Projections about how generative artificial intelligence ( GenAI ) will transform business are ubiquitous. E-commerce executives can already see the fuzzy outlines of an exciting future for their organizations, but in the meantime, they face a fundamental question: What investments in technology and talent will bring the highest and surest returns at a time when anything seems possible and every use case seems tempting?

Rather than follow the over-the-top hype about GenAI, e-commerce executives should be looking under the hood of their own organization to set their investment priorities. Companies that follow a pragmatic approach will realize that their best investment opportunities right now come from deciding strategically what they build versus what they buy, with a clear understanding of what capabilities will eventually become a core part of their existing platforms. This decision is vitally important for GenAI applications, because large e-commerce platforms and third-party specialist software companies will build and maintain much of GenAI’s necessary infrastructure and applications, and they will do it better and more efficiently than most companies that are in the business of e-commerce but not the business of software ever could.

The Decision Framework for Making GenAI Investments

The typical technology investment decision—buy a platform, buy a best-of-breed specialized solution, or build in-house—is different for GenAI, primarily because of the extreme pace and breadth of change. Building a unique solution in-house requires a high bar when major software players are integrating GenAI into every aspect of their platforms, thus rendering many custom-built solutions obsolete in a matter of months. The startup ecosystem faces this challenge as well: What should startups be building as point solutions, versus what will be integrated into the major platforms?

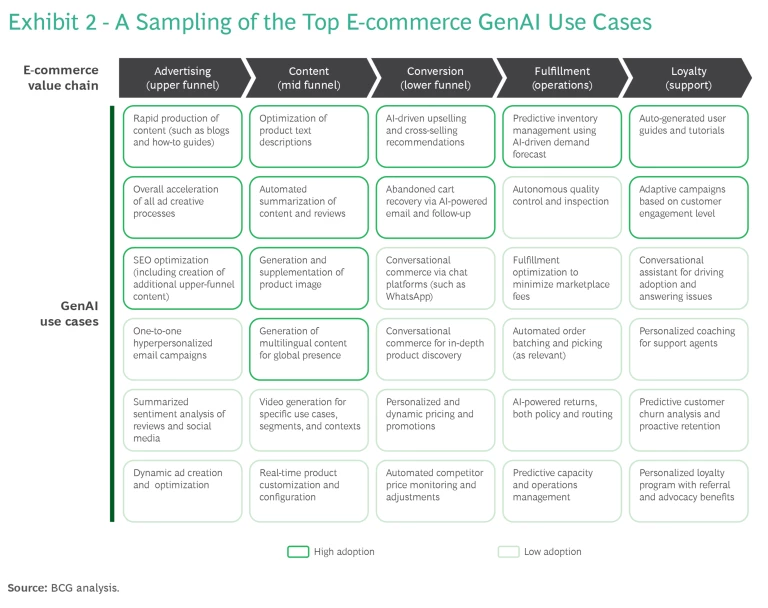

Exhibit 1 shows the questions that e-commerce executives should ask as they begin to take a pragmatic approach to evaluating their GenAI investment opportunities. Executives could consider building and scaling an e-commerce solution in-house if it’s highly unlikely for the use case to become part of one of the following:

- Existing State-of-the-Art Foundation Models. These models are constantly evolving, which means that the next versions of Anthropic’s Claude, Meta’s Llama, OpenAI’s GPT, and other models will have out-of-the-box capabilities that fit some of the use cases needed for best-in-class e-commerce operations.

- Big Tech Companies’ Platforms. Whether a company is using Salesforce as its e-commerce platform, Google for paid search, Meta for paid social media, or Amazon as a marketplace, there will always be near-in platform capabilities that these firms can build more efficiently and at higher quality than an e-commerce team could with its own resources.

- Third-Party Specialists’ Platforms. Most at-scale e-commerce teams already use a variety of best-of-breed specialists such as Bazaarvoice (for reviews) or LiveChat (for chat). These specialists will also seek to integrate relevant GenAI capabilities into their platforms.

Relying on these external providers instead of building a custom solution not only saves e-commerce teams time and money but also lets them focus their resources on developing and scaling solutions that can become sources of sustainable competitive advantage. Such solutions are typically use cases that external providers cannot be expected to provide and continue to evolve within their platforms, or they are use cases that fundamentally require data and information that external providers cannot match. In these specific cases, companies can take advantage of application programming interfaces (APIs) that provide easy access to the latest large language models (LLMs) and GenAI models to create custom solutions tailored to their unique needs.

The GenAI Opportunities That Exist for E-Commerce Teams

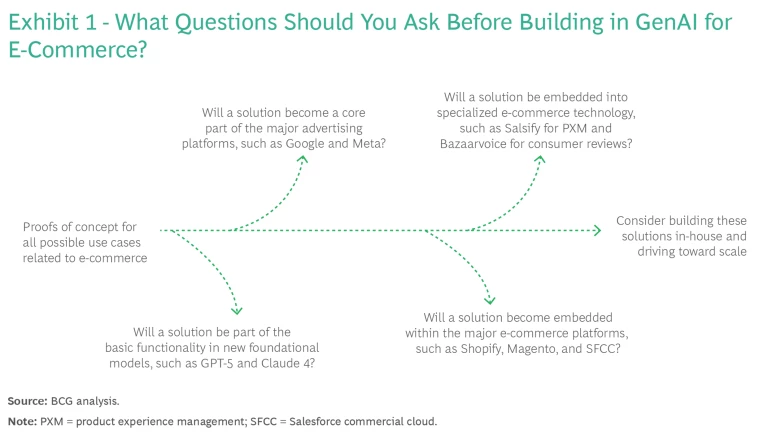

Teams that currently manage e-commerce experiences for their company have numerous GenAI use cases across the standard value chain, covering all aspects of the conversion funnel and the customer life cycle. New use cases are emerging daily, but in our experience, the cases shown in Exhibit 2 are already in focus for many leading e-commerce executives.

The use cases with the highest adoption focus more on productivity and efficiency and, to some extent, on automation. Many companies have succeeded in accelerating their creative process—from content generation and optimization to testing and adaptation—and thus shortened their time to market from weeks to days or even hours. We can envision the applications that power these use cases becoming more standardized over time, which would imply that e-commerce teams may be better off relying on external providers for these capabilities in the future.

More promising and ambitious cases—such as personalization , dynamic pricing, and predictive analytics—have proven to be more complex, which explains the lower levels of adoption. These may be better candidates for an in-house solution, especially because they are more likely to form the basis of sustainable competitive advantage.

The Role of Off-the-Shelf GenAI Assistants

GenAI will have major transformative impacts across the e-commerce value chain. For e-commerce executives, however, the important question is: Where in the stack will these innovations take place?

At the highest level of the stack, Anthropic’s Claude, Google’s Gemini, Meta’s Llama, OpenAI’s ChatGPT, and others are racing to build greater competencies in consumer-oriented general-intelligence chat-first experiences. E-commerce executives should be encouraging team members to use the out-of-the-box capabilities of these tools to enhance their productivity. They should celebrate and share successes as the capabilities continue to evolve.

Product owners can use the tools to simulate various users’ experiences and then use the results to refine their roadmap. For designers, the tools enable the testing of each design from the perspective of different personas, serving as both real-time panel and expert guides, with extensions into design execution. For engineers, the tools accelerate software development with code completion and real-time assistance on tool and platform configuration. For architects, the tools offer guidance on the right technology architecture to accommodate platform changes or new integrations and technologies. Finally, the tools give analysts the ability to rapidly understand all the core site and experience metrics across the funnel and provide paths for the e-commerce team.

The Role of Enhanced GenAI Features

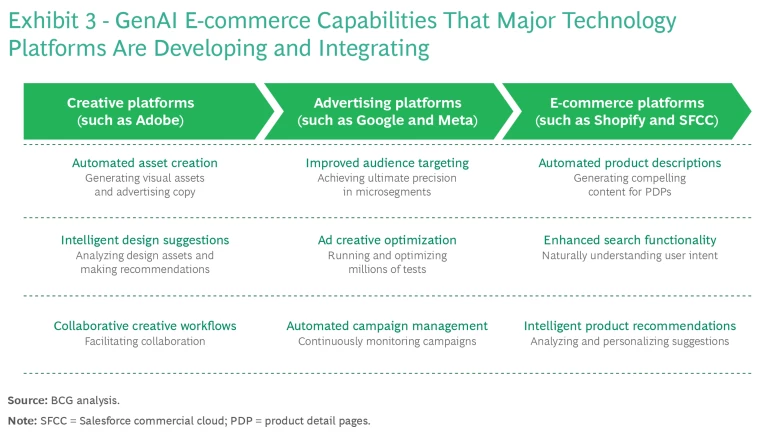

As GenAI continues to advance, major tech companies are likely to integrate specific capabilities into their existing platforms to enhance the user experience and provide more intelligent, personalized solutions. Exhibit 3 shows what e-commerce teams can expect from these platforms. Some of these capabilities—such as enhanced search functionality and intelligent product recommendations—are in early stages but are already being exposed as core GenAI capabilities in these major commerce platforms.

We have seen considerable energy and enthusiasm from some e-commerce teams about building similar solutions in these exciting areas in-house. But each company needs to consider whether it has the right scale and data advantages, relative to companies such as Meta and Shopify, to tackle these in a more efficient and capable way.

Supplementing big tech’s platforms is a deep ecosystem of third-party e-commerce tech solutions, each of which is also building GenAI capabilities into its platforms. For user-generated content and social commerce, for example, Bazaarvoice recently introduced three new capabilities—a matching service that uses AI to find creators and influencers, an automatic photo-captioning service for Instagram, and a content coach for its creator network—all driven by its HarmonyAI engine. For product information management and syndication, Salsify recently launched a platform called PXM Advance that includes AI and automation for generating content at scale. It reports that it has LLMs deeply integrated into the full workflow and connected into product detail pages that are based on more than 740 million products published across 950 destinations.

To carefully select and integrate the right third-party GenAI solutions, e-commerce executives should consider several factors beyond pricing and the potential return on investment (ROI). They should look at scalability and performance, data privacy and security measures, and vendor expertise and support. It is important for executives to strike a balance between adopting new technologies and maintaining a cohesive, manageable tech stack. As with any technology investment, executives should have a clear understanding of the business case and expected outcomes before committing to a new third-party integration.

Five Solutions for E-Commerce Teams to Build In-House

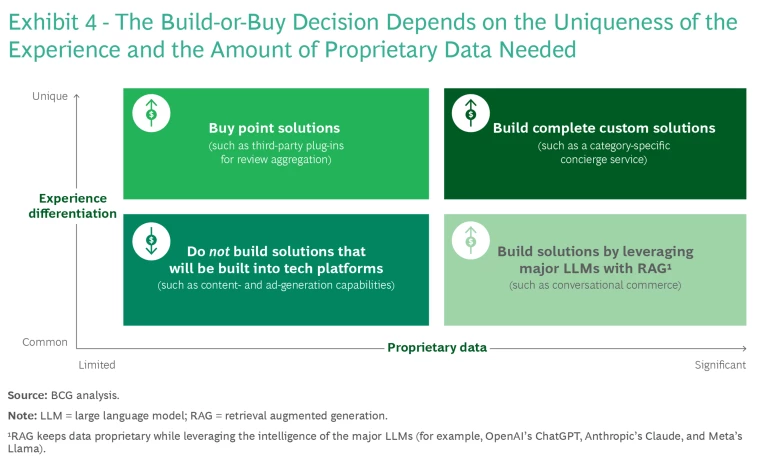

Two dimensions matter for e-commerce executives thinking through the build-or-buy decisions for their GenAI efforts:

- Experience Differentiation. How differentiated is the experience that is being considered? Is it a common e-commerce pattern, such as product detail summarization or advertising creative variants? Or is it something that is unique to the vertical that the company operates in, such as custom shirt variations or pharmaceutical interactions?

- Proprietary Data. How much proprietary data is available for use in the solution? Does the company have significant amounts of unique-to-you data? Or is most of this data common and exposed across the public internet or other sources?

Evaluating a use case against these two dimensions lands it within one of the four quadrants in Exhibit 4, with the accompanying build-or-buy recommendations.

The kinds of use cases that will land in the upper right quadrant—the ones that will frequently warrant more custom solutions—include:

- Highly Personalized Content Creation. Highly personalized content for individual customers can include product descriptions, email marketing campaigns, and custom landing pages. By building these capabilities in-house, e-commerce teams can ensure that the generated content aligns with their brand voice and messaging while maintaining full control over the data and algorithms.

- Customized Product Design and Configuration. E-commerce teams that offer customizable or configurable products can use GenAI to create intelligent design tools that guide customers through the process of creating their ideal product. Companies can differentiate themselves and create a more engaging and memorable customer experience.

- Predictive Inventory and Supply Chain Management. E-commerce teams can combine GenAI with internal data sources to build sophisticated predictive models for inventory management and supply chain optimization. In-house development allows for greater customization and integration with existing systems, potentially leading to more accurate predictions and cost savings.

- Intelligent Upselling and Cross-Selling. While many platforms and third-party solutions will offer product recommendation capabilities, building an in-house GenAI solution allows e-commerce teams to incorporate a wider variety of internal data and tailor the algorithms to their specific business goals and customer segments.

- Personalized Customer Service. Personalized experiences include virtual shopping assistants that provide tailored advice and recommendations on the basis of a customer’s unique preferences and history. An in-house solution can make the most efficient and productive use of this rich customer data.

Executives should keep in mind that in-house development can be resource intensive and may not always provide the best ROI, particularly in areas where off-the-shelf solutions are already highly advanced. Executives should carefully evaluate each use case and reserve in-house development resources for areas that offer the greatest potential for competitive advantage and customer value.

To make a pragmatic decision, however, e-commerce teams need to look beyond those two factors. They need to look under the hood of their organization to assess its capability to build, maintain, and evolve the solution. That means evaluating the availability of internal GenAI expertise and resources and the ability to integrate a solution with existing systems and processes. Companies also need to look at data privacy and security requirements and at long-term maintenance costs.

The Implications of Building In-House Solutions

The decision to invest in in-house development goes beyond the technology itself. In our experience, companies should follow the

10/20/70

rule to build a solid commercial foundation for GenAI. That rule implies that companies should devote 10% of their effort to designing the algorithms and 20% to the underlying technology and data. The bulk of the effort—70%—goes to supporting people and changing the organizational processes. Regarding GenAI, e-commerce teams need to consider three essential enablers:

- Proprietary Data. What no-regrets moves can the company make right now to improve customer data capture as well as any information data that feeds product detail pages?

- Talent. E-commerce teams can have teams of 300 to 500 people spread across many roles, including merchandising, marketing, and agile product development. How will the shape of the talent required and the operating model change as GenAI is integrated across the technology stack?

- Processes. These include the day-to-day operations of monitoring sales, traffic, and conversion rates, managing pricing and promotions and A/B testing improvements, as well as the end-to-end product development process for major releases and platform integrations. What, if anything, does GenAI change for core e-commerce operations and product development?

After answering these questions, companies may need to adjust their ROI projections, both short term (one year) and long term. They will also need to understand the barriers to success, which can include active resistance inside and outside the organization.

As the GenAI landscape continues to evolve rapidly, it is crucial for e-commerce teams to remain flexible and pragmatic in their approach to investments in GenAI. What may seem like a worthwhile in-house investment today could quickly become obsolete as new capabilities emerge in platforms and third-party solutions. By staying agile and continually reassessing their GenAI strategy, e-commerce teams can position themselves to take full advantage of this transformative technology.