Technology is disrupting every aspect of the e-commerce shopping journey and fundamentally altering consumer behavior. But the benefits for retailers have accrued unevenly so far.

A recent survey by BCG and World Retail Congress revealed that 60% of

retail innovation leaders

are prioritizing investments in e-commerce. Most US retailers, however, are not moving fast enough relative to the market leaders Amazon and Walmart, which accounted for over 38% of the US e-commerce market in 2023 and had a combined market share of over 50% in several product

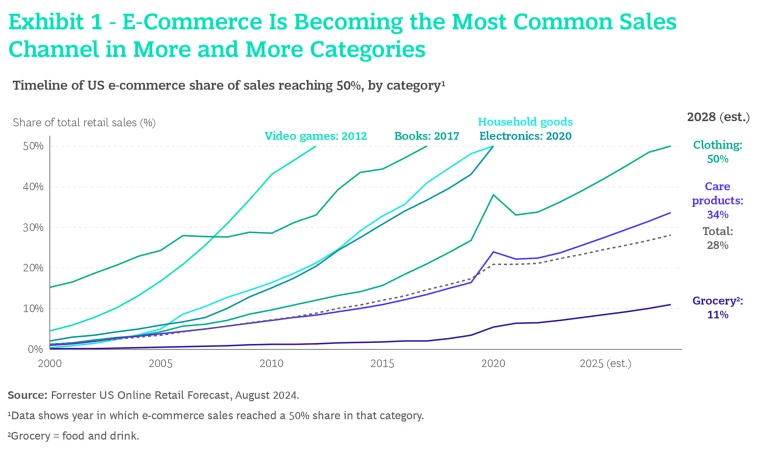

The success and momentum of these leading retailers have created an innovate-or-perish moment for other retailers with e-commerce aspirations. Heightening the urgency is the ongoing upsurge of e-commerce itself. Forrester forecasts that over 70% of total US retail sales will be digitally influenced by 2027. It’s only a matter of time before the majority of retail sales across many categories in the US takes place via e-commerce. (See Exhibit 1.)

What Are Retail Innovation Leaders Doing Right?

Among the 60% of retail innovation leaders that are prioritizing e-commerce, two of the top investment areas are third-party marketplaces (42%) and social commerce (39%). Adopting a marketplace model allows for assortment expansion without significant scaling of internal operations, while deploying social commerce can enhance brand awareness and increase market share among younger shoppers. AI, including GenAI, was one of the top investment areas for all retailers (58%) because it can help them boost efficiency, reduce lead times, manage complexity, and enhance creativity.

Increasing the end-to-end speed of their e-commerce initiatives—from identifying and testing opportunities to rapid scaling—will enhance traditional retailers’ staying power in this growing market. The slower they move, the greater the risk that they continue to fall behind the innovative traditional retailers or fast-moving digital natives.

Adopting Third-Party Marketplaces

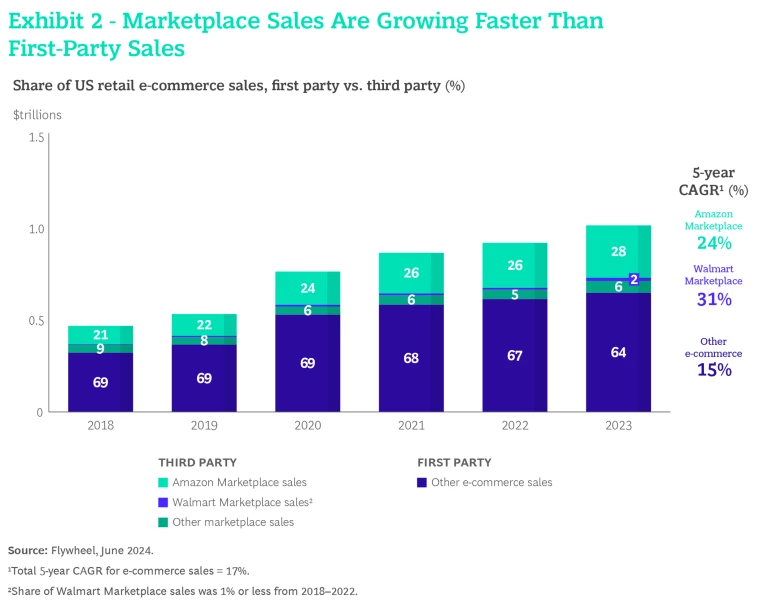

We view the adoption of a marketplace model as a no-regrets move for many retailers that want to rapidly expand their assortment by offering the existing ecosystem of sellers a new route to market. Overall marketplace sales are growing at a faster rate than first-party e-commerce sales, with Amazon and Walmart growing much faster than the remaining marketplace players in the US. (See Exhibit 2.)

Amazon’s marketplace model has reset the retail industry through a trusted platform with clear and recognized consumer benefits: free, fast delivery on a virtually endless assortment. Over 60% of the unit volume on Amazon’s global e-commerce platform now comes from third-party sellers, and its revenue from serving those sellers grew by 13% in the second quarter of 2024. Walmart has reported that sales on its marketplace have grown by over 30% in each of the last four quarters, and the number of sellers listing items on Walmart.com grew by 20% in the previous fiscal year.

Specialty retailers have also capitalized on opportunities to create marketplaces. UK home improvement retailer B&Q significantly expanded its product range to 1.5 million items after it implemented a marketplace model in 2022. Thanks to this broader assortment and conveniences such as free shipping, fast delivery, and easy returns, marketplace sales accounted for 40% of B&Q’s total online sales in the first half of 2024, up from 33% in the year prior and 22% in January 2023. In the 2023 fiscal year, 50% of customers who bought marketplace products from B&Q were first-time buyers.

Temu, meanwhile, has demonstrated that digital natives can follow alternative paths to success. Its strategy of low-priced products and a social referral system has led to exponential growth over the last few years, catapulting Temu into an e-commerce leadership position. The average prices of the products on the Temu platform are around 50% less than the prices on Amazon. Large in-app discount campaigns result in a 10% conversion rate versus the industry average of 2%.

We have identified several success factors for retailers looking to achieve a meaningful marketplace presence. The best marketplaces:

- Assess and test the demand. They determine the market demand for current and new product categories, test their hypotheses by enlisting third-party sellers for pilot listings, and then seek to scale the winning ideas.

- Foster a competitive environment. They create and encourage competition among third-party sellers while offering customers a one-stop-shop solution with one interface.

- Differentiate their positioning. This could be by segment or category, or through the integration of their physical assets, such as a store network.

- Create or design an organizational structure that supports autonomy. This structure should provide sufficient autonomy to establish guardrails and incentives for the marketplace, attract the right talent, and manage potential tensions between first-party and third-party sellers.

Deploying A Robust Social Commerce Strategy

The sheer size of social networks has made social commerce an increasingly important way for retailers and brands to reach customers and communicate their offerings. An estimated five billion people belong to social networks, and active users spend an average of two to four hours per day on them. A study by Adobe found that 41% of US consumers—and 64% of Gen Z consumers—have used TikTok as a search engine, having found TikTok’s short-video format to be more digestible, personalized, and current than typical search engines.

The popularity of livestreaming in the early part of the COVID-19 pandemic accelerated the rise of social commerce. By the end of 2021, for example, livestreaming had already accounted for 60% of online gross merchandise value for the retailers on Alibaba’s Taobao Live, a customer-to-customer streaming platform.

An estimated five billion people belong to social networks, and active users spend an average of two to four hours per day on them.

A social commerce strategy also helped the global fashion retailer Abercrombie & Fitch (A&F) successfully transform its reputation from the “most hated retailer” of 2016 to a favorite of Millennial

Social media also has contributed to the success of the Asian platform Shein, helping it become the fastest-growing e-commerce retailer in the fashion industry, with revenues in excess of $30 billion, according to Jamie Salter, CEO of Authentic Brands, which has partnered with Shein; Salter’s estimate would translate to 40% revenue growth for Shein in 2023, based on an earlier Wall Street Journal report that the platform had achieved $23 billion in sales in 2022.

The shopping app LTK allows influencers to have their own personal online store, where they can share the products they endorse and link their shops across all popular social media channels. LTK Creators drive $5 billion in annual retail sales through the platform, with more than 40 million monthly shoppers in over 150 countries.

Based on our experience, we have identified these key success factors for a social commerce strategy:

- If new to social commerce, pilot basic shopping links. Retailers should partner with influencers to test shoppable links on social platforms. This will help generate valuable first-party data, increase engagement, and identify where to offer rewards. They should aim to integrate shoppable links with influencer content to better track audience behavior and optimize conversion.

- If focused on scaling social commerce, diversify influencer and ad presence. Retailers should work with influencers across various platforms to reach different customer segments and create a personalized and scalable presence. By using influencer-driven content, they can better tailor messaging to different customer segments, tap into social media algorithms that boost targeted engagement, and reach broader audiences efficiently.

Implementing GenAI Along the Value Chain

The majority of companies in most sectors are still experimenting with AI and GenAI, but for retailers, the integration of GenAI is a question of “when,” not “if.” Companies that have invested heavily are already starting to achieve greater efficiencies and faster lead times, and they expect these benefits to grow. The commitment of Walmart to gain an advantage in AI talent and capabilities is one sign of how large the GenAI opportunity is. As of January 2024, Walmart had more AI-related job listings than major competitors such as Dollar General, Target, and Kroger combined.

Walmart is using GenAI to improve the quality of its product catalog by using large language models (LLMs) to create or enhance over 850 million pieces of product data. The company said that without the LLMs it would have needed around 100 times as many people to complete the work in the same amount of time. It is also using GenAI to help improve its multilingual search functionality. Even before LLMs had come into widespread use, Walmart had already added more than 600,000 of the most searched items to the model by July 2022.

For retailers, the integration of GenAI is a question of “when,” not “if.”

Among its many other initiatives, the retailer is also developing a virtual shopping assistant that provides customers a more interactive and conversational experience and a “Be Your Own Model” tool that allows shoppers to use their own photos to better visualize how clothing will look on them.

Target has incorporated GenAI into employees’ handheld devices, allowing them to handle basic tasks such as signing up a customer for a credit card. The company said that its employees have used the embedded tool over 50,000 times with an average chat time of less than one minute.

No single approach can capture the full scope of how and where GenAI can yield significant gains in productivity or enhance creativity. Instead, we recommend that retailers evaluate their opportunities

across three broad levels of depth, breadth, and intensity:

- Deploy. Retailers accelerate the adoption of AI and GenAI by pinpointing areas for enhancement along the value chain, executing AI-driven pilot projects, and then scaling AI applications across the organization. Many of the initiatives we described above fall into this category.

- Reshape. This involves an end-to-end redesign of critical functions for greater gains in efficiency and productivity. Thanks to ease of use and declining marginal costs, for example, GenAI can

enable content creators and marketers

to operate at a macro scale with micro precision. They can engage customers at the point of experience by generating personalized content in real time.

- Invent: This is the most ambitious area, as retailers look for ways to apply GenAI to create new customer experiences , offerings, and business models.

“Innovate or perish” is nothing new to the retail industry. Over the last several decades, retailers that lost their innovation edge have declined in size and importance or gone out of business altogether. The rapid rise of disruptive marketplaces such as Temu and the social power of Shein demonstrate that retailers can grow quickly when they capitalize on opportunities in marketplaces, social commerce, and GenAI.

Faster and more successful innovation in e-commerce is not about choosing one major initiative over another, but rather developing a strategy that capitalizes on a mix of innovation opportunities. Whether Temu, Shein, and other digital natives will match the speed and staying power of Amazon and Walmart—and whether other traditional retailers will do so—will depend in part on how well they can recognize and seize the same kinds of opportunities.