The need to maintain margins amid lingering inflation and uncertain growth opportunities has heightened the usual tension between B2B sales organizations and their customers’ procurement departments. More B2B organizations are tasking their sellers to price more strategically and proactively, while their customers feel compelled to cut budgets and consolidate suppliers.

To motivate their sales teams to achieve better pricing outcomes, companies have begun to redesign their sellers’ variable compensation and sales incentive plans (SIPs). In our experience, variable compensation represents, on average, around 40% of total sales compensation—and it can be as much as 100% depending on the sales role, selling context, and industry. SIPs are powerful motivational tools, but they can quickly become a wasted expense if they don’t drive the desired behaviors.

Including pricing metrics within an SIP brings several benefits beyond improving seller pricing discipline and payouts. The optimal mix of metrics can help salespeople capture low-hanging opportunities to boost margins, accelerate growth in price-sensitive customer segments, and improve how they demonstrate value to their customers. To incorporate price-based metrics successfully into SIPs, companies need to determine when they make sense, design the metrics that will drive the desired selling behaviors, and implement the tools and guidelines to support them.

When Price-Based Metrics Make Sense

The design of an SIP should always reflect an organization’s go-to-market strategies as well as its broader corporate goals and competitive objectives. Companies say they want their sales reps to price strategically; yet currently, fewer than 10% of SIPs reviewed by BCG include any price-based metrics or other mechanisms that reward the quality of revenue, which indicates how well revenue reflects the company’s financial and commercial goals.

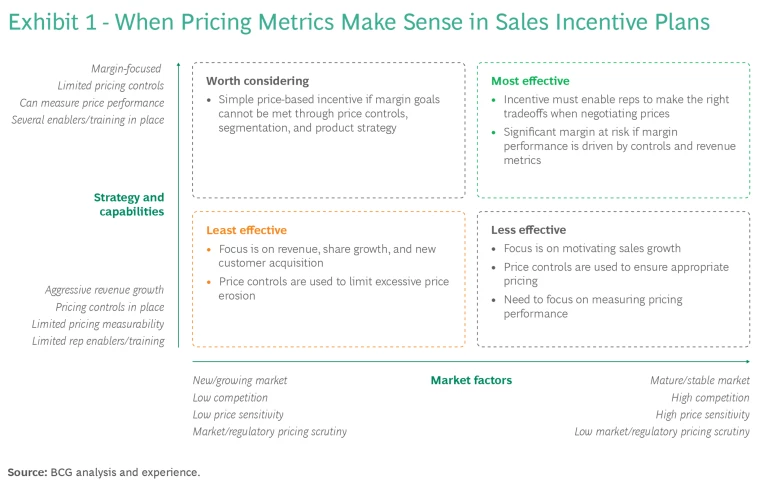

When organizations consider incorporating pricing metrics in their incentive plans, they tend to struggle with overly complex designs and a reluctance to expose confidential information. They often have difficulty setting pricing targets and lack adequate resources to administer metrics. But none of these barriers is insurmountable. A combination of market factors and internal capabilities influences whether price-based metrics are appropriate to include in the SIP. (See Exhibit 1).

These factors include the market’s maturity level, intensity of competition, and customers’ price sensitivity. Office supply companies, for example, face tight margins and the commoditization of high-volume products because of fierce competition and highly price-sensitive customers. In these situations, the tensions across the elements of the incentive plan should motivate sales reps to discount only when it is necessary to win highly competitive deals.

The design of an SIP should reflect an organization’s go-to-market strategies as well as its broader corporate goals and competitive objectives.

Companies also need to consider their growth objectives, their ability to measure and control pricing outcomes, and the extent to which they can enable sellers to price strategically. Organizations in an early development stage tend to focus more on revenue and growth outcomes, while mature organizations focus more on optimizing margins and pricing.

How to Design the Right Price-Based Metrics

Not all metrics are created equal. Poorly designed metrics can encourage behaviors that lead to margin erosion and slower-than-expected growth. To select the right measures, an organization should first align on the pricing behaviors it wants to incentivize. It then needs to design the specific metrics to drive those behaviors, decide how to assess performance, and determine the weight of the metrics within the SIP.

Align on pricing behaviors to incentivize. Companies typically focus on instituting or improving these four behaviors:

- Prioritizing High-Value Opportunities. Reps are encouraged to focus on profitable and high-value opportunities instead of pursuing all opportunities or trying to win revenue at all costs.

- Negotiating Prices Strategically. Strategic dimensions include the revenue and profit potential of the customer and the expected value of the company’s solution. These dimensions can vary by customer segment. For example, empowered reps may give favorable pricing to newer customers and then recover that investment later by reducing discounts and upselling at renewal time.

- Securing Better Terms and Conditions. The company rewards reps for including early payment terms, longer-term contracts (when desired), and stricter cancellation or termination clauses.

- Upselling and Cross-Selling. Reps drive sales of higher-margin or add-on products or convert customers to newer or premium versions of already implemented solutions.

When companies do not specify the desired behaviors, salespeople may act in ways that are attractive in isolation, but detrimental to the company in aggregate.

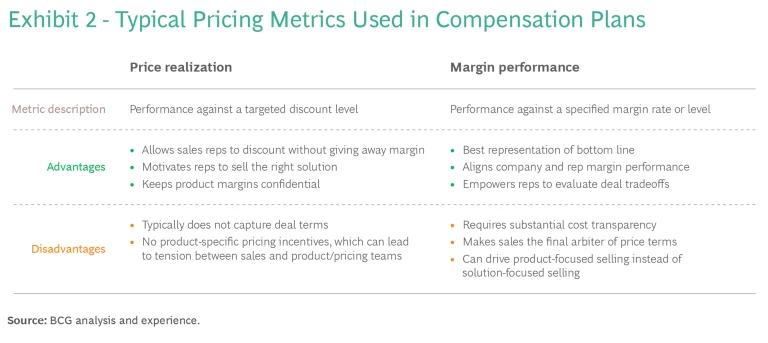

Design the specific metrics to drive those behaviors. Pricing metrics in incentive plans tend to focus either on realized price levels or on margin levels (See Exhibit 2). Price-realization metrics compare actual prices or discounts with their target levels, sometimes adjusting for the type of customer and their current price or discount levels. A metric based on margin levels compares the deal’s margin—expressed as a percentage or as absolute dollars—to a target margin.

Both kinds of metrics can motivate salespeople to concentrate their efforts on activities that improve pricing outcomes. Price-realization metrics can be an attractive option because implementation is manageable and because they don’t unnecessarily give away confidential margin information. However, they can create internal tensions because they focus on solution-specific price levels rather than prices for individual products. Margin-based metrics may be easier to communicate to salespeople and align their performance with the company’s margin goals but may lead them to focus on discrete higher-margin products instead of the overall customer solutions. They can also be hard to manage because product mix and costs change over time. And they risk exposing sellers, and often customers, to confidential cost information.

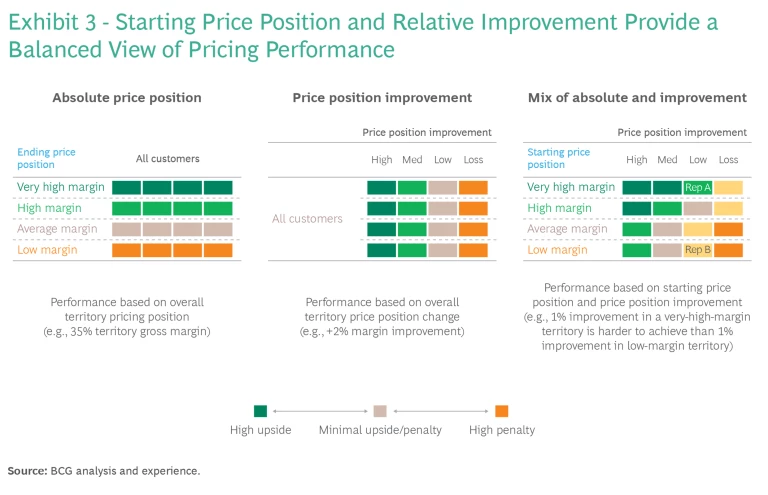

Decide how to assess performance. Companies have three basic options for measuring performance: the final pricing position, how much the pricing position improved, or a hybrid approach. (See Exhibit 3.) The hybrid approach defines desirable pricing outcomes by considering both the price position outcome and the relative price improvement. This approach typically works well for organizations with highly variable pricing performance across both customers and territories.

Consider two sales reps who sell in different territories for the same company. Rep A is a strong negotiator and is effective at offering discounts only when necessary to win deals. Rep B discounts aggressively to win deals, which means they have a greater opportunity to improve their pricing outcomes compared with Rep A. If each rep improved their annual margin performance by 1 percentage point, Rep B should earn less than Rep A, because Rep B has a relatively larger opportunity to improve pricing outcomes. Rep A should be rewarded for starting from a high baseline and still landing at a better overall price point.

The hybrid metric in Exhibit 3 is often implemented at either the territory or deal level:

- Territory Level. Reps are given authority to price within certain bands at the deal level, with their performance and payout based on their overall territory margin or price realization levels. At the end of the year, the table shown on the right side of Exhibit 3 serves as a payout reference table, based on the rep’s full-year price performance and the territory’s starting price position.

- Deal Level. Reps are given an overall revenue target and revenue credit multipliers depending on the price profile of the deal. For example, if a rep converted a $100,000 deal that had a “high” price improvement with an “average” starting price performance, they would receive an additional revenue credit to reward the improvement. Conversely, a poor pricing outcome would reduce the rep’s credit below the actual value of the contract.

Companies may want to overweight price metrics for salespeople in more challenging situations.

Organizations can also use multipliers if reps secure favorable contract terms, including revenue commitments, prepay arrangements, contract length, and pulling future-year payments forward. These multipliers are often strong motivators for reps who may otherwise have no incentive to pursue margin-enhancing terms and conditions during negotiations with customers.

Determine the weight within the SIP. To influence a sales rep’s behavior, an incentive metric typically needs to account for at least 20% of the variable compensation target pay within the SIP. This also applies to price-based metrics. Rebalancing the relative weights of a plan’s benchmarks after the introduction of a price-based metric is challenging because all the measures in the SIP need to remain aligned with the company’s success metrics. Companies want to avoid rewarding salespeople disproportionately for outcomes that are relatively easy to achieve. At the same time, they may need to overweight price metrics for salespeople who are trying to achieve significant margin in more challenging situations. One such situation is the attempt to improve price realization in key accounts where upside may exist but can be more difficult to unlock when the customer has a sophisticated procurement function with strong negotiation capabilities.

How to Implement Pricing Metrics Effectively in the SIP

A company needs several inputs and systems to launch pricing metrics effectively in the SIP. These include:

- Measurement and Reporting Systems. These determine the ability to measure and report on pricing outcomes in the CRM and finance systems at the account, deal, and territory levels. Reporting provides both the finance and the sales teams with a consistent single source of truth for tracking performance. The data must be robust enough to ensure that payouts are accurate and auditable. Systems need to be set up need to minimize the risk of disputes between salespeople and sales compensation administrators.

- Clear Plan Documentation and Rollout. Salespeople need detailed explanations of how the pricing metrics work and how they will affect their compensation. These explanations should include sample deals and payout calculations as well as a summary of the desired activities and behaviors that lead to improved pricing outcomes.

- Pricing Enablers. These are tools and other assets to support salespeople in their efforts to improve price realization. They include pricing tables, value-based-selling templates, and pricing recommendation models and systems. They also include training on negotiation tactics and deal desks to provide pricing support.

- Targets. Each salesperson needs accurate and achievable targets for the pricing metrics. These derive from historical performance and the company’s strategic margin or discount targets.

Sales incentives are a powerful way for B2B organizations to achieve their financial objectives though better pricing performance. When a company wants its reps to price strategically, it can incorporate price-based metrics in its SIP to motivate and reward salespeople to make the right pricing trade-offs during customer negotiations. The right pricing metrics can accelerate sustainable, profitable growth aligned with the organization’s broader go-to-market strategy.