Generation Z will be a defining force in discretionary spending over the next ten or more years. Born between 1998 and 2012, Gen-Zers in the US already account for the majority of spending in a few retail categories, such as skincare, despite their youth and relative lack of income. In fact, these young consumers are more likely to purchase fashion, beauty, skincare, and health and wellness products—all discretionary categories viewed as “high splurge”—than any other generation. Nearly half of those surveyed say they splurge on an item or buy themselves a treat more than once a month, compared with 43% of millennials and just 34% of Gen-Xers. In addition, Gen-Zers are ready to splurge even when they are trying to budget, particularly in two categories: apparel, footwear, and accessories; and beauty and skincare.

Of course, more mature consumers in the millennial, Gen X, and baby boomer generations currently have much greater disposable income and influence on household purchases than Gen-Zers. Nonetheless, Gen Z tends to defy expectations. A recent BCG survey of 6,000 consumers, extensive analysis of social media, and interviews with 400 respondents reveal the characteristics that retailers and brands need to understand about this group’s spending habits. (See “Our Methodology.”)

Our Methodology

Our research was also informed by more than five Social Standards analysis reports focused on key industries that were conducted over the same time period as our surveys, along with qualitative research consisting of multiple video interviews with each of 400 respondents.

The seven retail categories covered by our research were beauty and skincare, fashion and luxury, health and wellness, grocery, home goods, pet care, and travel and tourism.

What’s So Special About Gen Z?

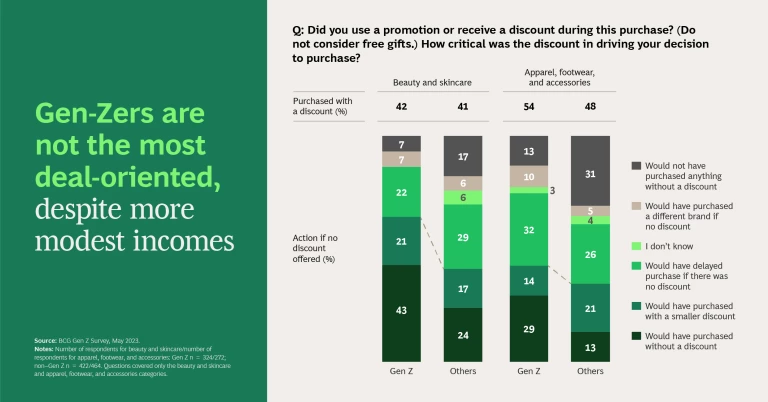

A number of Gen Z characteristics might be surprising. While brands might imagine that Gen-Zers are looking to save some of their relatively low income, we find that these consumers are not necessarily hunting the lowest price or the best promotion. Instead, their responses lean more toward the way they experience a brand. For example, earning the right to meet an influencer they follow might be more persuasive than a promotion.

Gen-Zers are also seeking items that they truly want, that speak to their lives, or that support their overall enjoyment. And they don’t want to make tradeoffs. In skincare, for example, they are unwilling to compromise on quality to get a lower price. A number of other characteristics also stand out as well.

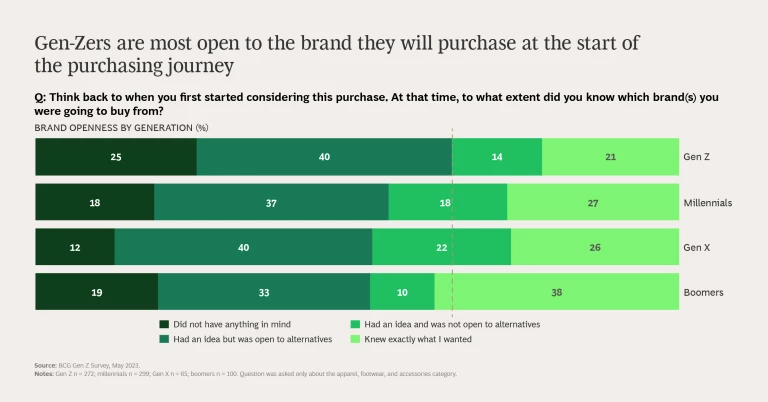

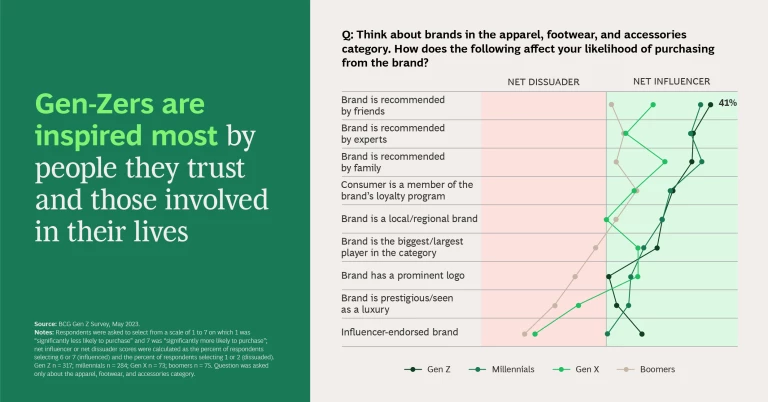

Most Influenceable. Gen Z is the most influenceable generation across age groups, as its members are the most open-minded about the brand they will ultimately buy when they begin their purchasing journey. In addition, they are far less interested than prior generations in purchasing items with a prominent brand logo or choosing a brand that is seen as “luxury.” Instead, they are most likely to base their choices on the opinions of the people they trust, such as friends and family—although experts also have a say. At the same time, they are less open to switching the outlets they buy from, being more retailer-loyal than brand-loyal.

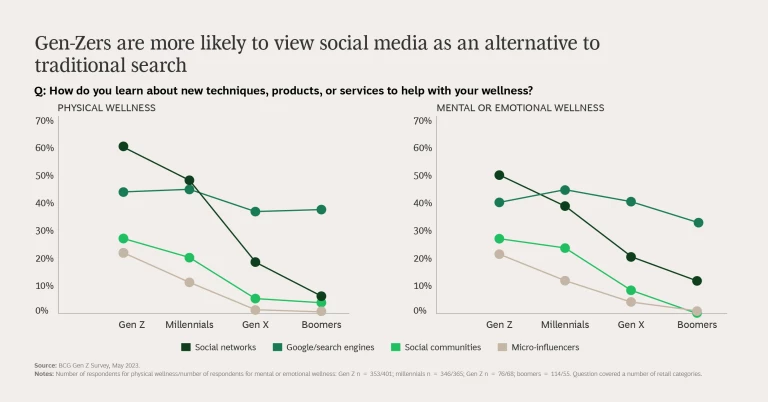

More Focused on Nontraditional Social Media. Gen-Zers rely less heavily than other generations on Google and other traditional search engines when choosing a product. Instead, they augment their traditional search findings with information from social communities such as Reddit and other message boards and traditional social media such as TikTok and YouTube. For instance, they use TikTok to discover what a new makeup looks like on others before buying it, or they watch their peers trying out the latest footwear on YouTube. In fact, Gen-Zers are very engaged with a variety of social media and use it in many different ways—including search, social shopping (using social media to browse, research, and buy products from digital storefronts), and staying up-to-date with trends.

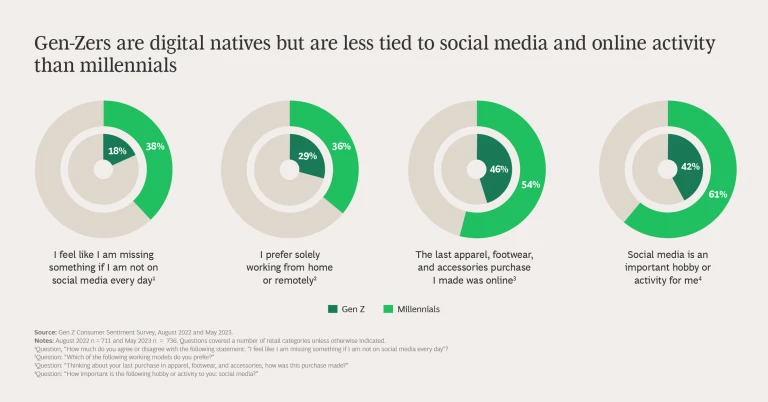

Less Social-Media Oriented. Despite their use of social media in buying decisions, Gen-Zers are less attached to social media in general than the previous generation of millennials. For example, only 18% say that they feel like they are missing something if they are not on social media every day, compared with 38% of millennials. Just 42% say that social media is an important activity or hobby for them, versus 61% of millennials. And we find that Gen-Zers prefer to shop in-store to understand the look and feel of the items they want, while millennials prefer to purchase online. This trend is consistent across categories, including grocery.

For more of what brands need to know about Gen Z, see the slideshow.

Finding New Ways to Engage Gen-Z

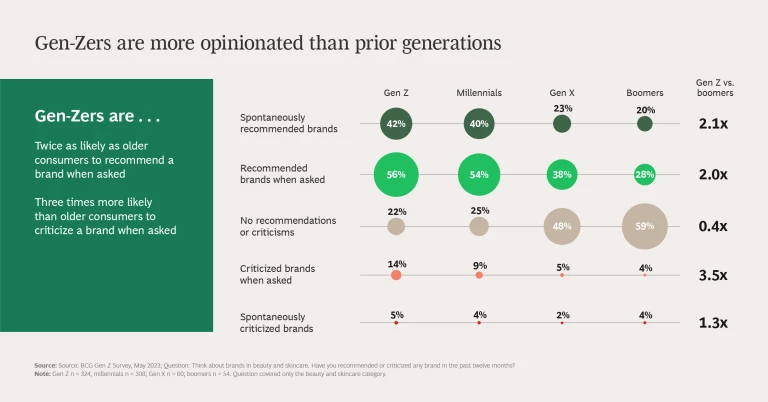

These unique Gen Z attributes require brands to rethink their approaches—communicating greater authenticity through their brand identity, improving their portfolio of influencers, identifying and addressing Gen-Zers’ distinct needs (which will become more prominent as they mature), and finding and developing grassroots brand advocates whom Gen-Zers trust.

Leverage unique aspects of the brand. Companies should prioritize understanding the aspects of their brand that can move Gen Z consumers along the purchasing journey. Finding the right data and technologies—such as AI—will be essential to this effort. And they should use what they uncover to engage with Gen Z in new ways, taking advantage of technologies that are disrupting the shopping experience.

Put a finger on the pulse of Gen Z. Companies should recognize that brand discovery differs across categories. In fashion, for example, discovery for Gen Z is often generated by specific aesthetics such as “outfit of the day” (OOTD), in which fashion bloggers post their outfit on a particular day or occasion, or “Barbiecore,” an aesthetic that meshes pastels with bright colors and bold accents. Baggu, for example, jumped on the OOTD trend early on, accelerating its mentions on social media. In contrast, discovery in the beauty category may be more influenced by ingredients and benefits.

Offer “IRL” experiences. Brands hoping to engage Gen Z should not limit themselves to online channels, as these consumers are also focused on IRL (in real life) experiences and authenticity. As a result, brands need to do a better job of tapping into alternative channels, such as in-person events in neighborhoods, stores, or other venues.

Find your Gen Z niche. Given the brand openness of Gen Z at the start of the shopping journey, popular brands cannot rest on their laurels; they need to innovate constantly to capture and repeatedly win these consumers. Gen-Zers are also discerning about the items they purchase and won’t simply buy the most popular or luxury brand. This creates an opportunity for smaller brands to grab share. These smaller brands also need to invest in finding authentic influencers among the Gen Z crowd—remember, recommendations from friends and family matter most to them.

Know your customer base. Of course, what influences one set of consumers may not be as effective with another. For example, despite the inflationary environment, a significant number of Gen Z consumers are willing to purchase at full price. Brands should therefore personalize their marketing as much as possible, including promotions. And they should engage in authentic dialogue with their Gen Z consumers because truly understanding this young market requires two-way communication.

There is much that brands both large and small can do to capture and win Gen Z consumers. The effort does not require the biggest budget or a massive transformation. Instead, tactical changes and experimentation can move a brand closer to becoming the purchase of choice for today’s Gen Z shoppers.

The authors would like to thank Priyanshu Praveen and Christian Leavitt for their contributions to this article and Mfour Mobile Research, Cint USA, Knit, and Social Standards for their contributions to the research.