Many

private equity

managers consider migrating a portfolio company’s enterprise resource planning system to be an unwelcome complication—but we believe it can be an opportunity to create greater operational and financial value during the holding period. PE firms should approach ERP-related requirements and interventions for portfolio companies more positively and systematically, from due diligence to exit. With this in mind, we have identified several actions PE firms and their portfolio companies can take to better ensure that these projects succeed.

Preserving Portfolio Valuations

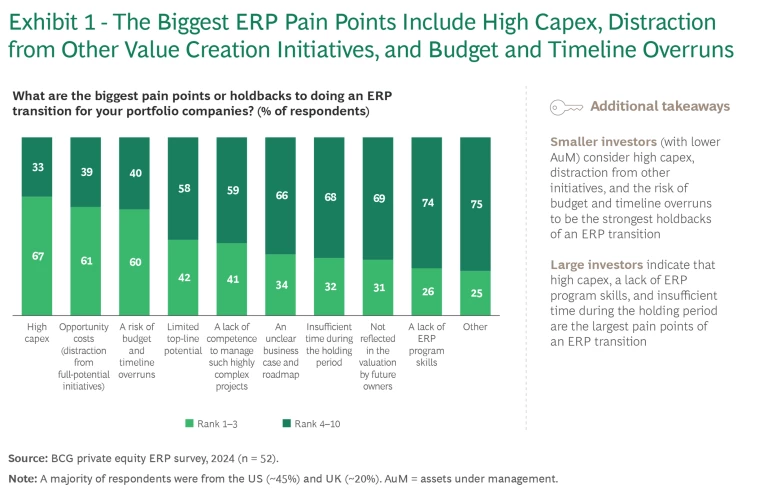

An upgraded ERP system can generate operational efficiencies, better decision making, as well as improved customer and employee satisfaction. But PE firms have historically avoided upgrading the ERP systems of their portfolio companies because these projects are expensive and time consuming, with benefits that are often difficult to measure. And there are many pain points along the way. (See Exhibit 1.)

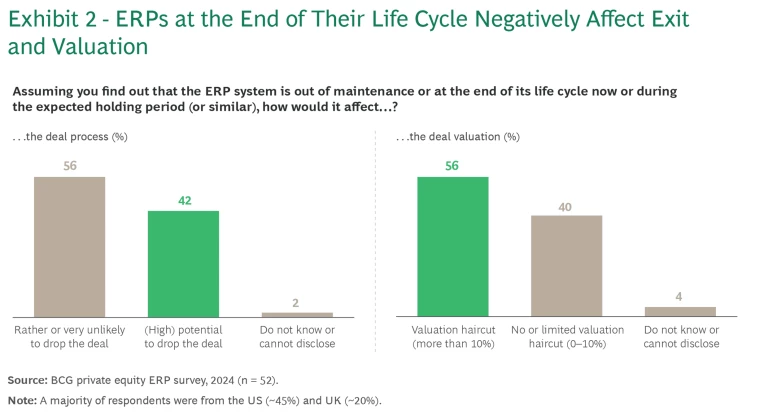

Despite the challenges related to upgrading an ERP system, most PE investors understand that a portfolio company’s valuation will take a hit if its ERP system is at the end of its life cycle: 56% predict a haircut of more than 10% (about 43% anticipate a reduction of 10% to 20% and approximately 13% expect more than that). (See Exhibit 2.) So it’s important that the investment, operating, and digital teams of PE firms become more comfortable with ERP optimizations, migrations, and re-platformings.

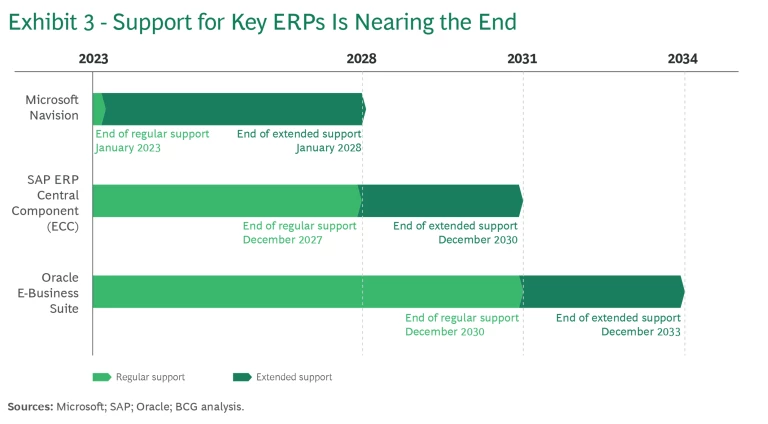

Even if valuations were not a concern, however, maintaining the status quo won’t be possible for much longer—and it will become increasingly expensive to do so. SAP’s widely used ERP Central Component (ECC) product is sunsetting, and users will need to migrate to SAP S/4HANA or another newer solution by 2030. The implications of this transition are acute given that SAP has a market share of more than 50% in Europe, Asia-Pacific, and the US. Meanwhile, extended support for Microsoft’s Navision is also ending in the near term. (See Exhibit 3.)

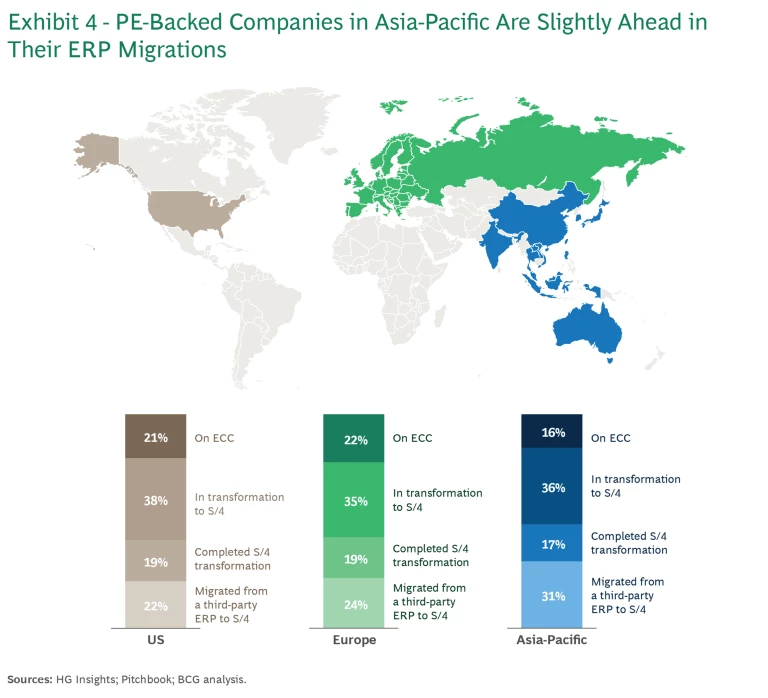

According to our research, SAP’s discontinuation of ECC globally will affect 726 PE-backed companies. Roughly two-thirds have ongoing or completed ERP migrations, but about 20% have not even begun their transitions. (See Exhibit 4.) The time to act is now because ERP transformations can take multiple years to implement.

Reaping the Benefits of the ERP Transformation

PE firms should assess a target’s ERP landscape as part of a technology or digital due diligence process before the acquisition. Increasingly, any PE firm with a portfolio company on SAP ECC—and hoping for a successful exit—will need to show a plan for a new ERP system or ongoing implementation. Moreover, any newly acquired company on ECC will almost certainly need to be migrated to SAP S/4HANA (or a different future-ready solution), assuming a typical holding period of three to seven years. And it’s worth noting that a high number of PE transactions are carve-outs or add-on acquisitions, potentially triggering ERP migrations.

A modern ERP is the foundation for streamlined business processes, financial and operational transparency, and hence a cost-efficient organization—and is a key building block for automation, data-driven insights, and leveraging GenAI.

This can lead to better decision making, internal improvements, as well as an enhanced customer experience and engagement. Typical examples are better category management, improved supply chain management and inventory levels, and data-driven pricing. For example, in our experience, upgraded demand management in the form of increased forecast accuracy and fewer lost sales can lift revenue 2% to 4%, while a greater focus on products geared toward priority customers can boost gross margins by 50 bps to 250 bps. Meanwhile, enhanced supply planning can lower goods inventory by 5% to 20% and raise gross margins by 25 bps to 50 bps by reducing inventory write-offs.

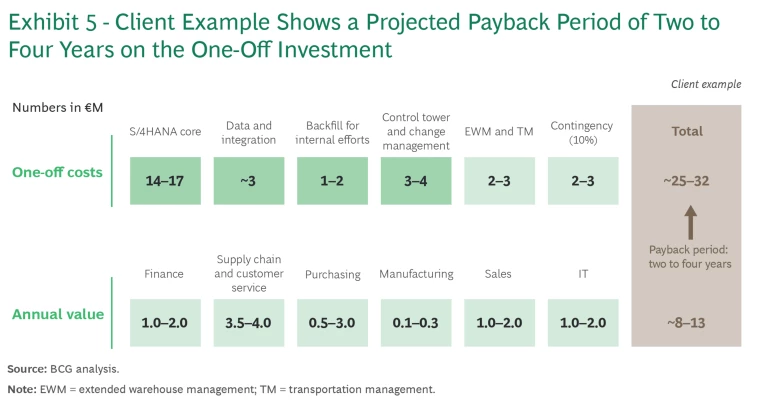

Further, it’s reasonable to expect a payback for these transformation costs within the PE firm’s holding period. We are working with one client that predicts a payback in two to four years. (See Exhibit 5.)

According to market benchmarks, the migration to a new ERP costs from 2% to 4% of a company’s revenue—varying based on the scope, degree of business process redesign, and complexity. Assuming a portfolio company with $500 million in revenue, the investment to re-platform would run anywhere from $10 million to $20 million, depending, for example, on the scope of the system. While that is a significant sum, it also means that an EBITDA exit multiple of 10 would require only $2 million in EBITDA benefits to pay back the investment—which is realistic based on the business benefits and improved IT run cost. So, although the investment horizon limits the duration for operational return on investment, the exit accelerates the payback.

Embarking on the Transformation

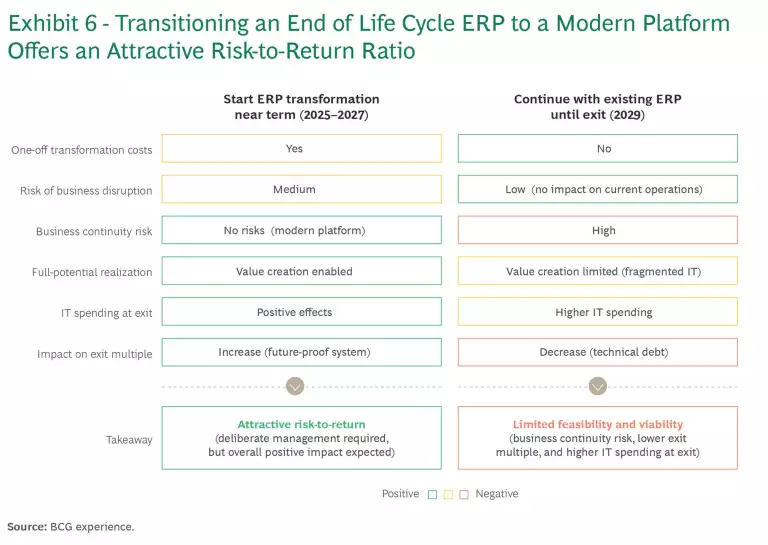

Transitioning portfolio companies to a new ERP system can offer an attractive risk-to-return ratio for PE firms. (See Exhibit 6.) But successfully managing an ERP migration hinges on several critical dimensions:

- The current progress of the ERP transition within the portfolio company, if an existing program is already in place.

- The stage in the PE deal cycle, such as during due diligence, early or late in the holding period (on the buy-side today, for example, just 63% consider ERP transformations prior to the nonbinding offer).

- The duration of the company’s holding period.

- The significance and complexity of an ERP system (for example, whether it’s essential for the offering or only for back-office activities).

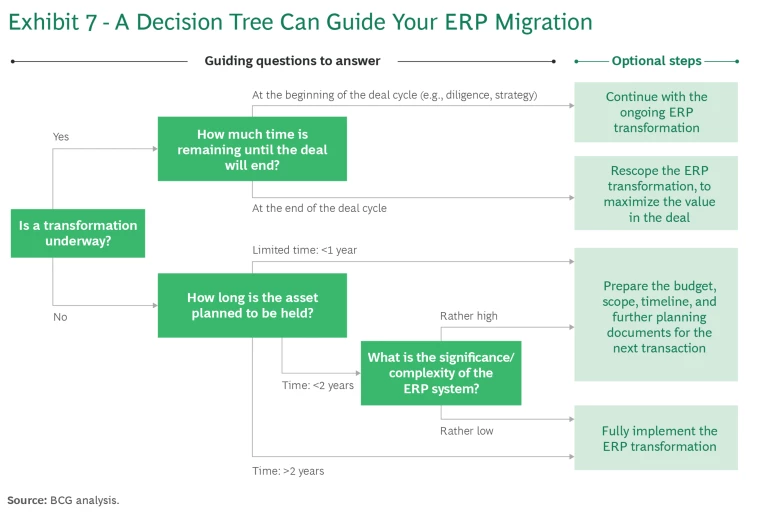

With these four considerations in mind, a PE firm must choose whether to fully implement an ERP transformation or merely prepare and initiate it, allowing the next owner to complete it. (See Exhibit 7.) In the latter case, it is important to show ERP migration plans are in place so that potential buyers are confident the risk is being managed.

If the PE firm decides to proceed with the ERP upgrade, determining its scope is essential. The three primary scope strategies are:

- Greenfield. An entirely new ERP is implemented, including updated business processes. This approach can yield the greatest benefits in terms of optimizing processes but demands many resources and has a long implementation time.

- Brownfield. An existing system is fully migrated to a new platform. This causes less operational disruption, but technical debt is also transferred.

- Hybrid. This strategy balances transformation and continuity but can stretch the timeline and increase costs.

Taking Key Steps to Prepare

No matter which of the three strategies a firm chooses, these transformations are large projects with many stakeholders, external partners, and a high degree of complexity. They affect the entire organization and require strong collaboration and contribution by both business and IT. They necessitate in-depth planning, so we suggest PE firms, in coordination with portfolio companies, take the following five steps over a 12- to 18-week period:

- Develop a clear business case. Define the case for change linked to business outcomes, financial benefits, and other value that the upgrade will create.

- Set the business target. Identify target capabilities, processes, data picture, and scope. Agree on business performance metrics and conduct a business readiness assessment.

- Establish a future-proof data strategy. Determine the target and intermediary picture and scope, including target architecture and the supporting integration strategy.

- Create effective program governance. Set up a program organization and governance framework across business and technology, including strong sponsorship from top management.

- Build a powerful deployment plan. Outline the change management and risk mitigation plans. Synchronize the ERP transformation with other ongoing programs.

Tracking Project Progress

Even the most solid transition plans can succeed only with solid execution. Once the migration is underway, the company must monitor the project closely—including budgets and timelines—and be ready to take immediate and decisive action if the plan begins to veer off track. That means assigning people clear responsibilities and holding them accountable.

A Practitioner’s Perspective

Carl-Magnus Hallberg is a technology enablement managing director at EQT Group and has overseen numerous ERP re-platformings during his career. He recognizes the challenges of such programs and the importance of involving the right experts: “ERP migrations historically have a mixed track record, including in PE. However, by following a clear ownership playbook for de-risking migrations, and by accessing experienced teams when needed, you can create value from such migrations.”

In contrast to corporations, PE firms typically engage in multiple ERP projects across their portfolio over time. The collective learning from these projects should be bundled somewhere in the organization so that dedicated experts can advise in new situations to drive continuous improvement and mitigate the risks of poor execution. According to our survey, just 25% of PE firms have a dedicated team involved in the ERP transitions of their portfolio companies.

Capturing Value

The discontinuation of SAP’s ECC system and the emergence of advanced technologies such as GenAI are powerful catalysts, compelling PE firms and their portfolio companies to reassess and revitalize their ERP strategies. These transitions present significant challenges but also opportunities for competitive differentiation by harmonizing and standardizing operations , leveraging innovative technologies, and enhancing the agility and resilience of portfolio companies. This, in turn, boosts value by improving decision making and strategic planning. On the flip side, transformations distract attention and resources from other potential initiatives—creating an opportunity cost that remains a major holdback for many investors.

Looking at the bigger picture, enterprise technology and digital transformation are evolving at an unprecedented pace. ERP migrations are just one piece of the digital transformation puzzle—but are core to success and essential if PE firms and their portfolio companies are to leverage cloud technologies and AI to build a reimagined, future-proof enterprise. Given the importance of ERP, we believe these platform upgrades can drive substantial value across the investment life cycle of PE-backed companies.

The authors thank Marc-André Drillose, Sebastian Heumann, Marius Hillert, Michael Krause, and Abhinav Sharma for their contributions to this article.