As a big sprawling industry, health care has a sizable carbon footprint accounting for 8.5% of greenhouse gas emissions in the US and 4.5% of worldwide emissions. About one-third of health care’s carbon emissions and most of the waste it generates are contributed by medtech products—a term that comprises disposables as well as large and small technology-based instruments and devices used for patient diagnoses, care, and treatments. That is certainly troubling, but the good news is that more than 50% of these emissions and a large amount of waste could be eliminated by circularity—or, put simply, fewer materials and more reuse and recycling.

Considering the worsening effect of carbon emissions and waste on the environment and quality of life, the medtech sector cannot afford to neglect this opportunity to improve its record. After all, if medtech exists to improve patient health, environmental implications of its products must also be paramount.

How Circularity Can Make a Difference

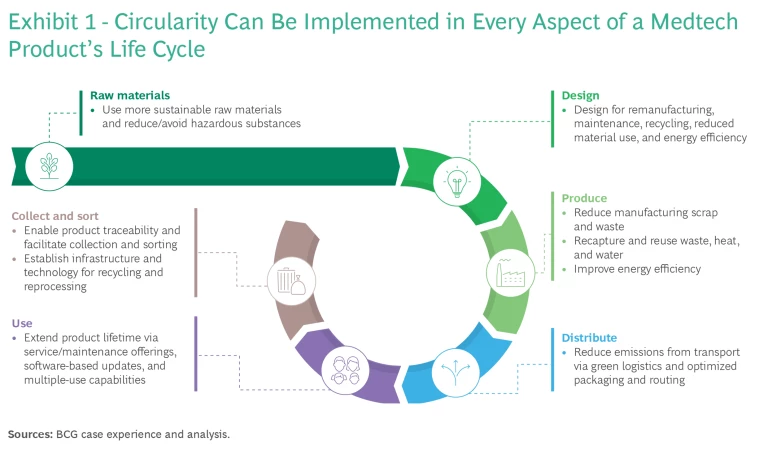

Circularity offers a potentially powerful solution because it means doing more with less. It entails minimizing material consumption and use of harmful substances in products and production, keeping products and parts in use for as long as possible, and recycling products at end of life. All these elements contribute to reducing carbon emissions and waste.

Circularity is a shift from the linear model of “take, make, waste” to a business ethos of “reduce, reuse, recycle.”

Circularity is a shift from the linear model of “take, make, waste” to a business ethos of “reduce, reuse, recycle.” To make this transition, medtech companies need to consider changes across the entire product life cycle—from raw materials through design, production, distribution, product use, and product end of life (see Exhibit 1).

Medtech companies that have already embraced circularity steps are reporting positive outcomes. For instance, US-based NewGen Surgical claims that its biobased emesis basin reduces CO2 equivalents by 80% compared with others widely used today, while the carbon footprint of Swedish firm Mölnlycke’s biobased surgical drapes is 20% smaller than traditional products. Further, a 2021 academic paper on medical remanufacturing of catheters demonstrated that increased recycling and remanufacturing can result in CO2 savings of as much as 50%, largely driven by less new-plastic production.

The waste reduction potential varies as well by product type. For instance, surgical gloves made of biobased materials eliminate all plastic waste, refurbished MRI machines or a reengineered glucose monitoring system cut waste by more than 50%, and product miniaturization diminishes waste by 10% to 50%.

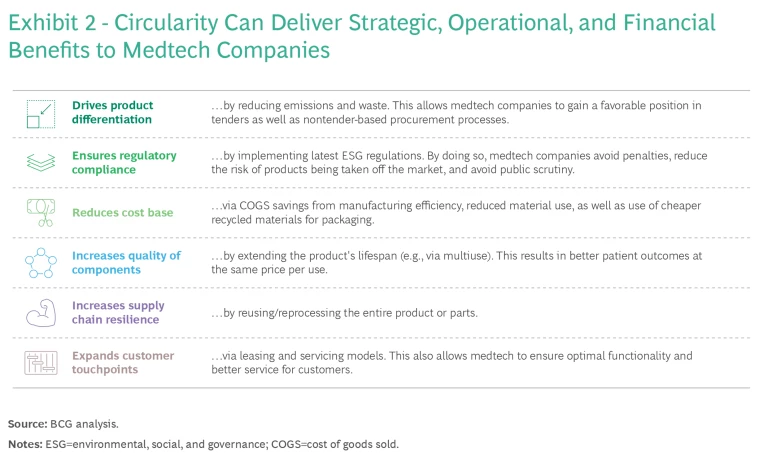

And on the business side, medtech firms that choose circularity can realize benefits such as product differentiation, cost reduction, and improved product quality and enhanced features at same price point per use (see Exhibit 2).

Circularity Levers in the Medtech Value Chain

Depending on their ambition level, medtech companies have a variety of options for adopting a circularity strategy. As a starting point, though, companies need to be mindful that there is a wide range of regulations and goals in different global regions regarding recycling, carbon emissions, and waste—and that these rules are in flux. Companies must make sure that their approach follows local directives in order to maintain their license to operate and ensure successful implementation. With that covered, medtech companies should begin circularity implementation by first considering each lever with a positive business case that is relatively easy to implement. For instance, product packaging can be altered to use fewer and recyclable materials or operational efficiency can be increased by reducing manufacturing scrap.

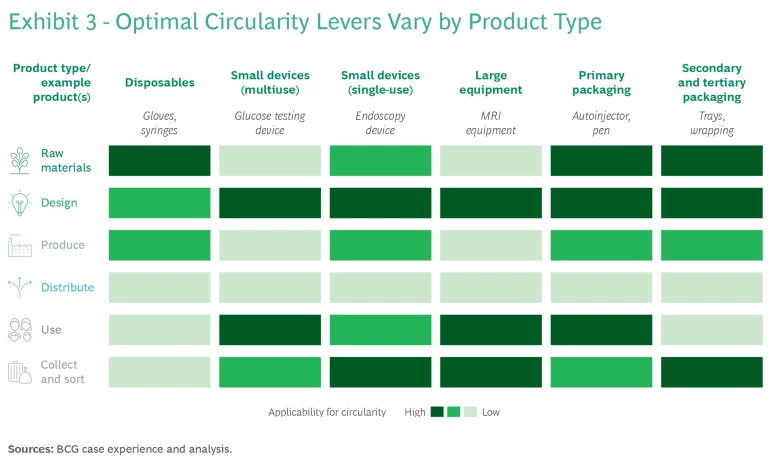

Beyond that, there are many more possible steps to take as well—ranging from product redesign to increase the energy efficiency of large medical equipment during use to extending the equipment’s useful life through servicing and updating programs. Partnerships with recyclers to promote downstream reprocessing can also produce positive results. The way the circularity levers are deployed—or even which ones are most relevant—will vary depending on the product type (see Exhibit 3). Methods for improving circularity in specific value chain elements follow here.

Raw Materials. Raw materials often account for the lion’s share (about 40%) of emissions in medtech products. For single-use products, this contribution is likely well beyond 50%. Companies can reduce the carbon footprint of input materials by switching to biobased or recycled raw materials.

When considering switching to biobased materials, manufacturers need to ensure that their physical properties are sufficiently similar, particularly regarding stress and stability, safety, durability, and manufacturing requirements.

Biobased materials (mostly plastics) are bioequivalent to conventional virgin plastics but are produced from regrowing plants, and they emit up to 80% fewer carbon emissions, according to biobased materials company Biovox. When considering switching to biobased materials, manufacturers need to ensure that their physical properties are sufficiently similar, particularly regarding stress and stability, safety, durability, and manufacturing requirements. For common polymers, biobased materials with similar characteristics are already available at a price premium of 5% to 10%.

Mölnlycke and NewGen Surgical, among others, have already launched products—surgical gloves, drapes, and staplers—made of biobased materials. Such materials are also under consideration for injection devices, endoscopes, and tubing. However, for more durable equipment needed in lab work or for imaging machines, there is some concern about whether biobased polymers can match the performance of traditional plastics over an equipment’s lifetime, often up to 20 years.

Recycled materials, especially for packaging, are another option given that they generate sizable CO2 reductions as compared with virgin materials, and they are less expensive. J&J medtech company DePuy Synthes, a maker of orthopedic products, launched more than 250 product items packed in postconsumer recycled paperboard material (93%), replacing white boxes made with 100% virgin paperboard.

Modular product design for devices (even across product families) is another less wasteful design strategy that helps companies keep costs down and enables easy and efficient maintenance, repairs, upgrades, updates, and refurbishment.

Design. Design is integral to circularity since it can influence the number of resources used in a product as well as product longevity, product use emissions, and the ability to remanufacture, reprocess, or recycle the product after use. Four design elements should be considered:

- Design for light-weighting: This involves making a product smaller and its walls or components thinner, digitizing (for instance, putting instructions online only) and omitting unnecessary components (like specific instruments in surgical kits). For example, device manufacturer Dexcom’s latest glucose monitoring product, the G7, contains 20% less plastic than the previous version while its packaging uses 56% less plastic and paper.

- Design for energy efficiency: This covers producing products that are more energy efficient, such as Siemens Healthineers’ MAGNETOM Free.Star MRI scanner that requires 30% less energy during usage compared with conventional machines.

- Design for extended lifetime: This comprises extending a product’s lifetime or even altering it from single use to multiuse. A good example is Medtronic’s insulin infusion sets that can be worn for seven days instead of three, reducing plastic waste by more than half.

- Design for reuse, remanufacturing, maintenance, and recycling: This can include products composed of a single material type to facilitate recycling. Mono-material use is most feasible for disposables as well as for packaging. Especially in the case of packaging, materials made solely from, for instance, paper or biobased plastics can be easily recycled as part of general hospital waste. Modular product design for devices (even across product families) is another less wasteful design strategy that helps companies keep costs down and enables easy and efficient maintenance, repairs, upgrades, updates, and refurbishment. For instance, J&J has launched a small battery device for traumatology and small bone surgeries that contains a comprehensive set of attachments and accessories so multiple devices can be operated with the same reusable ancillary equipment.

Produce and Distribute. Altering production and distribution tactics can be another element of a circularity strategy. In production, reducing factory greenhouse gases by switching to renewables is a critical first step. And by redesigning plant processes and product specifications, the volume of scrap can be minimized and targeted for recycling. In distribution, choosing more sustainable transport options—like switching from air to ocean, road to rail, and internal combustion to electric vehicles—is essential to cutting carbon emissions. Companies should also consider adopting logistics efficiency methods that reduce the number of trips and the distances traveled in distribution routes and shrinking packaging to decrease freight space requirements. In addition, companies are moving to reusable transport trays to further reduce logistics waste.

Use. Significant carbon emission and waste reduction can also be gained by extending a product’s lifetime. This is mostly relevant for high-value equipment or devices, like large imaging machines, and expensive lab and surgical machines. Some companies, such as Philips, have added AI-based predictive maintenance programs to these types of products to maximize uptime, as well as continuous software upgrades to keep equipment in use longer. Medtech companies could take this strategy a step further and adopt the product as a service business model. With this, users essentially lease devices from manufacturers, who will maintain the product and extend its life through repairs and improvements. For smaller products, like surgical instruments, reuse can be implemented by expanding sterilization, which of course has been routine practice for some medtech products for decades.

Stryker reports that through its program more than 3,000 customers have saved $1 billion in supply costs and diverted 27 million pounds of waste from landfills in the last five years.

Collect and Sort. The collect phase comprises refurbishing, reprocessing, and recycling. Medtech companies can take back products for sterilization, upgrades, or repairs before reselling them to hospitals at a slightly lower price. Some companies—among them, J&J, Stryker, and Cardinal Health—are already reprocessing single-use devices. Stryker reports that through its program—which covers catheters, hysteroscopic tissue removal devices, pulse oximeter sensors, and ultrasonic scalpels, to name a few—more than 3,000 customers have saved $1 billion in supply costs and diverted 27 million pounds of waste from landfills in the last five years.

Refurbishing is more feasible for large equipment. Customers trading in these items to manufacturers can realize some of the equipment’s remaining value or at least do not have to worry about disposal. Medtech companies can often resell this refurbished equipment on the secondary market at perhaps 20% to 40% of the original price. Finally, recycling is particularly suitable for low-priced commodity products, like gloves, drapes, and packaging, although partnerships with hospitals and recyclers are needed to make this happen. Germany-based Resourcify has designed a recycling app and platform that helps companies manage their waste flows and their recycling relationships to coordinate an often complicated effort with numerous involved vendors and types of waste.

Challenges to Circularity

Although most medtech companies realize that they must take action to reduce waste and downsize their carbon footprint, some are reluctant because there are very real commercial, operational, and business model obstacles to overcome.

Regarding raw materials, shifting to biobased materials is daunting because there is limited data about how these materials will perform and whether they will pass regulatory reviews, and there is a fear that the price premium will increase as demand rises. Moreover, unintended impacts on the environment must be considered as well, including ill-considered land use to grow these materials and actual degradability of the materials themselves.

To mitigate these concerns, medtech firms could join forces with suppliers to collaboratively invest in and build the market for sustainable materials, similar to the way the Sustainable Aviation Buyers Alliance has approached supporting the expanded use of fuel with reduced carbon emissions for planes. Perhaps more difficult to avoid is the possibility that material and design changes may require product requalification by regulators, which can be quite costly. As a result, medtech players often consider these new approaches primarily for new products.

On the provider side, hospitals have expressed displeasure about reducing single-use products in favor of multiuse products requiring sterilization. They argue that staff has little time to collect used items and that there is limited space for additional sterilization units. Moreover, they prefer single-use items as a boon for provider and patient safety.

Regulators will have to cooperate and be creative as well—or lose the potential to establish profitable reprocessing businesses that could simultaneously decrease health care costs for hospitals.

The most viable alternative—collection of used devices—is also problematic, given that staff time would have to be redirected to sorting these single-use items and there are space limitations for company-specific collection bins. Addressing these challenges is crucial to effectively reduce the prodigious end-of-life emissions from medtech products. But it will take a significant partnership among many companies: medtech competitors, hospitals, logistics providers, decontamination outfits, and recyclers. Together, they will need to design an innovative model that could include automated sorting of medical waste and cost incentives for take-back and recycling programs.

Regulators will have to cooperate and be creative as well—or lose the potential to establish profitable reprocessing businesses that could simultaneously decrease health care costs for hospitals. At the moment, most countries have strict regulations for recycling of contaminated waste, and even reprocessing is prohibited in certain European countries, like France, Italy, and Austria.

Where to Begin

These challenges only amplify the complex task for many medtech firms to identify the most beneficial, impactful, and profitable circularity levers for the different products in their portfolio. Based on our experience with companies undertaking this effort, we have distilled a six-step approach to realize its full value.

Some companies have made excellent strides and have identified ways to embrace circularity for a sustainable future and at the same time enjoy significant benefits for their businesses.

1. Select product categories. Select initial products for exploring circularity based on an educated estimate of the highest waste and carbon emissions reduction potential. Alternatively, choose products that are representative of the largest segments of the company’s product portfolio.

2. Establish a circularity baseline. For the products in the pilot, use a tool like BCG’s Circelligence to assess carbon emissions along the product life cycle, product-related waste, and use of harmful substances and raw materials. At the same, identify existing circularity initiatives within the company and among competitors, while gauging customer requirements for carbon and waste reduction.

3. Identify circularity potential. Work in a cross-functional team—including R&D, procurement, marketing, sales, manufacturing, legal, regulatory and product services—to assess ongoing successful initiatives inside and outside of your company as well as the feasibility and impact of each circularity lever on the products chosen for the initial program. Create a business case by simulating outcomes.

4. Set KPIs. Establish both strategic and operational KPIs for the pilot, considering product circularity potential as well as competitor activities and customer requirements that could affect the necessity for your company to engage in a circularity initiative.

5. Develop an actionable road map. Develop implementation road maps with clear responsible parties and milestones, and ensure sufficient resources to support the effort.

6. Implement scale to further the circularity initiative. Three forms of scale are crucial:

- Processes: Identify tactics that need to be adjusted to fully integrate circularity. These could include R&D integrating sustainable design principles, procurement targeting sustainable raw materials, and service helping with product and device maintenance and collection.

- Products: Select additional products and categories to incorporate into the circularity initiatives. This may require altering the playbook—and revisiting these six steps—if these new products are significantly different from the initial ones chosen for circularity.

- Business Model Innovation: Refocus the company’s business model around how your company can generate value, improve performance, support sustainability, and outpace competitors through circularity.

It is becoming increasingly clear that medtech companies can and should play a significant role in thwarting climate change and, at least until now, they have not emphasized doing this work enough. Some companies, though, have made excellent strides and have identified ways to embrace circularity for a sustainable future and at the same time enjoy significant benefits for their businesses. They have gained from enhanced brand reputation, cost savings, and increased innovation. And they are in a position to lead medtech and, indeed, the health care industry into an environmentally friendly tomorrow.