Once characterized by rapid growth, the payments industry is maturing. Investors, regulators, and customers are no longer just demanding continued expansion; they are seeking profitable growth built on sustainable business models. This shift reflects broader market trends, including evolving customer expectations, technological advances, and heightened regulatory scrutiny. To thrive, the industry must adapt swiftly and decisively.

Growth Is Slowing

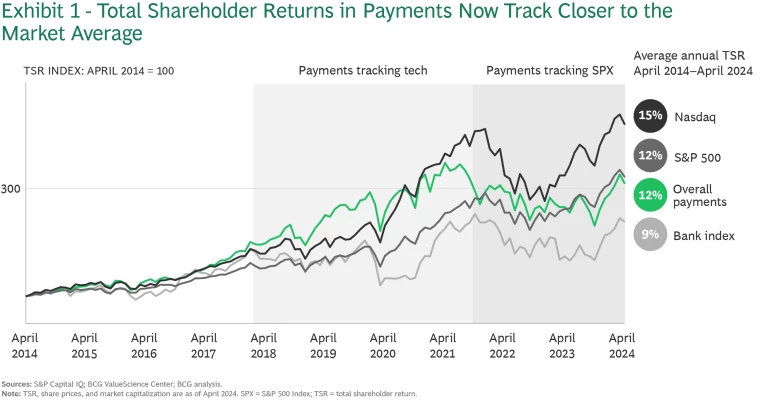

Payments companies have historically delivered robust total shareholder returns (TSR) on a par with high-growth tech sectors. In recent years, however, the rates of growth have slowed down. TSR percentages for payments companies now track closer to those for the S&P 500, signaling a more mature market. Investors have shifted their focus to unit economics, distinguishing between companies with stable, SaaS-like revenue streams and those with more volatile, banklike income sources. (See Exhibit 1.)

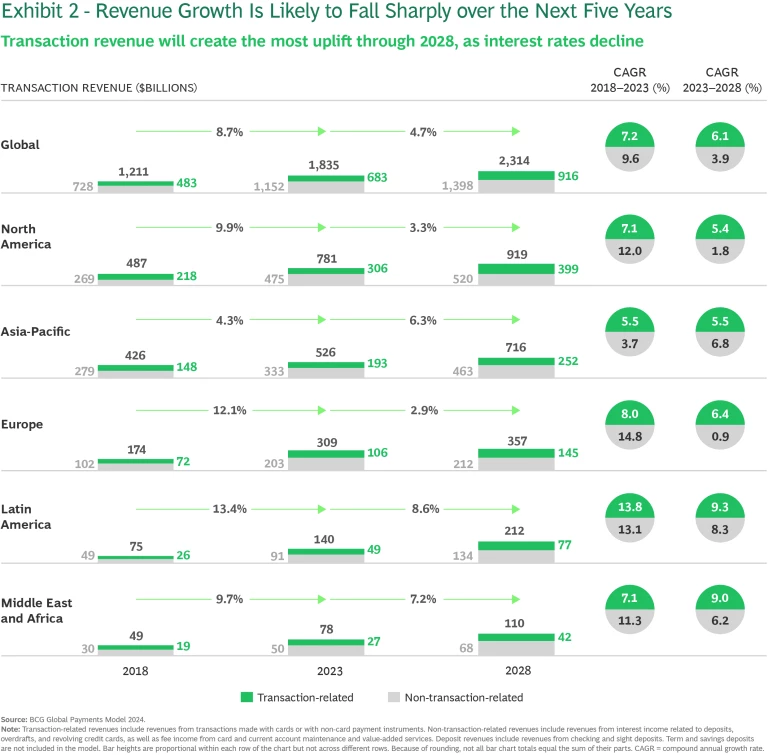

Adding to this pressure, revenue growth is likely to slow by half from now to 2028, as our modeling projects that global revenues will rise at a compound annual growth rate of just 5% to $2.3 trillion—a sharp decline from the 9% growth seen in the previous five years that had driven the global revenue pool to $1.8 trillion in 2023. (See Exhibit 2.) Several factors contribute to this souring outlook:

- Structurally, the shift from cash to digital payments is reaching its peak.

- Macroeconomically, the tailwind from rising interest rates and inflation is reversing.

- Operationally, payments companies face intensifying cost pressures.

To continue growing, companies must prioritize long-term strategies and resist the temptation to focus solely on short-term earnings.

Key Disruptions Herald the Need for Change

Several major forces are especially influential in reshaping the payments landscape, challenging companies to adapt or risk falling behind:

- Macroeconomic Pressures. Declining interest rates and flattening inflation are eroding deposit margins, especially in regions such as Europe and North America. Coupled with a shift by consumers from holding deposits on their current account toward seeking higher-yielding products, these factors exert stress on traditional revenue models.

- Slowing Digital Payment Conversions. In key markets such as the US, the UK, and Europe, the shift from cash to digital payments is plateauing, limiting one of the industry's major growth engines.

- Regulatory Scrutiny. Increasing oversight and harsher penalties for noncompliance are putting company equity at risk. Global regulations are tightening, forcing payments companies to invest heavily in their risk management and compliance infrastructure.

- Cost Pressures and Technological Inefficiencies. Rising operational costs, compounded by reliance on outdated and underperforming legacy systems, are significantly constraining payments companies. The inefficiency of these older systems drives up maintenance expenses and hampers agility, making it difficult for companies to innovate and scale their operations.

Replace Old Plays with Bold Plays

As the payments industry adapts to slower growth, companies must focus on several key areas to ensure long-term success:

- Modernize technology. A rationalized, modular, and scalable cloud-based architecture is essential for driving better unit economics, faster product innovation, and deeper customer value. By modernizing payment infrastructure, companies can unlock operational efficiencies and build higher-margin businesses.

- Reinvent payments for banks. Banks must rethink their approach to payments. Top performers will maximize their core, expand into adjacent businesses, and experiment with new, high-value business models.

- Engage in emerging infrastructure. Payments companies must take a leadership role in shaping emerging forms of payment infrastructure, including instant payments and digital currencies. These technologies offer new ways to deliver value, improve transaction speeds, and meet regulatory demands—and many are going mainstream.

- Strengthen risk and compliance functions. As regulatory pressures increase, payments companies must overhaul their risk and compliance frameworks. Building stronger, more agile risk and compliance functions is critical not only to avoid penalties but also to build investor confidence and safeguard long-term growth.

To meet the evolving demands of investors, regulators, and customers, payments companies must move beyond the status quo and embrace bold, strategic decisions. Although short-term pressures are real and require attention, long-term success hinges on modernizing infrastructure and optimizing capital allocation. Those who act decisively will unlock new growth opportunities and build resilient, high-margin businesses.

Contact the Authors

Americas