The solutions that corporate and investment banking (CIB) businesses provide to the global economy are as essential as ever: access to financing for companies of diverse shapes and sizes; entry to a wide range of asset classes for the international investor community; hedging options for various forms of risk; expertise at choosing and executing mergers and acquisitions; and guidance through many other domains of the financial landscape. Nonetheless, the economics of current CIB business models have remained under pressure since the global financial crisis of 2007 to 2009.

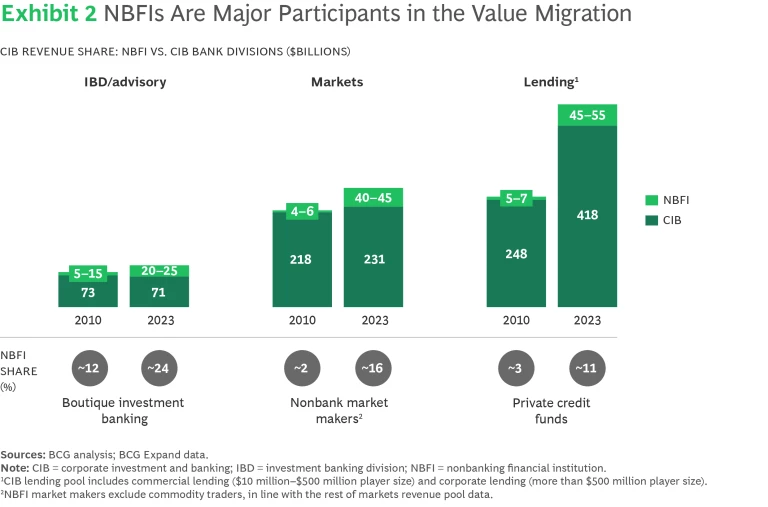

Tectonic shifts are gradually transforming the nature of CIB businesses, ultimately reshaping the industry. First, we are witnessing a value migration from traditional CIBs to nonbank financial institutions (NBFIs), whose share of revenue is increasing across various segments¾particularly in private credit, electronic trading, and advisory. A trend toward greater consolidation within the wider banking industry, in which larger players have substantially increased their market share, is also evident. Moreover, we are seeing broader transitions from public to private markets and from traditional to tech and green sectors. At the same time, regulatory changes such as the Basel III endgame are expanding capital requirements and placing continued strain on the economics of CIB businesses.

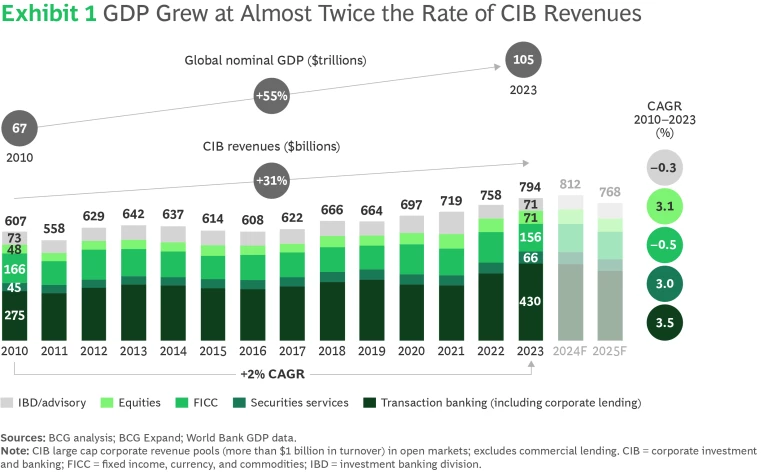

As a result of these and other trends, CIB revenue growth lags global GDP growth. (See Exhibit 1.) The sector is also dealing with stubbornly high costs that can rein in return on equity. Despite CIBs’ efforts to reduce expenses and reshape portfolios, the profitability of many CIB businesses faces ongoing challenges, with returns failing to cover the cost of capital and earnings remaining volatile. Overall, a downward force on bank valuations persists.

The situation demands an urgent and comprehensive response. In this report, we set out five key priorities for CIB leaders seeking to place their organizations on a positive trajectory to achieve ongoing competitive advantage:

- Strategize and implement. Reshape and dynamically manage business portfolios to improve returns.

- Ride the private markets wave. Capitalize on the shift toward private markets and partnership models.

- Reassess how to finance the energy transition. Align portfolios and strategies with emissions reduction targets.

- Level up the technology function. Leverage technology to enhance profitability and resilience.

- Transform risk management. Adapt risk frameworks, improve balance sheet strength, and co-pilot the transformation.

Most importantly, CIBs should view the dynamics detailed in this report as an opportunity to improve their performance, not as an existential threat. Our report will detail how CIBs can create long-term value by capturing the benefits of tectonic shifts in the sector. Although the task ahead is far from easy, CIBs can ensure sustainable returns and play an even more pivotal role in the global economy of the future by focusing on strategic transformation and disciplined execution.

Strategize and implement. We believe that banks need to prioritize making improvements in the main factors that drive valuations. Earnings volatility, scale, perceived growth potential, and a track record of returning capital to shareholders explain a good 40% of the typical bank valuation. Less tangible factors such as a clearly communicated commercial strategy and the support of experienced management teams also play significant roles. Still, most research indicates that expected longer-term return on tangible equity (RoTE) is by far the most important driver of price to tangible book value (P/TBV) at banks.

CIB divisions can boost returns by optimizing client portfolios, product portfolios, and capital allocations. They must also execute superior strategy and take a disciplined and iterative approach to transformation. Banks need to develop enhanced transparency and insights into their performance across products, regions, and client groups, and then use this analysis to select where and how to do business. They should underpin initiatives with concrete plans for implementation and communication, as well as with effective change-management practices.

Ride the private markets wave. NBFIs are gaining share across all CIB segments. (See Exhibit 2.) In response, CIBs can leverage partnerships with private credit funds, nonbank market makers, and boutique advisors to optimize balance sheet and costs and thereby bolster profitability and RoTE.

As a prime example, assets under management across private credit has grown from $0.4 trillion to $1.6 trillion over the past ten years, and we estimate further growth to $2.8 trillion by 2028. Many corporates have shown an increasing preference for private capital, and the investor appetite is growing.

Banks are equally interested in this market, given the attractive economics of sub-asset classes such as asset-based lending. However, they face constraints on their own balance sheet and capital. We believe that private credit vehicles are opening a new era for originate-to-distribute strategies. In partnering with NBFIs, banks should focus on their own core strengths, such as origination capabilities, deep client relationships, and overall sector knowledge. CIBs can also ensure the underwriting of higher deal volumes, manage risk-weighted assets (RWAs) more efficiently, and achieve greater certainty of distribution.

Reassess how to finance the energy transition. Having set emission reduction targets across multiple sectors, banks must determine how to steer their portfolios to reach their targets cost-effectively. We believe the answer is twofold.

First, steering a portfolio for sustainability involves maintaining a forward-looking orientation. Technologies that are not yet scaled, such as green cement and green steel, remain the only option for companies in certain sectors if they are eventually to achieve net zero. By adopting a longer-term view—one that extends beyond the next five years—on cost curves, policies, and other dependencies that determine technology deployment, banks can attain clarity on when and how to support their clients. They will then be able to channel funds appropriately.

Second, the delta between official climate scenarios and today’s reality requires proactive modeling. The direction of current policy and corporate action is likely to keep the economy on a trajectory toward a 2°C to 3°C temperature increase at best, but banks have often used more optimistic scenarios to set their targets. This discrepancy demands a comprehensive understanding of the gap between reality and projected scenarios across all parts of the organization so that banks can accurately adjust and steer their approach, modeling relevant factors such as technological maturity, supply chain constraints, and regulation.

Level up the technology function. Technology functions are increasingly important contributors to CIBs’ overall profitability and returns. Tech programs such as front-to-back process redesign, core systems modernization, adoption of platform operating models, and enhancement of cybersecurity practices through engineering excellence are key to fundamentally improving RoTE and making the bank more future-proof. Generative artificial intelligence (GenAI) can fuel such programs to maximize impact, but CIBs need to proceed carefully in this area and with the right foundation in place.

Effective tech transformation is potentially game-changing. Recent advances in GenAI and automation can sharply improve delivery of core objectives and programs. We already see leading CIB organizations adopting a combination of GenAI and traditional AI. For example, in software engineering, companies have generated productivity increases of up to 60% in smart code generation and completion by helping developers to code faster and with fewer errors. At the same time, using GenAI and automation in front-to-back process redesign initiatives has the potential to yield productivity increases of more than 40%.

Many financial institutions, however, have found it difficult to successfully scale proofs of concept and individual use cases, and to systematically generate value from GenAI and automation. A holistic program that focuses on creating the desired technological and organizational foundation is therefore essential.

Transform risk management. As the CIB landscape continues to change and as risks evolve, chief risk officers and their organizations must take an even more proactive role as guardians and stewards of the bank.

This needs to happen across four key dimensions: managing prospective risks, acting as an innovator for bankwide programs, reshaping ways of working, and protecting the core franchise to strengthen competitive advantage. Taking action in all four areas will improve balance sheet strength and contribute significantly to the bank’s overall efficiency.

The ultimate success of the endeavors discussed above depends on effective execution. Each of the five priorities requires a structured approach that rests on concrete objectives and targets, and entails changes in how CIBs operate. Business units and functions need to rethink their roles beyond their immediate remit, as each can exert a significant impact on profitability and growth.

When it comes to efficiency of execution, our experience shows that adding a formal transformation office can increase value creation by up to 50%, even though leaders may believe that their companies can achieve transformation with their existing structure.

The transformation journey is complex. Yet by keeping a positive mindset and maintaining overall discipline and strategic focus, CIB organizations can benefit from the value migration across the industry and secure both sustainable returns and increased resilience.