Unlocking Value through O&M

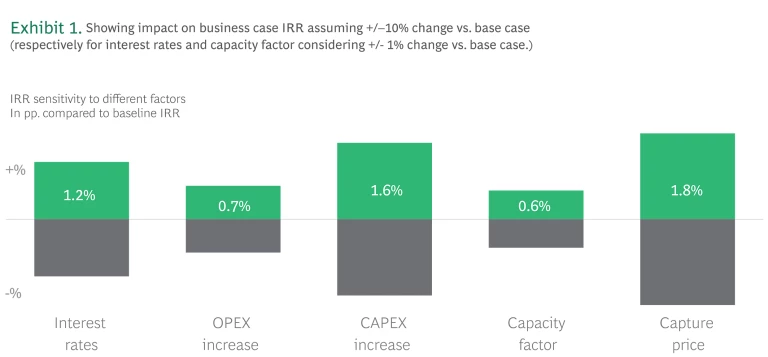

A review of recent offshore wind business cases shows that the importance of a focus on revenue during the lifetime of the asset creates most value of the business case expressed by the internal rate of return (IRR). (See Exhibit 1.)

How to Create Value in the Operational Phase

What is necessary to achieve strong O&M capabilities?

PEAK Wind and BCG have identified seven indicators that will help the offshore wind industry establish mature and more future-proof O&M practices:

- Finding the trade-off between innovation and standardization

- Moving from production-based to revenue-based availability metrics

- Redefining fitness-for-purpose throughout all phases of an offshore project

- Focus on continuously improving the production system

- Better optimization of synergies across portfolio and O&M collaboration with neighboring sites

- Designing data integration, learning models, and work processes to leverage predictables

- Earlier focus on life cycle management

Read the full report for a comprehensive guide on boosting offshore wind profitability.