So far, 2024 has fallen short of expectations for a strong resurgence in M&A activity, as instead a slow recovery persists. Many dealmakers remain cautious, either staying on the sidelines or tentatively dipping their toes in the water. Their hesitancy is understandable, considering the challenges involved in navigating today’s complex political and macroeconomic landscapes. Nevertheless, some dealmakers—most notably those in industries undergoing significant transformations—are forging ahead with their M&A strategies.

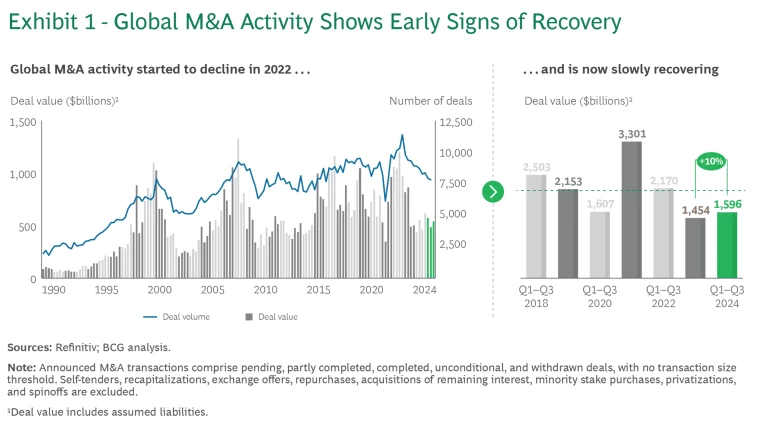

Amid global economic turbulence, M&A activity has been a mixed bag. The year began with a modest comeback in dealmaking, followed by a sluggish second quarter and, more recently, a volatile return to average activity levels. During the first nine months of 2024, global aggregate M&A value increased by approximately 10% compared with the same period last year.

BCG’s M&A Sentiment Index continues to show signs of a strengthening market, albeit slowly and steadily. We anticipate increased activity in the coming months, with dealmakers in the US and Europe leading the charge. Most industries will participate in the recovery, especially those in the energy, technology, and health care sectors. Fundamental factors, such as economic growth and political and regulatory conditions, will surely remain volatile. Even so, major trends, including energy transformation, digitization, and the rising importance of AI, will continue to propel the M&A market.

A Steady but Slow Recovery

Globally, M&A activity remains below historical norms—and particularly in comparison with recent years, including the deal frenzy of 2021. However, activity has rebounded since the low point observed during the second half of 2022 and the first three-quarters of 2023. (See Exhibit 1.) Through the first nine months of 2024, companies announced deals totaling approximately $1.6 trillion, spread across approximately 22,400 transactions. This represents a 10% increase in deal value versus the same period in 2023.

This positive but slow momentum aligns with our BCG M&A Sentiment Index, which has indicated higher but still below-average deal activity for most of 2024. However, our index continues to climb steadily, particularly in North America and Europe. It also shows a promising trajectory for most industries. The outlook is especially bright for the technology, energy and utilities, and health care sectors, while the consumer and industrial sectors continue to lag.

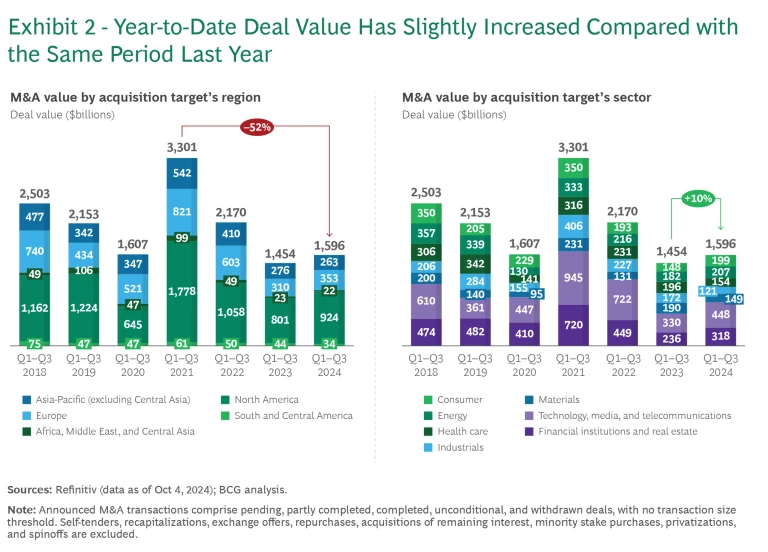

Regionally, North America has been the most active area, followed by Europe. The dealmaking slump has continued in Asia-Pacific and Africa. (See Exhibit 2.)

- Deals involving targets in the Americas had a total value of $958 billion, an increase of approximately 13% versus the first nine months of 2023. The vast majority (worth $877 billion) involved targets in North America, which accounted for 55% of overall global M&A activity. US companies acquired most of these targets. Deal value in South America and Central America declined by 24%.

- The value of European M&A totaled $353 billion, a 14% increase compared with the first nine months of last year. Deal value in the UK increased by 131%, resulting in the country’s highest share of European dealmaking since 2015. Deal value also increased strongly in Sweden (111%), the Czech Republic (68%), and France (29%), driven by a few larger deals. In contrast, aggregate deal value was significantly lower than during the same period last year in Germany (–52%), Austria (–34%), Switzerland (–31%), and Italy (–25%).

- In Africa, the Middle East, and Central Asia, the aggregate deal value was 7% lower than during the same period last year.

- Deal value in Asia-Pacific declined by 5% to a ten-year low of $263 billion. Declines in China (–41%) and Australia (–7%) were major factors in the lower regional total. There were bright spots, however, including Malaysia (132%), India (66%), Singapore (48%), Japan (37%) and South Korea (10%).

Among the most active sectors in improved year-to-date deal value compared with the same period last year were financial institutions and real estate (35% increase), technology, media, and telecommunications (36% increase), and energy and power (14%). BCG’s M&A Sentiment Index suggests that these sectors will continue to drive M&A activity in the coming months.

The consumer sector had one of the largest percentage gains in aggregate deal value—a 35% increase—a first sign of recovery from its previous trough of sluggish activity. Still, this renewed strength reflects not a broad-based increase in deals but a few recent very large deal announcements, such as the intended acquisition by Canada’s Alimentation Couche-Tard of Japan-based Seven & i Holdings, valued at $38.7 billion, and in the US, Mars Inc.’s bid for Kellanova, valued at $29.7 billion. If completed, these transactions would be the consumer sector’s largest deals in recent years.

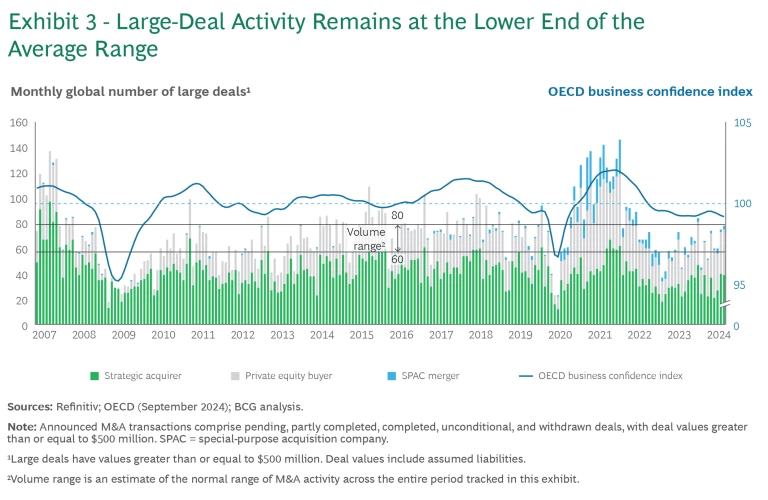

The number of large M&A deals (those valued at more than $500 million) typically serves as a good indicator of overall M&A health. (See Exhibit 3.) The market for large deals was very active in 2021 and 2022, fueled in part by the surge in mergers involving special-purpose acquisition companies (SPACs). Since then, the market has cooled, often settling at the lower end of the average range of 60 to 80 deals per month. This decline aligns with a drop in overall business confidence, reflecting the challenging economic environment.

The number of megadeals (those valued at more than $10 billion) has not matched the levels seen in 2022 and 2023. Companies reported only 17 megadeals in the first nine months of 2024, compared with 28 and 20 during the same period in 2022 and 2023, respectively.

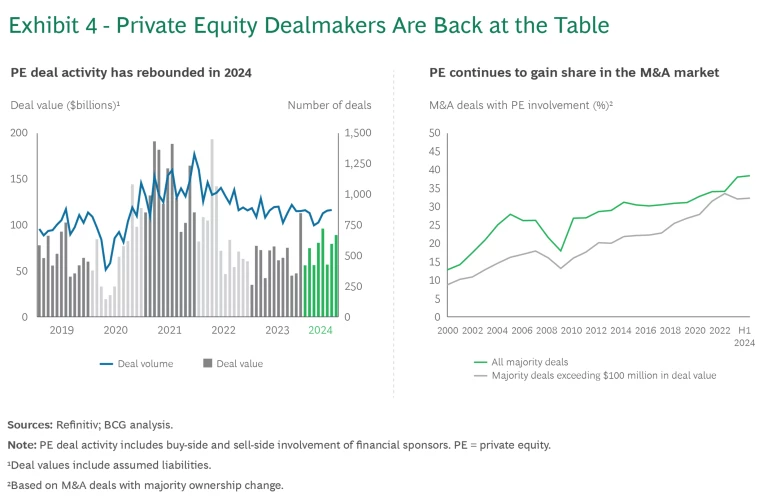

Private Equity Dealmaking Is Resurgent

Private equity (PE) firms’ dry powder—cash reserves or liquid assets available for new investments—reached a record $2.1 trillion at the end of September 2024, fueling the resurgence of PE dealmaking. (See Exhibit 4.) Conditions are favorable, as firms need to deploy this capital at the same time that interest rates are declining and valuation gaps between sellers and buyers are narrowing. So far in 2024, the two most active sectors for PE investments have been technology, media, and telecommunications and financial institutions and real estate.

Although the second quarter of 2024 saw an uptick in global venture capital funding—particularly in North America and Europe—venture capital activity has not yet fully recovered and remains far below the level of 2021. Even so, companies involved in artificial intelligence (AI) continue to attract significant investments, despite continuing concerns about a crowded market, high valuations, and uncertain growth prospects.

Collaborative Ventures Continue to Gain Popularity

Although their motivations may vary, many dealmakers are considering collaborative ventures, which they regard as an important strategic tool. Companies announced several sizable

joint ventures

and partnerships in 2024. Notably, established companies are collaborating with each other, startups and technology firms, and PE players. Here are four examples:

- In India, The Walt Disney Co. and Reliance Industries received conditional regulatory approval for an $8.5 billion merger of their Indian media assets into a joint venture creating India's largest entertainment company.

- German automaker Volkswagen agreed to invest in US-based electric vehicle (EV) maker Rivian to form a joint venture aimed at developing and sharing EV architecture and software. The anticipated investment is expected to reach up to $5 billion over the coming years.

- In the US, KKR and T-Mobile US joined forces to acquire subscription programming services provider Metronet Holdings in a deal valued at $4.9 billion.

- In the materials sector, BHP and Lundin Mining teamed up to acquire Canadian Filo and form a 50-50 joint venture. The collaboration seeks to advance the Filo del Sol and Josemaria copper projects. The value of the deal is $3.2 billion.

Conditions May, on Balance, Foster Momentum

Dealmakers must contend with several short-term headwinds. These include uncertainty caused by recent and upcoming elections, the pace of interest rate cuts, the potential for an economic slowdown, and elevated market volatility. Longer-term concerns include evolving climate regulations, stricter antitrust laws, the fragmentation of global trade, and geopolitical tensions and conflicts.

The increasing influence of regulation and policy changes on M&A activity is noteworthy, too. Traditional antitrust regulations often complicate larger deals. In some cases, antitrust scrutiny promotes dealmaking because companies often use divestitures to address these concerns. Dealmakers face further challenges related to foreign direct investment regulations, national security concerns, and sanctions. In addition, M&A processes are now subject to greater scrutiny owing to data and privacy protection laws, cybersecurity issues, and ESG and climate change regulations. The impact of these factors varies significantly by country.

Meanwhile, on the positive side, dealmakers benefit from several tailwinds. Most of the year’s major elections, including those in the EU, France, the UK, and India, are behind us, giving greater clarity to the political outlook. In addition, many companies have healthy balance sheets, with cash ready to be deployed in deals. Moreover, as mentioned above, PE firms have record levels of dry powder available.

Valuation levels have recovered as well. The current S&P 1200 price-to-earnings ratio is 24.5x, versus 15.5x in October 2022, and the price expectations of buyers and sellers have largely aligned. Furthermore, as inflation comes under control, interest rates are dropping.

Taken together, these tailwinds could build momentum in deal activity—especially as business confidence and sentiment gain strength.

Trends Promote M&A over the Long Term

Over the long term, several trends will continue to foster an M&A recovery:

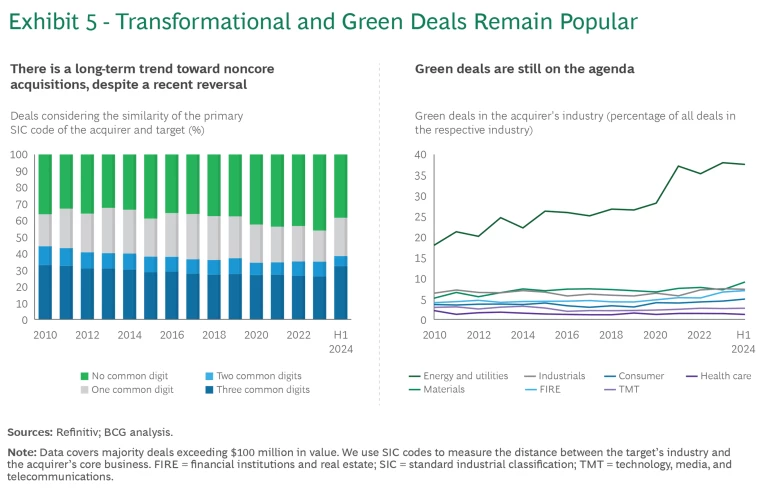

- Transformations. Staying the course is not an option in an era of technological advances, geopolitical tensions, and economic uncertainty. Continuous development and transformation are necessary to counter challenges arising from new customer behaviors, supply chain disruptions, the energy transition, and evolving regulatory frameworks. For many executives, gaining and retaining competitive advantage and building resilience are top priorities. M&A and divestitures are essential tools for transforming companies, and their importance will only increase. We expect to see more transformational deals, including those involving assets outside the company’s core business. (See Exhibit 5.) On the buy side, this involves acquiring for growth, efficiency, technology, or talent. On the sell side, it means divesting underperforming business units or noncore assets.

- Climate and Sustainability.

Green deals

that pursue climate and sustainability objectives gained steam over the past decade. Although the focus on ESG issues has waned somewhat—particularly in North America—they remain firmly on CEO agendas. The ongoing energy transition, decarbonization, the rise of the circular economy, and broader concerns about social impact are influencing companies across all sectors. Acquisitions and divestitures are valuable tools for achieving strategic goals related to these challenges.

- Sector-Level Considerations. Global trends affect different sectors to varying degrees. For example, ongoing energy transition and decarbonization efforts are especially influential in the energy, power, materials, and automotive sectors. On the other hand, the continuously evolving regulatory landscape and increased antitrust scrutiny are of special concern to large tech and pharma companies as they continue to grow.

- Digitization and AI. The ongoing push for digitization remains a major driver of deals. Recent advances in generative AI (GenAI) and robotics, in particular, will continue to fuel M&A activity as companies pursue emerging technological solutions and tech-enhanced capabilities. In this context, "acquihire" deals—in which the acquirer’s primary goal is to gain access to a company’s highly skilled employees—are likely to become more common. AI is also likely to transform the way deal M&A teams operate and manage their activities. To keep pace with ongoing advances, dealmakers must consider how to integrate AI into their work. (See “Applying AI in Dealmaking.”)

Applying AI in Dealmaking

During due diligence, advanced analytics and machine learning-based methods can provide insights by processing large amounts of structured and unstructured data, leading to faster and more accurate decision making. AI can also assist with various aspects of business planning, financial modeling, and valuation. The increased speed that AI-powered tools bring to tedious tasks such as document review offers a clear indication of the technologies’ potential impact and its future role in dealmaking.

Overall, AI-based technologies should significantly enhance productivity, and dealmakers are understandably eager to capitalize on these efficiency gains. Beyond applying technology, success requires finding and retaining the right talent and investing in developing the necessary skills among deal team members.

Exercising caution in today’s environment is understandable, but it does not excuse a lack of preparation. Dealmakers should take the opportunity to refine their strategies, identify suitable targets, build the right M&A teams and organizations , and invest in new technologies for deal execution. Now is also the ideal time to prepare for being a target when dealmaking picks up, such as by prepackaging carve-outs .

For bold dealmakers, doing deals now—when the market is not at its peak and valuations have not returned to their heights—provides more time to ensure that transactions align closely with long-term strategy, often resulting in higher returns. As always, dealmakers should maintain a strong focus on the value creation thesis, especially synergies and related integration implications.

In this period of relative calm, proactive preparation will differentiate dealmakers who are ready to navigate the complexities of the market from those who are at risk of being caught off guard. The next wave of M&A is building—and the companies that prepare for it now will be the ones leading it.