Companies that build brand value

generate significantly higher sales and shareholder returns than those that don’t

. But most marketers aren’t generating these returns because they are unable to effectively demonstrate the direct impact of their brand investment.

The So What

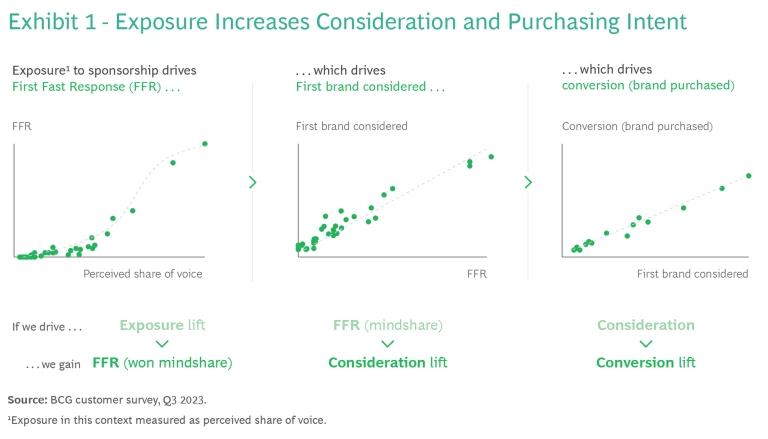

Brand strength is correlated with “mindshare.” The more closely a customer associates their needs with your offering, the greater the consideration and purchasing intent near-term and longer-term.

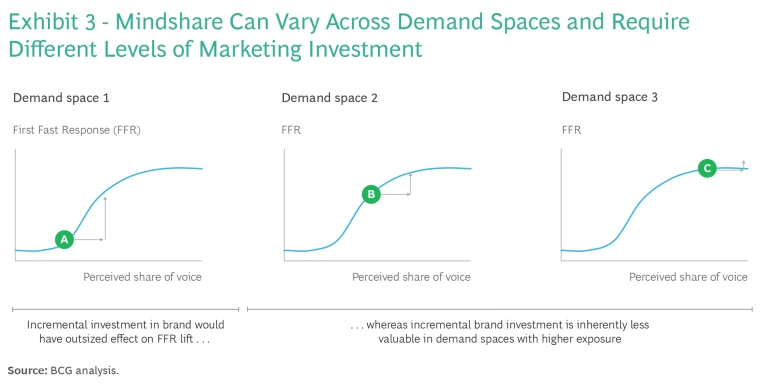

Mindshare growth follows an S-curve: It takes significant investment to build but much less investment to maintain. Marketers can drive faster growth up the S-curve by targeting demand spaces that are defined by customer needs and by focusing on total impressions, not just paid ones. These activities build exposure and increase a customer’s receptivity to future impressions.

Metrics such as BCG’s

First Fast Response

(FFR) allow marketers to measure and influence mindshare.

Dive Deeper

It is better to be big in a smaller footprint than small in a bigger footprint. As customer mindshare grows, receptivity to future impressions also grows, conferring scale advantage. Without knowing how the S-curve works, some “challenger” brands deploy spending over too many initiatives.

The small footprint is a demand space. Marketing activity focused on demand spaces can lift mindshare by 10 to 20 points on average. And it’s highly efficient. Our studies found that when a customer is targeted by relevant marketing in a demand space, they are up to five times more likely to name that brand first over other competing brands.

Capturing mindshare is not just about paid media. Direct and indirect exposure (that comes from using or hearing about a brand) can drive mindshare just as much as paid impressions, and it’s far cheaper. In fact, some of the most successful brands in the world have had limited reliance on paid impressions yet achieve high mindshare.

Growing total “share of mindshare” matters. Total perceived impression volume (direct, indirect, and paid combined) is highly correlated with mindshare and consideration—achieving a relationship value of more than 0.8 in our studies. This correlation means that a challenger brand looking to dislodge a competitor should offset its lower direct exposure by investing in more paid media.

Growing mindshare requires sustained investment. A 1 percentage point increase in FFR can drive a 1.5 to 2 percentage point lift in conversion. (See Exhibit 1.) But marketers must be willing to invest for multiple years—measuring and refining efforts and partnering with finance and the product organization to capture the full performance picture. By working in these ways, one client achieved a return of three times its investment.

Content isn’t a volume game. It’s better to deliver fewer messages targeted at specific demand spaces than many messages aimed at broad segments. The more authentic and engaging those messages are, the greater the ROI.

Now What

Current brand tracking tools are inadequate to measure and predict mindshare and give marketers the lift they need. This is the time for a new approach.

Start measuring mindshare. Marketers should begin tracking mindshare and total exposure by demand space. The correlations between the two can help them quantify the lift from a total addressable market and lifetime value perspective. FFR deploys and delivers results in real time.

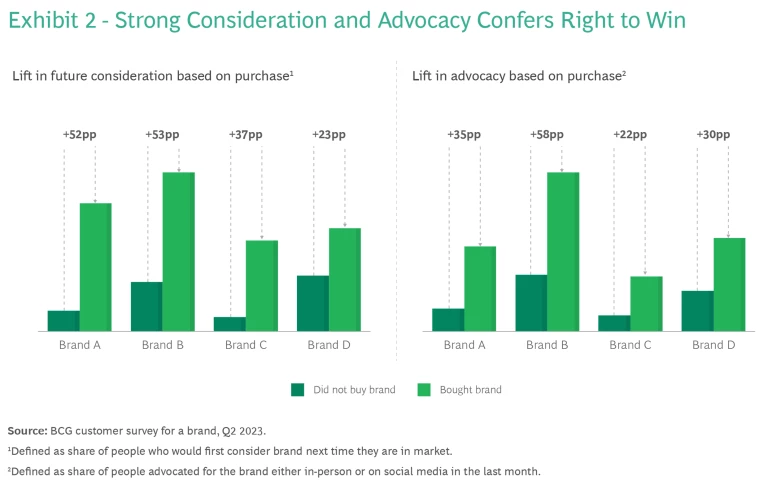

Know if you have the right to win. Marketers should determine the relative strength of their brand’s consideration and advocacy on a demand space level. High scores confer what we call the “right to win.” (See Exhibit 2.) Marketers can shift funding from areas where their brand enjoys strong mindshare and right to win into spaces where they need to “go big” to challenge current leaders.

Leverage exposure. The more a customer is exposed to a brand—whether directly or indirectly—the more the brand imprints, so each incremental impression matters. Growing mindshare makes it harder and more expensive for challenger brands to compete, further cementing a dominant brand’s advantage.

Identify where you sit on the S-curve. Marketers should look at each key demand space and plot their brand’s positioning. (See Exhibit 3.) Brands that are underpenetrated, as defined by having low perceived share of voice relative to their competition, will need the most investment intensity—and patience to ride out several years of low returns. Those at the upper end of the S-curve will see less marginal benefit from increased spending, allowing those resources to be reallocated.

The authors are grateful to Katherine Lou, Robbie Faselt, and Julius Niehaus for their contributions to this article.