For aerospace and defense (A&D) programs, ramping-up from a prototype to full production is a critical period fraught with challenges—and most OEMs stumble. Over 75% of A&D programs exceed scheduled timelines, and more than 40% run over budget. The F-35 took twice as long as its original schedule. Boeing’s 787 Dreamliner was more than three times over budget. As aircraft become ever-more complex, the problem is getting worse .

The good news is that it is far easier to fix issues in this upstream formative stage than after programs go into full-rate production—and doing so can yield benefits that go well beyond initial delivery and into sustainment and the after-market. For defense programs, governments can get critical assets into the field faster, improving readiness and national security. For commercial aircraft, OEMs can dramatically improve financial performance and maintain strong customer relationships.

Most of these actions may seem self-evident, but in our experience across hundreds of programs, OEMs and defense agencies are more likely to get them wrong than right. Program leaders are always going to be challenged during the ramp-up phase as new, unexpected issues arise—including shifting budgets, requirement changes, and technical issues. This “firefighting” prevents program leads from establishing the foundational elements that will ensure the program succeeds. Strong leaders will proactively identify gaps and intervene before their program goes off track.

Five Priorities to Improve Program Ramp-ups

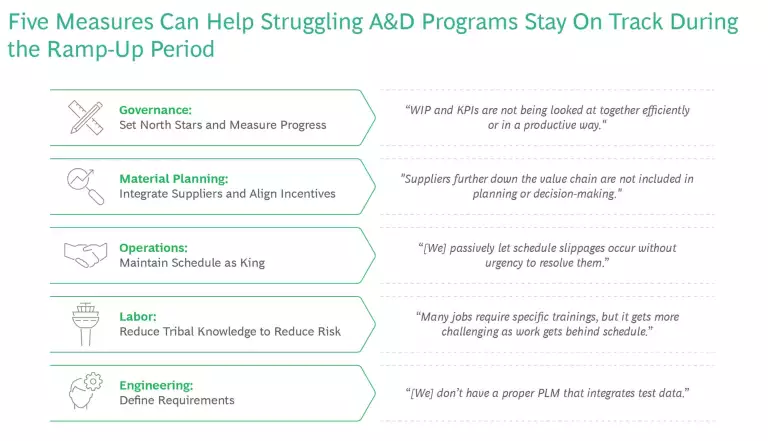

Based on our experience working with aerospace and defense clients, we have identified specific actions that leaders at OEMs, defense ministries, and other stakeholders can take during the ramp-up period to identify and correct common mistakes. (See the exhibit). Our analysis also identified steps that A&D customers can take to keep programs on-track during the ramp-up phase. (See “Key Actions that A&D Customers Need to Get Right.”)

Key Actions that A&D Customers Need to Get Right

Strong contract alignment. Customer and OEM performance incentives should be aligned, and they should jointly set a realistic cost target to achieve desired outcomes.

Tight requirement integration. Production and development teams between the customer and OEM must be in lock-step throughout critical ramp-up phases as requirements evolve.

Embedded support. Customer teams should be embedded with OEMs as on-the-ground technical liaisons.

Full collaboration. From leadership to front-line teams, customers and OEMs should have full transparency to operational metrics (including overall North Star goals and KPIs), engage on a recurring and frequent basis, and co-develop solutions as challenges arise.

Set a North Star production target and continuously measure progress.

From leadership to shop floor, A&D programs lack a common production goal that is clear, measurable, and directly aligned with the requirements and capabilities that the customer requires. In our benchmarking data, less than 40% of programs have executive-level KPIs that flow down to the shop floor during ramp-up. Without data showing true production status, leaders can’t make informed decisions, see emerging problems, or properly set priorities. OEMs think they’re on pace—until they’re suddenly far short of where they need to be.

Beginning from day one, program leaders must agree upon a clear North Star—a production rate that will define program success—and then establish three to five easily measurable, guiding KPIs that are tracked and automatically updated and communicated through a central means. Strong KPIs tie directly to outcomes against the North Star outcomes (for example, end-to-end production turnaround time), whereas weak KPIs only allude to performance but don’t tell the full story (for example, percent of milestones achieved). Strong, top-level KPIs need to cascade down to the front line, so that people at all levels of the organization have clear transparency into current performance and make decisions that are aligned to the KPIs to ensure that the program stays on track to meet the goals. To further keep teams focused on meetings these KPIs, customers must make sure the North Star is contractually incentivized.

Integrate suppliers to meet evolving requirements.

As programs ramp up, especially on extended timelines, requirements and technology evolve rapidly. Unfortunately, those changes often don’t get communicated throughout the entire supply chain, and suppliers often lag OEM timelines in meeting requirements. The result is a supply chain that cannot support OEMs’ plans to stand-up and scale production. Only about 35% of programs effectively communicate and manage evolving requirements and scale forecasts with suppliers, causing preventable delays throughout the ramp-up period.

The most important suppliers to on-time, on-budget delivery must be pulled into development and requirements early. In the ramp-up phase, OEMs need to have a cohesive strategy to integrate suppliers and ensure they are intimately familiar with the program’s path to full production—as well as any changes that may occur along the way. Often, OEMs view supplier management as a cost to be minimized, when they should instead view it as a critical element to program success. Long-term and as programs scale, OEMs need to establish supply chain control towers and leverage AI to provide end-to-end visibility and material forecasting across the full value stream.

Centralize the production schedule.

In establishing production lines for prototypes and initial production, new programs often lack the necessary controls and processes to ensure that all operations and functions work together effectively to maintain the schedule. An effective production control center (PCC), with close program manager and executive oversight, is crucial to establish and scale production operations and coordinate across numerous functions. Although many OEMs have a PCC in spirit, less than 15% have a fully functional PCC during the critical prototype and ramp-up phases, which impedes planning and progress across production lines.

In addition to a PCC, OEMs also need a well-planned integrated master schedule (IMS) to guide decision making against the North Star KPIs and manage critical paths. The IMS must be managed and executed by the PCC, informing daily operations to meet critical targets and identifying and removing roadblocks. If the PCC cannot address a specific roadblock, it needs to be escalated before it impacts the program’s North Star performance objectives.

Empower the workforce and minimize tribal knowledge.

Finding the right talent is a challenge in all phases of production. At many OEMs and suppliers, the workforce is understaffed and underskilled, with a large portion of experienced staff retiring and industries competing for scarce labor. But the issue is even more acute during ramp-up, as programs try to scale and train a new workforce. Less than 40% of new programs have sufficient labor with the skills needed to meet ramp-up demand.

Long-term, more effective recruiting, hiring, and retention can ease labor shortages. In the meantime, successful programs must invest to improve readiness for their current workforce. Tools such as a GenAI “copilot” can help technicians by providing on-the-floor assistance. (See “Using GenAI to Manage Engineering Complexity.”) Routine documentation of procedures and a cross-training regimen also prevent overreliance on a small portion of highly skilled workers and the risk of “brain drain” when those workers leave.

Using GenAI to Manage Engineering Complexity

To improve, the company is leveraging generative AI (GenAI) tools and iterative output analysis to reduce engineering complexity. For example, a new GenAI interface is helping engineers query technical documents more efficiently. As a result, the OEM can automatically prioritize engineering tasks based on their impact on the program and address engineering requests faster. In addition, the OEM is developing an autonomous “agent” to develop solutions to complex problems and further increase engineering efficiency.

Bring engineering to the center.

Engineering is especially critical during the prototype and initial production phases for A&D programs, but engineers are often involved in only a fraction of the processes at this stage. Instead of being on the shop floor with their programs—observing and providing inputs constantly throughout these phases—engineers are located across site, or even across country, impeding progress and incurring avoidable delays. Kelly Johnson, the founder of Lockheed Martin’s famed Skunk Works, mandated that engineers were on the manufacturing floor with their designs, which contributed to developing and delivering revolutionary new aircraft prototypes in as little as 180 days.

Additionally, a strong relationship must exist between the business development and engineering teams, not only in establishing the initial requirements but also as requirements evolve over the long life cycle from prototype to production. Too often the business development team gets ahead of the engineering team, resulting in committing to requirements and timelines that may not be feasible and result in cost and schedule overruns.

A recent A&D disruptor has excelled at building a strong and integrated business development and engineering team to ensure requirements are codified, reasonable within the constraints of delivery expectation, and meet the customer’s request. This has helped the company deliver products on time, on schedule, and at the customer’s desired requirements, and ultimately take market share from incumbents.

The Power of Being Proactive

Many of these solutions may seem like fundamental blocking and tackling—and OEM executives may say that they already have these measures in place. In our experience, however, there is a big gap between aspirations and execution. Some OEMs may be strong in one area, but very few are strong across all five and in a manner that is consistent and disciplined enough to improve performance.

More important, few OEMs are forward-looking enough to recognize the telltale signs of impending challenges early enough to intervene. All too often, companies wait to act until they encounter a full-blown emergency, when they are already behind schedule and over budget. To avoid such situations, business leaders must proactively conduct a comprehensive diagnostic of how their program is performing across all dimensions of ramp-up execution. Then, they must continually monitor and make corrective actions where necessary. Identifying strengths, weaknesses, and blind spots within a program often requires an independent, unbiased, third-party assessment. The timeliness and degree of urgency in spotting and addressing challenges is critical in keeping programs on schedule and on budget.

In health care, prevention and early detection are far more effective than curing a full-blown disease. The same approach should be applied to A&D programs. By being proactive and making course-corrections early, programs are better positioned to maintain schedule and cost, and customers gain the crucial confidence and communication required to field a complex A&D platform. (See “Proactive Measures Pay Off for a Rotorcraft OEM.”)

Proactive Measures Pay Off for a Rotorcraft OEM

For both commercial and defense programs, the ramp-up period is a critical window where OEMs experience challenges. By focusing on the five priorities discussed here, senior leaders at OEMs can take proactive steps to identify issues and ensure that they stay in line with budget and schedule requirements.

The authors would like to thank Nate Miller, Jon Alles, and Greg Mallory for their input and expertise.