Boards of directors are confronting an ever-expanding list of critical, complex topics. For the past few years, that list has been driven by an increased urgency to address climate and sustainability issues, and that imperative continues. But other issues—such as the rising importance of generative AI (GenAI) and intensifying trade and geopolitical disruptions—have also become a central part of the board agenda.

BCG, INSEAD Corporate Governance Centre, and Heidrick & Struggles have teamed up to understand how boards are responding to these complex trends and disruptions. Our work this year includes a survey of 444 directors and executives around the world, along with a dozen roundtables that brought together more than 130 directors in North America, Europe, Southeast Asia, Africa, and South America.

Our research revealed that while boards have made meaningful advances to address sustainability topics, they are less confident when it comes to their understanding of and ability to capitalize on GenAI. We also found that the lessons boards learned by addressing sustainability issues are helping them evolve toward a new model of governance that stresses forward-looking strategies and adaptability.

Boards Confront Multiple Disruptions

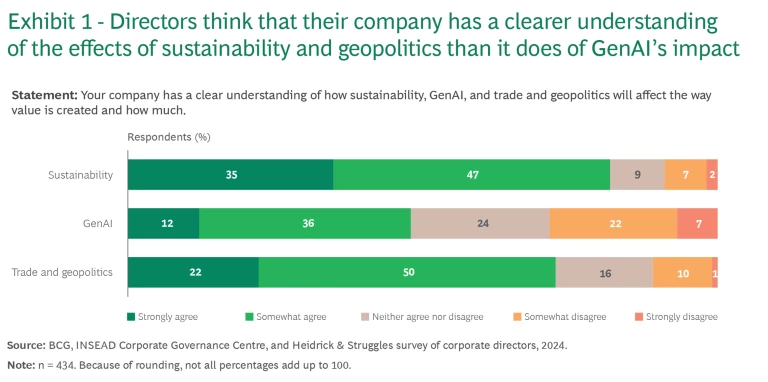

We asked directors whether their company has a clear understanding of how sustainability, GenAI, and trade and geopolitics will affect the way value is created and how much. A healthy majority say they strongly or somewhat agree that their company has a clear understanding of the effects of sustainability and trade and geopolitics. But when it comes to GenAI—which has emerged relatively recently as a critical factor—the directors have less confidence in their company’s understanding. (See Exhibit 1.)

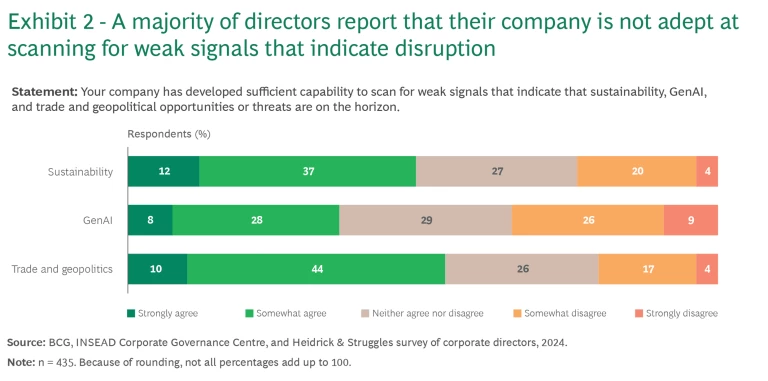

Understanding the changes that are occurring is one thing. It is quite another to “look around corners” and anticipate how major trends may evolve and then set a path to translate those shifts into competitive advantage. Roughly half of directors are not confident that their company has the muscle to scan the horizon for new threats or opportunities connected to sustainability, GenAI, and trade and geopolitics. (See Exhibit 2.)

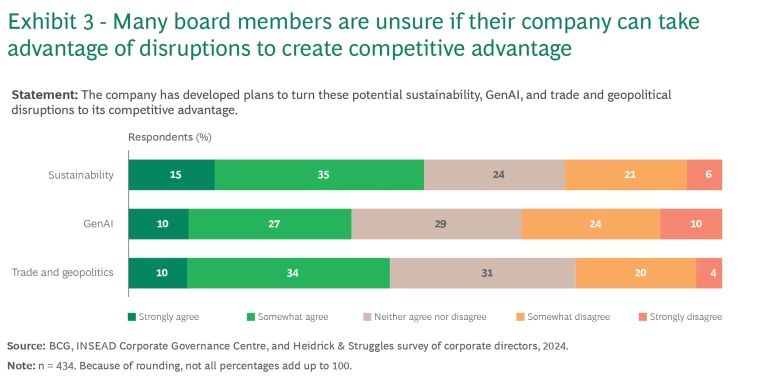

Similarly, the survey reflects that companies are still struggling to develop strategies for translating disruption in any of those three areas into competitive advantage. The challenge is most stark for GenAI. (See Exhibit 3.)

Governance Evolves Amid Change

Our research finds that boards have made meaningful progress in addressing sustainability issues:

- In 2023, one-quarter of directors lacked confidence in their company’s understanding of how sustainability would impact value creation. This year, that figure stands at just 9%.

- Last year, 37% said their company lacked the capability to scan for weak signals of future sustainability shocks; this year, only 24% say the same.

- Last year, 46% of directors said their company lacked a plan to turn sustainability shocks into competitive advantage, a figure that falls to 27% this year.

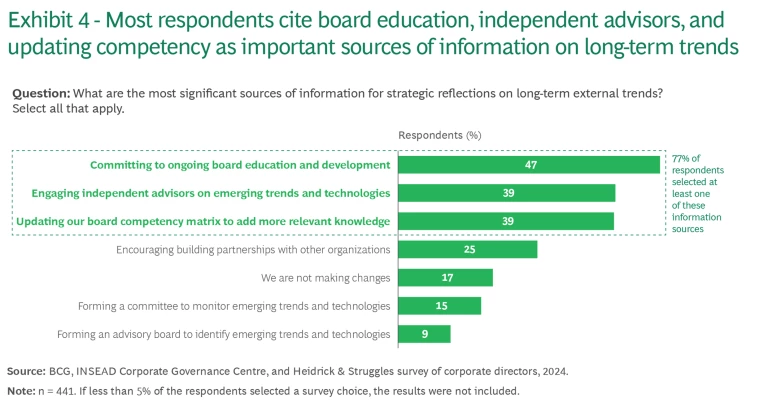

When asked what boards are doing to adapt to disruptions around sustainability, GenAI, and trade and geopolitics, the top three actions directors cite include adapting the competency matrix, along with ongoing education and engaging with independent experts. (See Exhibit 4.)

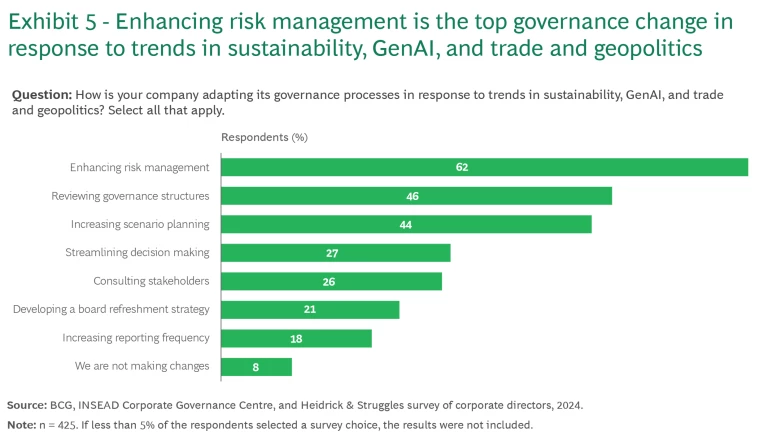

At the same time, more than 60% of directors report that their board is enhancing risk management, making it the top governance change. (See Exhibit 5.) And a full 44% of respondents report that their board is increasingly conducting scenario planning—an encouraging sign.

Companies based in emerging markets operate in a context that is quite different from the context in Europe or North America—and our roundtable discussions and survey reflect the distinctions. For example, directors who joined our roundtables in emerging markets reported that they focus on governance practices such as making their board more independent. Our discussions also made clear that regulatory changes elsewhere in the world, particularly Europe’s Corporate Sustainability Reporting Directive and Corporate Sustainability Due Diligence Directive, are strengthening the business case for sustainability action among companies in emerging markets.

Ensuring a Resilient and Adaptive Board

We encourage boards to take four primary steps to ensure that their governance approach can meet today’s challenges.

- Enhance horizon scanning and risk management. Boards that embrace scenario planning and enhanced risk management processes, including through regular input from external advisors, can help their company better anticipate and respond to future risks and opportunities.

- Take a long-term perspective grounded in purpose. Boards can also help their company thrive amid uncertainty by regularly stress testing the capital allocation process. Such an assessment can determine whether investment decisions are aligned with the long-term strategy and purpose, yet flexible enough to allow for swift changes.

- Lead across the divides. A complicating factor is that the growing polarization outside the boardroom can occasionally surface within it. By promoting meaningful engagement with many types of stakeholders (not only shareholders and customers but also activists, competitors, and government officials), boards can bridge the divides that separate various groups.

- Drive impact beyond business boundaries. Boards should encourage management to engage in shaping industry standards, regulatory frameworks, and societal expectations, ensuring their company is not merely responding to change but driving it in an ethical, sustainable, and responsible way.

The list of fast-changing and complex issues on the board agenda is extensive—and seems to grow longer by the day. The good news is that we see clear signs that boards are rising to the challenges. Forward-looking boards are reshaping the way they govern to become more outward-looking and adaptive. That will be the key to success in an era of continued disruption.

Featured Insights: Explore the ideas shaping the future of business

The authors thank their colleagues at BCG, INSEAD Corporate Governance Centre, and Heidrick & Struggles for their support and contributions to the publication.