Logistics service providers (LSPs) are facing an inflection point, stemming from a combination of disruptive megatrends—changing consumer demands, geopolitical uncertainty, and intensifying decarbonization regulations, to name a few. What makes this moment so special for LSPs is not just these considerable challenges (which affect companies across sectors), but the attractive opportunities they offer to create lasting value into the future—and the array of assets they have in order to carry out a needed recalibration of their overall strategy:

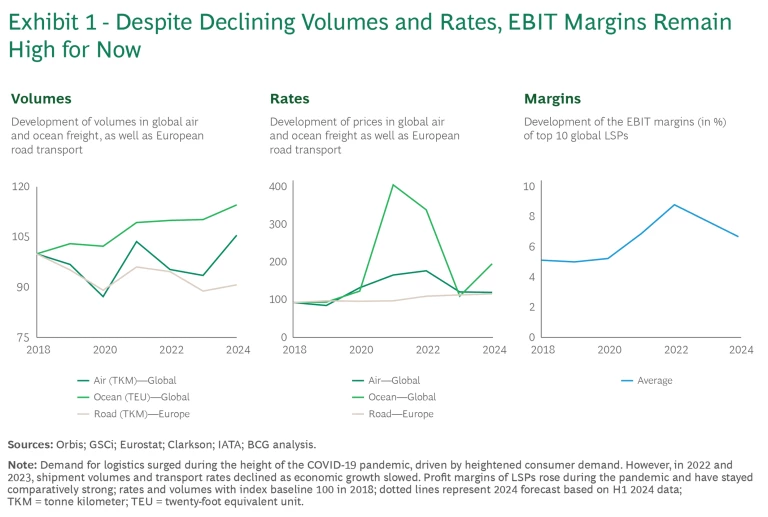

- Many LSPs are sitting on cash reserves amassed during the COVID-19 crisis. Temporary spikes in volumes and rates drove up profits significantly during 2021 and 2022, with LSPs reserving large parts of the excess income for potential future investments. (See Exhibit 1.)

- LSP leaders are benefiting from lessons learned during the pandemic and appear ready to adapt and evolve further. For example, when shipment volumes and rates declined following the peak of the pandemic, many LSPs wisely cut costs—a strong indicator of a more foresighted mindset. As a result, LSPs improved their overall profitability in 2023, compared with their pre-COVID situation, and early indications in 2024 are this momentum will continue.

- Powerful new tools are available to help drive needed changes. Disruptive technologies, like AI and GenAI, that are accelerating the pace of change are also creating major opportunities for those who embrace them as the key to maintaining nimbleness and competitiveness.

LSPs that leverage this rare combination of available resources and experience can overhaul outdated operating models and gain an edge on the competition while the opportunity is ripe. But while these organizations appear to be in an economically strong position, they should resist complacency. Those who take a wait-and-see approach risk becoming vulnerable to the looming global changes and uncertainties in the market.

Four Bold Moves on the Strategic Radar

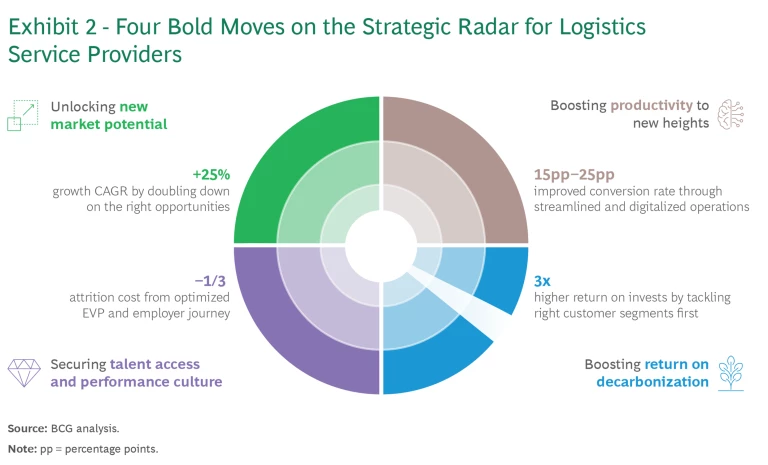

Based on our conversations with logistics executives, we see four critical fields of action for LSPs to consider in their mid-term strategy: growth, productivity, decarbonization, and talent. (See Exhibit 2.)

For each of these fields, and their estimated impacts over the next five years, we have modeled two options—do nothing and bold move—and their impact for an archetypical LSP with broad geographic, vertical, modal, and customer coverage. Our assessment shows that companies may achieve significant improvements in all four areas by prioritizing boldness over continuity:

- Unlock new revenue potential. Faced with slowing volume growth and rate development as well as geographic, vertical, and customer shifts, LSPs should reconfigure their growth portfolios. By doubling down on few hand-picked market opportunities with a tailored approach, players may add up to 25% to their overall growth rate compared with the do-nothing option. (Note: Our analysis focused only on organic growth scenarios, without addressing what more could be done through possible M&A plays).

- Boost productivity. Productivity in logistics has been rather stagnant for years and remains low, with gross profit-to-EBIT (earnings before interest and tax) conversion as a good indicator. With a fresh approach to the right operations model and by leveraging new technology—such as GenAI—in a comprehensive approach, LSPs stand to achieve productivity breakthroughs that can improve conversion rates by an estimated 15 to 25 percentage points.

- Decarbonize smartly. Decarbonizing the organization’s own value chain is no longer a “can do” but a “must do” for LSPs. By focusing on the right levers and by promoting green services to customer segments with higher willingness to pay, LSPs may potentially achieve a greater than threefold increase in return on their costly decarbonization investments compared with an undifferentiated approach.

- Secure talents and performance. Effectively acquiring and retaining talent will be crucial for LSPs to foster a DEI (diversity, equity, and inclusion) and performance culture. By taking rigorous measures to reshape the employer value proposition and journey for both desk-based and deskless workers, we estimate that LSPs could bring down attrition costs by roughly one-third without damage to quality of sales, operations, and administration.

We will take a closer look at these four critical moves in the following sections.

Move 1: Unlock New Revenue Potential

To counter the impact of various global developments, LSPs must look for new ways to drive profitable, above-average growth. Increasing tensions between the West and China and conflicts in the Middle East, as well as a rise of the middle class in ASEAN markets and a greater product-based economy, are few examples of the economic developments and geopolitical shifts reshaping global trade patterns and the logistics market. Many international LSPs are overexposed to mature markets with lower growth prospects, but they have an opportunity to build a new growth platform and increase revenue by reconfiguring their existing business portfolio.

Bold move impact: Add 25% to the revenue growth rate by 2030 by doubling down on selected market opportunities and adopting tailored approaches to grow market share.

Increase share in growth markets. Countries that are attractive manufacturing locations, like India, Vietnam, and Indonesia, are expected to benefit substantially from global shifts such as alternative omni- and nearshoring. By gaining a fair share in these markets, LSPs can grow their exposure in revenue streams with annual growth rates of 5% or more.

Boost presence in attractive verticals. A focus on high-potential sectors such as health care requires investment in capabilities and partnerships as well as strategic alignment to unlock network synergies. If done well, players can access opportunities with annual growth rates of 8% or more.

Crack the small and medium enterprise market through digital channels. LSPs can profitably expand in the SME segment by using digital channels to boost growth through combination of a user-friendly interface and a strong operational backbone.

Seize M&A opportunities with care. With earnings multiples of acquisition targets having dropped 25 percentage points from their peak in 2021, M&A sprees may seem tempting. However, LSPs must invest strategically to expand capabilities, avoiding scale for scale's sake and assessing ROI versus other alternatives.

Deep Dive: Increase Share in Growth Markets

To navigate the complexities and particularities in new growth markets, LSPs must:

- Set a clear market vision and ambition. Logistics organizations should align the target market with their overall growth strategy and set measurable goals for success. An ambitious vision can serve as a North Star to drive growth and align actions and budgets.

- Define a focused play. Companies should assess subsegments (such as customer groups and transport modes) within the target market and focus ruthlessly on the most attractive niches. They can thus avoid falling for segments that seem attractive only at first glance.

- Launch a customized go-to-market approach. A strong foothold demands a strategy and operating model that is tailored to meet local demands and that aligns with proven success factors. Companies should not be afraid to try new approaches that contrast with strategies deployed in other geographic areas.

Case Study: India’s Growth Strategy

Various multinational logistics companies have demonstrated successful approaches to growing market share in India, via a path of strategic cooperation with well nested local players.

Set a clear market vision and ambition. The combination of factors, including low costs and anticipated high market growth rates can potentially enable global LSPs to achieve up to a $2 billion to $3 billion revenue contribution at EBIT margins that are 1 to 2 percentage points higher than their global averages. With this, India can play a key role in the future LSP portfolio.

Define a carefully focused play. The attractiveness of segments within the Indian logistics market varies widely. For instance, road transportation is the largest subsector and shows strong growth at around a 9% growth rate. However, it is also notably competitive, with a scattered landscape of local operators that are difficult to compete with. Consequently, margins reside at the lower end of the spectrum. In contrast, air and ocean markets are more mature and offer higher margins, but at lower absolute growth. To define an effective play, these factors need to be carefully considered.

Launch a customized go-to-market approach. Our industry analysis finds that strategic partnerships with local heroes as well as a localized offering, entity, and possibly also brand are critical success factors that can increase the likelihood of success in India.

Move 2: Boost Productivity

The logistics sector lags other industries in efficiency. And within the industry, there are stark differences between frontrunners and laggards, reflected by GP-to-EBIT conversion rates that range from as low as 20% up to nearly 50%, according to our research. Furthermore, there has not been a tangible productivity increase for many players in recent years. As the market further consolidates and more efficient providers compete in the race for scale, an effective push for productivity is imperative.

Bold move impact: Uplift GP-to-EBIT conversion rate by 15 to 25 percentage points by streamlining and digitalizing operations.

LSPs have multiple levers at their disposal to improve productivity.

Leverage efficiencies from GenAI. GenAI promises a breakthrough impact on productivity. Our analysis shows cost takeout of 20% or more is possible across critical selling, general, and administrative (SG&A) cost categories such as customer service or administrative processes like booking and document management.

Modernize IT. Outdated system landscapes with multiple transportation management and warehouse management solutions can result in significant inefficiencies for LSPs, amounting to tens of millions of dollars of lost profit annually. Industry leaders are unlocking substantial value by harmonizing and modernizing their systems, including by leveraging customized off-the-shelf software.

Streamline operations setup. Most LSPs operate with old-fashioned production models. In our experience, centralized and standardized operations can achieve unit cost reductions of 5% or more, for example, through bundling administration and management functions in fewer locations as part of a “centers of excellence” strategy.

Deep Dive: Leverage Efficiencies from GenAI

To fully harness the potential of GenAI, companies need to take a structured approach:

- Establish a baseline. Understand current operational processes by identifying the most common job profiles that make up 80% of the total workforce. Create a standardized activity taxonomy and description for each role to ensure clarity and consistency.

- Identify high-value use cases. Determine where GenAI can have significant impact. Assess potential use cases based on their ability to reduce time and increase the activity value of prioritized job profiles (e.g., based on task repetitiveness, need for complex human interactions).

- Scale rapidly. After piloting high-value use cases, it is crucial to scale quickly. Refine the value estimation based on feedback from the pilots and scale up to realize efficiency gains.

- Manage change effectively. The success of GenAI adoption depends as much on people and processes as on the technology itself. It’s important to support the transformation with a careful change management program that involves employees in the process through effective communication and training.

Case Study: BCG Bionic Workforce Assessment

BCG’s Bionic Workforce Assessment evaluates the impact of GenAI on job roles and functions, prioritizing use cases and identifying necessary skills adjustments.

Our evaluation indicates that LSPs have the potential to enhance efficiency by 20% or more across SG&A functions through a combination of off-the-shelf and custom GenAI solutions such as service bots or data analytics platforms. The largest opportunities—considering the underlying FTE base—can be observed in functions such as sales planning and support, operational and administrative processes, dispatching, and customer service.

Our discussions with executives uncover that many LSPs are assessing opportunities to use GenAI to boost productivity. So far, however, only a few are in the piloting or even scale-up phases.

Move 3: Decarbonize Smartly

According to estimates, the transport and logistics sectors (road passenger, road freight, passenger aviation, cargo aviation, shipping, and rail activities) are responsible for 22% of global CO2 emissions and are under increasing pressure to decarbonize. To recoup investments and increased costs from green capacities as much as possible, a smart approach is essential. Companies are in a better position now to recover costs because of customers’ increasing willingness to pay for green solutions.

Bold move impact: Achieve a greater than 3x higher ROI per dollar invested in decarbonization by prioritizing emission reduction levers and focusing on the most attractive customer segments.

To decarbonize efficiently, LSPs need to look especially at four elements:

Decarbonize the value chain. LSPs’s CO2 footprint is largely concentrated in Scope 3 emissions—those caused by other organizations in the company’s value chain, such as suppliers, that are not under the company’s direct control. Consequently, companies need to transform their fragmented supplier portfolios; for instance, by cooperating closely with carriers to take advantage of decarbonization opportunities.

Develop green services and new business models. LSPs have a variety of ways to take advantage of the growing demand for green logistics as well as a slow but steady rise in shippers’ willingness to pay for sustainable services. Opportunities include (1) providing transparency on emissions and recommendations on how to reduce them, (2) offering green transport and warehousing services, and (3) creating new business models, such as helping shippers to set up more resilient supply chains.

Gain strategic fuel and energy access. LSPs can expand their role along the value chain and invest in own capacities or form partnerships with industry players (e.g., for clean fuel production). The goal is to secure long-term access to resources and reduce reliance on traditional fuels.

Enhance supply chain resilience. As climate risks and disruptions become more frequent, LSPs must conduct risk assessments to head off potential supply chain disruptions. By developing contingency plans, investing in alternative routings, and forming strategic partnerships, LSPs can improve reliability of their services.

Deep Dive: Decarbonize the Value Chain

LSPs have the highest potential to reduce emissions by making three types of changes in the value chain:

- Cut emissions. LSPs can make relevant progress on decarbonization—while also improving operational efficiency—by adjusting their mix of transport modes and optimizing routes and hub locations.

- Decarbonize the organization’s operations. Companies can do this by increasing the use of green assets as well as clean energy production and adopting sustainable practices in offices and operations.

- Transform the supplier portfolio. To address the difficult, but critical, challenge of Scope 3 emissions in a meaningful way, LSPs will have to strategically collaborate with both small suppliers and large carriers. This involves setting targets for the existing supplier portfolio and following a dual path of demand (establishing buying conditions that push suppliers to meet minimum green standards) and encouragement (supporting suppliers in their green transition. For example, they might enter into purchasing alliances and strategic cooperation with carriers to promote clean fuel procurement). In addition, LSPs can take over the role as demand aggregator by bundling “green customer demand” to enable carriers to offer green products at scale.

Best-Practice Examples

Some of the largest LSPs have set ambitious decarbonization targets and are actively working with carriers to achieve them.

Incentives and demands for suppliers. Some LSPs have introduced certifications for carriers meeting strict environmental standards. These certifications help carriers reduce their carbon footprint and enhance their marketability.

Support of small suppliers. Some LSPs are offering guidance and resources to small suppliers to help them lower emissions. For instance, LSPs may help these suppliers apply for government grants that promote road freight decarbonization.

Strategic carrier cooperations. A few leading LSPs are collaborating strategically with large suppliers to promote the use of sustainable fuels and reduce emissions, particularly by establishing clean fuel commitments with air and ocean transport partners.

Move 4: Secure Talent and Performance

The logistics sector is facing a talent shortage in both deskless workers (warehouse personnel, truck drivers) and desk-based talent with scarce skills (e.g., in IT and digital functions). Furthermore, LSPs struggle with retention and high attrition costs, with a notable attrition rate of 31% in 2022, according to BCG’s Future of Work survey. Considering not only the financial costs but also factors like knowledge loss, low morale, and underperformance, it’s clear that reducing attrition and upskilling is a more strategic approach than a cycle of constant recruitment.

Bold move impact: Reduce attrition cost by up to one-third by modernizing the employee value proposition and journey.

Source and recruit the right talent. LSPs can take advantage of global sourcing paired with a strong relocation and integration strategy to tap new talent pools and address labor shortages across both deskless and desk-based segments. Additionally, companies need to be aware of changing candidate preferences. For instance, younger employees are often drawn to organizations with strong environmental, social, and governance ambitions.

Retain employees and reduce attrition costs. To retain employees, LSPs must shape attractive employee value propositions (EVP) that address the needs of different types of workers. Besides competitive pay and benefits, an EVP should also address intrinsic motivators like purpose, personal growth, and belonging.

Shape performance culture. Embed a high-performance culture to sustain productivity during transformations like GenAI adoption. Prioritize high standards and continuous improvement by applying insights (useful modern approaches come from diverse sources like anthropology, behavioral science, and gamification) to promote behavioral change and boost performance.

Transform to a skill-based organization. As technology evolves, some skills are becoming more critical than fixed job descriptions, particularly in tech and digital roles. Accordingly, companies must reshape HR functions like workforce planning, recruiting, and career pathing to prioritize skills over traditional roles.

Deep Dive: Retain Employees and Reduce Attrition Costs

BCG’s Deskless Worker Sentiment Survey illustrates the connection between employees’ emotional needs and attrition rates. While pay and benefits are important, emotional needs, like work-life balance and feeling fairly treated, drive attrition when unmet.

Companies can increase retention by crafting an EVP that addresses the needs of different worker segments—both deskless and desk-based—by including elements such as company values, development opportunities, work-life balance policies, and team management standards.

An EVP is not a one-size-fits-all solution for all worker types; it requires a structured and analytical approach. Companies can:

- Conduct surveys to identify employee needs and preferences, which can be segmented by seniority or job group (operations, customer service, central functions), and so on.

- Convert the insights to initiatives and prioritize them based on impact and feasibility.

- Focus on developing skilled managers, and evaluate the impact by collecting feedback and tracking effectiveness over time, and adapt the EVP or introduce new initiatives accordingly.

Charting the Course Forward

To chart the course toward 2030, LSPs should tailor their strategic radar to their own priorities and capabilities. They must:

- Prioritize actions. Companies should first prioritize the improvement areas with the greatest gaps and highest value-creation potential, instead of attempting to move ahead on all fronts simultaneously.

- Translate priorities into a strong transformation program. To achieve impact, LSPs need to establish an internal transformation program with a detailed roadmap and clear ownership and accountability.

- Execute relentlessly. LSPs need to create a “fail fast” culture that allows them to trial new ideas in a secure environment. Once impact is demonstrated, the organization needs to provide the backing and mandate for a company-wide rollout. An effective transformation management office ensures a high drumbeat and tracks value creation along the way.

LSPs are in a unique position of strength that they can leverage to invest in new capabilities and actively shape their future position in a changing market full of pressures and uncertainties. They should consider whether they are well positioned along four fields of action—growth, productivity, decarbonization, and talent. Those that are lagging and risk being outpaced by peers should take decisive steps to reap the opportunities that are available.