A Different Holiday Shopping Season

For retailers in the United States, the holiday cheer will be present but measured for 2024. It’s a different kind of year. On one hand, signs point to strong consumer spending; however, on the other hand, there are factors that will add a few twists and turns to this year’s calendar. While consumers will have divided attention in the coming months, retailers across all channels should ready the sleigh, because conditions call for a fast, exhilarating ride as shopping begins.

Spending Will Grow, but Modestly

BCG’s 2024 Holiday Outlook Survey gathered insights from US consumers and credit card data. The growth outlook is mixed. While just over a quarter of consumers (28%) plan to spend more than they did last year, just over a quarter (27%) plan to spend less—and just under half (45%) plan to spend the same. Several factors play a role in this modest growth outlook. On one hand, real consumption has continued to grow in the post-pandemic era, and American household incomes and balance sheets are strong relative to historical levels. Moreover, both job growth and income growth are at similar levels to the pre-pandemic economy.

But other factors keep the cheer in check: Despite positive indicators of economic growth, however, consumer sentiment has fallen over the past two years. Ongoing geopolitical tensions, global military conflicts, and the upcoming 2024 presidential election are creating an environment of split attention for US consumers. Moreover, high inflation, even with its recent cooling, has led to peak prices for consumer staples—tightening budgets for holiday shopping and making for more intentional channel selection and deal-seeking throughout the season. Feeling uncertain but financially stable, households may choose to play it safe this holiday season but still spend as much as, or modestly more than, they did last year.

The 2024 Holiday Retail Calendar Adds Twists, Turns, and Speed

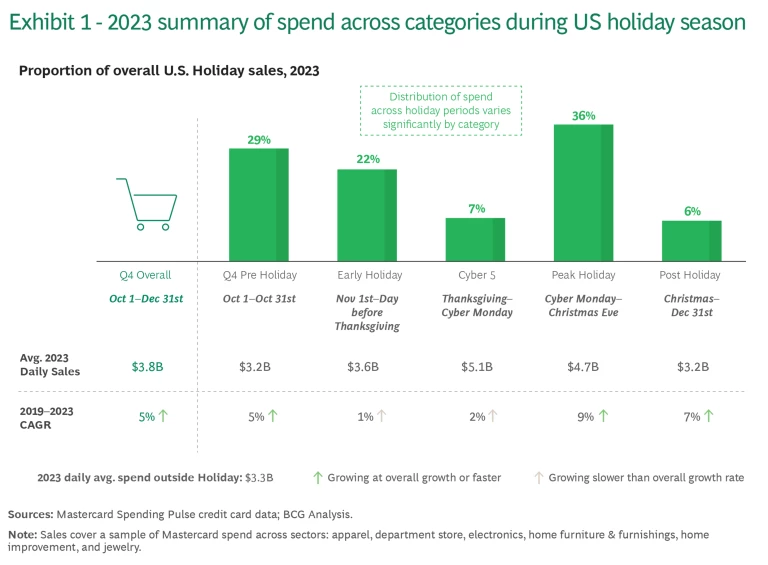

The holiday retail sleigh ride also gets some new twists and turns this year, courtesy of the calendar. We define the holiday season in five periods as outlined in Exhibit 1. In 2023, over 50% of the holiday shopping was completed before Thanksgiving. The Peak Holiday period (after Cyber Monday through Christmas Eve), however, was still the busiest with 36% of shopping.

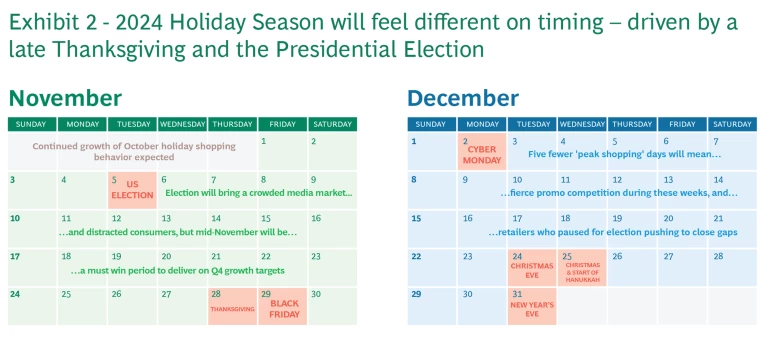

This year, a late Thanksgiving leaves only 27 days between Thanksgiving and Christmas—five fewer shopping days compared to last year. Hanukkah is also later relative to 2023.

Second, the US Presidential election comes in early November. Marketers are keenly aware of factors typical of the lead-up to major elections, including a crowded media market and higher costs due to increased competition. These factors are now in full swing, as the election is already contracting supply and boosting prices for the best media spots likely to draw consumer attention. As a result, consumers’ attention will indeed be fragmented, with many less likely to think about their holiday shopping lists until their votes are in.

Historical precedent suggests, however, that the election is unlikely to drive a contraction in consumer spending, no matter which candidate wins. Why? The answer lies with a nuanced distinction: the same circumstances can affect consumer confidence differently from actual consumer spending. Consider some notable events in recent history that affected consumer confidence: the financial crisis, the pandemic, and the last two presidential elections. Of these four, only two triggered decreases in consumer spending (the financial crisis and the pandemic). In both cases, the drop in consumer confidence was bipartisan, and spending took a meaningful hit. By contrast, during the last two elections, consumer confidence decreases were partisan rather than bipartisan—and consumer spending grew following both. Given this precedent, it is reasonable to predict that the election will have little ultimate impact on consumer spending, regardless of the outcome—but it could affect who is doing the spending, and when.

In light of these calendar twists and turns, we recommend that retailers keep three things in mind:

- We expect a distinct early peak in spending ahead of Black Friday & Cyber weekend—and that these weeks are a must-win timeframe for retailers

- The compressed peak season, the desire to wait-out higher media costs around the election, and fewer days between Thanksgiving and Christmas could create more active media and promo competition during Peak Season

- Winning strategies will be multi-faceted throughout the season, with the first tactics deployed in October and a highly responsive approach during peak December shopping days.

Shifting from Macro Timing Considerations to Micro Consumer Behavior

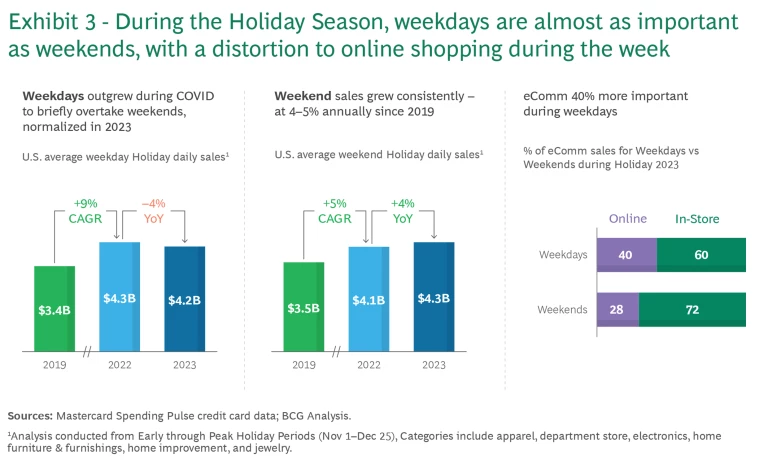

Among the many trends that emerged during the pandemic was a major acceleration in weekday holiday shopping, which ultimately led to weekdays overtaking weekends in daily spending. This trend saw a reversal last year during the 2023 holiday shopping season, during which things seemed to return to ‘normal’ with weekday spending dropping slightly below Saturday and Sunday levels. Weekend shopping trips made a return to the American consumer routine and are expected to continue through the 2024 holiday season.

But retailers shouldn’t underestimate the importance of weekday shopping. E-commerce has continued to grow, and the prominence of online channels is 1.4x higher during weekdays. This raises the stakes for digital experiences Monday through Friday. With online shopping comprising 40% of weekday shopping, it is quickly approaching the status of primary channel for consumers making weekday purchases, and we wouldn’t be surprised to see online exceed 50% of weekday spending in the next 2-4 shopping seasons. The takeaway? Winning the holiday season and achieving growth targets in 2024 and beyond will rely more on weekday success online than on record in-store days on the weekend.

Evolving Shopping Behavior and Channel Landscape Will Lead to Mixed Results

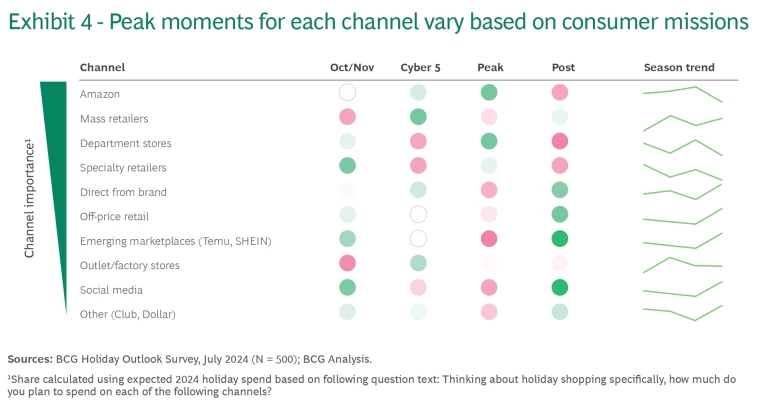

Over the past three years, some channels have struggled to keep pace with market growth while others have accelerated unexpectedly. The pandemic era (2019-2022) saw modest customer growth for direct-from-brand stores and specialty retailers. But both channels experienced significant acceleration last holiday season, and, continuing this trend, we expect them to continue to outgrow the total retail landscape this year.

Disruptor channels have found a solid foothold over the past two years. While they remain small, both social media commerce and online marketplaces specialized in deals and gamification such as Temu and SHEIN are becoming increasingly formidable players. Timing matters, though—direct, social media, and emerging marketplace channels see the most strength early in the holiday shopping season, when early shoppers are seeking the ‘just right’ gift and often prefer to buy directly from brands.

Later in the season, shoppers will insist on the predictable fulfillment and competitive prices that mega-retailers and platforms are better known for. Leaning into fast-fulfillment advantage can help capitalize on consumers seeking rapid shipping to ensure gifts arrive in time.

Our view is that holiday performance for consumer brands and for retailers will depend on well-timed execution, recognizing that shoppers have different missions across the full holiday season. Throughout the season deal-seeking will be a core behavior, in part a reaction to the higher prices across grocery and other non-discretionary categories.

How to Deck the Halls for a Different Holiday Season

In summary, the consumer outlook is positive, but there are some important things for retailers to bear in mind this year. First, the shorter Thanksgiving-to-Christmas shopping window will make early holiday sales more critical to full-season results. Second, the Presidential election while be a distraction for many and will crowd the media market, but shopping is likely to accelerate once votes are cast. Third, while weekend shopping trips have made a return, weekday eCommerce continues to gain importance and cannot be ignored. And fourth, consumer expectations will continue to vary widely across channels and at different moments in the season—priorities will shift across best brand, best fulfillment, or best deal depending on needs and timing.

US retailers can prepare for these twists and turns by taking 5 strategic actions:

- Be early & agile: Focus on winning early and making agile adjustments through the peak of shopping season, rather than waiting to deploy the best tactics when the market is most crowded. For example, creating micro moments that balance demand capture of physical shopping (weekend) with a weekday online deal strategy during early holiday

- Create compelling content: In holiday, retailers and brands should not only think about which product they want to sell, but also about what it takes to sell it. During this time, what matters to consumers is deals, trends/looks, and gift guide inspiration. AI can be a powerful tool for enabling more content variety this season at lower cost.

- Win the battle for influence: To cut through the noise, the right influential content on the right channel is critical. Content focused on gift guides, trends, promos, etc. deployed into immersive and community-rich channels such as YouTube and Social can drive breakthrough consideration in this highly competitive time.

- Define a holistic activation plan: In addition to influence, brands and retailers need win on performance channels (e.g., search, product ads, commerce journalism) to drive conversion and close the sale loop.

- Remember the basics: Don’t forget the table stakes. Customers expect and demand predictable fulfillment and seamless online experiences – especially later in the season.

Ready the Sleigh and Hang on Tight

The 2024 Holiday season in the US will accelerate quickly, right out of the gate. With hilly, twisty terrain ahead across a compressed peak-season calendar and election-related distractions, it’s important to be ready with speed and agility alike. With the right approach, retailers can look forward to a season of cheer, despite a moderate growth outlook for US consumers’ holiday spending.

Special thanks to Hind Saleh, BCG SurveyOps, BCG Lighthouse, and Inc-Query for their support