Climate scenario analysis is a vital tool to help companies understand the impact of climate change on their strategy, operating model, performance and risk profile.

Investors and regulators are now demanding this type of analysis. With over 8,000 global companies making commitments to the Science Based Target Initiative (SBTi) and general acceptance of the principles of the Task Force for Climate Related Financial Disclosure (TCFD), good scenario analysis has become a requirement for good corporate disclosures. In recognition of its importance, current and proposed legislation by regulators in the EU, US, Australia and New Zealand is making the disclosure mandatory.

To comply, companies will have to conduct climate scenario analysis to test their business exposures, over the long-term, to a variety climate change scenarios. At its simplest, this work can be a desktop exercise conducted by a small number of specialist climate analysts. However, we argue that a contained exercise is a missed opportunity. When climate scenario analysis is done properly, it will engage senior leaders in the most important questions facing their business over longer term. It can shine a light on key strategic questions, uncover underappreciated risks, lift up emerging opportunities, and provide compelling context for communication with stakeholders in the capital markets and government.

To get the most out of this exercise, we recommend the following process.

1. Seek best practices from global climate leaders

Every company and industry will face different climate related challenges. To inform your analysis, we recommend benchmarking 3 groups of companies.

- Local peers against which local investors will judge you

- A targeted list of global peers or competitors in your specific industry

- A selection of recognised global sustainability leaders, outside of your own industry

This exercise will identify best practices and set the stage for your own analysis. In our experience, no company will exhibit every best practice. One thing all will have in common is a direct link between analysis and their core industry. For example, BMW’s climate planning involves targets to produce more than 7 million electric vehicles by 2030, informing overall business growth targets.

2. Set clear ground-rules and identify critical overlaps between climate and company strategy

Scenario analysis is not a forecast; it is a description of what would have to be true to meet a certain outcome. For example, to keep global warming at 1.5oC, what would your industry have to do? With that framing, ask your team what assets, customers, products, investors and government actions could be material in different scenarios? Which are likely to be the most important for your business?

You will want to come up with a strong sense of how climate scenarios link to your business’ position. For example, a premium, full-service airline might want to integrate action on climate change as a differentiator for their trusted brand. A low-fare competitor may be principally focused on the effects of rising carbon prices on their relative cost position and fleet purchase decisions.

A clear definition of the ground rules and design principles for your analysis will help to guide the work and generate early hypotheses on the impact of climate change on your business. This step is essential to generate insight out of complex and uncertain scenario analyses.

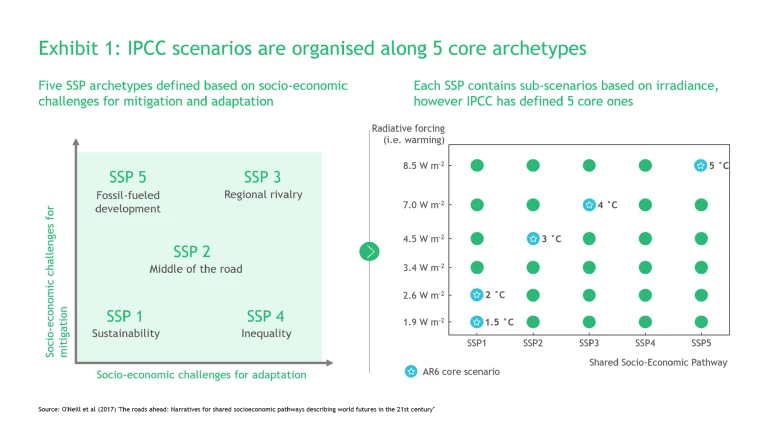

3. Pick a powerful and useful set of global scenarios, aligned with the prevailing global consensus

The Intergovernmental Panel on Climate Change (IPCC) is the accepted gold standard for the consolidation of climate science research. Each selected scenario should align to one of the IPCC’s 5 shared socioeconomic pathways that cover 5 different temperature and societal outcomes (see Exhibit 1). Other well-respected global bodies, such as the International Energy Agency, SBTi and the UNEP have also provided detailed sector pathways to achieve net zero. These can be a valuable starting point to anchor your analysis. Importantly, they will provide meaning for your stakeholders as they seek to compare your work with your peers.

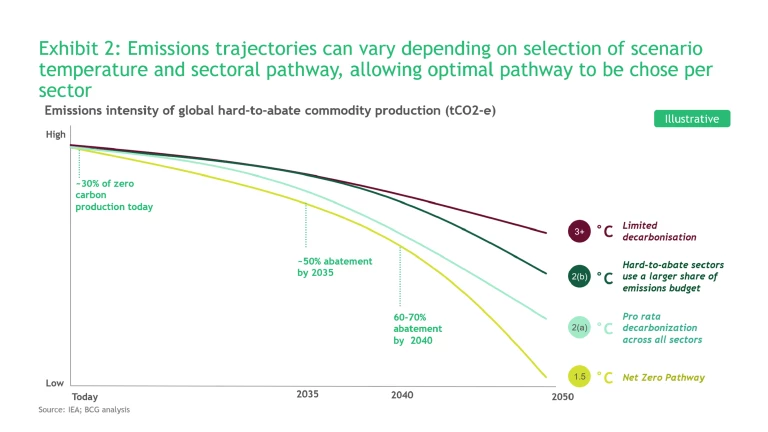

No company will want to analyse more than 3 or 4 core scenarios, due to the scale of work required. However, it is important that those scenarios are different enough from each other to surface major differences in potential strategic decisions. For example, there are multiple ways to get to a 2oC global outcome. The emissions and temperature outcomes need to be the same, but the “how” varies. It could be that emissions reduction is driven by a subset of highly emitting countries (doing more than others), or evenly spread across every nation. Alternately, we could see dramatic reductions in one industry (e.g. Electric Vehicles) that outpaces others (e.g. Agriculture). When deciding on scenarios, choose and describe pathways that bring out the most important nuances for your company. By way of example, Exhibit 2 shows 4 different emissions trajectories for a generic global industry.

4. Engage a broad set of experts, iterate often, and synthesize to identify cross-cutting themes and no-regret actions

Your business has a wealth of expertise across many functions. Pull in the experts early. Seek input from operations, marketing, finance, climate experts, strategy, capital markets, and government affairs. Start by aligning on scenario selection and key strategic hypotheses. Then systematically work through the major cross-cutting questions. As you align on key findings, and identify new questions, it will be beneficial to engage with the most senior leaders in the business, to test your findings and ensure buy-in. This will allow for essential consensus among key decision makers. More importantly, your senior leaders are likely to have the depth of experience and the most global, strategic view to make the climate scenarios as robust as possible.

This will be an iterative process. Your hypotheses on strategic question will lead to analysis, then to themes, then to more questions. Over time, it will all coalesce into 2 major outputs. The first will be high level decisions that will be influenced by how global action on climate change evolves. For example, a major capital investment to decarbonise a large facility may be dependent on a high carbon price and the development of critical infrastructure. You’ll need to identify these influences and determine signposts to monitor for them. The second will be ‘no regret’ actions that are positive in any climate scenario. For example, taking part in industry efforts to advance critical technological pilots or develop energy hubs will put your company at the table for critical conversations and demonstrate your commitment to investors and regulators.

5. Create a strong climate narrative and embed it in strategic planning processes

The final step in your process is to create a structured narrative that describes the outcomes of your climate scenario analysis. The narrative will include the expected effects on key assets, the magnitude of financial impacts, and the key decision points that will be encountered. It will form the backbone of your external communications and engagement. It should also be directly linked into your strategic planning process, by articulating key strategic decisions, now and in the future, as well as no-regrets actions, which feed into specific inputs to financial models that inform future capital decisions.

Climate scenario analysis is a compelling tool for companies to prepare to adapt to an uncertain future, identify ways to strengthen their core business, and demonstrate impact to investors and regulators. Companies that begin now will learn to execute complex analyses of climate impacts on strategy, operating model, performance, and risk profile – a capability that is set to become a competitive advantage in the 21st century.