With a total of $8.7 trillion in assets under management, the private equity (PE) industry makes up a substantial part of the global economy, giving PE firms significant influence over their portfolio companies’ efforts to reduce their greenhouse gas (GHG) emissions—and creating value at the same time. We know that many private equity funds employ decarbonization as a strategic lever to improve financial results through growing revenues, lowering costs, and reducing risk, which we discuss in depth later in this article.

Are PE firms making the most of this opportunity? To answer the question, this year the ESG Data Convergence Initiative (EDCI) introduced several new metrics aimed at measuring the progress that PE-backed companies are making toward decarbonization. Developed in close collaboration with a range of industry associations—in particular the Initiative Climate International (iCI) and the Institutional Investors Group on Climate Change (IIGCC)—and with strategic guidance from BCG, these metrics focus on three distinct questions for PE firms:

- Do their portfolio companies have a decarbonization strategy in place?

- Do they have a near-term GHG emissions reduction target?

- And do they have a long-term 2050 net zero ambition that is aligned with the Paris Agreement?

The new metrics were intentionally designed to reflect the nature of the PE ownership model. PE firms typically own their portfolio companies for five to seven years—a hold period that gives them enough time to implement decarbonization initiatives, even though they are unlikely to fully realize their net zero ambitions during the ownership period.

This year’s results also help us shed light on several additional questions:

- What impact do near-term decarbonization strategies and emissions reduction targets have on a portfolio company’s emissions performance during the hold period?

- How are investors approaching the establishment of these near-term strategies and targets in ways that improve enterprise value?

- And what is the impact of near-term emissions targets on the long-term net zero trajectory of these companies?

The answers to these questions are critical to the PE industry’s ability to continue creating value in a rapidly evolving world.

See the full report

appendix

for additional details on the composition of the EDCI benchmark and member survey, as well as submission rates across EDCI metrics.

Signs of Progress

How many privately owned companies are actually taking steps to decarbonize and commit to net zero? That is a key question as climate change becomes an increasingly important priority for both general partners in PE firms and the limited partners that invest in them.

Decarbonization

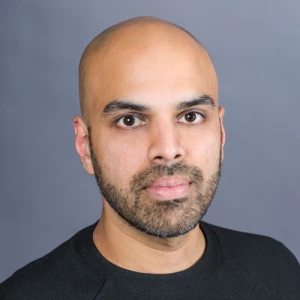

At present, just 22% of PE-owned companies have a decarbonization strategy in place. (See Exhibit 1.) While this is likely an improvement from a few years ago, it’s still a small percentage, and lower than the 29% of public companies that have implemented such strategies. This gap is understandable: Public companies have been working on decarbonization for several years, especially after COP 26, held in Glasgow in 2021, which led to a wave of companies announcing strategies and commitments. Still, the small slice of PE portfolio companies committed to decarbonization makes clear how much work remains for the industry if it is to make meaningful progress on this dimension.

Once they have established a decarbonization strategy, private companies often put in place an associated short-term GHG emissions reduction target. Nearly 20% of private companies have set a five-to ten-year emissions reduction target—a valuable tool for tracking and measuring progress, and for demonstrating to key stakeholders their commitment to decarbonization and accountability for progress.

Net Zero

Considerably fewer private companies—just 11%—have made longer-term net zero commitments, while an additional 6% have longer-term decarbonization goals in place that are not fully aligned with a net zero pathway. Given the relatively short investment hold periods in PE, this isn’t surprising. However, another 19% of private companies do say they plan to establish a long-term net zero path within the next two years, an encouraging sign of growing commitment to emissions reductions on the part of the PE industry and the companies it owns.

A closer look at the kinds of private companies that are devising emissions strategies and setting both short- and long-term goals, and where they are located, provides insight into where progress is happening and where it’s most needed.

Strategy and Location

The global decarbonization strategy rate of 22% is predominately driven by companies based in Europe, where 35% of private companies have a strategy in place. This isn’t surprising—decarbonization is more central to European company strategies and is supported by a wider range of commercial forces, including government regulation and clear customer preferences for greener offerings. In contrast, only 10% of private companies in North America and 23% in Asia have decarbonization strategies. These differences are also true in the case of long-term net zero pathways.

Company Size

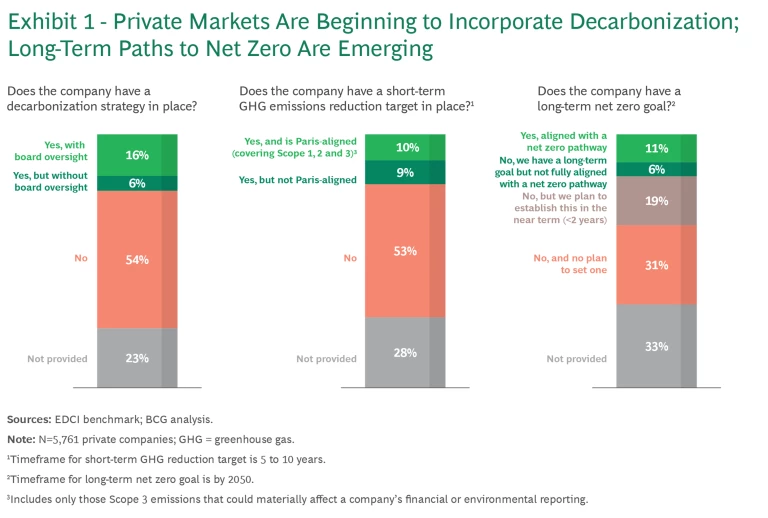

Larger private companies are making significant strides toward a long-term net zero pathway (as well as in their decarbonization strategy coverage). Among companies with more than $200 million in revenue, 22% have a net zero path in place and a further 19% plan to do so within two years. (See Exhibit 2.) This is likely the result of the capital intensity and scale of these companies, combined with the complex task of establishing a thoughtful long-term net zero commitment. Larger companies are better positioned and capitalized to do the hard work required to feel comfortable committing to such initiatives. They are also more likely to be preparing to list on public markets, and once public, they will face even greater pressure to commit to net zero goals.

Sector Goals

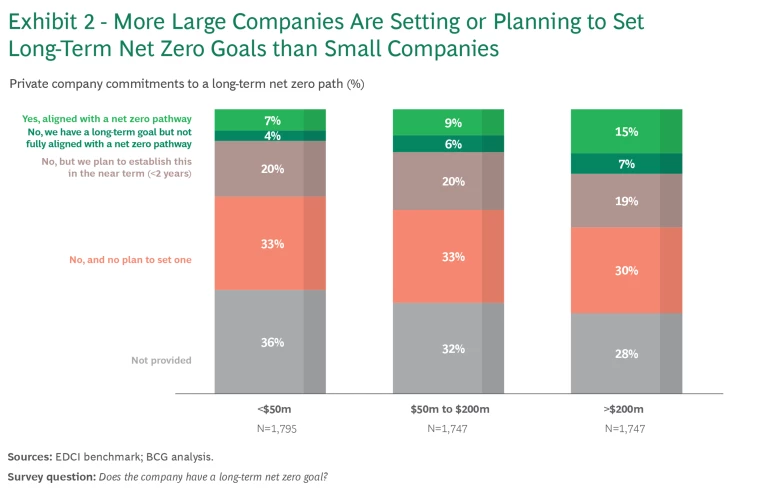

Looking across sectors, we saw relatively consistent levels of commitment to reaching net zero. The proportion of companies with a long-term decarbonization goal in place is generally between 15% and 20% across a wide range of sectors. (See Exhibit 3.) This is despite very significant differences in average emissions intensity across sectors and the respective feasibility of decarbonization plans based on the cost-competitiveness of current technologies available in each sector.

It’s also worth noting that in every sector there are clear leaders setting an example for those companies that are not yet on a path to net zero and have no plans to set one. This is often due to the lack of a perceived net zero pathway for many companies in the sector, yet these leaders have demonstrated that a trajectory toward net zero is possible, even in sectors where it’s traditionally viewed as challenging.

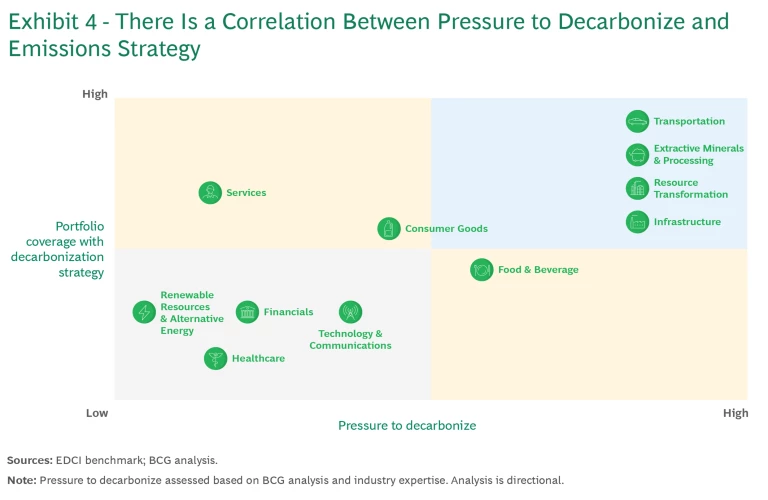

A Broad Push to Decarbonize

Regulators, investors, employees, customers, and other stakeholders are upping the pressure on companies to decarbonize. The relative degree of pressure to decarbonize in the short term varies considerably among sectors, as does the complexity and return on investment of the abatement levers available to companies. Companies in sectors with relatively low-emitting business models, such as Healthcare, face relatively less pressure on average, while high-emitting companies in sectors like Transportation, Resource Transformation, and Extractive Minerals and Processing face considerably more. (Of course, certain companies in each sector may produce considerably more emissions than others, and thus face more pressure. In the Technology and Communications sector, for example, a data center will have a very different emissions profile than a software business.) Moreover, the nature and degree of pressure from regulators, customers, and employees will also vary by region.

It’s encouraging that companies in sectors under the greatest pressure are also the most likely to have decarbonization strategies. (See Exhibit 4.) Successfully executing these strategies should position these industries well to benefit from powerful commercial tailwinds in the coming years. At the same time, companies in low-emitting sectors would be wise to continuously track how strategic pressures are evolving. Many low-emitting companies in the Technology sector, for example, are currently experiencing a rapid growth in emissions due to the considerable energy intensity of generative AI, and the pressure to reduce the related emissions is growing.

Commitments and Results

It’s promising to see more companies in private markets committing to lower emissions and long-term net zero goals. But the key question is whether or not this has any actual impact on real-world emissions outcomes. In reviewing emissions data in the light of the new net zero metric, two insights come through clearly.

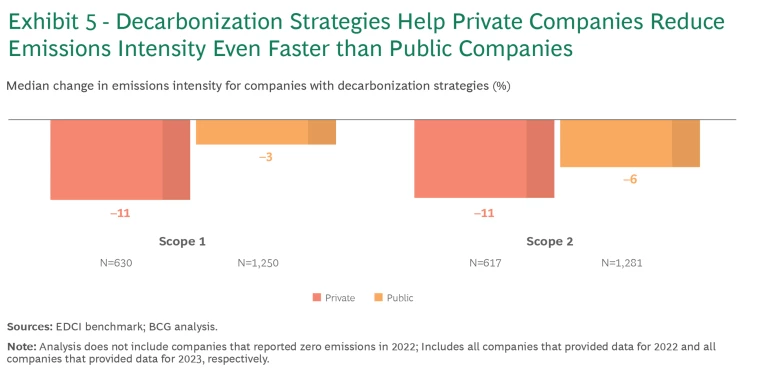

First, the data shows that private companies with decarbonization strategies in place have indeed been significantly more successful in reducing emissions than their private peers without a strategy. Between 2022 and 2023, companies with a strategy reduced their emissions by approximately 11% for both Scope 1 and Scope 2 emissions, compared to just 5% (Scope 1) and 6% (Scope 2) for those without a strategy. This is encouraging. Those putting in the effort to measure and reduce emissions and to identify ROI-positive opportunities to decarbonize are realizing meaningful improvements in emissions—and creating business value as they do so.

Second, while significant variations across sectors, regions, and company size make comparisons of emissions between the private and public markets challenging, private companies with a decarbonization strategy in place are decarbonizing their businesses at a faster rate than public companies. (See Exhibit 5.)

This demonstrates just how effective private companies can be at executing on their emissions reduction strategies when they establish them. It also highlights the strength of the PE ownership and control model and long-term mindset, which allows PE firms to engage effectively with management teams at portfolio companies, identify decarbonization opportunities, and drive real change. (See “Decarbonization in Practice.”)

The Performance Connection

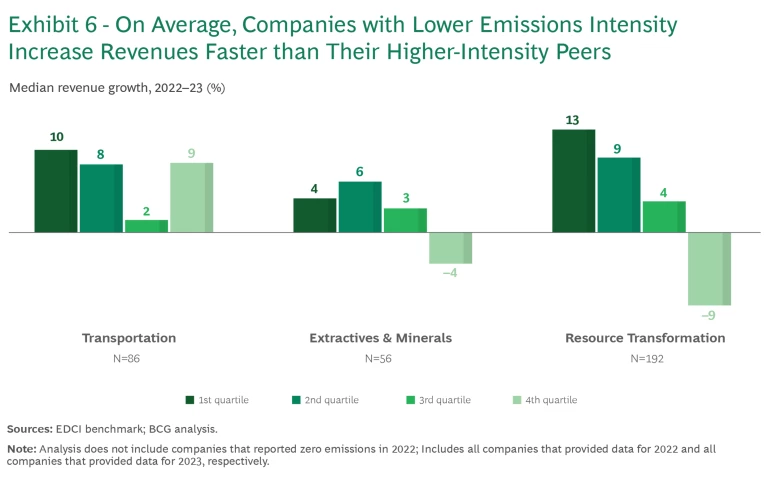

The primary goal of PE firms, of course, is to increase the value of the companies they own. This makes the connection between emissions reductions and financial indicators, such as revenue growth, essential to firms’ continued efforts to decarbonize their holdings. There are several mechanisms through which decarbonization can help companies gain competitive advantage and improve financial results. Decarbonization can help position businesses to increase revenues from customers that are increasingly incorporating suppliers’ carbon emissions into their procurement decisions. It can lower costs through the move to cheaper, more reliable renewable energy or through energy-efficiency initiatives. And it can reduce risk exposure, such as a potential future carbon tax.

We explored the link between decarbonization and revenue growth and found that, on average, there is a negative correlation between combined Scope 1 and 2 emissions intensity and revenue growth at companies in industries with the highest share of decarbonization strategies. Companies in the first, or lowest, quartile of emissions intensity relative to peers tend to have higher revenue growth than those with higher levels of emissions intensity. (See Exhibit 6.) While this is an interesting link, it’s important not to overstate the connection; every sector includes a wide range of different types of businesses, which could affect this finding. And the correlation in lower emitting sectors is not as strong. Furthermore, this is a correlation, not causation: It may be that companies that boost their revenues have the time to take a longer-term approach to strategic planning and the additional resources needed to invest in decarbonization initiatives.

As we have seen from our work with clients and in the EDCI data, when PE firms encourage their portfolio companies to develop decarbonization strategies, they are able to rapidly and effectively reduce emissions, creating both commercial and social value. If more funds and portfolio companies follow this lead, we will soon see real long-term impact at scale.