Carbon capture, utilization, and sequestration (CCUS) is shaping up to be an important decarbonization lever owing to its ability to tackle emissions in hard-to-abate sectors. The value chain involves transporting the CO2 that is captured from large stationary emitters—such as power, cement, chemical, and iron and steel plants—so that it can be permanently sequestered in depleted oil and gas fields or saline aquifers or, to a lesser extent, utilized in different applications. In 2023, the total worldwide capacity of commercial CCUS

Where sequestration opportunities close to emitters are limited, cross-border shipping of CO2 can play a key part in the CCUS value chain and help mitigate climate change, according to Opportunities for Shipping to Enable Cross-Border CCUS Initiatives, a new report by BCG and the Global Centre for Maritime Decarbonisation (GCMD). Shipping CO2 will be especially important in Asia-Pacific (APAC) due to the region’s geography, with vast oceans and seas between emitters and sequestration sites.

Cross-border shipping of CO2 can play a key part in the CCUS value chain and help mitigate climate change.

We estimate that around 170 MtPA of CO2 captured using CCUS technology will be transported globally via shipping by 2050, with a significant volume operating within APAC. This will require 100 to 200 vessels, costing up to $30 billion. Creating a market of this size will necessitate actions from both the public and the private sectors. These include economic support measures, long-term contracts for midstream players, greater clarity on key standards, as well as an overarching regulatory framework that establishes sector rules and regulations, such as for the cross-border movement of CO2.

Three Key Insights

Through our collaboration, three important insights have emerged relating to the role of shipping in unlocking the potential of cross-border CCUS, the importance of technical specifications and standards as enablers, and the regulatory hurdles that threaten to hold back its development. While the insights are globally applicable, the report specifically highlights opportunities for shipping that support APAC governments’ ambition to decarbonize their economies. We see the broadest demand and need for shipping in this region.

The Role of Shipping

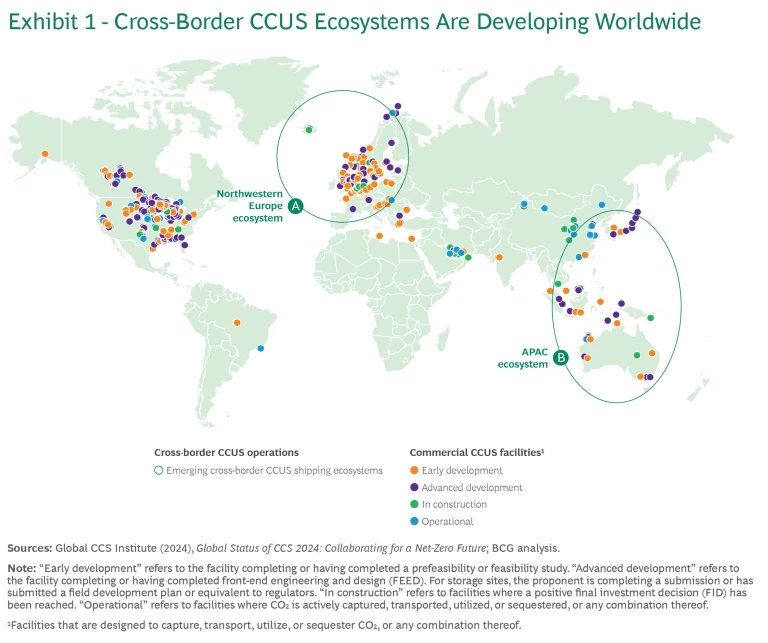

Shipping is a viable solution for transporting captured CO2 across borders because it is more cost-effective than pipelines over longer distances (particularly across more than 500 kilometers and below an annual volume of 5 MtPA). Given the cost advantage, maritime transportation of CO2 is expected to emerge as part of the CCUS value chain in APAC and Europe, especially where some clusters of emitters do not have local access to CO2 sequestration sites. (See Exhibit 1.) Norway’s Northern Lights cross-border project, for example, will include the shipping of captured CO2 from industrial sources to an onshore terminal on the country’s west coast, with the first injection into a geological formation in the North Sea expected in 2025. In APAC, shipping can help countries achieve ambitious decarbonization targets by connecting regions with substantial CO2 emission volumes, such as Northeast Asia, to regions with available sequestration capacity, such as Australia and Southeast Asia.

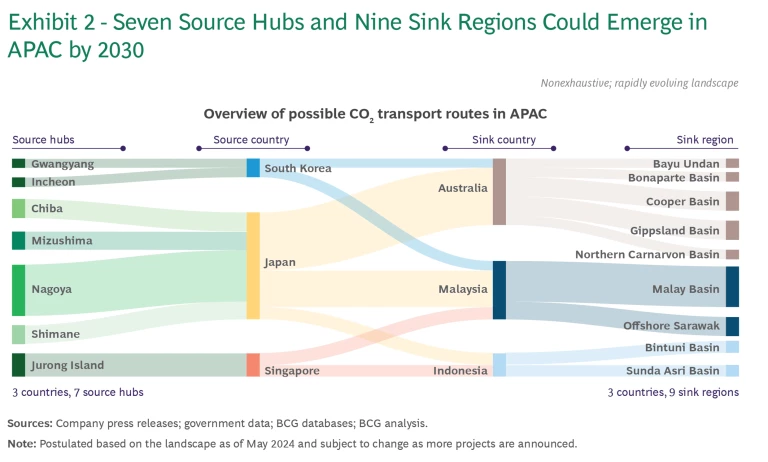

Several APAC governments, including Australia, South Korea, Japan, Singapore, Malaysia, and Indonesia, are pursuing partnerships and initiatives to facilitate cross-border CO2 transportation and sequestration. On the basis of these agreements, we have identified multiple routes that could emerge by 2030. (See Exhibit 2.)

We estimate that the total volume of captured CO2 transported by sea across borders within APAC could reach about 100 MtPA by 2050. Shipping this volume of liquefied CO2 would require 85 to 150 vessels, costing from $10 billion to $25 billion.

The Importance of Technical Specifications and Standards

To be shipped, CO2 must be liquefied and kept under pressure. Today, CO2 is shipped mainly for food and beverage applications and is usually conveyed under medium-pressure

Getting the technical aspects right is essential for seamless cross-border CCUS project development. Consequently, greater coordination and alignment on specifications governing infrastructure and the conditions under which CO2 can be transported will be required. The private sector can lead the efforts to achieve effective standards, with governments playing a role in formalizing and endorsing standards once companies reach a general agreement.

The Impact of Economic and Regulatory Gaps

We have identified several gaps in financial support mechanisms and regulations that need to be addressed if cross-border CCUS is to flourish.

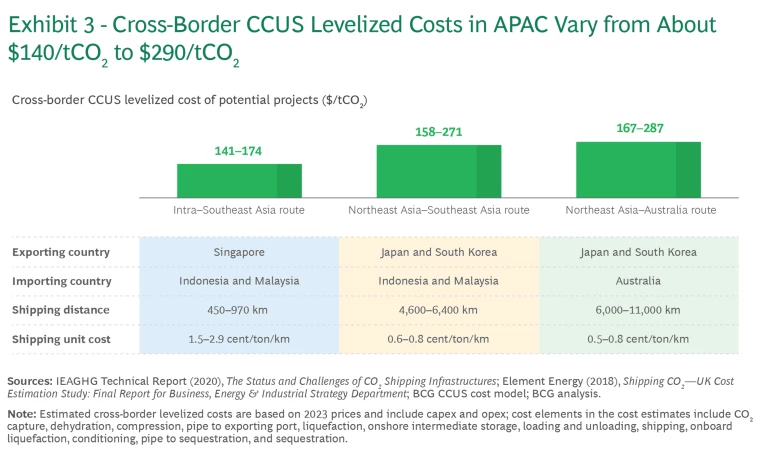

Economic Gaps. The investment required to scale up cross-border CCUS is substantial. The end-to-end levelized

Capture and shipping costs account for 60% to 80% of the estimated total expenses of cross-border CCUS routes. Longer shipping routes, such as from Northeast Asia to Australia, tend to have higher average levelized costs owing to greater shipping costs. Moreover, CO2 shipping routes within APAC involve emitters with low CO2 concentration streams—including cement, chemical, and iron and steel plants—resulting in increased capture costs compared with emitters that have high concentration streams.

Because of these expenses, a significant gap exists for potential CO2 exporters between levelized cross-border CCUS costs and domestic carbon pricing. In APAC countries, carbon taxes and emissions-trading-system prices are $2 to $18 per ton of CO2, which is far below the range of levelized CCUS costs within the region. Without additional financial support, the challenging economics of cross-border CCUS could impede its development.

Regulatory Gaps. Nascent regulations in several areas threaten to hinder the development of cross-border CCUS in the region. In countries across APAC, domestic regulations need to be established to govern carbon accounting and verification methodologies for CCUS, establish permitting procedures for cross-border CCUS projects, and define players’ liabilities. In addition, bilateral and multilateral frameworks are required to clarify the jurisdictional authority responsible for cross-border projects and provide certainty on the allocation of liabilities (such as commercial and operational liabilities for CO2 leaks). Establishing these regulations and frameworks can provide greater certainty to project developers—mitigating policy risk concerns and supporting CCUS projects and offtake agreements.

Three Components to Actuate Cross-Border CCUS via Shipping

Governments and private sector players need to provide three essential elements to activate the shipping industry for cross-border CCUS.

Direct Economic Support

Governments can extend economic assistance to midstream players, such as shipping and port providers, using financial incentives, support packages that can underwrite cross-value-chain risks, and other forms of business model support. Such measures can help to reduce upfront capital expenditures and overall project costs for companies, which is particularly important for cross-border CCUS and shipping to take off.

Long-Term Contracts and Minimum Volume Guarantees

Emitters will need to provide long-term contracts to shipping and terminal providers—ideally agreements of ten years or more—and commit to transporting a minimum volume of CO2 to give these value chain participants greater certainty and allow them to plan ahead. (Together with owners and operators of sequestration capacity, emitters are expected to orchestrate the cross-border CCUS value chain by providing long-term contracts, owning key cargo [CO2] and infrastructure, and leading consultations with governments.) Such commitments also enable shipping and terminal players to obtain the necessary financing for investing in vessels and capacity.

Clarity on Standards and Specifications for Shipping

For the sector to expand, shipping providers need clarity from regulators and leading companies on the standards governing technical matters such as permissible impurities in CO2 cargo, operating pressures, and temperatures along the value chain. Early alignment on specifications will enable midstream players, such as shipping and terminal providers, to put in place interoperable infrastructure.

Developments in the upstream (carbon capture) and downstream (sequestration) parts of the CCUS value chain will inevitably have a major impact on midstream players, and vice versa, owing to interdependencies along the value chain. Providing financial incentives and regulatory certainty to upstream and downstream companies can help to stimulate investment certainty for the midstream. Consequently, regulators and the private sector will need to monitor linkages between the different parts of the value chain to ensure that they are aligned.

The success of CCUS hinges on the development of all elements of the value chain—including midstream activities, such as shipping and intermediate storage—simultaneously. By working together and overcoming the obstacles outlined in this report, both public and private stakeholders can successfully develop the CCUS value chain in its entirety, unlocking the valuable decarbonization opportunities that carbon capture can offer.

This research was a collaboration between GCMD and BCG. GCMD and BCG engaged with approximately 60 individuals from 17 industry stakeholder organizations when developing the report. This included more than ten hours of group workshops and 16 interviews.

ABOUT THE GLOBAL CENTRE FOR MARITIME DECARBONISATION

The Global Centre for Maritime Decarbonisation (GCMD) was established as a non-profit organisation on 1 August 2021 with a mission to support the decarbonisation of the maritime industry by shaping standards, deploying solutions, financing projects, and fostering collaboration across sectors.

Founded by six industry partners namely BHP, BW Group, Eastern Pacific Shipping, Foundation Det Norske Veritas, Ocean Network Express and Seatrium, GCMD also receives funding from the Maritime and Port Authority of Singapore (MPA) for qualifying research and development programmes and projects. Since its founding, bp, Hanwha Ocean, Hapag-Lloyd and NYK Line have joined as Strategic partners. To-date, over 100 centre- and project-level partners have joined GCMD, contributing funds, expertise and in-kind support to accelerate the deployment of scalable low-carbon technologies and lowering adoption barriers.

Since its establishment, GCMD has launched four key initiatives to close technical and operational gaps in: deploying ammonia as a marine fuel, developing an assurance framework for drop-in green fuels, unlocking the carbon value chain through onboard carbon capture and articulating the value chain of captured carbon dioxide as well as closing the data-financing gap to widen the adoption of energy efficiency technologies.

GCMD is strategically located in Singapore, the world’s largest bunkering hub and busiest transshipment port. For more information, go to www.gcformd.org.