The property and casualty (P&C) insurance industry is facing severe headwinds that leaders cannot ignore or wish away. Underwriting losses totaled more than $24 billion in 2022, compared with an average profit of approximately $8 billion from 2018 to 2020, according to global credit agency AM Best. Such losses are clearly not sustainable, yet the plight of insurers could get worse before it gets better. The ferocity of new weather patterns, population growth in hazardous areas, complex technology and supply chains associated with electric vehicles, regulatory interventions on pricing, third-party funding for litigation, and political uncertainty are just some of the circumstances that point to volatile days ahead.

Companies must weave resilience into the fabric of the organization.

These and other trends will interact in unpredictable ways and must be managed holistically. Leaders who continue to manage each uncertainty independently will find themselves missing targets each year for different reasons. P&C leaders must fundamentally shift their mindset to rethink the business, how they set strategies, and how they formulate short- and long-term plans. A new approach is needed: Companies must weave resilience into the fabric of the organization. With this in mind, we have developed a roadmap to help firms push back against the significant threats to performance.

Resilience Creates Opportunities

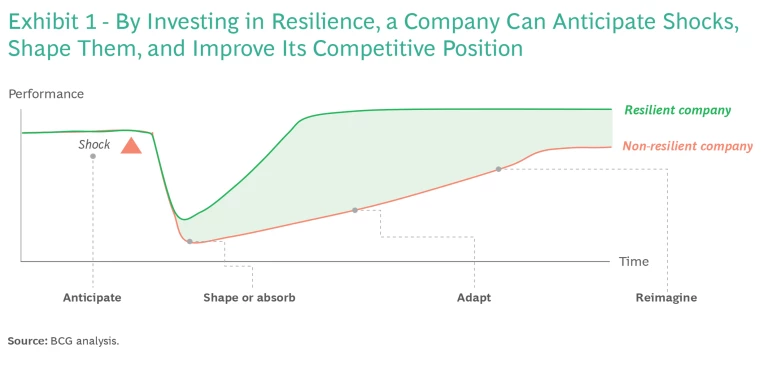

By “resilience” we mean the capacity to anticipate shocks, shape or absorb the impact on a company’s offerings, adapt to exploit new opportunities or recover critical functionality, and reimagine the business in altered circumstances. (See Exhibit 1.) Traditional planning too often views risks only as challenges and misses the opportunities they can offer. As a result, management tends to cede the initiative instead of seizing it.

Particularly in periods of crisis, resilience bestows significant competitive advantages. In a cross-industry study, BCG found that in normal quarters companies in the top 25% of total shareholder returns (TSR) enjoyed 8% returns, while those in the bottom 25% saw negative 8% returns. But in crisis quarters, TSR for companies in the top 25% jumped to 20%, while those in the bottom 25% percentile dropped to negative 10%.

If resilience puts this much additional value within reach, it only makes sense that companies should become more programmatically resilient and create an “uncertainty advantage” that can open pathways to profitability. Indeed, for insurance companies, whose business is managing risk, the benefits of resilience during quarters of crisis could be even more acute.

Resilience Planning in Other Industries

To tackle this issue, P&C insurers should study what companies in other fields with more experience building resilience have done. In the energy industry, leaders have long had to contend with many intersecting global trends that create unforeseen complexities. BCG worked with one integrated downstream energy company that wanted a long-term strategic approach to potential disruptions such as the future of mobility, energy transition, regulation and climate change, shifts in consumer needs, and oil product supply and demand. To help with this, we used a four-step approach for its strategic review:

1. Scan. Survey the current environment for challenges and opportunities.

2. Orient. Understand emerging scenarios to identify sources of future competitive advantage.

3. Decide. Develop a strategy in response to the current environment and expected trends.

4. Act. Translate strategy into priority actions.

This approach, derived from the OODA Loop—the four-step decision-making model “observe, orient, decide, act” articulated by US Air Force Colonel John Boyd—emphasizes a continuous scanning and risk-sensing step, while still focusing on deciding and acting on any singular risk.

In another case, BCG worked with a global energy player that wanted to improve its understanding of market capacity and anticipate potential disruptions across capital projects. By leveraging existing client data sources and processes, we helped the company design a dashboard to anticipate potential disruption in the short term and long term—instead of just giving a snapshot of the current risk level.

The project identified more than 30 possible disruptions. It also identified and categorized 15 client sources (and recommended 30 more) to develop leading indicators or “signposts” that could alert the company about disruptions to its global capital projects. The initiative also offered other advanced tools to enhance insights and predictability, such as applying generative AI (GenAI) to data analysis.

Companies in the hospitality industry, too, have become adept at building resilience. For example, some large, brand-name hotels use credit card products to build customer loyalty and profits. One of these global companies was feeling increasingly threatened by multiple sources of disruption, including from banks that were moving aggressively to offer competitive products, banking innovation that could render the hotel’s existing suite of products obsolete, and proposed legislation that could change card economics.

The company decided that its traditional ways of anticipating and planning for how various uncertainties might unfold weren’t generating new ideas or hypotheses fast enough. In response, it decided to leverage competitive simulation and war gaming to get a better understanding of the motivations of different marketplace players, develop a better sense for what those players might do, and identify leading key risk indicators (KRIs) for better preparedness.

The result was a set of decision points to activate contingency plans with various moves and countermoves, along with a set of strategic recommendations for the board of directors to drive organizational alignment on key priorities and revenue generation for the next 12 to 24 months.

These examples show that P&C insurers can do more than simply react defensively to the challenges thrown in their path. By shifting their mindset, leaders can begin to sense and seize opportunities—and harness industry uncertainty for their own benefit. P&C companies that anticipate shocks and changes in the landscape can respond better in areas of the business such as pricing and rating plans, product and coverage design, reinsurance program design, loss prevention and mitigation services, deductibles and retentions for policy holders, and adjustments to underwriting guidelines. This posture will help them shift their growth focus away from areas impacted by shocks and toward places not yet affected.

So how can P&C insurers build and incorporate the requisite resilience? We suggest the following five actions.

Assess macro trends and drivers of uncertainty. P&C executives face some existential questions, such as How will continued advances in private passenger vehicle technology impact driving patterns, loss frequency, and severities? Will the growing third-party litigation funding market significantly accelerate liability losses? Are there any legal or regulatory interventions that will slow this trend?

But there is one fundamental question at the root of them all: Will P&C return to previous loss levels or are we now in a new normal? The answer, in our view, is the latter. There is more data but less clarity on the future than at any other time. As a result, planning can’t follow the past formulas, because the past ten years are a poor indicator for the next ten years. Executives will need to shift their mindset, be nimbler in their thinking, and prepare for diverse scenarios.

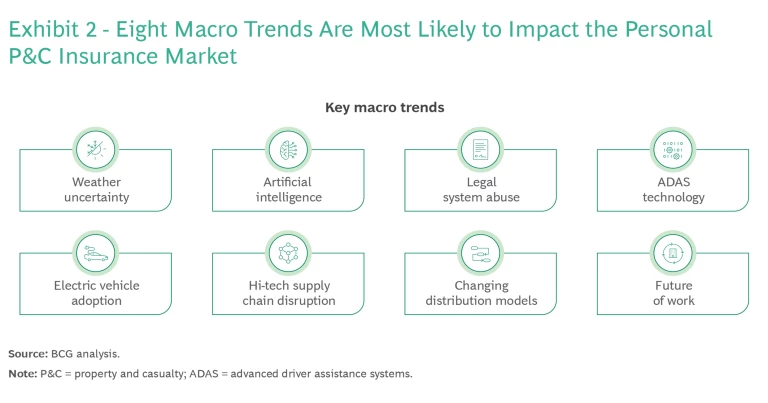

The first step in this mental adjustment is to identify the macro trends and drivers of uncertainty. There are many factors at play, and they are increasingly intertwined, but we have found eight that we believe will have a significant impact on the pace, volatility, and uncertainty of events shaping the world of tomorrow. (See Exhibit 2.) Each company needs to assess trends and drivers based on their own business model, but these eight are a solid starting point to begin mentally framing the future.

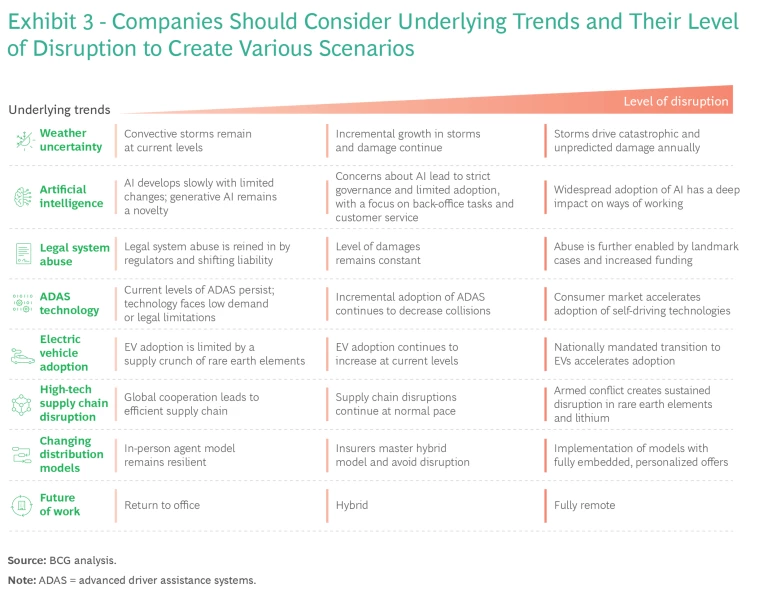

Conduct scenario planning to test resilience. Once leaders have settled on the macro trends and drivers they will consider, it’s time to conduct scenario planning. More specifically, they should think of a range of “stretched but plausible” scenarios for the future, assess how these would impact the business, and determine how well the company could react. These scenarios will represent several possible futures, and that’s the point. The exercise allows the company to build up its data-driven, decision-making capabilities for strategic response. Leaders can generate these scenarios by considering the level of possible disruption across each macro trend and assess how those trends might interact and impact the business. (See Exhibit 3.)

For example, one scenario that might incorporate these trends could be “extreme regulation.” Imagine that stricter consumer protection-oriented regulation emerges that makes innovation (such as AI or novel data usage) more difficult and expensive. As a result, underlying technology advancements relating to vehicles or other forms of disruption slow down while profitability challenges for insurers continue to grow due to other underlying trends (such as weather uncertainty and legal system abuse), leading to a solvency crisis.

Another future scenario that could reflect a completely different set of trend evolutions might be “AI everywhere.” Imagine that exponential advances in AI and enthusiastic public adoption drive vastly different driving, living, and working experiences than is currently expected. Self-driving adoption then exceeds projections (shifting auto liability rapidly from consumer to commercial insurance), and advanced GenAI takes over sales and customer service.

The goal is to shift mindsets to anticipate and capitalize on opportunities—and even to shape the future.

Both of these scenarios require insurers to think differently about their technology, approach to risk, and go-to-market strategy. Bear in mind that these are thought experiments. Few if any are likely to occur as envisioned, but accurately forecasting a specific scenario isn’t the point. This is not an exercise in predicting the future but rather in becoming better prepared for whatever version of the future might materialize.

Rather, the goal is to shift mindsets to anticipate and capitalize on opportunities—and even to shape the future. For example, a company might choose to lobby for a regulatory change that it is pre-positioned to capitalize on instantly, as opposed to waiting until the change occurs, then figuring out what it means, then taking steps to adjust its strategy. Challenging assumptions and stretching mental models will help leaders be decisive now and agile in the future.

Invest in horizon scanning and tracking capabilities. P&C insurers can also boost resilience by strengthening their market-sensing function to better recognize weak, early signals of important changes in the environment. This will not only give a company more time to prepare for the change and adapt its offerings (based on evolving customer preferences, for example) but will also help them get a jump on the competition. To that end, leaders should create a comprehensive list of signposts they can track over the long term so that they can systematically monitor their exposure to various uncertainties.

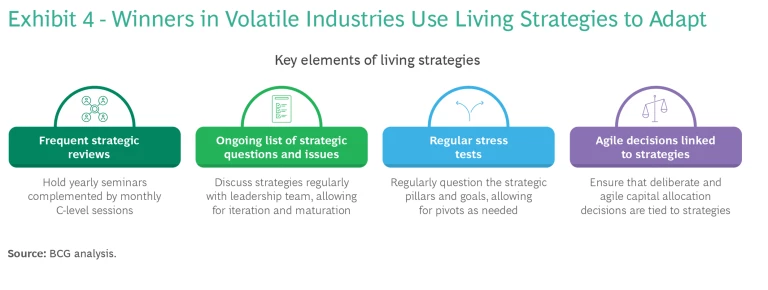

Facilitate living strategies with agile planning. As noted, insurers need to weave resilience into the fabric of the organization at the business unit level, and that requires an agile, multiyear development plan that incorporates a risk intelligence framework. (See Exhibit 4.) Agile planning not only sets a course but enables course correction at frequent intervals if necessary. This agile planning is critical for the P&C insurer to maintain a living strategy (one that constantly evolves) based on how the key trends and drivers are shifting the market environment and creating uncertainties.

Develop skills for nimble execution. Improving resilience demands a lot from employees. They must integrate risk management with strategic planning, reframe risk management to identify opportunities, and develop offensive and defensive risk strategies. They also need to carry out the four elements of a strategic planning process that we defined earlier: scan, orient, decide, and act.

Not surprisingly, these new undertakings will require a range of new tools, including dynamic risk scanning and identification, AI- and machine learning-based foresight and risk radar, and the use of scenarios and war gaming for enhanced strategic planning.

Companies will need to assess whether they have the right skills in-house, and then take steps to plug any skills gaps by either training employees to develop a sustainable muscle memory in these areas, hiring expertise, or both. These new skills include cross-functional expertise in both risk and strategy.

The outlook for the P&C industry is for more volatility, uncertainty, and complexity. The organizations that thrive will be those that can play both defense and offense and see risk as a two-sided coin: on one side there are challenges around mitigation and compliance, and on the other side there are opportunities to open new profitability pathways. Building resilience to cope with—and take advantage of—this uncertainty is vital. The five actions we’ve outlined here can help companies weave that resilience into the fabric of the organization and thrive where others may struggle to survive.