Automotive companies are investing billions of dollars to radically change automobile technology, powertrains, connectivity, and design. In the longer term, these moves are intended to cut carbon emissions and redefine mobility, revolutionizing the in-car experience and making it an extension of personal space. But one aspect of the automobile landscape is barely changing at all, especially among traditional OEMs: the car buying experience.

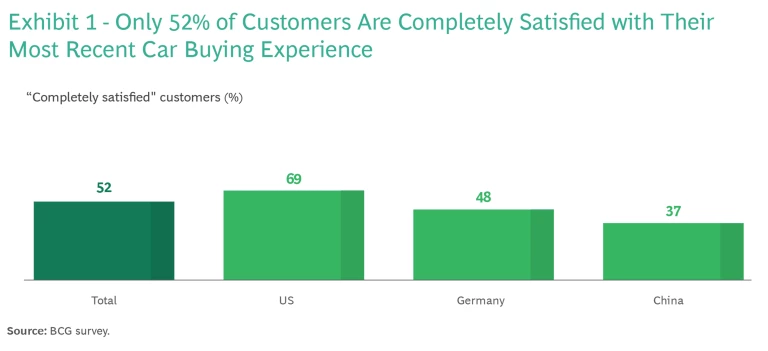

Only about half of car purchasers say that they were completely satisfied with their latest buying experience, according to a BCG survey of nearly 2,000 consumers in China, Germany, and the US who had purchased a car within the past two years. (See Exhibit 1.) Notably, in China, the percentage of completely satisfied buyers drops to 37%. Just 43% of respondents believe that their recent vehicle purchasing experience surpassed the one they had eight years prior. Moreover, survey respondents identified the critical “awareness phase”—when car buyers are inspired to buy a new car and choose the brands they favor—as the most disappointing part of the experience, fully satisfying the expectations of only 34% of customers overall and 20% of customers in the Chinese market.

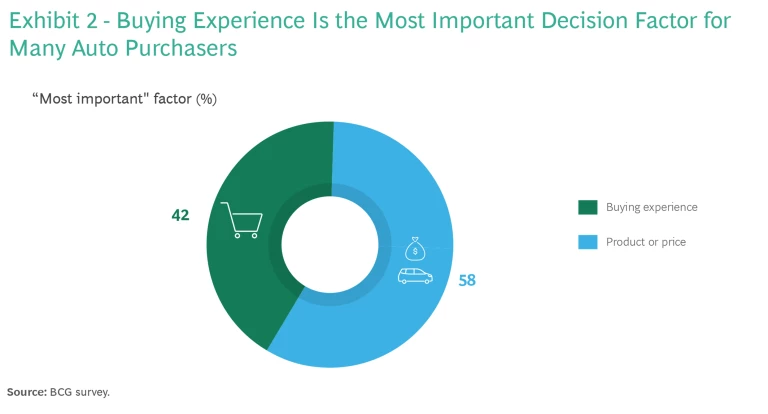

To amplify the significance of this frustration, 42% of respondents said that customer experience is the most important element in their car purchasing decision. (See Exhibit 2.) If the customer experience is negative, it can outweigh other considerations—such as brand, price, and performance—that OEMs invest heavily in.

Fortunately, OEMs can hurdle these shortcomings in their customers experiences if they are willing to embrace creativity and innovate their sales and marketing tactics. Emerging technologies offer numerous opportunities to create more attractive and enjoyable car purchasing experiences. By harnessing these technologies, OEMs can bolster customer loyalty, trigger repeat purchases, and ignite active word-of-mouth referrals to fuel top-line growth. Simultaneously, cost savings in sales and marketing operations can enhance their bottom line.

Three Technologies That Can Boost the Customer Experience

The most pivotal strategies to disrupt a prospective customer’s car buying journey fall into three categories:

- Direct-to-Consumer (D2C). The D2C model (not applicable in the US) allows OEMs to move closer to end-customers, selling vehicles directly to them through online channels (for instance), with physical dealers and agents acting as product experts. This approach can also aid potential buyers in customizing the vehicle and finalizing the sales paperwork. And D2C models increase price transparency and reduce or eliminate individual negotiations, depending on the legally permissible D2C model in a particular global region. Moreover, direct, web-based access to customers enables OEMs to collect massive amounts of customer data that can lead to further personalization of the purchasing experience and improvement of OEM products.

- Generative Artificial Intelligence (GenAI). For some time, OEMs have been channeling resources toward AI for autonomous vehicle (AV) driving and advanced driving-assistant technologies. But automakers have paid little attention to using AI to enrich the customer experience, even though the required level of investment is lower and the horizon for positive returns nearer. Among other things, AI can help OEMs analyze massive amounts of driving and usage data that their vehicles that are already on the road collect. This data can be combined with information drawn from customer responses and engagement during the purchasing process. Automakers can leverage these analyses to personalize and tailor offers, anticipating customer needs and preferences. GenAI can also scale interactions with customers, using smart chatbots in sales websites or call centers to engage potential buyers with comfortable natural-language dialogs to help facilitate vehicle decisions.

- Augmented Reality (AR) and Virtual Reality (VR). AR and VR create immersive, interactive landscapes and overlay digital information onto the real world. Although AR and VR are not new to the industry, the quality of these technologies has significantly improved in recent years. When deployed together, they can revolutionize the customer journey, allowing customers to experience the car in various simulated environments, explore configuration options, and virtually test-drive vehicles from their homes.

A Pop-Up Store in the Customer’s Living Room. Each of the technologies discussed above give OEMs the opportunity to enhance the customer experience. But when combined in larger imaginative strategies, they have the potential to unlock an immense transformation grounded in direct and personalized interaction between OEM and customers in an immersive experience.

One intriguing example involves what we call a pop-up store in the customer’s living room. With this approach, OEMs employ VR to create a digital showroom in customers’ homes, enabling customers to configure colors, interiors, accessories, and other features in real time, and to experience the car with various looks, feels, angles, and settings applied. Without leaving their homes, they can virtually test-drive cars in different terrains and conditions and enjoy a highly personalized and interactive experience.

To support the customer in this pop-up store adventure, a GenAI-enabled chatbot can suggest appropriate vehicles on the basis of the customer’s needs and preferences and can answer various questions that may arise. The bot also can recommend additional features or configuration choices after analyzing the customer’s profile—for example, suggesting four-wheel-drive for a person who frequently commutes on icy roads.

In addition, the bot can provide information on pricing, including leasing and financing options, and guarantee competitively low prices (even offering research that shows recent sales in the area) to convince a customer to order the vehicle at once via the online channel.

A Unique Customer Experience

Three characteristics of the living room pop-up store are distinctive in the context of vehicle sales journeys:

- True Customer Focus. Automobile buyers typically research and buy vehicles during nonworking hours—that is, when many dealerships are closed. The pop-up store is open 24-7 and therefore is always accessible on the customer’s schedule. Moreover, it uses its AI capabilities to personalize the buying experience in response to customer preferences identified from digital profiles, data culled from the sales process over many years, and vehicle usage data.

- Alignment with OEM Objectives. The pop-up store can actively steer sales efforts toward the OEM’s target customers and develop volume projections, without having to build complex incentive programs for dealers. Marketing and incentive programs appeal directly to customers and are effective immediately, eliminating the lag in a typical dealership model between launching a program and seeing its impact.

- Continuous Improvement. The retailer can continuously and automatically improve and update its pop-up store in response to recent customer interactions. It can systematically refine an individual customer’s profile throughout the purchasing experience, leading to increasingly tailored offerings. This personalized approach ensures that encounters with each customer are relevant and engaging. Moreover, the OEM can leverage the knowledge gleaned from a specific customer interaction across the sales channel to enhance the experience of other customers with similar attributes and preferences. Ultimately, the data that OEMs gather and use in the virtual reality pop-up environment can inform broad aspects of their business, such as portfolio strategy, R&D direction, and product management, packaging, and pricing. This will enable OEMs and retailers to align more closely with evolving market trends and customer attitudes.

The pop-up store in the customer’s living room is just one of several possible applications of the new technologies that OEMs can employ to their advantage. Another option is product testing communities, in which companies offer people game points for completing virtual vehicle-related tasks, such as driving a specific distance under certain driving conditions. Participants can earn more points from likes that they receive from other users. Players who collect the most points can win prizes such as serving as real-life test drivers for a week.

Yet another possibility involves convenient test drives. Shortly before officially launching a car, automakers can promote the vehicle in select cities, displaying the car in prime locations and allowing passersby to book test drives instantly via an app. Once in the car, drivers receive a short introduction through AR glasses, while a GenAI-enabled voice assistant answers questions and highlights relevant features. After the ride, the OEM offers the potential customer a video of the test drive and a summary of key data points (including speed, route, battery usage, and driver sentiment) via the app.

Other applications exist, as well—for example, exclusive entertainment. For autonomous driving environments and during relatively long electric vehicle (EV) charging intervals, OEMs can turn standard vehicles into entertainment venues, offering customers individualized music, movies, or gaming that they developed jointly with partners in the multimedia industry. Using such features of the car as variable seats, climate control, and ambient lighting, OEMs can orchestrate a uniquely immersive experience.

What Are the Benefits?

BCG recently analyzed how innovative companies create shareholder value and improve performance by adopting new technologies and developing unique approaches to outpace competitors in their market. In our Build for the Future (BFF) analysis of more than 2,500 companies, we found that only 17% of automotive firms had adopted immersive sales experiences—and those companies outperformed the rest of the industry. The data indicates that technology-based customer experience initiatives, such as integrated apps and market intelligence to understand customer needs and preferences, were a clear priority of the most advanced companies in the BFF analysis. This was not the case with lagging automotive companies.

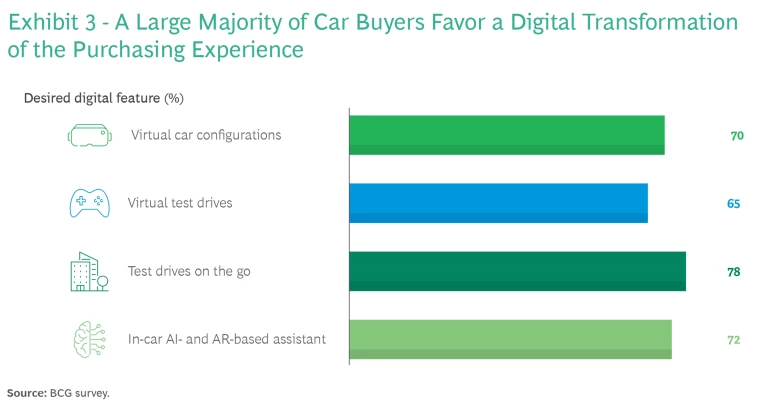

In light of today's competitive automotive market—where many vehicles share similar technical specifications, features, and performance—the overall customer experience plays a crucial role in setting OEMs apart, and there is clearly both room and a need for improvement. Just ask potential buyers. In our survey, around 70% of respondents said that they wanted new digital technologies to be a central component of purchasing a car. (See Exhibit 3.)

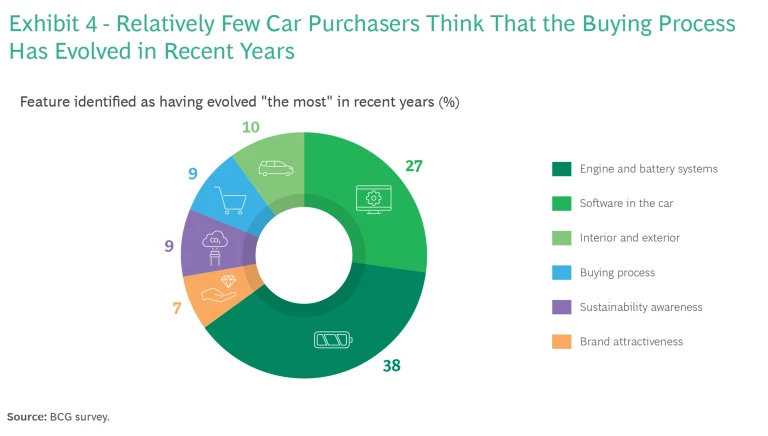

But only 9% pointed to the buying process as the most evolved aspect of the automotive industry in recent years. (See Exhibit 4.)

By integrating innovation and digital enhancements into the customer journey, OEMs can establish a distinctive identity and secure critical topline gains in a competitive landscape marked by declining global growth. The customer journey is not solely about selling a product, but also about creating a holistic experience that leaves a lasting impression. To set themselves apart, OEMs should focus on the following strategic steps:

- Establish exclusivity. Offering a seamless, interactive journey enhances customer loyalty.

- Create an innovator image. Adopting digital concepts such as AR/VR showrooms resonates with tech-savvy clients.

- Drive community building. A vibrant online community fosters brand loyalty and engagement.

- Enable personalization. Offering customers tailored experiences, from vehicle configurations to post-sales interactions, makes them feel valued.

- Emphasize convenience. Streamlining processes such as test-drive scheduling and purchasing can significantly enhance the customer journey.

A digitized customer experience can also sharply lower the cost base of OEMs. Traditional OEMs have long struggled with high costs of sales, driven by extensive dealer networks, physical showrooms, and traditional marketing efforts. These expenditures usually increase in line with rising vehicle sales, yielding only limited economies of scale.

In contrast, digital-native OEMs have a much leaner approach, leveraging online platforms and D2C models to streamline sales processes, reduce physical space, and minimize inventory. With their model, increasing vehicle sales affects the absolute cost base for marketing and sales only marginally. As a result, the relative costs for marketing and sales drop drastically as customer volume rises, making the digital-native OEMs’ strategy far more competitive than the traditional sales model. In fact, it translates into a savings of $2,000 to $4,000 per vehicle sold—a number that will increase as sales expand, due to the infinite scalability of the model at marginal costs.

OEMs can also achieve substantial short-term marketing savings. By understanding the needs of customers better, companies can focus their marketing budgets on precision and personalization, while reducing their spending on more generic promotional campaigns. Furthermore, measuring marketing and sales return on investment is more accurate and precise because it reflects significantly more data and AI analysis, enabling continuous improvement in budget allocation.

Given the stakes for OEMs in the automobile’s transformation—the size of their investments and the sales growth that they are counting on to kickstart EV and AV mobility—an equally aggressive approach to selling and marketing their vehicles is crucial. By integrating the emerging technologies of Big Data, GenAI, and AR/VR, companies can put themselves in a better position to drive profit margins that only tech-savvy automakers enjoy today.

Currently, OEMs may view these technologies as merely “nice to have” and perhaps as capabilities to casually consider. But tomorrow comes quickly in a disrupted industry. For this reason, OEMs must prioritize implementing new sales and marketing environments—and building the technological capabilities to navigate them efficiently and effectively—or risk playing catch up.

The authors thank their colleagues Johannes Seyfried and Mario Farsky for their contributions to this report.