indirect ways to boost demand for durable CDR, which vary significantly in terms of the amount of demand created.

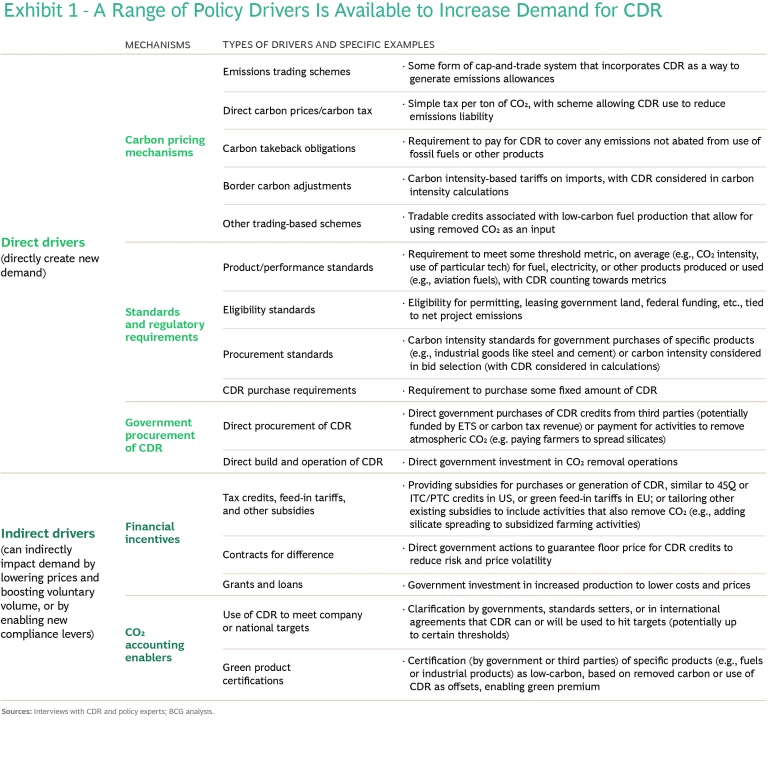

Direct demand drivers include the integration of durable CDR into carbon pricing mechanisms, regulatory requirements to decarbonize, and government procurement of CDR. Indirect drivers include enabling policies, such as financial incentives to reduce prices, and CO2 accounting enablers, such as requirements that must be met for a company to claim it is “net zero.” In addition to promoting the scale-up of durable CDR demand, many of these policies could also play a major role in incentivizing the maximum emissions reductions possible. (See Exhibit 1.)

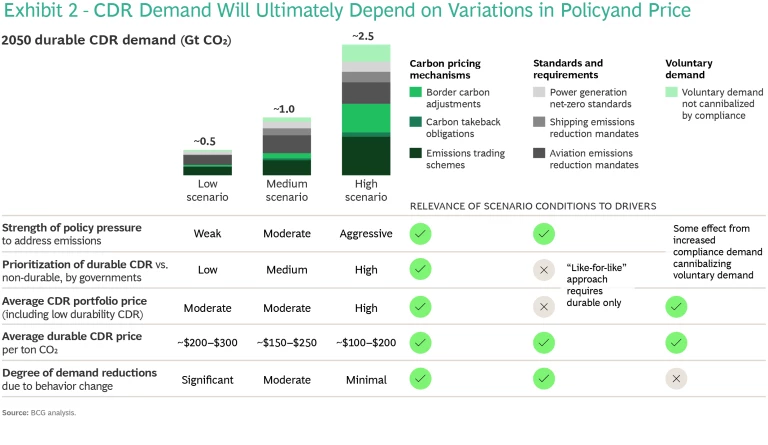

We estimate that the expansion of existing and proposed policies to incorporate durable CDR could lead to around 0.5 to 2.5 Gtpa of CO2 in durable CDR demand in 2050, covering as much as 30% of global residual emissions. Two policy demand drivers in particular—carbon pricing mechanisms and standards and requirements—have the greatest potential to incentivize demand. (See Exhibit 2.)

Carbon pricing

Integrating durable CDR pathways into carbon pricing mechanisms could drive the largest share of potential demand—as much as 1.25 Gtpa—because existing and proposed carbon pricing mechanisms already cover a large portion of global emissions. Both emissions trading schemes and border carbon adjustments could incentivize durable CDR demand in two ways. Durable CDR could be directly integrated into these systems, allowing participants to procure durable CDR to generate an allowance or avoid a levy. In addition, parallel removal trading systems could be created that require a minimum purchase of durable CDR, which would rise over time.

Current efforts to address emissions primarily focus on reduction—which will not be enough to fully curtail climate impacts. Carbon pricing mechanisms will be most effective in promoting both CO2 emissions reductions and CDR demand when high-quality, durable CDR is prioritized, a larger portion of emissions across industries is covered, and the cost of durable CDR declines to between $100 and $200 per ton of CO2. Adopting subsidies to lower durable CDR prices in the near term would encourage CDR purchases; however, in the long term, keeping prices artificially low through subsidies could encourage emitters to remove emissions rather than reducing them, which must occur first.

Standards and regulatory requirements

New standards and requirements could encourage the

decarbonization

of various industries, allowing companies to use CDR as one option to decrease their emissions. This would incentivize demand when durable CDR is more economically viable than

carbon reduction

alternatives, and would be especially effective in sectors such as transportation and power.

- Aviation and shipping are among the sectors that are especially difficult to abate, with limited decarbonization levers. CDR can effectively accelerate decarbonization in these sectors, both as a source of CO2 feedstock for e-fuels production and as a direct counterbalance to fossil fuel emissions. Regional and national clean fuel mandates and standards could increase CDR demand from decarbonizing aviation and shipping by up to 600 Mtpa by 2050. (It is important to note that demand for CDR is highly impacted by whether policies specifically target pathways that require CDR or whether they are left open to alternatives that may be more economical, such as the use of sustainable aviation fuels produced from biomass feedstocks.)

- Power industry net zero portfolio standards could drive demand through the use of bioenergy with carbon capture and storage, a negative emissions power generation technology. Purchases of CDR credits could also account for residual emissions from peaker plants as well as any other remaining fossil-based power generation, even when mitigated with carbon capture and storage. These regulations and requirements would be particularly relevant in geographies where power generation is not regulated under an ETS.

In addition to these direct demand drivers, governments could induce further demand indirectly through financial incentives and carbon dioxide accounting enablers.

- Financial incentives could reduce the cost or risk associated with CDR production and purchasing. Examples include tax credits and feed-in tariffs, such as current investment tax credits, production tax credits, or credits for various green technologies. Rather than increasing the number of potential CDR buyers, these mechanisms would help boost the supply of CDR to increase demand from buyers who were already interested in purchasing but deterred by price or lack of supply.

- Carbon dioxide accounting enablers would generally allow for clarity in how to use CDR to meet voluntary or policy commitments. Changes in how greenhouse gases (which include more than CO2) are accounted for could indirectly increase demand. For example, standard-setting bodies such as the Science Based Targets initiative (SBTi) could clarify how companies should use CDR to meet net zero targets. International efforts like the Paris Agreement could define mechanisms for countries to count CDR as part of their own nationally determined contributions to reducing all carbon emissions. However, accounting enablers would not inherently drive CDR demand without additional voluntary or policy actions.

The Regional Outlook for CDR Demand

The scale of demand incentivized by incorporating CDR into these policy demand drivers will vary regionally, driven by the maturity of existing climate policies, the ambition of proposed policies, and the ability to finance decarbonization, with the largest gaps likely to remain in Asia Pacific.

Europe and North America are the most advanced regions in the implementation of climate policies and therefore are also the most likely to drive significant demand for durable CDR. As a result, Europe and North America could see the highest coverage of residual emissions—around 65% in Europe and 60% in North America. Some countries in Asia Pacific will face challenges in covering residual emissions with durable CDR due to the scale of projected residuals, a lack of regional consistency in the advancement of climate policy, and the high cost of decarbonization and durable CDR.

Methods for increasing CDR demand in Asia Pacific and other regions with significant residual emissions, such as Africa and South America, could include expanding the scope of existing and proposed demand drivers and creating new durable CDR demand drivers. Emissions trading schemes and border carbon adjustments, for example, could expand to cover additional industries and goods. Demand could also grow significantly if more governments were to implement sustainable fuel blending or decarbonization requirements in transport. Among new demand drivers, government procurement of enhanced rock weathering or biochar on agricultural lands has significant potential: allocating just 2% of total existing agricultural subsidies in regions with the highest capacity for ERW could generate as much as 1 Gtpa or more in durable CO2 removals.

Taking Action

What steps need to be taken to increase the demand for durable CDR—and to ensure that there’s enough supply to meet that demand? We see three actions that could be taken in the near-term.

First, governments could set clear goals for durable CDR and encourage near-term supply and demand. These actions could include pursuing durable CDR targets, promoting government procurement of durable CDR, funding more R&D for CDR technologies, and developing policies, such as financial incentives, to encourage voluntary demand. Governments could also define frameworks for durable CDR to be integrated into both compliance and voluntary carbon markets.

Second, standard-setters could encourage procurement of high-quality durable CDR in tandem with meaningful emissions reduction measures. They could also provide market clarity by defining guidelines for when durable CDR is needed, such as encouraging its use in accounting for fossil emissions in hard-to-abate sectors.

Finally, actors across the ecosystem must continue to drive innovation in CDR methods to help expand the supply. In this report, we have focused on increasing the demand for durable CDR, but it will also be crucial for CDR supply to grow further and for costs to decrease. This will require public-private collaboration and increased investment in technology and infrastructure—including expanded R&D, pilot projects, and demonstration plants—to prove the viability, efficiency, and environmental impacts of CDR technologies such as direct air capture and ocean-based removals. Suppliers, investors, and other relevant stakeholders should focus on building a supportive ecosystem that includes financial incentives, partnerships, and streamlined regulatory processes in order to accelerate innovation and maximize CO2 removal.