Because of its potential role in creating a more circular global economy, carbon capture and utilization (CCU) has attracted growing interest from both policymakers and investors in recent years. As the name suggests, captured CO2 is recycled into carbon-dependent products.

But CCU still plays second fiddle to carbon capture and storage (CCS), which permanently sequesters CO2 in subterranean aquifers. Of the $7.1 billion of private sector money invested in the two technologies since 2017 by venture capital, private equity, and other financial players, twice as much has gone to CCS as to CCU.

To assess the nascent CCU market and explore an important climate change and sustainability topic, BCG partnered with the Oil and Gas Climate Initiative on a joint report, Carbon Capture and Utilization as a Decarbonization Lever. We discovered the following:

- While the size of the CCU market could in time be meaningful—with CCU accounting for 10% to 33% of total captured carbon by 2050, according to some estimates—the amount of captured carbon required to achieve net zero far exceeds the potential of CCU. As a result, CCS will remain the dominant decarbonization lever.

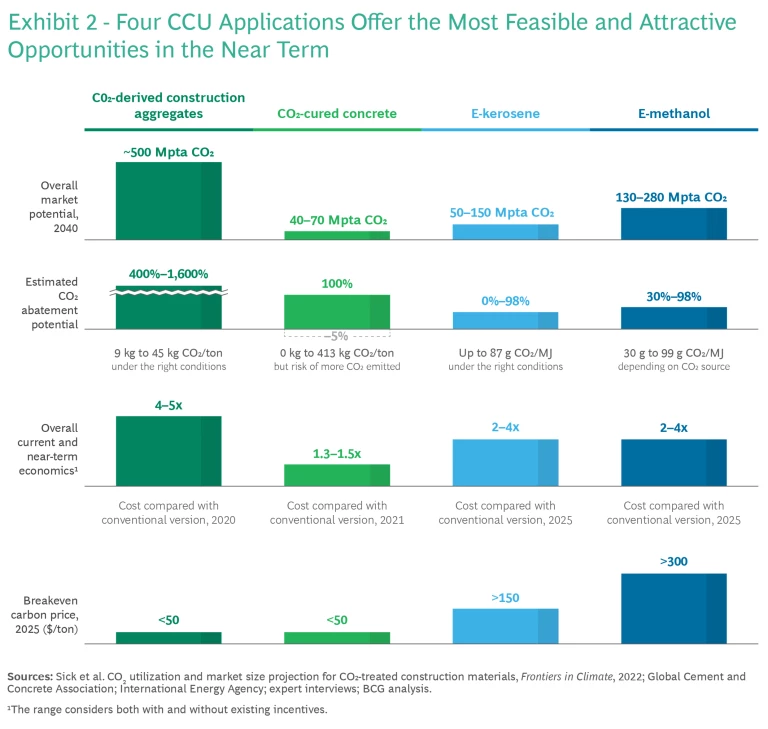

- Although more than 25 CCU applications are under development, 4 applications—resulting in CO2-derived construction aggregates, CO2-cured concrete, e-kerosene, and e-methanol—stand out as the most feasible and attractive market opportunities in the near term.

- CCU is important because it can provide another means of limiting the overall level of carbon in the atmosphere. But we found that this is not a given, with the decarbonization impact of CCU applications highly dependent on the source of the utilized CO2, the relative efficiency of the production process, and whether CO2 is emitted during use.

Notably, we also found that CO2 utilization increases the unit cost of our four end products by as much as five times compared with conventional versions. As a result, policymakers will need to be proactive. They will have to deploy a raft of direct and indirect measures—including financial incentives, carbon pricing, and better carbon-accounting rules and emission measurement mechanisms—to improve the economics of applications, support scaling, and turn CCU into a decarbonization lever for the longer term.

The Potential of CCU

Carbon capture is an essential climate mitigation tool because it can tackle hard-to-abate emissions from large stationary industrial sources and remove historical emissions directly from the atmosphere. As part of the International Energy Agency’s Net Zero Emissions by 2050 Scenario, CCUS—which includes storage and utilization—will need to capture 4 gigatons per annum (Gtpa) of CO2 by 2040 (about 90 times 2022 levels) and 6 Gtpa by 2060.

CCU capacity is a small fraction of that amount today. About 250 million tons per annum (Mtpa) of captured or mined CO2 is currently used across applications, with most of it going toward urea production or enhanced oil recovery (which relies on the gas to increase the volume of oil extracted from a reservoir).

Assessments of the future size of CCU vary significantly. The International Energy Agency and Energy Transitions Commission project that 430 Mtpa to 840 Mtpa of CO2 will be captured and recycled by 2040 using CCU. For this report, we have created our own assessment by analyzing the four applications with the greatest near-term potential.

Four Applications

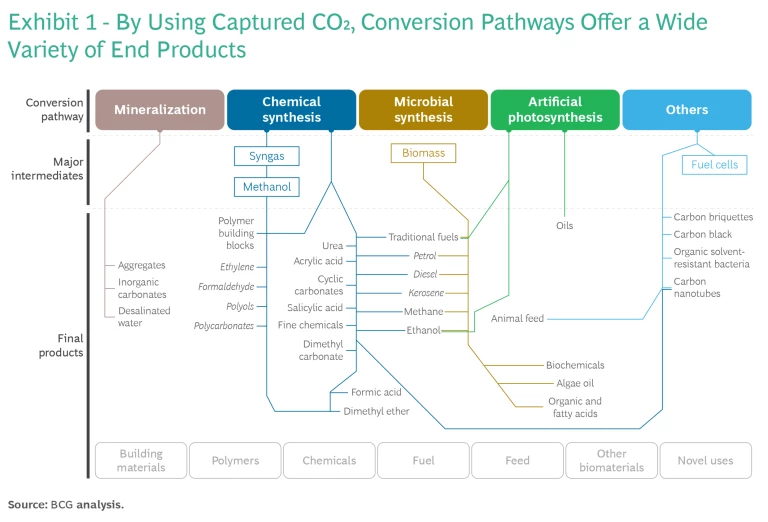

More than 25 CCU applications are in development. These rely on a handful of conversion pathways—from mineralization to artificial photosynthesis—that embed CO2 in new products through chemical reactions. (See Exhibit 1.)

But four applications in particular offer viable near-term opportunities on the basis of their technological readiness, level of investment, and potential market size in 2040. (See Exhibit 2.)

In our joint report with OGCI, we provided an overview of the production process, possible carbon impact, estimated market size, and unit economics for each application. Together, these illustrate the potential of the four applications and the hurdles that need to be overcome. Here is a summary of our findings.

CO2-Derived Construction Aggregates

Construction aggregates are by far the biggest potential market as measured by CO2 volume. We estimate that aggregates could utilize about 0.5 Gtpa of CO₂ by 2040. CO2-derived aggregates are produced through the carbonation of solid ash and other waste byproducts or by carbonating crushed granules from recycled concrete. The carbon is sequestered permanently in the aggregate, resulting in a net climate benefit.

Construction aggregates are by far the biggest potential market as measured by CO2 volume.

Conventional construction aggregates emit 3 kg of CO2 per ton during production. Utilizing captured carbon, CO2-derived aggregates can save 12 kg to 48 kg of CO2 emissions per ton under the right conditions (short or nonexistent transportation distances, preexisting waste streams, and low energy costs). This results in a net savings of 9 kg to 45 kg per ton compared with conventional aggregates.

Our 0.5 Gtpa estimate assumes that CO2-derived aggregates will account for about 2% of the total global market by 2040 and that approximately 0.26 tons of CO2 will be utilized for every ton of aggregate. It also presumes that crushed granules are the primary production route owing to a shortage of alternative waste streams.

In addition to reaching these targets, another challenge to achieving the full CCU potential of CO2-derived aggregates is the low cost of conventional aggregates. Without landfill taxes, which make it less expensive to utilize waste streams than to discard them, CO2-derived aggregates are four to five times more expensive. Moreover, transportation costs—for waste streams and conveying CO2 from industrial emitters to concrete plants—have a significant negative impact on the economics of CO2-derived aggregates.

As a result, regulatory measures (including landfill taxes, public-procurement targets, and government carbon-pricing schemes) will be required to drive wide-scale adoption. At the same time, developers and investors will need to collocate aggregate plants close to concrete factories and emitters as well as identify sources of abundant, inexpensive CO2 to improve the commercial feasibility of projects.

CO2-Cured Concrete

Using CO2 to cure concrete (rather than conventional methods such as water curing or steam curing) results in a stronger product and requires less cement. But because CO2 curing can increase the risk of steel corrosion, CO2-cured concrete is usually used only in precast structural components. As with construction aggregates, CO2 is permanently sequestered as part of the carbonation process.

Depending on the transportation distances involved, the amount of cement, technology efficiencies, and emission intensity of the energy source used, the production of CO2-cured concrete emits 0 kg to 413 kg of CO2. This compares with 240 kg to 420 kg for conventional methods. These data suggest that, if the right conditions are not met, CO2-based curing can be worse for the climate (even after taking into account the small amount of utilized CO2).

Even if CO2-cured concrete makes up 30% to 50% of the market in 2040, its CCU potential would be only about 40 Mtpa to 70 Mtpa of CO2, according to our calculations. This is due to the small amount of CO2 required per ton of concrete and limited applicability of CO2-cured concrete to the precast concrete market. Nevertheless, this technology is fairly mature, with some players already using it in the precast market.

Because CO2-cured concrete is 1.3 to 1.5 times more expensive than conventional versions, it’s economically viable only under specific circumstances.

Because CO2-cured concrete is 1.3 to 1.5 times more expensive than conventional versions, however, it’s economically viable only under specific circumstances. In most cases, for example, the CO2 source needs to be less than 160 km from the concrete plant to keep transportation costs low.

To reduce the cost of CO2-cured concrete so that it is 10% to 20% more expensive than conventional concrete—making it an affordable and greener alternative—would necessitate a 50% cut in capex expenses. In addition, a carbon price of $125 to $175 would be required to increase the willingness to pay, or other regulatory measures such as public procurement targets would be needed. As with aggregates, proximity to a reliable and low-cost source of CO2 is another key factor to drive widespread adoption of CO2-cured concrete.

E-Kerosene and E-Methanol

E-kerosene and e-methanol both rely on electricity, CO2, and hydrogen for their manufacture—unlike conventional variants, which depend on fossil resources. E-kerosene is typically used for aviation, whereas e-methanol is used as a fuel for shipping, though it can also be converted into olefins and aromatics for use in the chemicals industry.

Because CO2 is emitted into the atmosphere when e-methanol and e-kerosene are burned as fuels, the CO2 feedstock for both would have to come from biogenic sources or direct air capture (DAC) rather than industrial sources before either could be marketed as carbon neutral—a prerequisite for capturing a bigger market. Low-carbon or renewable power and green hydrogen would also be needed.

We estimate that the carbon abatement potential of e-kerosene ranges from 0% to 98% (through the product life cycle) and for e-methanol, it’s 30% to 98%, compared with conventional variants. High abatement depends on access to abundant biogenic CO2 or cost-efficient DAC and low-cost renewable energy. But it would also require regulatory advances and efficiency gains to cut technology costs.

Assuming that e-kerosene makes up 3% to 10% of the overall jet fuel market in 2040, the e-kerosene market could utilize 50 Mtpa to 150 Mtpa of CO2 annually by then. In comparison, the e-methanol market could utilize 130 Mtpa to 280 Mtpa of CO2 in 2040, assuming a share of the overall methanol market of 10% to 60%. In shipping, e-methanol, which is an important decarbonization lever for the sector, could account for up to 40% of the methanol market in 2040.

But a number of factors are likely to constrain the ability of these e-fuels to fulfill their CCU potential and utilize CO2 at the upper end of the ranges above: several low-carbon alternatives to both e-fuels are available, such as biofuels and ammonia; additional infrastructure would be required with e-methanol; and the necessary regulations supporting the use of these fuels are not yet in place. Despite these limitations, numerous large e-methanol and e-kerosene projects are set to come onstream this decade.

Cost will be a factor as well, however. Both e-kerosene and e-methanol are two to four times more expensive than conventional variants, depending on whether they benefit from US subsidies under the Inflation Reduction Act. As a result, substantial carbon prices would be required to make both commercially feasible. We calculate that a carbon price of $180 per ton with e-kerosene, and a carbon price of $330 per ton with e-methanol, are necessary today for producers to break even in 2025.

The Vital Role of Regulation

Several common technical hurdles need to be overcome to improve the commercial feasibility of our four CCU applications. At present, these uses are held back by expensive inputs, such as green hydrogen and CO2 feedstock; the large amount of energy required to utilize CO2; and the necessity for costly commercial-grade catalysts. Reducing costs and energy usage will take time and require funding from developers and investors.

And there’s another, equally important challenge that requires a serious commitment from policymakers: ensuring that the right regulatory environment is in place. Several countries have created effective policies and regulatory frameworks for carbon capture and storage but have yet to develop them specifically for utilization. In addition to incentives, carbon pricing, and public procurement targets, governments need to consider introducing landfill taxes that encourage CO2-derived aggregates and updating building codes to boost the use of CO2-cured concrete.

Clear accounting rules governing carbon offsets and CCU applications that are harmonized across regions are also essential to promote wider use. Right now, under EU regulations, CO2 from fossil resources can be used to make synthetic fuels such as e-kerosene and e-methanol until 2040. This is intended as a practical concession to encourage the industry to scale, although it is an undermining factor when considering overall climate impact.

Improving product carbon footprints and life cycle assessments so that they measure the decarbonization impact of CCU applications more effectively is another significant enabler. PCFs measure the greenhouse gas emissions impact of a specific product or service, while LCAs calculate the broader environmental impact beyond GHGs.

Both emission measurement mechanisms can help suppliers justify charging a premium for CCU products. Without better such mechanisms and clearer accounting rules, however, CCU applications may be seen as little more than greenwashing by end customers—especially if these uses do not deliver lower CO2 emissions than conventional versions or permanently remove CO2 from the atmosphere.

While CCU is unlikely to ever be a substitute for carbon storage, this technology has the potential to reduce the carbon footprint of several products we use today—starting with the four we examined above. But for CCU to achieve its full potential, there will need to be a mixture of targeted incentives and regulations, clear rules around carbon accounting, and better access to inexpensive renewable power as well as CO2 capture and transport infrastructure. By taking these steps, investors and policymakers can close the gap between carbon storage and utilization.

The authors thank Josien Bovenberg and Erik Rakhou for their contributions to the original research.

This research was a collaboration between BCG and OGCI.

The Oil and Gas Climate Initiative

OGCI members are Aramco, bp, Chevron, CNPC, Eni, Equinor, ExxonMobil, Occidental, Petrobras, Repsol, Shell and TotalEnergies. Together, OGCI member companies represent almost a third of global oil and gas production.

OGCI members set up Climate Investment to create a US$1 billion-plus fund that invests in companies, technologies and projects that accelerate decarbonization in energy, industry, built environments and transportation.