For the CEO

A message from our editor on this critical topic.

Space has never been more accessible—or more central to a forward-thinking CEO’s agenda. The cost of launching satellites has fallen rapidly in recent years, catalyzing a new era of space-based services that promise to help companies lower costs, improve productivity, drive growth, and meet sustainability goals.

“New products and services are being developed that you couldn’t think about five years ago, even three years ago,” says Troy Thomas, a BCG managing director and partner and leader of its global space business. “It changes the paradigm of innovation.”

But that paradigm also introduces new vulnerabilities. “The question for CEOs is how to seize the opportunities of space-based services while recognizing the risks, which may not be familiar to them,” says Thomas.

Five Steps to Become a Space-Savvy CEO

Satellites are already a critical part of the planet’s economic infrastructure, transmitting near real-time information for weather forecasting, navigation, mobile phones, internet, and crop yields. What makes this moment pivotal is the potential for companies to leverage the new wave of space-enabled communications, navigation, and imagery in concert to unlock even greater value.

“You have all these commercial services available, but we’re still somewhat figuring out how they are best used across industries,” says Mike French, a BCG senior advisor on space policy. “There’s a unique opportunity to be the first to market and capitalize on these new capabilities.”

There’s a unique opportunity to be the first to market and capitalize on these new capabilities. — Mike French

Satellites deliver precision location services such as GPS, while low earth orbit (LEO) satellite constellations can deliver always-on, high-speed data anywhere on the planet—from giant, floating oil platforms to rural gas stations. Satellites can also generate increasingly detailed earth imaging that can be used for specific business needs, such as insurance loss assessment or detecting undiscovered ore deposits.

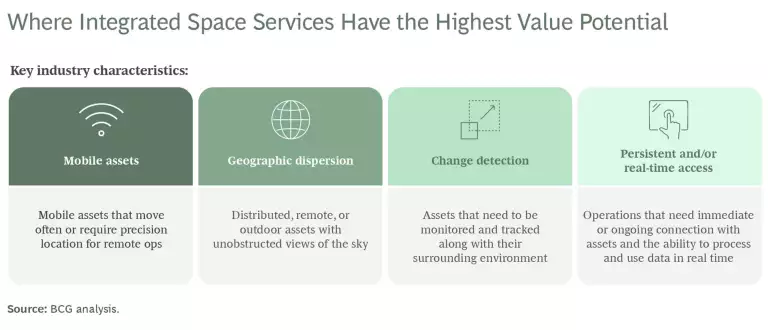

Individually, these services can enable important new products and ways of working. But in combination they are even more potent. Companies with mobile assets, or operations in remote areas, as well as those that can create value from real-time data and tracking, could realize as much as a 25% increase in revenue and a 10% decrease in operating costs within one year of adopting integrated space services, BCG estimates.

There are caveats, however. In many cases, unlocking value will require companies to build additional processing capabilities on top of space-based services—using AI, for example, to turn satellite images into business-useful intelligence, such as whether crops need additional fertilizer or gas pipelines are leaking.

“The leaders are the ones who are looking at this data and coming up with the key that unlocks it for their industry,” says French.

Space has always inspired bold visions. But CEOs must complement a courageous vision with strategies that tap, shape, and maximize new opportunities while mitigating existing and emerging risks. With the right combination of actions, CEOs can boost their odds of successfully opening new frontiers for their companies through integrated space services. The savviest among them may even lead the way for entire industries.

As Costs Fall, Opportunities Soar

Accessing space has never been more affordable. The latest generation of reusable rockets can launch a satellite into space for a small fraction of what it once cost to use the Space Shuttle. Another reason costs are plummeting: most commercial providers are using LEO satellites only a few hundred miles above the earth’s surface, which means they can be built smaller and lighter, in part because they are much closer to their ground stations. They also require less fuel to get into orbit. It takes approximately 90 minutes for a LEO satellite to circle the earth; by comparison, a satellite in geosynchronous earth orbit (GEO) is approximately 22,000 miles from the planet’s surface and takes a day to journey around the globe.

Expense is not the only barrier that’s falling. Firms no longer need to navigate government bureaucracy to access space; many commercial providers are making it easier for companies to access their services by delivering them through software APIs, offering trial periods, or integrating services into the cloud.

How One Industry Is Creating Value

Companies are already putting space-based services to work, including those operating in one of humankind’s oldest industries: mining.

Tom Butler, former CEO of the International Council on Mining and Metals and a current BCG senior advisor, has seen a large, remote mining operation in Australia transformed by trucks, trains, and drills operated remotely from suburban-based control rooms more than 800 miles away.

“The positional technology is so accurate that when they first started this, the trucks were creating ruts because they were going along exactly the same path each time,” he says, “So, they had to introduce some kind of randomness into how the trucks went along.”

The positional technology is so accurate that when they first started [using satellite services], the trucks were creating ruts because they were going along exactly the same path each time. — Tom Butler

Satellites make remote operation of these assets possible by enabling each piece of equipment to determine its exact location—and crucially, transmit that data locally and back to the control rooms as needed. Not only does this reduce the number of people who need to be flown to the mine and supported there; the technology can also help lower fuel costs, improve tire efficiency, and even work in tandem with AI to improve the maintenance and operational life of trucks that can cost between $3 million and $5 million.

The productivity and cost savings can be significant. BCG estimates that mining operations harnessing integrated space services could see a 10% to 15% improvement in equipment uptime and a 15% increase in machine life.

And these are still the early days. Integrated space-based services could potentially transform every stage of mining, from identifying deposits and processing ore to enhancing safety on mining sites. For example, synthetic aperture radar (SAR) satellites can see wavelengths of light invisible to the human eye, as well as through clouds, enabling them to scan vast areas of land for potential ore deposits. Satellites can also help optimize a downstream processing plant for a precise grade of ore by reliably feeding high volumes of data from upstream extraction facilities into AI-processing tools.

“You could be adjusting parameters in the processing plant to deal with impending changes in the ore that’s going to arrive in a few hours’ time,” says Butler.

Satellites also enable more accurate environmental and social impact assessments—for example, by measuring changes to the crops and population centers surrounding mines. New-generation satellites can even mitigate potential hazards. MethaneSAT, which launched in March and is expected to go online before the end of the year, is designed to detect methane—a highly flammable, explosive gas that can be released during ore extraction—at just a few parts per billion.

Potential Benefits Across Industries

Another industry on the leading edge of integrating space-based services is agriculture, an early adopter of autonomous tractors. “A single tractor, while passing through the field, can not only sense the performance of the vehicle, and the wear and tear on parts, and operate the vehicle autonomously, but is sensing the soil condition, the plant life, and processing this in real time onboard,” Thomas recently told BCG’s Imagine This podcast. In the same pass, he said, the tractor is doing the precision application of the fertilizer, which dramatically increases crop yields while reducing costs and environmental impacts.

The insurance industry is also poised to benefit from space-based services, according to Andrea De Blasi, a BCG managing director and partner and head of its European space business. He sees breakthrough applications ranging from assessing risk and real-time monitoring of insured assets to assessing payouts after events. “This is a dramatic innovation compared to whatever has been done in insurance in the past,” he says.

Myriad applications can be harnessed across other industries as well. For example, satellites can give manufacturers a clearer picture of the available space for new fabrication plants, along with potential access routes. Or they can help companies gain a better understanding of how pipework may be rerouted for a factory upgrade.

“It gives the envelope needed to design and make the decisions early on, such as whether it is actually going to fit without being close to a hazard or other negative influence,” says David Seaton, former chairman and CEO of Fluor Corp and a current BCG senior advisor.

New opportunities are also emerging as the size of the terrestrial equipment for accessing satellite services shrinks. “In layman’s terms, instead of having a big, bulky device the size of a car sunroof to connect a vehicle to a high-speed satellite constellation, there will be much smaller terminals, about the size of a large laptop,” says Matt Martinez, a BCG managing director and partner and the North American lead for the firm’s space business.

New opportunities are also emerging as the size of the terrestrial equipment for accessing satellite services shrinks.

Space-based communications may well be possible with a conventional phone. Already, some of the latest smartphones have basic satellite connectivity, providing limited emergency alerts for users who are out of cell coverage. As this trend continues, whole new application areas could emerge, such as extending the Internet of Things far beyond the reach of cellular networks to remote devices, vehicles, or sensors.

“The industry is clearly trending in that direction,” says Martinez, “which is going to open up a whole host of opportunities for people to put [space] connectivity on things that didn’t make sense in the past because the equipment was so big and expensive.”

Coming Down to Earth: Challenges and Risks

Realizing value from space-based services is not a turnkey proposition. “To become space savvy, you need to understand what is the potential that can be unlocked via space services to your business,” says De Blasi.

Realizing that potential will require companies to mount additional, possibly proprietary processing, he notes, such as using AI to analyze satellite imagery.

This is where generating business value from space-based services becomes challenging. Even some of the newest offerings are sold as raw technologies rather than business solutions.

Space may be a vacuum, but space-based services don’t exist in one.

French, whose career includes a spell at the industry’s Aerospace Industries Association, concedes the industry needs to talk more about solutions. “Many of us in the space industry think about the business side, but we’re also excited about exploration and turning science fiction into science fact,” he says. “But space will be successful and really make its mark on the economy when we don't talk about space-based capabilities, we just talk about capabilities.”

Beyond value creation, other challenges remain—and significant risks. Space may be a vacuum, but space-based services don’t exist in one. Like any emerging technology, their promise is accompanied by several potential perils that must be assessed and proactively managed.

Physical Risks

Even when small satellites survive the hazardous journey into orbit, they are still vulnerable to risks stemming from an array of factors: solar flares and other variations in “space weather,” component failures, software glitches, problems with communications equipment back on earth, collisions, and even malicious interference. A NASA study found that 35% of small satellite missions that launched successfully between 2000 and 2016 either ended in failure or partial failure.

The toll of satellite failures to businesses that rely on them can be significant. An outage in global GPS systems could cost the US economy, excluding agriculture, an average of $1 billion a day, according to the US National Institute of Standards and Technology. If the outage were to happen during the critical planting months of April or May, the impact on farmers alone could double the overall figure to $2 billion per day or more.

An outage in global GPS systems could cost the US economy, excluding agriculture, an average of $1 billion a day.

Another potential hazard—one that has received a lot of press attention—is the growing risk of collisions in increasingly congested orbital paths. The average distance between satellites in GEO orbit shrank by roughly a third from 2010 to 2023, according to a report by Slingshot Aerospace, while LEO is strewn with inactive satellites, rocket parts, and other human-made debris. In 2009, the first orbital collision was recorded when a Russian military satellite and a US commercial satellite collided at around 25,000 miles per hour over Siberia; the shower of debris from such incidents poses an additional risk. Yet there is no binding international treaty to govern the sustainable use of space, including the clean-up of debris and mandatory end-of-life plans for satellites.

Meanwhile, ground-based facilities are also at risk of the usual humdrum problems of even the most carefully built data facilities, such as power outages and delayed or even botched software updates.

Geopolitical Risks

Not only is space more congested—it’s also more competitive, as the space race between nations heats up. “We can’t ignore the fact that geopolitical competition is extending into space,” says Thomas. “Any type of conflict that could emerge here on earth could very likely extend into the space domain.”

Laura Juliano, a BCG managing director and senior partner who works primarily with aerospace and defense clients, says while the specter of nations destroying rival satellites may loom large, there are more prosaic—and immediate—risks to consider as well.

“I’d say the areas that give me the biggest concern are—and we’ve started to see it already—deliberate attacks to cut off the communications with the satellites in orbit,” she says.

Interference in the name of national security during times of domestic unrest could also thwart satellite operations, especially those that could be used to circumvent communications and internet blackouts.

Supplier and Data Risks

Juliano notes an additional, important risk: many new entrants to the space-services business are standalone companies, some of which rely on a small number of customers. The loss of a single key account, such as a government user that decides to launch its own capability, could lead to a space supplier’s collapse. Switching to another supplier could require a company to rewrite software, and it could create a more significant issue if its remote equipment uses communications or location hardware that is unlikely to work with another satellite network.

Data governance—specifically, who owns it—needs to be negotiated as well, says Juliano. Geospatial providers have different tiers and product types. In some cases, the customer owns all the data and the provider cannot sell it elsewhere. In others, though, the data remains the property of the satellite owner, who can sell it multiple times. Juliano says that ownership rights should be part of the contract negotiation.

And, of course, companies must take all the usual steps to ensure that firms being added to their digital supply chain don’t create new sources of cyber risk. Any cybersecure CEO needs to ask tough questions about how space-based services will impact their company’s overall risk profile.

Five Steps to Become a Space-Savvy CEO

Space-based services can power new types of digital innovation. But they also come with unique, albeit manageable, risks. Based on expert interviews, the following five steps can help CEOs forge a successful space strategy for their company:

Understand your existing space dependencies. Companies across industries currently rely on space-based services—although many may not realize exactly where they are exposed to potential risks.

For instance, even if a business does not rely on GPS for location services, the same satellite signals provide microsecond-accurate time signals vital to power grids, financial markets, and especially mobile networks.

Martinez advises companies to conduct a thorough review of space dependencies. This not only provides a basis for assessing risk; it also provokes thinking on how new technologies can be deployed. “If you're using slow satellite links or low-quality images at the moment, you should think what you could do if they were ten times better,” he says.

Understand how rapidly space capabilities—and their vulnerabilities—are evolving. “That’s probably not as easy as it sounds,” says Martinez. “Partly because the industry is rapidly changing.”

For example, while costs and equipment size are decreasing for space-based communications services and data speeds are increasing, the need to customize equipment for individual satellite services makes switching providers an expensive proposition. To ensure a healthy return on investment, CEOs need to ensure their company has a good grasp of their business case for space-based communications (as well as how much it would cost to switch providers, Martinez notes).

The cost of switching satellite image providers can be less onerous, and the technology should continue to evolve to become sharper, refresh faster, and be more tuned for specific use cases. But CEOs need to be aware that many satellite companies have government contracts that take precedence over commercial customers. Companies therefore may want to find providers that image all the earth’s surface frequently (although the image quality may be lower) or at the very least have a backup provider to ensure mission-critical images can be secured on a timely basis.

Positioning and navigation should also see continued improvement in precision and performance as private firms innovate in a sector that was previously government-powered (GPS is operated by the US Air Force, and its three global rivals are all state-run). Thomas says there is no replacement at scale for satellite positioning. It has proved highly reliable, however, and given that these systems are heavily used by the military, there is substantial government investment in further hardening systems and generating innovative fallback options.

Identify the right space opportunities for your business—and know how to unlock value from them. This step might sound obvious, but creating products and services based on new space-based services requires hard work and imagination.

“It’s not just saying this [product] is something that’s valuable,” says Martinez, “but rather, this is something that’s valuable and worth investing in and then incurring future expense to be able to sustain it.”

Juliano gives the example of monitoring cargo at sea or in transit through remote regions. While it may be easy to think of novel ways of doing this with the newer generation of space-based services, creating a cost-effective service that resonates with a sufficiently large group of customers is not so straightforward. “The challenge is who’s going to pay for it, and what is the commercial model?” she says.

Moreover, companies need to be realistic about their own skillsets and the work involved in turning a space-based capability into a business advantage or a saleable product.

"Getting a satellite image is fine, but you'll need some form of machine learning to find the interesting things that will generate business value,” says Juliano. “It needs more than just technical capability.”

Build security into your space transformation. Companies must mitigate cyber risks and have plans in place to recover quickly if a space-based service goes down. But there’s a need for perspective. All digital services can be disrupted; for example, the International Cable Protection Committee says that, on average, there are 150 faults in submarine cables each year.

Thomas says the causes of failure of space-based systems may be novel—such as the risk of “space weather” damaging a satellite—but companies should have already de-risked their potential exposure to disruptions, as with any other digital service, with fallback plans and alternative ways of working.

“Space tech is novel, but resiliency involves a lot of familiar risk-mitigation measures,” he says.

Encrypted communications, secure firmware, and constant vigilance are needed. For some satellite-based communications, it may be possible to use cellular as backup. The key is to think about security from the outset—and not to let security fears stifle innovation.

Get integrating. The key to creating value from integrated space services is a mental reset on what’s possible. If a team is working in an area where space-based services are relevant, they are almost certainly making assumptions; they may, for instance, assume remote connectivity is low-bandwidth and intermittent or that a vehicle can only know its location to a limited degree of accuracy.

Challenging such assumptions doesn’t mean starting a new “space team” to monitor daily developments in space-based capabilities. Instead, the CEO—or at the very least, the CTO—needs a broad awareness of what space-based services can deliver. They must charge the development team with discovering new possibilities and seeing how the company’s products or services can be reimagined by deploying them.

When thinking about space-based services, development teams also need to consider the second-level impact of these new capabilities. For instance, faster, always-on remote connectivity means processing can be moved to the cloud, opening new vistas for improved efficiency or other features.

Keep in mind, too, that space-based suppliers need the same level of vendor and supply chain management as any other supplier. Active management ensures that companies can monitor suppliers’ performance and mitigate any potential risks, making the integration process smoother and more successful.

Space-based services are no longer science fiction. They are a business fact—one that CEOs who want to stay on the cutting edge of digital transformations should embrace. Capabilities available now, such as always-on global communications, super-accurate positioning, and earth imaging, can pave the way for greater productivity and efficiencies—and even lay the foundations for new business building.