Like corporate boards elsewhere, boards in emerging markets are grappling with a growing number of complex challenges—not just sustainability, but more recently, the rise of generative AI (GenAI) and intensifying trade and geopolitical disruptions. Their challenges are further complicated by their internal governance issues and an evolving governance landscape.

How can emerging markets boards more effectively navigate these challenges? That is the focus of this report, part of our series produced jointly with Heidrick & Struggles and INSEAD, on how boards are responding to today’s complex trends and disruptions. Our full report (see below to download) is based on our global survey of 444 directors and CEOs, out of which 112 are from emerging markets, and a series of regional roundtables.

How Well Are Emerging Markets Boards Managing Sustainability?

Emerging market boards are taking decisive action in response to sustainability and other global trends—in many cases, more so than their developed market counterparts. Notably, more than 60% of directors in emerging markets reported that their companies are making long-term investments in new sustainability-related technologies, compared with 48% of developed market directors. Additionally, 16% of emerging market companies are pursuing mergers and acquisitions prompted by GenAI, surpassing the 10% seen in developed markets.

There is, however, a significant gap in sustainability progress between emerging market companies and those in developed markets, according to various sources. Why the disparity?

For one thing, developed market companies generally embarked on their sustainability journey much earlier—whether driven by societal pressures or regulatory or legislative mandates. Moreover, the sustainability journey is more complicated in emerging markets because governance practices, the general operating environment, regulatory landscapes, and political realities are still evolving—and at different rates.

In addition, we found that:

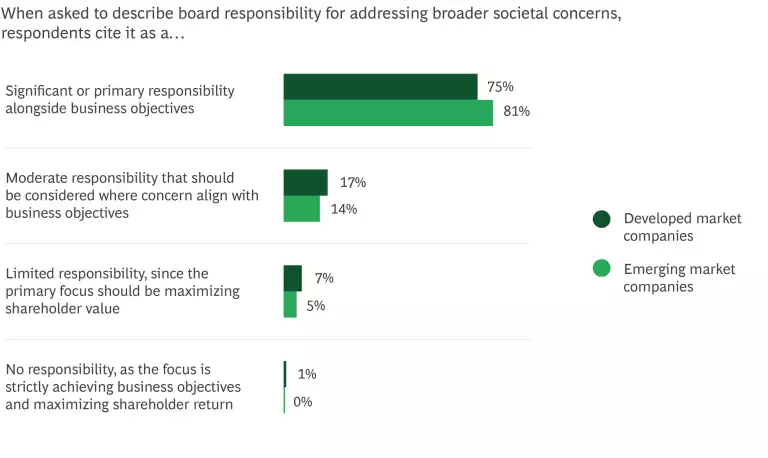

Although trailing in progress, they lead in commitment. While the majority in both emerging and developed markets recognize the board's responsibility for societal concerns, this sentiment is slightly stronger in emerging markets: 81% of emerging market survey respondents view the board as having a primary or significant role, compared to 75% in developed markets. (See the exhibit.)

They share a number of priorities with their developed market peers. Both emphasize strong risk management, stakeholder engagement, and flexible long-term resource allocation strategies.

Their priorities diverge in two particular ways:

- Overall, emerging markets boards spend less time on sustainability education (29%) than the global average (49%). However, they recognize the need to access critical sustainability information.

- Sustainability is more often treated as a separate agenda item than as an element integral to the company's overall strategy. This makes it harder to demonstrate its role in driving long-term value.

The environment poses challenges. Climate change has a disproportionate impact on developing nations—yet companies in these regions are governed by sustainability targets set by developed economies.

Other key inhibiting factors include:

Limited access to green finance and other financing constraints. The funding gap for energy transition initiatives at emerging markets companies is twice as large as that of developed market companies.

Different sources of influence. In developed markets, employees have often driven initial sustainability efforts, while in emerging markets, regulators and investors typically play that role—but there are signs this is beginning to shift .

A web of different regulations. Emerging market companies that supply developed markets face an ever-expanding set of regulations that vary from region to region.

The impact of international regulations, which is often underestimated. For instance, new European regulations apply not only to companies based in the EU, but also have ripple effects down the supply chain.

The Limitations of Existing Governance Practices

Many general corporate governance practices in emerging markets are not adapted to handle the kind of complex challenges companies face today. This not only complicates the integration of sustainability into governance structures, but it also makes it difficult to grasp how other emerging trends—such as GenAI, trade dynamics, and geopolitical risks—will impact how companies create value, and to what extent.

On top of this, the gaps in institutional frameworks and legislative and regulatory structures, along with political realities, leave companies with little external support or pressure to improve their governance standards.

Among the other complicating governance factors we uncovered:

Not enough board diversity. Boards in these regions tend to rely on conventional professional profiles, so that in background, expertise, generation, and overall mindset, most are quite homogeneous. This lack of diversity, as well as a lack of independent directors, can also hinder a company’s ability to adapt and remain competitive in a rapidly changing global environment.

Traditionally, a more “status quo” mindset. Our roundtable participants pointed to the entrenched nature of some emerging markets boards, which seem more focused on preserving the status quo than on driving meaningful change.

A board-management dynamic that is often more transactional than collaborative. Such a relationship prevents the kind of deep, candid engagement necessary for boards to fully perform their oversight function and contribute value to management and the company.

How to Move Forward

Despite their later start in the sustainability journey and their particular internal and external challenges, emerging markets boards can find advantage in the fact that they are working from more of a clean slate. With their fresh perspectives—and the benefit of global experiences to draw from—they have the ability to design innovative sustainability strategies that are more suited to their unique contexts. Amid a more nascent regulatory environment, they have the opportunity to help shape governance policy and practices. Ultimately, they are well-positioned to forge a more responsible and resilient business ecosystem, driving long-term value while contributing to the development of future-forward governance frameworks.

Our full report presents a detailed list of practical questions that directors can take into the boardroom today to evaluate their overall governance practices and structures as well as the effectiveness of their sustainability oversight—and where they need to focus and act in both areas. In this way, they can move quickly to enhance their governance effectiveness, build resilience, and create long-term value.