Ten years is a long time to show no improvement. But that’s exactly what’s happened with the ability of companies to implement large-scale tech programs since we last looked in 2015. Of the more than 1,000 companies surveyed in our latest research, two-thirds have mounted large-scale tech programs, which we define as involving more than 3% of the annual tech budget. (See “About Our Research.”) Such programs can involve investments of as much as €1 billion over their duration. But more than two-thirds are not expected to be delivered on time, within budget, or within their planned scope. This represents a big drag on business value.

About Our Research

Survey respondents came from 59 countries in Asia, Europe, and North America and covered ten industries: consumer goods, energy, financial services, health care, industrial goods, insurance, the public sector, technology, media, and telecommunications.

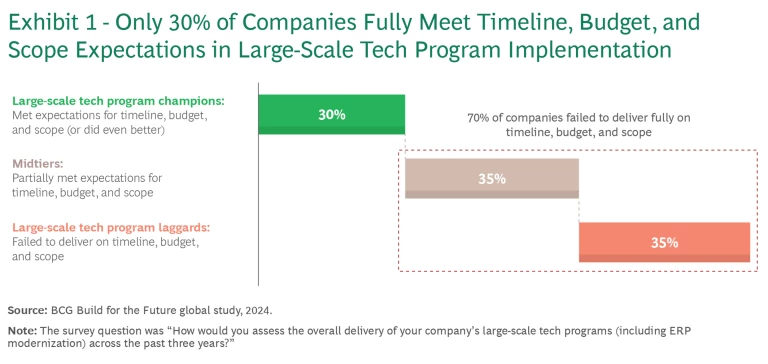

Based on the survey results, we identified three groups of companies:

- Champions: The 30% of companies whose programs met timeline, budget, and scope expectations (or did even better)

- Laggards: The 35% of companies whose programs did not meet timeline, budget, and scope expectations

- Midtiers: The 35% of companies that met budget but not timeline and scope expectations

The reasons for companies’ failure to improve include shortcomings in program planning (for example, defining a clear scope and business case), in management (such as mobilizing internal resources and overseeing external partners), and in delivery (such as identifying and mitigating interdependencies and risks and sticking to a well-thought-through roadmap).

Tech today is at the center of virtually every large organization. Programs such as ERP, CRM, core system replacement for financial institutions, and digital marketing and sales—not to mention artificial intelligence and generative AI—are commonplace. So why the persistent problems with implementation, and what can companies do about them? Our study provides some answers.

How to Lose €20 Million (or More) a Year

Large-scale program implementation remains a routine responsibility of corporate IT departments. But delivering these tech programs is a challenge for most companies. Only 30% of them—companies we call large-scale tech program champions—fully meet expectations for timeline, budget, and scope. (See Exhibit 1.) Another 35%—the large-tech program laggards—fail to deliver across all criteria, and the rest meet some criteria while falling short elsewhere.

The waste from failed implementation is dramatic. A greenfield ERP program, for example, typically costs about 3% to 4% of annual revenues and runs for approximately six years. A delay of only one year leads to additional costs of about 0.5% of revenues, or up to €250 million for a €50 billion company. On top of this, the benefits (typically up to 1% of EBIT) are not delivered on time and are therefore lost to the income statement until the program gets on track (assuming it does). Given the median annual revenue of €18 billion for the 2,500 companies in the Blackrock iShares ACWI ETF, we estimate that more than €20 billion in tech investments go to waste every year as a result of the failure to deliver large-scale programs on time, within budget, or within the planned scope. According to our research methodology, that means an average loss of about €20 million a year if only a single significant program in a company’s portfolio is delayed. Take the example of a global company that was unable to deliver a multihundred-million-dollar ERP program after more than eight years and multiple warning signs. The budget after restarting is expected to triple to almost €1 billion overall, with a doubled timeline and reduced program scope. Similar examples are common.

Maturity Matters

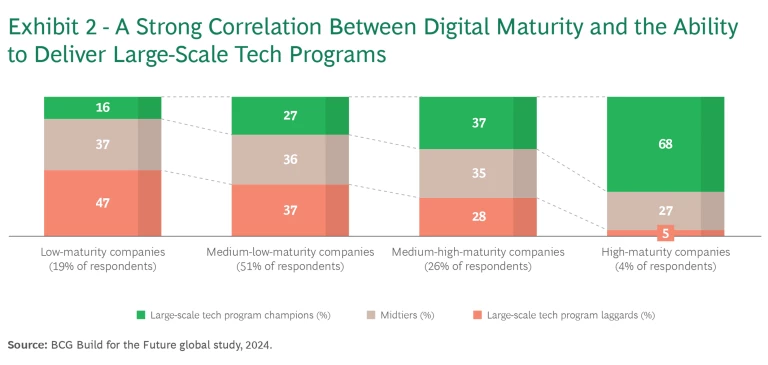

Companies with high digital and AI maturity implement large-scale tech programs significantly faster. They also are much more likely than others to stay within budget and exceed the program’s planned scope. (See Exhibit 2.) On average, more than four out of five program champions deliver on time and on budget. Only 5% fall short on scope. The programs of more than 85% of champions exceed their initially planned scope, 41% are completed faster, and 27% cost less than expected.

Maturity in people and data capabilities are big drivers of success. While champions outperform laggards across all of the more than 50 capabilities that we measured, we found particularly large differences in the people dimension (C-suite expertise, change management, and talent sourcing, for example), as well as in data management and governance.

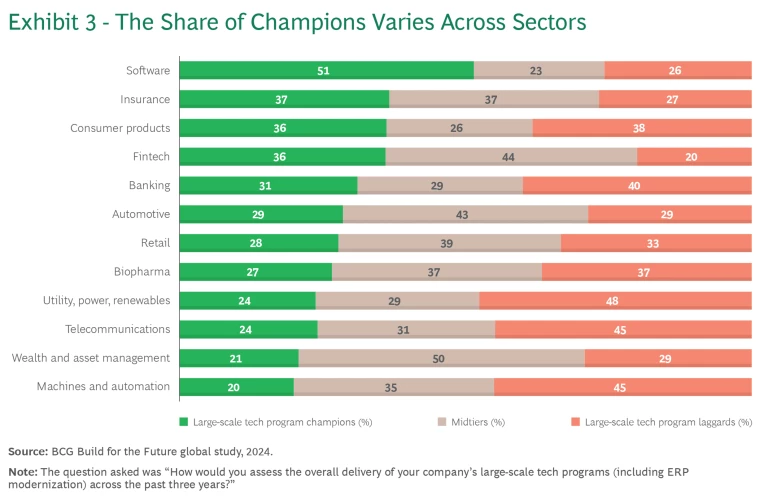

Successful delivery does vary significantly by sector, which is likely a function of tech savviness and experience. (See Exhibit 3.) In software, for example, more than 50% of companies manage to deliver programs on time, within budget, and within the planned scope. Financial institutions and consumer goods companies—both early victims of digital disruption—also show higher than average rates of success. In other sectors, however, such as power and utilities, telecommunications, and machines and automation, almost 50% of companies lag, unable to meet the three main delivery criteria.

The Roots of Pain

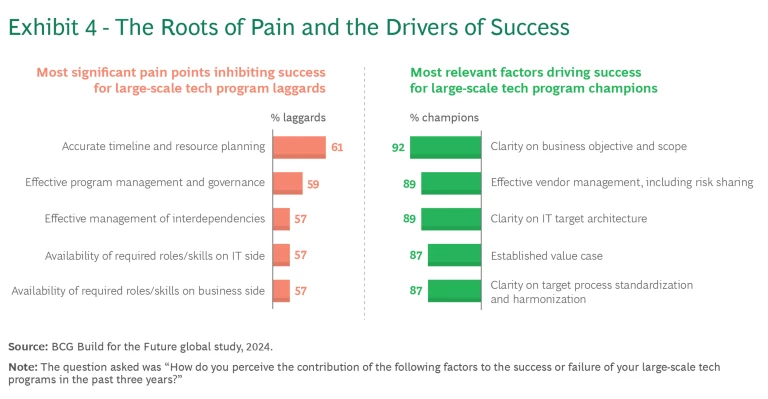

For laggards, executional pain is rooted in multiple factors related to planning, management, and personnel. (See Exhibit 4.)

Inaccurate Timeline and Resource Planning. More than 60% of respondents to our survey ascribed their lack of success to the absence of an overarching, end-to-end master plan, including a critical pathway to success with clear milestones and interdependencies, a well-analyzed and communicated roadmap of key success factors, and a thorough resourcing model based on well-understood assumptions about what the organization can deliver.

Lack of Effective Program Management and Governance. Another 60% cited the lack of an active program management office to monitor value delivery, identify emerging risks, and handle impact management and mitigation. Senior leadership must be actively involved, buy into the program’s ambition and objectives, and empower the program team to make decisions and drive progress. (See “Integrating Agile into Large-Scale Tech Programs.”) Other governance problems include the need for multiple stakeholders to sign off on program results and a governance model that fails to empower teams to achieve results and solve problems on their own, rather than escalating issues to senior leadership for resolution.

Integrating Agile into Large-Scale Tech Programs

For companies managing large-scale tech programs that have not yet implemented agile or have not implemented it successfully, we recommend a waterfall or hybrid-agile approach that combines the benefits of agile with those of traditional planning and execution. Specifically, companies should seek to ensure the following:

- The implementation roadmap is incremental (following a minimum viable product mindset), but everyone has a clear understanding of the value and impact to be delivered at each stage.

- Reviews take place in a rigorous cadence at all stages of the program (annual and quarterly business reviews to agree on big milestones and dependencies and more frequent reviews to ensure that teams are operating on track).

- Prioritization and decision making are the responsibility of a group of accountable and empowered leaders from business and IT (known as a design authority), supported by a value-focused program management office.

- The critical path and all interdependencies within and beyond the program are identified and deliberately tracked and managed.

- The timeline, scope, and budget are tracked rigorously with total transparency.

- Deployment is end-to-end and includes the business and not just the tech function.

Ineffective Management of Interdependencies. More than 55% of respondents reported that their companies fail to manage the full portfolio of tech projects, including the interdependencies within and across projects that are specific to system replacement programs. Failure to define and track interdependencies was one reason that a large European company’s plan to replace major core reporting systems was behind schedule and over budget after two and a half years.

Poor Business–Tech Collaboration. Another 57% of survey respondents pointed to the lack of dual leadership from both the business and technology sides, which undermines project sponsorship and team-level collaboration. Teams are often plagued by missing business experts who can define, validate, and prioritize business requirements. Tech involvement (both time and focus) suffers from experts being committed to too many other high-priority tech programs.

Tech + Us: Monthly insights for harnessing the full potential of AI and tech.

The Drivers of Success

In contrast, nine out of ten companies that are successful at delivering large-scale tech programs report a common set of success factors.

Clarity on Business Objectives and Scope. Business and IT together define the overarching objectives and outcomes, which form the purpose and ambition of the program. Teams can design a clear business and technology target picture, prepare for tradeoffs on requirements, and understand the implications and scope of other projects involved in the overall program.

Effective Vendor Management. External partners in implementation share similar risks and rewards through well-structured contracts and incentive models that push all parties to stay within budget and on time. Champion companies avoid overlapping or redundant roles for partners and emphasize the importance of delivery assurance as an integral part of the initial project budget and a core workstream that is essential for preventing cost overruns.

Clarity on Target IT Architecture. Champions take the time to draw a clear picture of the targeted end state, including all involved systems, interfaces, and the intermediate stages (also known as value plateaus) that will get them to where they want to be. Management and the staff involved have a shared understanding of the current status of the project at any given time based on predefined qualitative and quantitative reporting mechanisms.

Established Value Case. The complexity of large-scale tech programs puts a premium on defining the expected impact of the program based on clearly prioritized business requirements. This understanding enables those involved to stay on course and make sometimes tough tradeoff decisions on the specifics of value realized or not.

Clarity on Target Process Standardization and Harmonization. A clear understanding among business and technology stakeholders on the standardization and harmonization of each end-to-end business process is critical, especially for ERP transformations. The extent of the ambition should reflect the competitive advantages of the company and the desired level of customization in nondifferentiating areas.

How to Add, Not Erode, Value

To determine where your program(s) stand and the best path forward, we recommend five steps:

- Take the time to understand your current portfolio of tech programs and the progress each one has made toward completion.

- Review the portfolio regularly, including the important KPIs for each program, such as total and used budget and time, the proportion of internal versus external resources, the ratio of near- and offshoring, collaboration of business and tech leaders around an aligned value case, involvement of senior leadership, and established risk tracking and management.

- If programs are not in line with expectations, perform an in-depth health check to assess key challenges and define mitigation measures.

- Work with program leadership to implement mitigation measures following the success factors described above, assign owners, and track progress.

- Manage agile implementation using a hybrid approach that emphasizes end-to-end planning that keeps the big picture front and center and an incremental roadmap for execution with clear definition of the value and impact delivered for each increment.

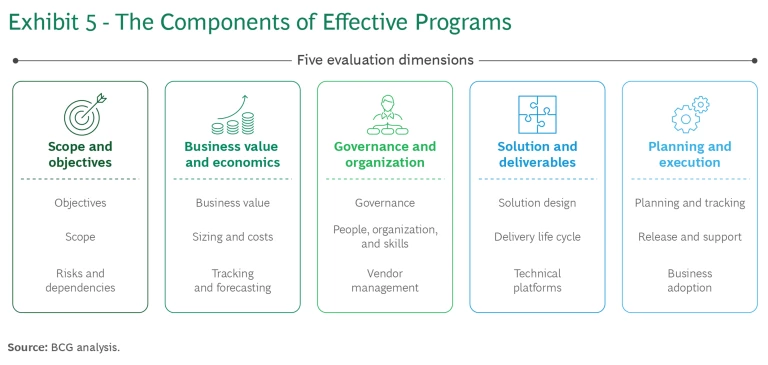

BCG’s assessment framework for large-scale tech programs, which our clients have followed successfully for the last decade, covers 15 areas of evaluation along five major dimensions. (See Exhibit 5.) Two of the dimensions—scope and objectives and business value and economics—are crucial to good program design and value creation . The other three—governance and organization, solution and deliverables, and planning and execution—determine successful execution and minimize value erosion.

Large-scale tech programs are by definition complex, and execution is fraught with opportunities to veer off course. Since both the value to be gained and the potential value to be lost are so big, the importance of management time spent on proper design and effective execution cannot be overstated. Digital maturity and a clear understanding of where you stand in key aspects of the program will dramatically shift the odds. Managing according to the success factors described above can mean the difference between a smooth and successful journey and multiple time-consuming and expensive restarts.

The authors are grateful to Abhinaba Dam, Marc Roman Franke, Ignacio Gonzales, Anagha Kumar, Clemens Nopp, and Joe Sassine for their valuable contributions to research and the writing of this article.