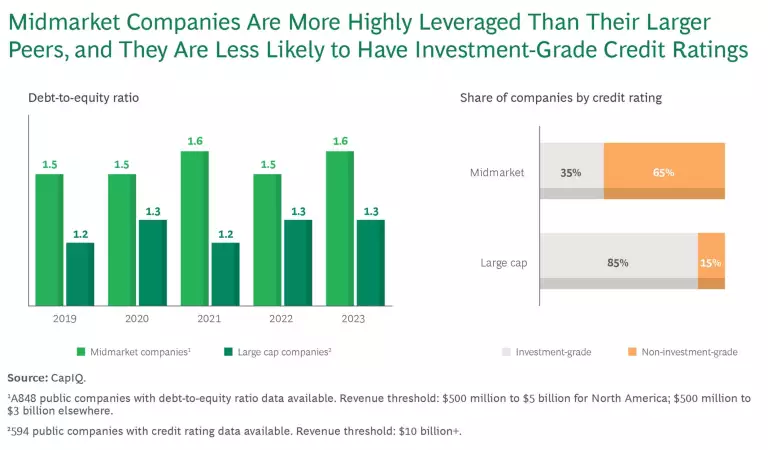

Midmarket companies are feeling a financial squeeze. Almost two-thirds have non-investment-grade credit ratings. They pay more to borrow than larger companies, and they have greater exposure to variable-rate debt. High-yield rates have been hovering around 7.5%, almost double 2021 levels. While recent reports show inflation to be easing, it is still unclear how quickly the US Federal Reserve will move in reducing interest rates. (See the exhibit.)

Midmarket firms need to get lean if they want to survive and prosper. Which ones will take the necessary steps to ride out a tough road? Which will fall by the wayside?

A Transformative Response

In our client work, we see multiple problems that hit midmarket firms especially hard, including high interest rates and debt service, rising labor and materials costs, and compressed margins and cash flow. The knock-on effects include less flexibility to consider acquisitions, hire new staff, and invest in innovation and technology.

Having fewer resources to allocate to technology strategy and innovation can lead to lower operational efficiency, reduced customer satisfaction, and inability to scale. A 2023 BCG survey of C-suite executives found that talent and people actions were the second most cited priority (after cost reduction) to mitigate risks and accelerate opportunities in response to global headwinds. But midmarket companies invest fewer resources in upskilling their workforce. They also cite significant difficulties attracting and retaining top talent.

Most midmarket firms approach these issues piecemeal—with limited success. Winners take a more comprehensive approach. Management or their private-equity owners make a strong case for change with employees and investors, define an ambitious agenda that pulls all the available value levers, and launch a program of end-to-end execution with clear roadmaps and accountability. Freed-up cash, especially in the early days, is invested in people, technology, and a culture that can sustain success into the future. Successful companies have achieved multifold increases in operating profit and shareholder returns by following an established playbook of key success factors that guide the transformation program.

Times of economic or business difficulty are exactly when midmarket companies should be exploring the power of transformation to improve.

While it may seem counterintuitive, times of economic or business difficulty are exactly when midmarket companies should be exploring the power of transformation to improve. The transformation process sharpens thinking, crystallizes focus, and boosts resolve. Midmarket companies can often make decisions more quickly and complete work in a relatively short time frame. Given the right resolve, midmarket companies can see impact in weeks compared with months for larger companies.

A Playbook for Getting It Right

All transformations are difficult. Most companies fail to achieve their objectives (70%, according to our latest research) as they are overwhelmed by the broad range of changes involved. These can include processes, product offerings, pricing, governance, structure, the operating model itself, and human behavior.

While transformations are ultimately about improving results, midsized organizations often focus mostly on the “what” of the process—the cost and revenue levers and the value they expect to deliver. But they should also look at changing people’s behavior and mindset (the “how”). Successful companies focus on both by concentrating on four elements: a strong commitment from an enabled leadership team, ambitious goals that energize and engage teams, execution certainty, and an improved culture to sustain the impact.

Commitment from an Enabled Leadership Team. Leaders must communicate the plan for change internally and externally, focusing on how to capture short-term savings while funding future growth, scrutinizing existing processes and capabilities, and investing in the development of people and technology. Senior leadership can often act fast, but only when team members are committed to the change. Moving quickly to make big strategic decisions can be challenging and cumbersome for large companies, but with the right decisive leadership, midmarket companies can be much nimbler. Conversely, a failure by senior leaders to commit can be especially damaging to transformation efforts in these organizations. Talent benches often aren’t as deep as they are at larger firms, and resistance to change in the managerial ranks can be stronger without the committed push from the top.

Moving quickly to make big strategic decisions can be cumbersome for large companies, but with the right decisive leadership, midmarket companies can be much nimbler.

Take the example of a recently spun-off tech hardware company that missed its post-IPO EBITDA targets for several consecutive quarters, resulting in 40% share price drop. Management issued a strong call for change and launched a formal business transformation. It announced the program internally to more than 200 leaders as well as externally in a letter to shareholders. Communications included the details of the program, leadership alignment, and governance plan. The company strengthened its board with two independent directors with extensive experience in leading corporate transformations. More important, senior leaders made tough decisions to restructure the organization, reprioritize the product pipeline, and resize corporate functions to put in place a sustainable operating model. The transformation doubled the firm’s EBITDA, which led to a fivefold increase in the share price and $5 billion of new value creation.

Ambitious Goals That Energize and Engage People. The transformation agenda should be bold, encompassing all parts of the business, and include all the levers that can help a company address its current challenges. It’s critical to define a clear future vision, including aggressive targets for financial performance, capability development, and culture. In our experience, achieving a broad mandate for change is a major challenge at large companies, but midmarket companies are often able to put all options on the table.

An alternative energy storage company suffered stock price declines of 60% from its IPO, the result of significant margin erosion in its contract backlog, concerns about pricing and competitive landscape, and a decline in cash balances. EBITDA had fallen from more than $300 million to less than $40 million over two years as input material costs rose, and supply chain disruptions led to costly project delays.

The company brought in a new CEO and launched a full assessment of its situation. Everything was up for discussion, not just the immediate problem of runaway project costs. The resulting transformation program went well beyond managing expenditures to encompass top-line strategy and long-term capabilities as well. More than 35 initiatives across seven workstreams (contracts, pricing and revenue, procurement, operations, organization and operating model, strategy, and enablement) led to $230 million margin lift from increased revenues and reduced costs. The company realized an early opportunity to release more than $70 million of cash through working capital improvements.

Execution Certainty. Transformations need priorities, structure, and hands-on management. All too often, midmarket companies haven’t developed the governance muscle to effectively prioritize initiatives and bullet-proof execution. Compared with their larger peers, they are more focused on running the business and don’t sufficiently allocate resources to changing it.

For midmarket companies, the challenge of prioritizing initiatives is often compounded by shortages of the right kind of talent and capabilities needed to manage a transformation program. Smaller firms are less likely to have the experience in-house and more likely than large firms to have inadequate tools and processes for rigorously running and tracking a change program.

To address these roadblocks, companies need to create a transformation office that defines the program’s structure and timeline, identifies who owns what initiatives, and develops the plan for successful execution.

For example, when the longtime healthy growth pattern of a major jewelry company turned south, management realized that it faced multiple hurdles. The brand’s promise and storytelling had become stale. The company lacked a strong digital, social, e-commerce, and store presence. It was also failing to attract and develop talent. Perhaps most urgently, the company needed to prioritize the numerous initiatives it had in the works.

Management launched an enterprise-wide transformation focused on reestablishing brand relevance and attractiveness, resetting its costs, and rethinking the commercial offering. It was an ambitious undertaking, but a transformation office clearly defined financial targets and made sure the overarching goals were easily understood by all employees. It deprioritized some opportunities and built roadmaps and stage-gate approaches for each priority initiative—instituting regular tracking to assess progress, address issues, adjust course, and ultimately execute. The function developed clear processes, training, and tools to build capabilities and enable employees to do their jobs more effectively.

The company realized more than $100 million in savings in the first year and $400 million in annual savings over the medium term.

Improved Culture to Sustain the Impact. Leaders are responsible for energizing employees at each step of the transformation and making thoughtful investments to develop a culture that is aligned with the desired end state. Changing culture takes time, but it can be one of the most important ways to improve performance and ensure the long-term success of a transformation program.

Each of the midmarket companies described above invested in people and culture, having established employee empowerment as a critical driver of sustaining the increased EBITDA unlocked by their transformation. They defined new ways of working and identified opportunities to develop leadership skills. They carefully assessed the health and skills of their talent and the organization to create a pipeline of improvement initiatives. And they all incentivized their leadership teams on an improved culture of achievement.

At some point, most midmarket companies will face the need to transform. The onset of a downturn, from either external or internal factors, can be a signal that the time has come for your firm. Forward-looking management teams will undertake an objective assessment and make the changes that can lead the company through the rough patches and into its next phase of profitable growth.