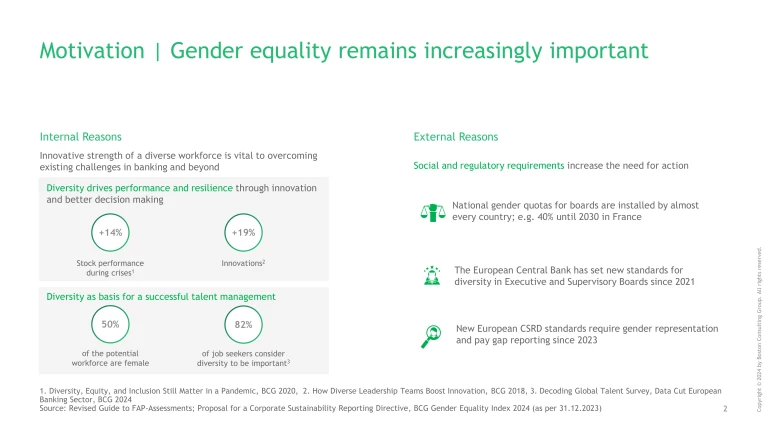

While some view gender equality as largely achieved, the reality is more complex. Despite years of commitment to gender diversity, Europe’s banking sector still faces significant hurdles in achieving true gender equality. Women remain notably underrepresented in the top leadership. BCG’s Gender Equality study 2024 for the European Banking Sector shows that women hold only a quarter of executive board seats in Europe’s largest banks, while men continue to dominate the industry.

This is notably as gender diversity has become a business necessity, driving performance, innovation, crisis management, creativity, and talent retention in a volatile economy. On top, external requirements enforce improvement of representation and remuneration of women. In this fourth edition of BCG’s Gender Equality Study for the European Banking Sector 2024 we uncover the current state and progress towards parity of the European banking sector.

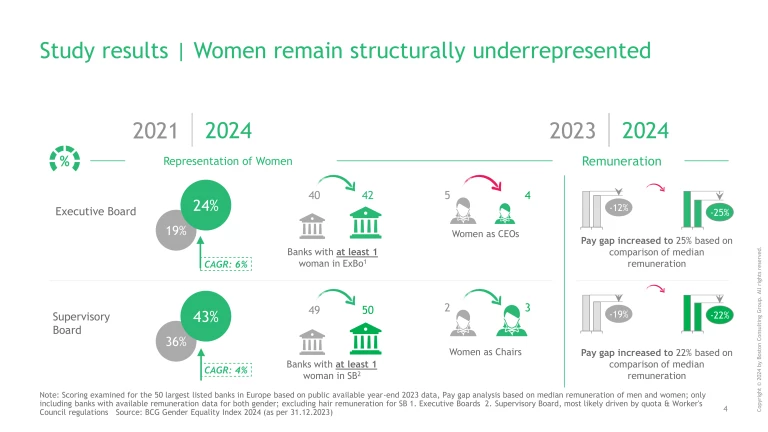

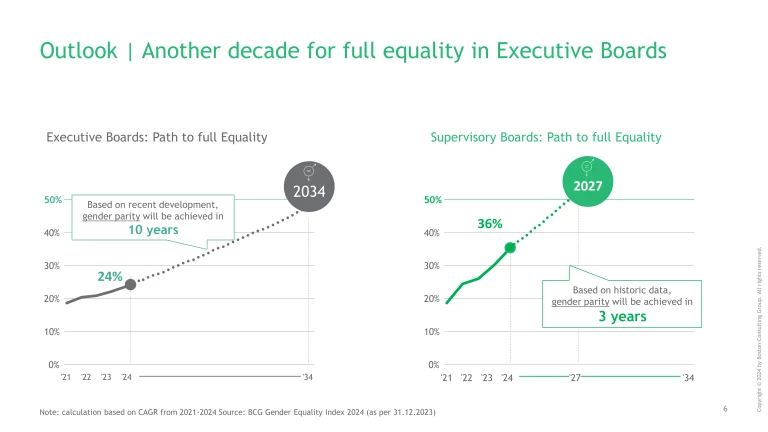

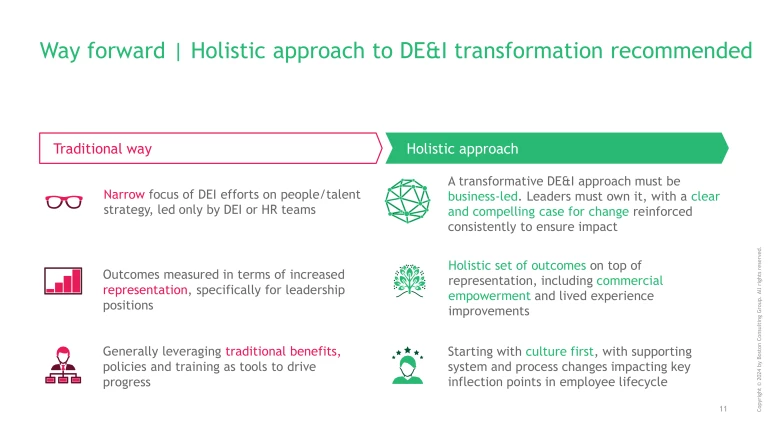

While there is a slight positive trend in the representation, women currently account for only 24% of executive board members at the 50 largest listed European banks. Representation on supervisory boards is higher, with women holding 43% of the seats. However, despite these improvements, the sector remains far from achieving gender parity at the highest levels. At the executive level it could take another decade if progress continues at its current pace. For banks, this timeline is a wake-up call—a reminder that traditional, HR-led diversity efforts alone are insufficient to drive meaningful change.

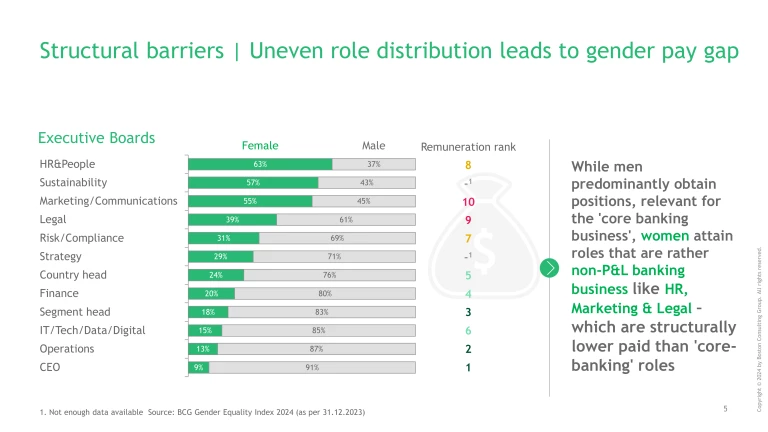

A key finding of the study is the widening gender pay gap, with women earning ~20% less than men, reflecting systemic inequities in role allocation. While men primarily occupy business-oriented positions, women are often positioned in non-P&L areas like HR and marketing. Such roles, although vital, typically receive lower compensation than core banking functions. The same picture in supervisory boards: Men often hold top positions like the Chair, while women are typically members or employee-elected, reinforcing the disparity. These patterns not only restrict women’s influence but also affect their financial recognition, deepening gender inequities across the sector.

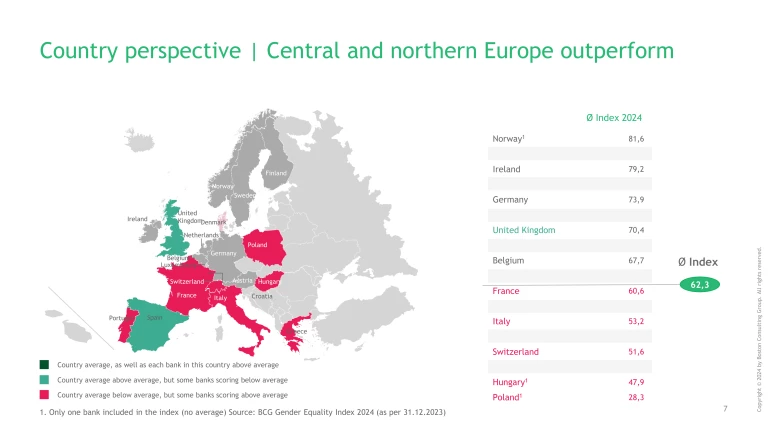

A notable contrast across regions emerges from the analysis. Northern and Central Europe, led by countries like Norway, the Netherlands, and Germany, show greater gender balance, likely due to strong social and regulatory frameworks. However, true parity remains alsp here elusive. Southern and Eastern Europe lag behind, reflecting the influence of local policies, norms, and regulations on gender equality.

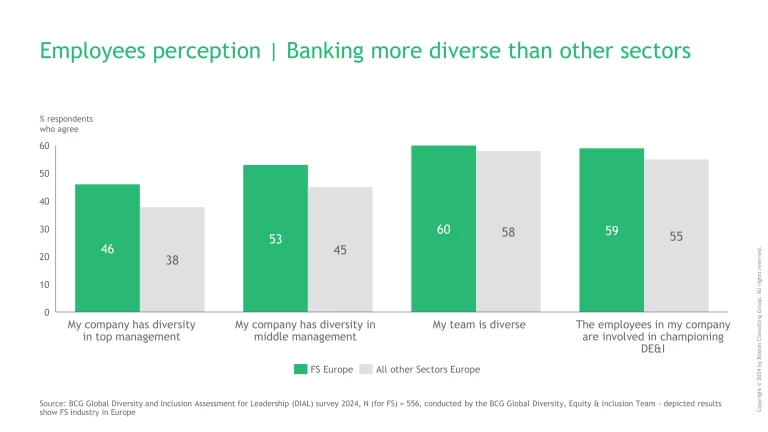

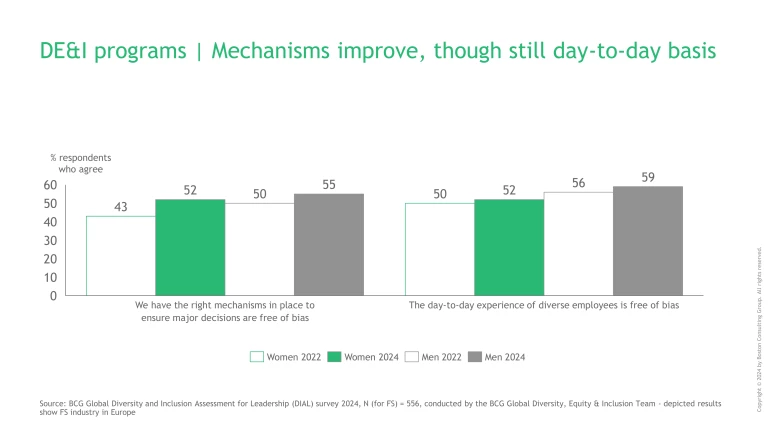

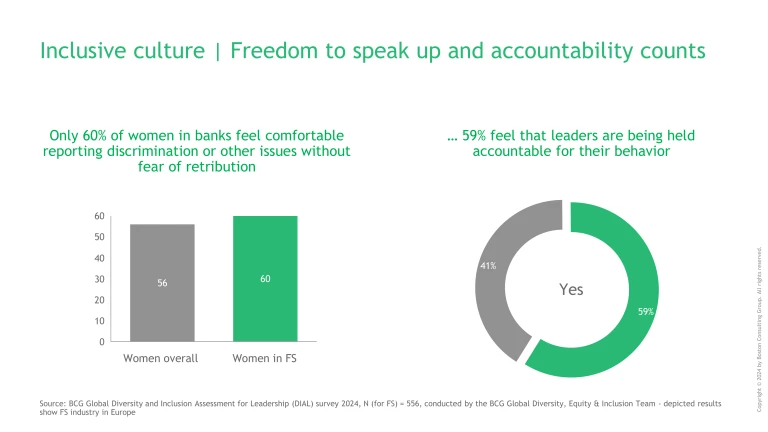

Beyond representation and pay, women in banking are still contending with workplace discrimination. According to BCG’s Diversity and Inclusion Assessment for Leadership (DIAL) from 2024, 20% of women in banking still report experiencing discrimination, and only a slight majority feel comfortable raising issues without fear of retribution. Furthermore, fewer than 60% of employees feel that leaders are accountable for their actions and biases. This combination of structural and cultural gaps calls for a comprehensive transformation creating an inclusive culture, true accountability, and equitable opportunities across all roles and job functions.

In sum, the fourth edition of the study shows that there is little progress year by year. Hence, achieving meaningful progress demands a holistic DEI approach — one that not only promotes women into higher positions but also ensures that equality is reflected in pay, career progression, role allocation, and workplace culture.

The full study dives deeper into the methodology, key findings, and actionable steps companies can take to foster a more inclusive, equitable future in the banking sector.