Entertainment Parks Industry: Resurgence and Growth

The entertainment parks industry, with over 140 years of history, draws more than 500 million visits annually on a global basis. This sector encompasses a wide array of parks ranging from small amusement parks, offering diverse attractions, to larger-scale theme and water parks centered around a specific theme or iconic intellectual properties (IP).

Despite a 67% drop in attendance during the COVID-19

The robust expansion of this industry is evident worldwide, with significant new projects both completed or in the pipeline. Notable developments over the past few years included the opening of Universal Studios Beijing in September 2021, making it one of the largest theme parks globally, and Disneyland Paris’ €2 billion expansion

The future of the entertainment parks industry looks promising, with ongoing innovation and expansion ensuring its place as a thriving and dynamic sector. The theme park market currently accounting for more than USD 70 billion is expected to grow at an estimated CAGR (compound annual growth rate) of 5% over the next ten

Global Market Trends and Influences

The entertainment park industry is entering an exciting era of intense expansion and innovation, driven by surging demand and massive competition. Diverse global market trends are reshaping entertainment offerings, visitor experiences, and industry operations, propelling the sector into a dynamic period of growth (Exhibit 1).

Sophisticated & Gamified Experiences

The increased sophistication in attractions has become a hallmark of the entertainment parks industry, with flagship parks worldwide leveraging technology ranging from virtual reality to gamification features and accessories. For example, at Universal Studios’ Super Nintendo World, guests can collect digital stamps and coins through mobile apps and power bands. This trend extends beyond theme parks into water parks, where VR-enabled attractions are gaining popularity. In 2022, there were around 27 VR-enabled attractions in water parks globally, nearly tripling from 2019. These features transform traditional rides into highly engaging experiences, ensuring parks remain competitive by offering unique & attractive experiences to guests.

IP-driven Development

Increasingly, entertainment parks are themed around popular movie, TV show, and video game intellectual properties (IPs), significantly boosting visitor interest and driving higher attendance. For instance, Disney has capitalized on the massive popularity of its classic fairy tales with themed zones like Fantasyland in Disneyland Paris. Recently, Disney has unveiled unique IP-driven offerings, including the world’s first Zootopia-themed show, set to debut in winter 2025, and other IP-themed attractions complemented by retail and

Dynamic Pricing

Entertainment parks are increasingly adopting dynamic pricing strategies to optimize revenue and manage crowd levels by varying prices based on demand, timing, and seasonality. This approach not only helps balance attendance, but also makes these destinations attractive to visitors by offering more affordable options and improving their experience through better crowd management and reduced wait times.

Tech-enabled journey

Entertainment parks are leveraging a wide range of technologies to facilitate and enhance their guests’ experience from planning to the visit itself. For instance, SeaWorld’s mobile app provides personalized recommendations, park directions, real-time updates on wait times, and show schedules. Similarly, in 2021, Disney introduced their “Genie+ service” offering virtual queuing and personalized itineraries. These innovations help meet rising visitor expectations, maintain a competitive edge in the industry and create additional sources of revenue.

Sustainability and Accessibility

Parks are enhancing eco-friendly practices to appeal to environmentally conscious consumers. For example, LEGOLAND uses solar panels and water recycling systems, while Chimelong Water Park in China integrates energy efficient water pumps and solar heating. Additionally, entertainment parks are focusing on accessibility and inclusivity. For example, Morgan’s Wonderland in Texas serves as an industry model, with all rides and attractions designed specifically to accommodate people with special needs.

Surging Interest in Saudi Arabia

Vision 2030

Until recently, Saudi Arabia’s entertainment sector has been limited, with few options for leisure and recreational activities. But in 2016, Vision 2030 was launched with three primary pillars: a vibrant society, a thriving economy, and an ambitious nation.

A key goal under the second pillar is to diversify Saudi Arabia’s economy by fostering growth in multiple sectors, including entertainment and tourism. Development in these sectors focuses on two areas relevant to this discussion. The first is enhancing local tourism to cater to the domestic population, aiming to keep leisure spending within the country. The second is boosting the Kingdom’s appeal as a global entertainment destination, seeking to attract a diverse and international audience.

Expanding and enriching entertainment options is also aligned with the first pillar – a vibrant society. With on average 50% of the Saudi population under the age of 29, the Kingdom enjoys a predominantly young

Population Interest

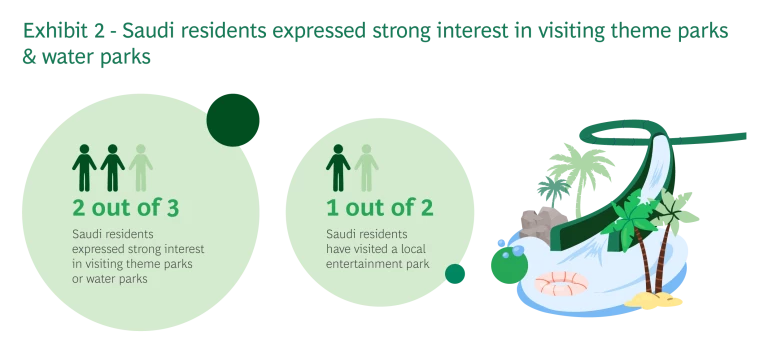

Based on a 2024

Demand Patterns in Saudi Arabia

Note that all the insights below are based on the responses of Saudi residents who expressed a strong interest in visiting theme parks or water parks and completed the full survey.

Insights into visitor preferences and behaviors reveal valuable demand patterns for theme park and water parks. Interestingly, the survey highlighted significant similarities in preferences across theme parks and water parks as well as among different target groups. To comprehensively understand residents’ preferences, the survey explored multiple aspects including visit format, visit drivers, and offering preferences.

Visit Format & Drivers

- 90% of the survey respondents would visit a theme or water park at least once a year if it were located within their city, with 67% willing to visit twice or more.

- Around 80% of respondents interested in such destinations would visit during weekends or holidays, with half choosing holidays.

- Sixty percent of interested respondents want to spend between 4 and 8 hours at the park, seeking comprehensive experiences that include attractions, retail, and dining options, with 78% expressing interest in having at least one meal during their visit.

- Meanwhile, on average, 40% of respondents are also interested in staying overnight at adjacent hotels after spending a full day at the park.

- Cost, including ticket prices and travel expenses, is the main driver for 43% of visitors when deciding to visit theme parks and water parks. Along with cost, one-third of respondents base their visit decision on the variety of offerings, such as the appeal of rides and shows, and 20% of visitors make their decision based on the park’s theme.

Offering Preferences

Overall Environment

When visiting a theme park or water park, most surveyed residents prefer parks that feature both indoor and outdoor areas, while seeking fun and excitement throughout their visit. This indicates the importance of offering a mix of settings and activities, ensuring a balanced, engaging experience that caters to all visitor needs.

Attractions and Experiences

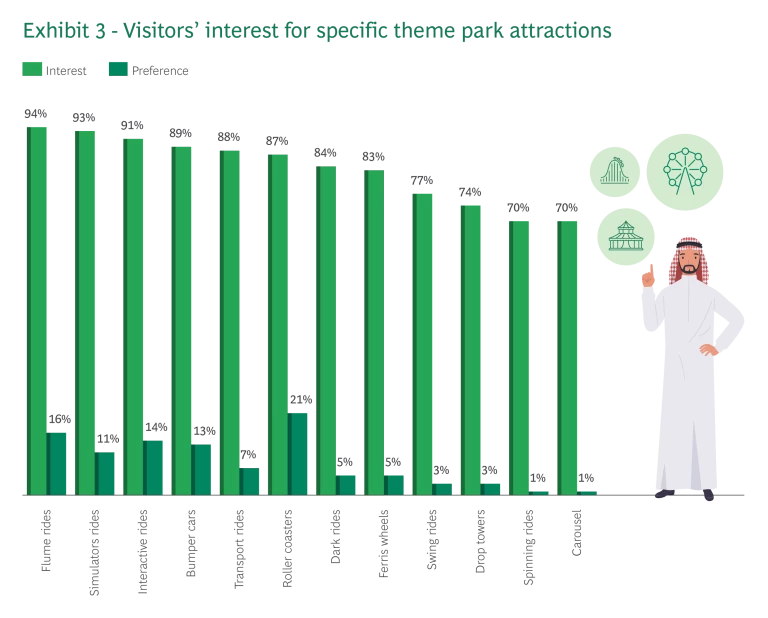

At least 70% of respondents expressed a strong interest in exploring a diverse range of attractions and experiences while visiting a theme park (Exhibit 3). The survey findings also revealed that 90% of participants are interested in attractions such as flume rides, simulators, and interactive rides. However, when survey respondents were asked to choose one preferred attraction, roller coasters showed the highest popularity (21% of responses).

Note: This graph presents the interest in theme park attractions, evaluated through ‘would do vs. wouldn’t do’ questions for each attraction, and preference measured by asking respondents to choose their favorite attraction from this list in a single-answer format.

The survey reveals similar patterns for water parks, with at least 9 out 10 showing interest in traditional attractions like typical body slides, mat slides, and speed body slides, along with family friendly attractions such as family tube slides. This data validates the interest for traditional attractions found in global benchmarks, along with a slight preference for water-based rides even in dry theme parks. Additionally, it highlights the importance of technology in such settings with 43% of visitors showing stronger interest in parks featuring innovative tech-enabled attractions like virtual reality rides. To cater to these diverse preferences, parks should focus on integrating traditional attractions catering to the different visitor segments, along with unique experiences to stand out in the market. This approach will ensure a captivating and engaging experience for all age groups and family outings adding a layer of differentiation.

Additional Offerings & Services

In addition to exciting and diverse attractions, Saudis residents seek a comprehensive experience enabled by a wide range of additional offerings:

- At least 1 out of 3 visitors surveyed would purchase exclusive merchandise and souvenirs during their visit.

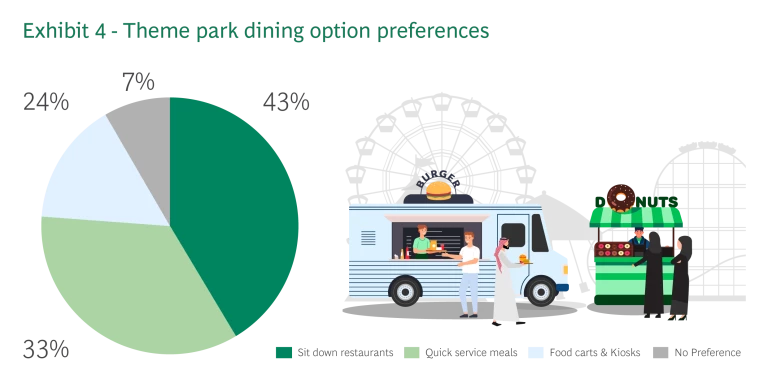

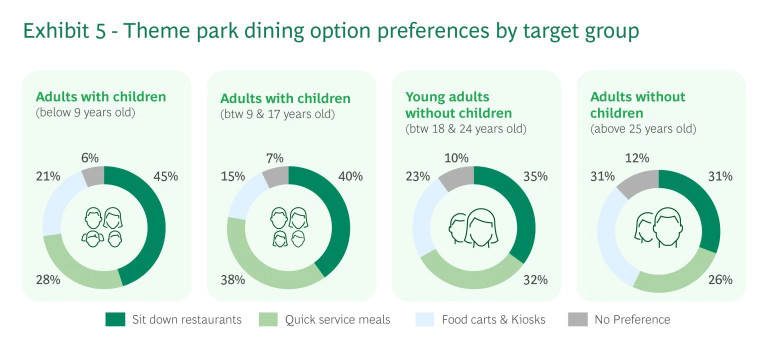

- More than 40% of theme park visitors prefer sit-down restaurants for meals. This is primarily driven by families with children in contrast to adults who would also grab quick meals from food carts and kiosks. (Exhibits 4 and 5).

- Among the 40% of respondents interested in staying overnight, half choose family-oriented accommodations. This indicates that providing a variety of lodging options, including family-oriented hotels will encourage extended stays and ensure access for the different visitor segments.

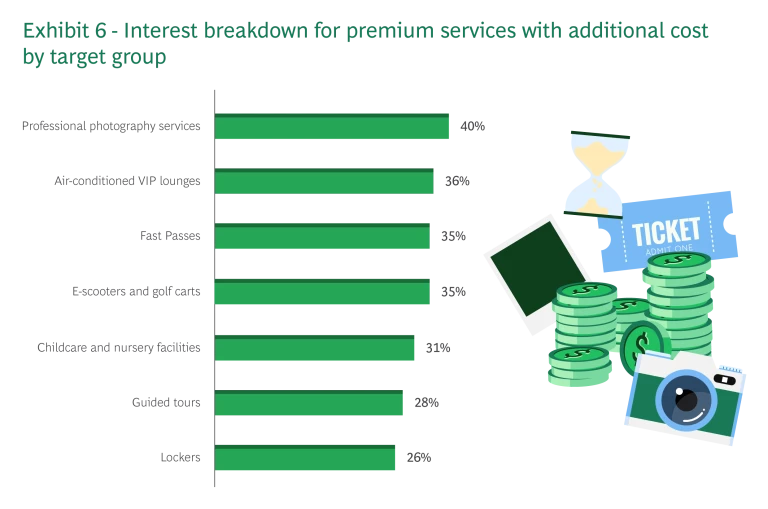

On top of these comprehensive offerings and despite cost being the main driver for deciding a visit, most visitors are willing to pay extra for premium services to enhance their experience (Exhibit 6). For example, 40% of respondents are willing to pay extra for professional photography services, and 35% for fast passes to reduce wait times in the park.

This finding indicates how premium services can enhance visitor comfort and satisfaction while providing valuable additional revenue streams. It also validates the importance of using technology to provide the visitors with sophisticated tools like virtual queuing options to navigate their journey in an optimal way. These innovations not only streamline the visitor experience but also contribute to overall operational efficiency, ensuring a seamless and enjoyable journey for all guests.

It is clear that Saudi residents of all ages are entertainment park enthusiasts, visiting both local and international parks for fun and diverse experiences. This demand, complemented by Vision 2030 ambitions and general industry innovation, is set to drive a dramatic evolution in the country’s entertainment park ecosystem.

Saudi Arabia’s Evolving Entertainment Park Ecosystem

Global Positioning of Entertainment Parks

From a global perspective, entertainment parks can be analyzed along the dimensions of scale and theming. Three categories are of particular interest:

- Amusement parks are mid-size parks that primarily attract local visitors from nearby areas. They feature a diverse range of offerings, including rides and attractions, without a specific overarching theme. Examples include Tivoli Gardens in Denmark and Cedar Point in the United States.

- Regional theme parks are mid- to large-size themed parks that attract visitors from the local region and nearby areas. These parks feature a diverse range of offerings, including themed attractions that create an immersive experience, making them popular destinations for local tourism. Two examples of regional theme parks are Chimelong Paradise in China and Europa park in Germany.

- Global theme parks are large-size parks that attract both regional and global visitors. They are organized around an overarching theme which helps create an immersive narrative for visitors. Global theme parks usually feature world-class offerings such as unique attractions, experiences, and events often tied to popular movie, TV show, or video game IPs. Examples include Universal Studios in Orlando, Disneyland in Paris, and Ferrari World in Abu Dhabi.

The breakdown of these categories provides a framework for understanding the potential of Saudi Arabia’s entertainment sector. Comparing the Kingdom’s entertainment ecosystem with global standards presents valuable insights into its potential for growth and development. The following section will delve into the current state and emerging ecosystem of Saudi Arabia’s entertainment parks and their alignment with global trends.

Saudi Arabia’s Current vs. Emerging Ecosystem

Over the years, several amusement parks and water parks have been established across the country with standard offerings and no overarching theme, primarily targeting local visitors. One of the first amusement parks in KSA, was Atallah Happy Land

Analysis of the current Saudi entertainment ecosystem reveals an industry poised for modernization and transformation. Despite strong stated demand, more than five parks have closed over the past couple of years, typically due to limited offering diversity, and sub-par experience. Many existing parks only feature a couple thrill rides and water attractions, lacking the unique experiences, complementary offerings & overarching themes found in global theme parks.

Driven by the launch of Vision 2030, Saudi Arabia’s entertainment industry has experienced a surge in investment opportunities, creating a rapidly evolving entertainment landscape. Along this mission, The General Entertainment Authority (GEA) was established in 2017 to enable the development of Saudi Arabia’s entertainment ecosystem through overseeing and licensing all investment opportunities related to the entertainment sector. For example, GEA has licensed the recent opening of Jeddah’s largest water park, Cyan, in the region, offering numerous aquatic rides and attractions, and leveraging the high local interest in water-based entertainment.

An exciting new ecosystem of entertainment destinations is emerging in Saudi Arabia, positioning the Kingdom as a global entertainment hub for residents and tourists. This transformation, driven by Vision 2030, encompasses several ambitious initiatives, including Riyadh Season, an annual festival featuring global performances, events, and cultural spectacles; King Salman Park, a large-scale urban park designed to integrate arts, culture, and leisure, with several entertainment venues and events; The Rig, an offshore destination offering thrilling and unique experiences; and three major entertainment initiatives: SEVEN, which is developing a range of entertainment complexes across the Kingdom; Qiddiya, a groundbreaking destination for theme parks and adrenaline-pumping attractions; and New Murabba, a futuristic urban district designed to deliver immersive, technology-driven entertainment experiences.

SEVEN

SEVEN plans to develop multiple entertainment complexes across Saudi Arabia, each featuring multiple themed zones that provide a wide array of attractions and experiences. These entertainment clusters are designed to offer a mix of activities, including family entertainment centers, adventure zones, cinemas, children’s areas, unique attractions, dining & retail spaces. Each destination will present new concepts through partnerships with globally recognized IPs like Discovery, Hasbro and Mattel, ensuring world-class experiences. One example is Al Hamra.

Al Hamra Entertainment Destination

Qiddiya

Located just 40 minutes’ drive from Riyadh, Qiddiya City is set to revolutionize the Saudi entertainment landscape and become a premier entertainment, sports, and cultural destination. Qiddiya will set a new benchmark for entertainment in the Kingdom by introducing more than 10 theme parks, featuring collaborations with world-class IPs and brands. Three of these parks have already been announced, promising to initiate a transformative shift in this industry.

Dragon Ball Theme Park

Six Flags

Aquarabia

New Murabba

This emerging ecosystem lays the foundation for a revolutionary entertainment transformation in the Kingdom by introducing world-class concepts in partnership with global brands. To ensure success, these parks must be tailored to meet the needs and standards of the local population, highlighted in the previous section. For instance, survey findings indicate a high demand for comprehensive experiences, varied dining options, retail opportunities, premium services, and amenities that cater to extended visits.

Conclusion

Saudi residents’ strong interest in theme parks and water parks highlights the significant potential for growth in this sector. Their readiness to travel locally and globally for exciting park experiences confirms this interest and demonstrates willingness to spend on entertainment parks. By updating facilities and introducing world-class offerings, Saudi Arabia’s entertainment sector can take advantage of this demand and align with global trends, catering to local visitors and potentially attracting international ones.

The upcoming launch of more than 10 parks in Qiddiya highlights the potential of theme parks & water parks in Saudi Arabia along with the vast opportunities available in the market. In fact, partnerships with renowned IPs and brands like Transformers, Hot Wheels, Six Flags or DragonBall, along with the introduction of world-class attractions, hospitality, retail, and dining options tailored to the needs of the population, will establish new standards and boost both local and international tourism. However, the entertainment parks industry remains to be explored across the Kingdom, to cater to the broader population and strengthen Saudi Arabia’s position as a global player in the industry.

In conclusion, the Kingdom’s new projects along with its ambitious and forward-thinking approach will transform it into a leading hub for entertainment and tourism. By focusing on local needs and continuous improvement, the Saudi entertainment park ecosystem is set to drive economic growth, boost local tourism, and solidify the country’s desired status as a premier leisure destination. The future of theme parks and water parks in Saudi Arabia is bright, with a clear path toward offering vibrant and engaging experiences for a growing and diverse array of visitors.