This article is part of the 2024 European Consumer Sentiment Report series, which examines consumers’ shopping habits and preferences.

Swedish consumers started the year with significant concerns about the country's the political outlook and the environment but felt better about their own circumstances. According to new BCG research, the pinch of higher prices led people to economize - buying fewer non-essentials, shopping less often, and hunting for bargains or lower-cost brands.

Among other trends we observed, three stood out:

- Swedish consumers adopted a range of tactics to address their challenged personal finances. On top of cutting back on non-essentials, they reduced how much they bought, actively searched for deals and low prices, and traded down to lower cost brands.

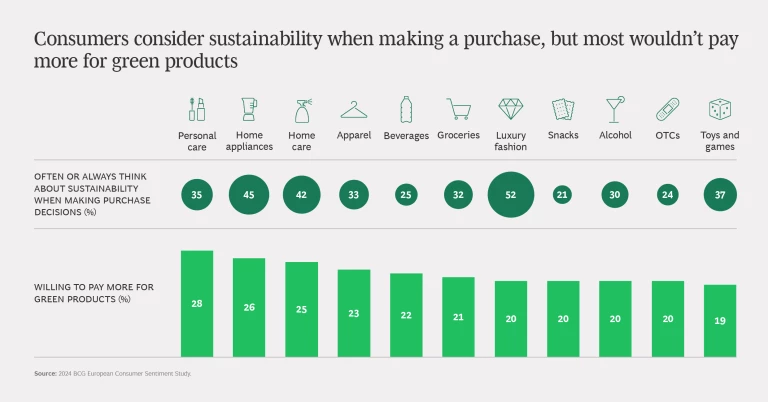

- Consumers are concerned about the environment and are taking steps to go green as a result: 66% are actively trying to reduce their consumption. However, only a minority would pay more for green products. In many product categories, they continue to rate traditional purchase considerations such as value, price, and functionality above sustainability.

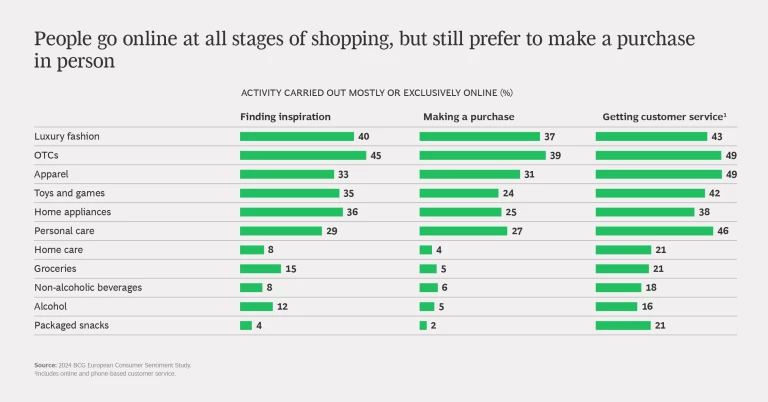

- Swedes like shopping online and many go online at some point when they're making a purchase. However, if forced to choose, 75% still would prefer to buy something at a physical-only store rather than at an online-only vendor.

These trends are a snapshot of how consumers felt about the economy and themselves during the first half of the year. It’s based on a BCG survey of 1,400 people in Sweden conducted July 3-12. The findings are part of a larger survey of consumers in five European countries done to understand people’s feelings about current affairs and their personal lives and how those sentiments affect shopping habits and preferences.

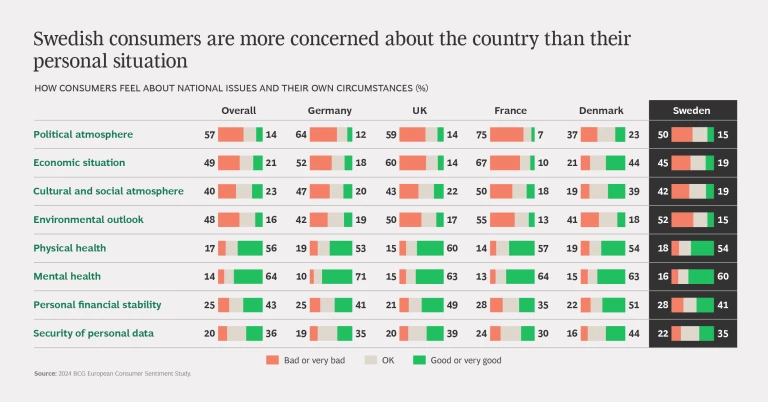

People Worry More About Where Sweden Is Headed than Their Own Circumstances

We found that Swedish consumers were more worried about the state of the country than their own affairs. Half the people polled felt bad or very bad about the country’s political outlook. That makes them more pessimistic than their Danish neighbors (37%) but less than the average for all the countries we surveyed (57%) or people in France (75%), Germany (64%), and the UK (59%). Swedes were more optimistic about their own circumstances, with 60% reporting feeling good or very good about their mental health, and 54% feeling the same way about their physical health.

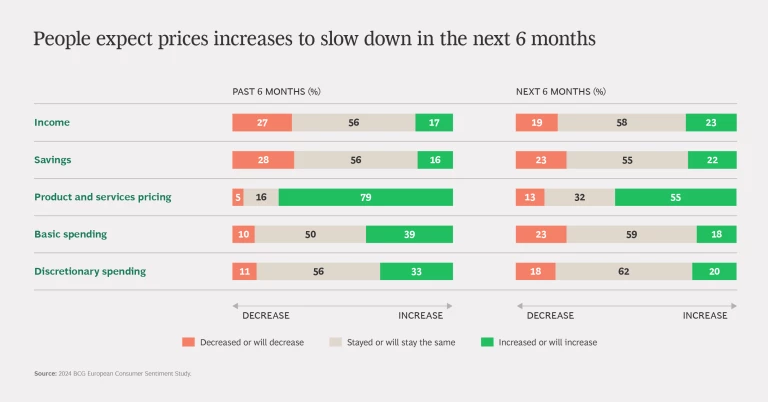

Pinched by higher prices. One thing Swedes aren’t upbeat about is prices, an outcome of recent years’ inflation. Close to eight in ten said they experienced increased prices for goods and services during the first half of the year. During the same time, wages and savings didn’t keep pace: 27% of people said their income dropped in the first half of 2024, and 28% said they didn’t save as much.

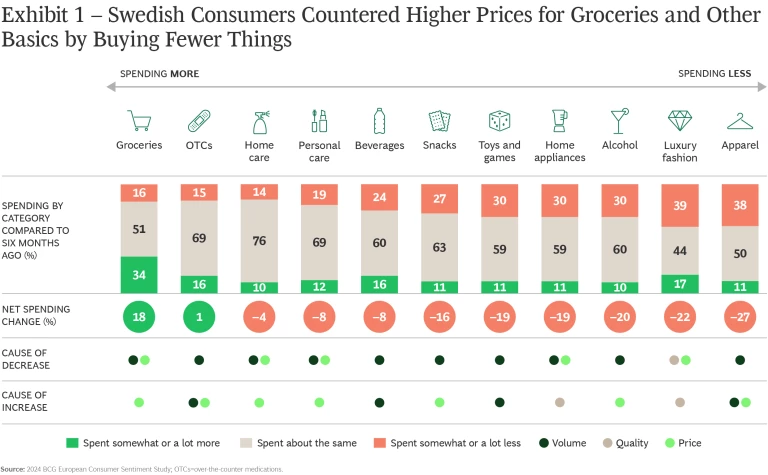

As prices rose, 39% of consumers reported spending more on the basics that they cannot do without, specifically groceries and over-the-counter medications. During the same period, they cut back on non-essentials such as apparel, luxury fashion, alcohol, and home appliances. (See Exhibit 1.)

In addition to cutting back on non-essentials, consumers countered higher prices by buying less, shopping less often, looking for lower prices or deals, and trading down to lower-cost brands. One tactic they however didn't resort to was switching to buying lower quality goods.

Feelings about personal finances and inflation weren’t uniform across age groups. A larger share of Baby Boomers and Gen X than younger generations reported experiencing price increases in the first half of the year. Older consumers also were more likely than younger ones to be pessimistic about the near term, with more of them expecting prices to continue to rise.

That said, overall concerns about higher prices and spending appear to be easing. Fewer people overall believe that prices will continue to increase over the next six months (55%) than reported higher prices in the beginning of the year (79%). Such sentiments could eventually lead people to abandon some of the behaviors people adopted to cut spending in order to get by.

Sustainability Matters, But Only if It's Associated with Value

Worries about the environment top the list of things that concern people in Sweden: 52% reported feeling bad or very bad about climate change, slightly more than the European average (48%) and second only to the French (55%). Swedes want to act on environmental issues. Two-thirds (66%) said they are actively trying to reduce their consumption and become less materialistic. For the first half of 2024, Swedes reported adopting more sustainable behaviors than the European average, including buying fewer clothes (30% v. 27%), recycling empty bottles and cups (51% v. 39%), and bringing their own bags to the grocery store (66% v. 59%).

But caring about the environment doesn't always carry over to the types of products people buy. Only a minority of Swedish consumers reported buying products with recyclable packaging, including for home care items (22%), personal care products (16%), beverages (14%), and snacks (10%). Fewer Swedes than residents of other countries we surveyed buy toys made from wood or recyclable materials. Multiple factors could explain the differences, including the amount of trust people have in their countries’ recycling programs, and the attention given to the environmental impact of sustainable choices.

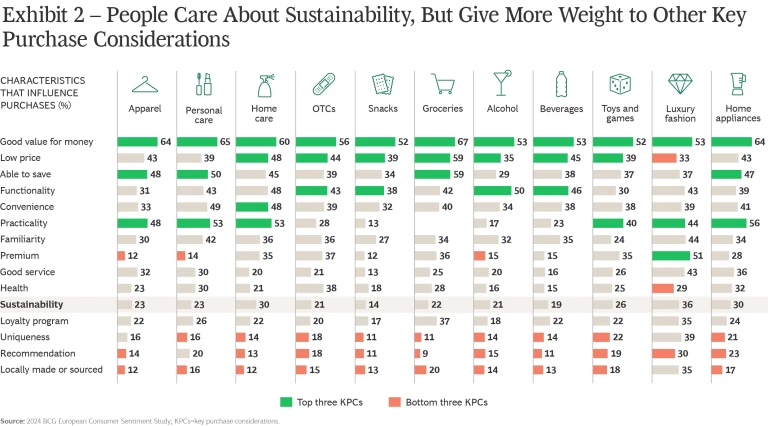

When it’s time to shop, Swedish consumers still value traditional purchase considerations more than sustainability, including price, value, practicality, and functionality. On average, only about 22% would pay a premium for sustainable products, slightly more than the European average of 19%. A slightly higher portion would pay more for sustainable personal care products (28%), home appliances (26%), home care items (25%), and apparel (23%).

The gap between what people say is important and what they are willing to pay extra for is consistent with findings of other, non-BCG research, indicating that companies need to offer customers products with inherent value and introduce sustainability as an additional benefit. (See Exhibit 2.).

Online Shopping Is Commonplace, But People Still Prefer a Physical Store

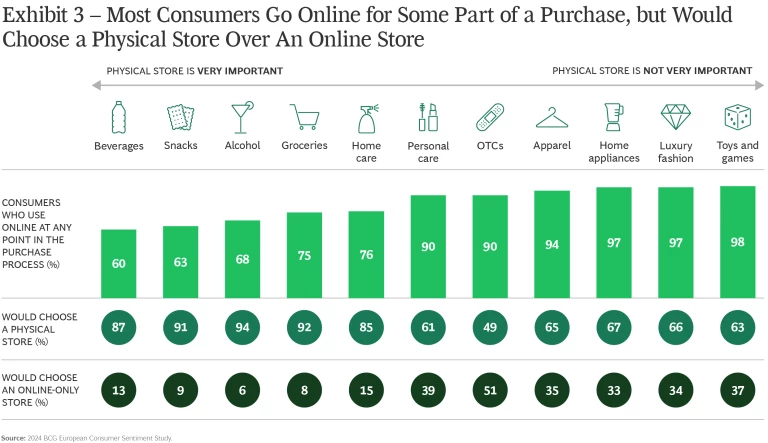

In Sweden, going online is an integral part of shopping. In a majority of product categories, 90% or more of consumers go online at some stage of making a purchase. (See Exhibit 3.)

But shopping in person remains tough to fully replace. If forced to choose, the majority of Swedish consumers would still pick shopping at a physical store over an online-only merchant.

Swedes' shopping behaviors fall into two distinct patterns depending on the product category. For big items or purchases that people don’t make as often, such as home appliances, luxury goods, apparel, or toys and games, they go online at every stage of the journey. That includes to do research, complete a purchase, or manage the post-purchase experience. For smaller items that people buy more often, such as groceries, personal care items and home care items, they prefer the more hands-on experience of buying something directly from a physical store. Only 2% to 5% of consumers report primarily buying convenience items like snacks, groceries, and beverages online.

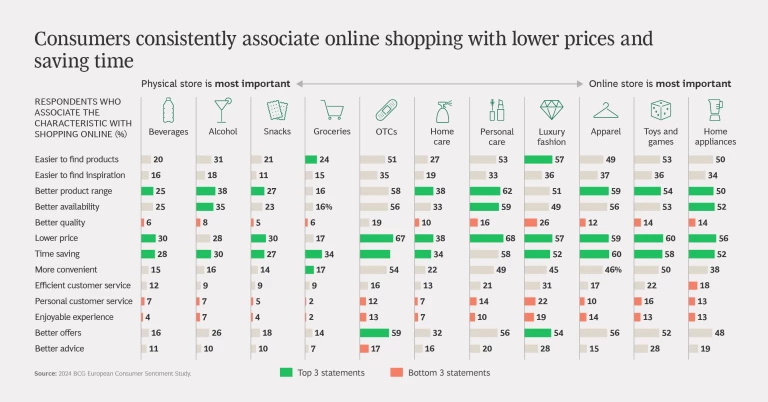

Despite the divide, Swedes generally associate online shopping with better selection and availability, especially for personal care items and apparel. For categories such as over-the-counter medications, personal care items, and home appliances, people also view online shopping as a way to access lower prices and save time. This sentiment indicates that more consumers could be open to shopping online for products they buy a lot, if the experience becomes more convenient and faster as those offerings mature.

Stay ahead with BCG insights on the consumer products industry

How Companies Can Address the Trends

Retailers and consumer goods players can use these trends as a starting point to make changes to stay competitive and strengthen ties with customers. Companies should consider acting on several fronts, including pricing and promotions; product assortment; the online shopping experience; and sustainability. Companies can support their efforts through data and analytics to better track changes to consumer needs and preferences over time.

Revisit pricing and promotion strategies. Swedish consumers countered paying higher prices for basics by trimming spending on non-essentials, buying less, looking for deals, and trading down to lower-cost brands. Although many are optimistic that price increases won’t continue at the same pace in the future, their finances are still tight. If price pressures continue, current spending patterns could as well.

To address the current economic climate, companies can update pricing strategies in three areas:

- Offer products at entry-level price points. If companies don't offer the low prices that consumers seek, shoppers might bypass them and buy other brands. Companies also need to carefully explain the added value available in their complete product assortment, and how consumers could benefit from buying an item at a slightly higher price point.

- Adopt dynamic pricing. Use data and analytics to make sure products are priced competitively. Very few companies can be competitive on all products, but they must make pricing competitive where it matters most to drive price perception.

- Make promotions strategic. Many companies create a vicious circle by scaling up promotions and then finding it difficult to scale back. Adopting an overarching promotions strategy based on white pricing and dynamic pricing can help companies achieve a sustainable business model while also assuring customers that they're getting a product at a competitive price whether or not it's on sale.

Localize stores and broaden online assortment. Swedish consumers are spending less, especially on non-essentials. They have varying preferences for where they like to shop, and many still would rather buy in a physical store. To adapt, companies could customize what they offer in their physical locations to meet local demand. At the same time, they should offer a broader, more global range online, which could appeal to shoppers who go online to browse or be inspired. The growth of online marketplaces, which have mushroomed to account for more than two-thirds (67%) of e-commerce sales, highlights the need for companies to adopt a broad product assortment and low prices.

Simplify the online experience. For multiple product categories, practicality is among the top three criteria that Swedish consumers consider when they buy something. When companies are mapping out their online offering, they must ensure that the customer journey offers practicality and the other, basic factors that consumers value. That includes providing the information consumers need to make the right choices, simple check-out and returns, fast deliveries, and good value. Even companies with e-commerce channels that still maturing need to provide a simple, yet high-quality, consistent customer experience that will attract customers and continue to accommodate them as sales increase.

Give shoppers reasons to buy green. It's clear from our findings that very few Swedish consumers will pay a premium for sustainability. For their environmental efforts to succeed, companies must make sustainability a better, more economical option. How they do that depends on the product category. For companies selling higher-priced products, for example, it could mean offering more second-hand merchandise as an option.

Enhance data collection. To successfully launch and sustain the initiatives we've described, companies must improve their ability to collect and analyze rich data on consumer behaviors and preferences across sales channels to detect patterns and trends. This includes consumer demographics, interests, and motivational drivers; what people buy, when, how, where, and why; and how they engage with sales channels, including through promotions or loyalty programs. As we've seen, consumer feelings can change quickly, and being data-driven allows companies to act on changes just as quickly.

Swedish consumers perceive the country's political and environmental outlook as dire but are satisfied with their personal situation and being wiser about how they spend. Consumer companies must up their game to keep pace. By adapting product assortment and pricing to consumer needs by sales channel, improving their offer and experience, and support those changes through better data, companies can give consumers what they want and solidify their business and profits.

Acknowledgements

The authors would like to thank Mary Patrikiou and Martina Scrocco for their helpful comments and suggestions. The authors would also like to thank Megan Moore for conducting the research upon which this report is based.