A recent global survey of dealmakers by BCG and Gibson Dunn reveals a striking consensus: conducting environmental, social, and governance (ESG) due diligence is now indispensable for M&A transactions .

Dealmakers say that the insights gained from these assessments are crucial not only for mitigating risks but also for preserving and enhancing deal value. Although Europe has spearheaded more stringent ESG regulations, dealmakers in all surveyed countries, including those in the US, recognize the importance of performing such assessments before closing a deal. (See the sidebar “About the Survey.”)

About the Survey

When assessments uncover material ESG issues, dealmakers say that they usually negotiate financially and legally viable solutions that allow the transaction to proceed. These mechanisms include reducing the purchase price, refining the deal structure, and agreeing on specific indemnities, to name a few. Dealmakers also pointed to the tangible rewards of conducting ESG due diligence—such as protecting up to 10% of a deal’s value—that often surpass the associated costs.

However, dealmakers cited challenges, including incomplete data and difficulty in quantifying ESG’s direct financial impact. Several levers—including ESG knowledge specialists, enhanced resource allocation, and early ESG assessments—are emerging to help dealmakers overcome these obstacles. The levers will improve the quality and precision of ESG due diligence and allow dealmakers to incorporate the findings more deeply into their business and legal strategies.

ESG Due Diligence Is Gaining Traction

As M&A activity recovers from its recent lull, ESG factors will continue to play a pivotal role in dealmaking across various industries in the medium to long term. The greater focus on, for example, net zero targets, sustainability reporting, diversity, and overall regulatory compliance has made performing ESG due diligence during the M&A process increasingly crucial to achieving the goals of corporate and financial investors. (See the sidebar “Practitioners’ Perspectives.”) The survey confirmed the importance of this emerging workstream: two-thirds of M&A professionals across all industries said they have engaged on ESG topics during transactions.

Practitioners' Perspective

Altana AG

Altana consistently gears its activities to pursue sustained profitable growth. We can only achieve economic success in the long run if we also consider ecological and social aspects and anchor them firmly in our company. To support this objective, we are significantly evolving our approach to due diligence beyond mere risk minimization.

At the same time, we recognize that sustainable products and a reduced carbon footprint are increasingly becoming value-enhancing factors for which customers and investors are willing to pay a premium. This reflects a transformative shift in how we assess and engage with investment opportunities.

Henning Schmischke

Head of M&A

Triton Partners

At Triton, a structured application of sustainability factors provides a critical value-creation lever in reaching businesses’ full potential. We seek to grow and improve portfolio companies for long-term sustainability and for the benefit of multiple stakeholders.

We target companies that we believe are well positioned to bring goods and services to market that are aligned with sustainability drivers. This strategic sustainability focus is coupled with operational analysis during due diligence, as we focus on whether companies face high levels of environmental, social, and governance risk. We determine if companies have processes and systems in place to manage these risks. If not, creating them would form a core part of our professionalization of the business during Triton’s ownership.

Ultimately, creating value and mitigating risk should logically translate to higher numbers on both sides of the valuation equation—earnings and multiples—and thereby support a strategy of successful realizations and returns to our investors.

Ashim Paun

Head of Sustainable Investing

Graeme Ardus

Head of ESG

However, the influence of ESG factors on due diligence processes is not yet uniform across different regions and deal sizes. Europe is at the forefront, with ESG due diligence performed in half of the deals, compared with one-third of the deals in North and South America and Asia. Buyers are more likely to include ESG considerations for large acquisitions, with due diligence occurring in approximately 60% of such deals. Buyers conduct ESG due diligence in approximately 40% of mid-cap acquisitions. For smaller acquisitions, the frequency of ESG due diligence falls to about 30%. The survey revealed a similar pattern when respondents were asked how often they conduct ESG due diligence to prepare for selling a company.

Approximately 90% of survey respondents who conduct ESG due diligence hire external providers, while the rest rely on in-house teams. Slightly more than half of those who use external support conduct ESG due diligence as a standalone assessment. Of these, 46% seek to identify risks generally, 28% zero in on industry-specific risks, and 26% focus on value-creation opportunities. Of the respondents who do not conduct standalone assessments, equal proportions integrate ESG topics into either legal or commercial due diligence.

The Benefits of ESG Due Diligence

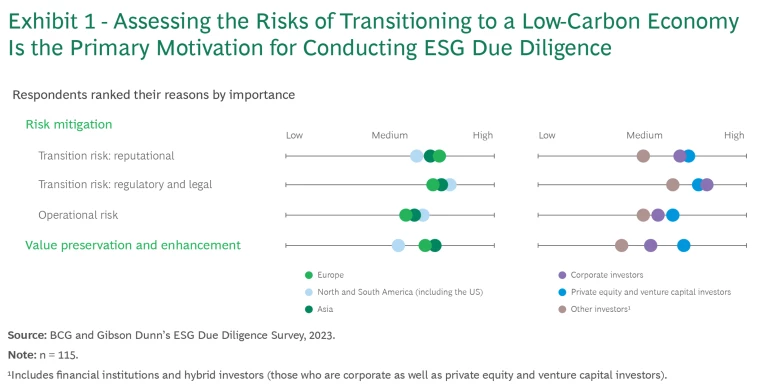

Survey respondents recognize that including ESG due diligence in their agenda confers benefits for risk mitigation as well as value preservation and enhancement. (See Exhibit 1.)

Risk Mitigation

Respondents across regions and investor types indicated that assessing the reputational risks and regulatory and legal risks entailed in transitioning to a sustainable, low-carbon economy is the most important reason to conduct ESG due diligence. Such transition risks arise from, for example, the need to mitigate environmental impact or meet societal expectations and compliance requirements. When considering ESG topics in due diligence, corporate executives and investors have emphasized mitigating transition risks as well as operational risks, such as higher expenses and disruptions resulting from poor compliance.

Transition and operational risks have become increasingly relevant across industries because companies must cope with heightened public scrutiny, more stringent regulations, and the broader international reach of compliance requirements. (See the sidebar “Compliance Needs Are Intensifying, with Broad Implications.”)

Compliance Needs Are Intensifying, with Broad Implications

US dealmakers, among others globally, must consider the international reach of the EU’s ESG regulations. For example, subsidiaries of multientity corporate groups based outside the EU are subject to CSRD’s reporting requirements if they meet certain size thresholds for their EU presence. Beginning in 2028, these reporting obligations expand to include the entire non-EU group at a consolidated level, surpassing the requirements set by the US Securities and Exchange Commission or California law. Consequently, US acquirers should use the due diligence process to assess whether an EU acquisition would trigger CSRD reporting obligations that could affect their entire corporate group.

Value Preservation and Enhancement

In addition to mitigating risks, dealmakers are increasingly motivated to conduct ESG due diligence to preserve deal value, assess whether there is an ESG valuation premium, and identify value-creation opportunities.

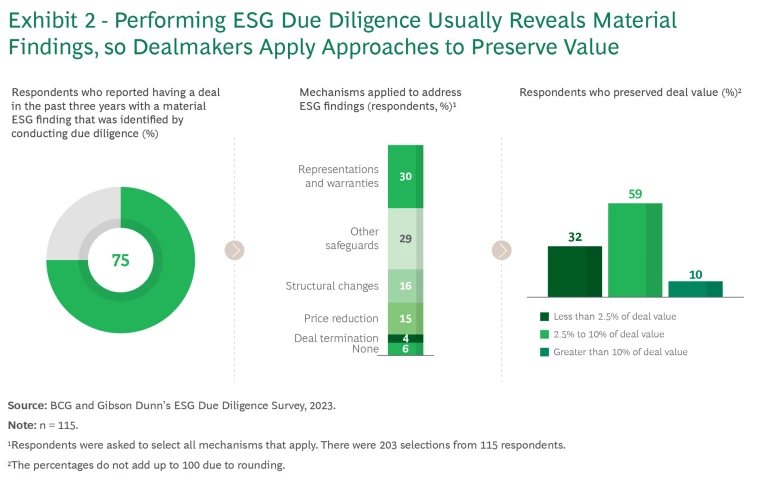

Preserving Deal Value. Among the survey respondents, 75% reported having a deal with a material ESG finding over the past three years that was identified because they conducted due diligence. (See Exhibit 2.)

In nearly 90% of these cases, the parties identified the issue before the closing. Material findings motivated the parties to terminate the deal in only 4% of such cases. If the problems were deemed manageable, 3% of buyers opted to resolve them after closing the deal and becoming the new owner. Only 2% of buyers ignored the discovered risks.

In most cases, the parties applied mechanisms to actively deal with the identified issues. The most common approach, used in 30% of the cases, involved requesting representations and warranties to address material findings. Although representations and warranties do not protect against known risks, they have great value in protecting against additional unknown risks that may be related to a finding. For example, if an identified issue relates to soil contamination, an environmental warranty still can provide comfort that there are no other environmental issues. The parties also pursued additional solutions to preserve deal value. These measures, also employed in approximately 30% of the cases, included additional indemnities, escrow arrangements, or requiring sellers to take remedial actions before the closing. It is less common for parties to change the deal’s scope, timeline, or other structural aspects (16%) or reduce the purchase price (15%). Most respondents indicated that addressing ESG findings during negotiations has allowed them to preserve up to 10% of the deal value.

The average value preserved, or loss avoided, by respondents equated to 5.4% of the deal value. This finding is important to buyers who are considering the economics of conducting ESG due diligence. It shows that ESG due diligence had a net positive impact, on average. Our experience also shows that the costs of performing ESG due diligence on several deals can often be offset by the amount saved on just one transaction.

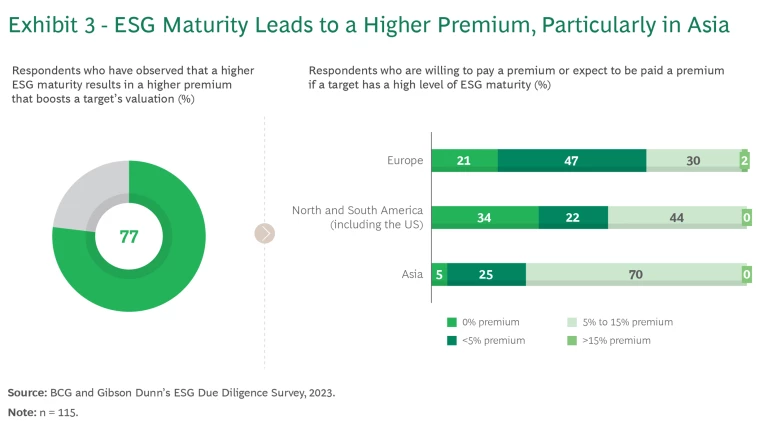

Assessing the ESG Valuation Premium. Among survey respondents, 77% have observed that a higher ESG maturity results in a higher valuation for targets—that is, an ESG premium leading to higher multiples. (See Exhibit 3.) Correspondingly, most respondents are willing to pay a premium, or expect to be paid a premium, for companies with high levels of ESG maturity. European respondents generally anticipate a premium of less than 5%, whereas their counterparts in North and South America and Asia typically expect higher premiums. Although strong ESG performance is expected to become the norm in Europe, it is still the exception elsewhere. As a result, investors reward ESG frontrunners outside of Europe with higher premiums, especially in Asia.

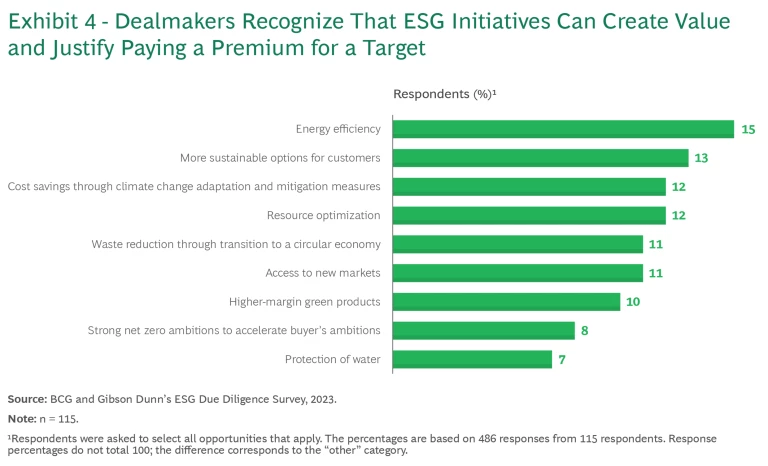

Identifying Value-Creation Opportunities. ESG maturity also promotes better financial performance and higher margins, offering numerous avenues for value creation across industries. Our study identifies several important opportunities, including employee attraction and retention, operational efficiency and cost reduction, market differentiation, and supply chain optimization. Companies are pursuing these through ESG initiatives such as improving energy efficiency, offering sustainable options to customers, and mitigating climate effects. (See Exhibit 4.)

Priorities Vary Among Industries

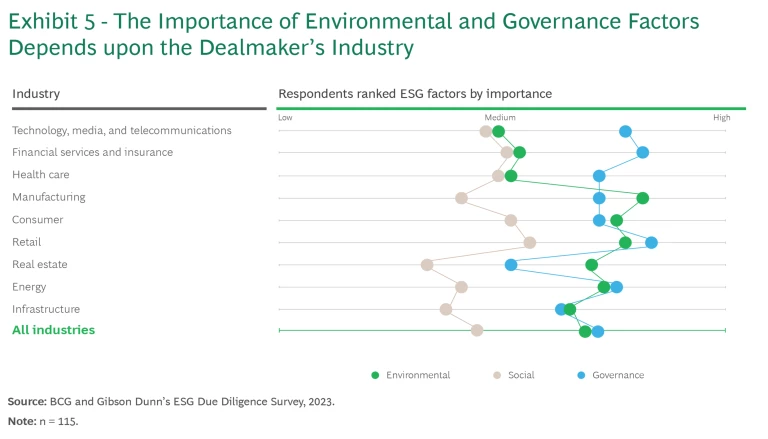

Dealmakers’ prioritization of ESG factors in due diligence is determined by the nature of the respondent’s industry, including its inherent risks and stakeholder expectations. (See Exhibit 5.) For instance, in sectors that rely heavily on natural resources or manufacturing, environmental factors are often paramount owing to their direct impact on meeting sustainability goals and promoting the company’s long-term viability. Manufacturing industry respondents rated environmental factors as highly important (4.4 out of 5), with carbon footprint management, resource conservation, and compliance with environmental regulations being key concerns. The consumer and retail sectors also place a high emphasis on these issues.

Governance factors, including transparent corporate structures and regulatory compliance, are deemed to have high importance across industries (except for real estate). Governance-related issues are often the primary reason for abandoning a deal. In contrast, the social dimension receives greater focus in sectors where human capital is crucial and public scrutiny is more intense, such as in the financial services, consumer, and retail industries.

Challenges to Realizing the Potential

Although the payoffs of ESG due diligence are clear, dealmakers must overcome numerous challenges to realize its full potential. Issues relating to data, standards, and quantification are the primary obstacles.

Incomplete and Inconsistent Data. According to survey respondents, the most significant challenge to performing ESG due diligence is the absence of reliable data (19%) or the lack of standardized approaches (19%). (Respondents could select multiple challenges; the percentages are based on the total number of responses.) Another important challenge is the difficulty of making meaningful comparisons (14% of respondents). Because some companies fail to track or disclose all relevant ESG information—or do so in nonstandardized formats—it is difficult to ensure comprehensiveness and comparability in the due diligence process.

Failure to Grasp or Quantify the Value. Respondents pointed to not being able to fully understand the impact of ESG factors on a company’s value as another significant challenge (14%). In addition, more than half of the respondents said that they did not have metrics to quantify the impact of ESG findings on valuations. Some respondents have tried to integrate their ESG findings by adjusting calculations of the weighted average cost of capital (typically by 100 to 150 basis points), cash flow, or net debt.

Though considered to be less prominent obstacles by respondents, other challenges include the inadequate integration of ESG assessments with other due diligence streams, poor coordination with in-house experts, ambiguous results, and greenwashing.

Emerging Levers for Maximizing the Impact

Several emerging levers are expected to help dealmakers unlock the full potential of ESG due diligence. By applying the following levers, dealmakers will be able to significantly mitigate the challenges of ESG assessments, improve their accuracy, and encourage responsible investment practices.

ESG Knowledge Specialists. As the complexity of ESG due diligence becomes more evident, investors are increasingly seeking specialized knowledge. In the coming years, there will likely be a significant uptick in the use of specialists who can navigate the intricate ESG landscape and offer vital insights. Currently, 85% of respondents are prepared to invest in ESG due diligence. Of these respondents, 21% say they are willing to invest specifically in ESG due diligence that is conducted by an industry expert, while 33% are prepared to pay separately for ESG assessments included in a comprehensive report from their current advisors. The remaining 31% would not pay separately for ESG assessments but expect them to be integrated into a comprehensive due diligence report.

Standardized Guidelines. We expect collaborations among regulatory authorities, industry groups, and ESG thought leaders to yield standardized guidelines for ESG due diligence. Such frameworks will promote consistency and enhance the quality of ESG evaluations, facilitating more effective due diligence practices.

A Wider Scope of ESG Topics. The range of issues encompassed by ESG due diligence is broadening to include areas such as human rights and supply chain sustainability. As these topics gain traction, ESG due diligence will evolve to cover a wider spectrum of concerns, providing a holistic view of a company’s ESG impact.

Enhanced Resource Allocation. We anticipate an increase in the resources dedicated to ESG due diligence, with companies and investors allocating more funds and personnel to the specialized ESG teams, tools, and technologies that are needed to conduct assessments. These investments will enhance the quality and depth of ESG analyses.

Early ESG Assessments. ESG considerations will likely be incorporated earlier in the transaction process. This front-loading will allow for ESG factors to be integrated into investment strategies from the outset, leading to a more comprehensive and proactive approach to managing the related risks and opportunities. Conducting ESG assessments and handling the related issues after closing a deal will become rare exceptions.

Our global survey highlights the widely held view among dealmakers that ESG due diligence is essential in M&A transactions for risk mitigation and value enhancement. In 90% of the deals with ESG issues, due diligence made it possible to identify the concerns before closing the deal. By employing practical solutions, such as indemnities and purchase price adjustments, parties are proceeding with transactions even when due diligence reveals issues. Moreover, the data gathered from ESG due diligence is vital input for articulating the ESG impact narrative that guides strategy throughout the deal’s life cycle.

Our findings also make clear that the value preserved and created by ESG due diligence often surpasses the investment required for comprehensive assessments. For parties to reap these benefits, they must tailor their assessments to the distinctive aspects of their transition. Now is the time for all dealmakers to effectively use ESG due diligence to create value.