Since 2015, when the Food and Drug Administration (FDA) approved the first biosimilar drug in the US, the market has grown as more reference brands lose exclusivity and more biosimilars are approved. As of August 2024, ten different molecules have biosimilars, 43 biosimilars have launched, and the US market represents approximately $7 billion in annual revenue for biosimilars manufacturers.

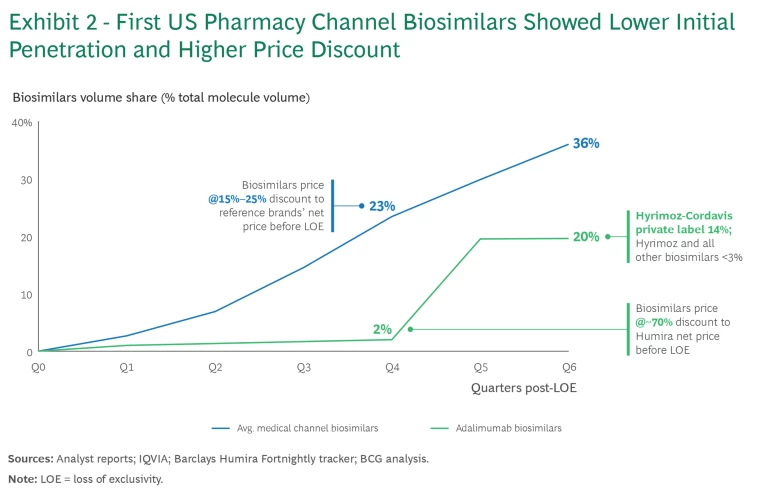

The market’s short-term memory has been biased by the slow uptake of adalimumab biosimilars for the blockbuster drug Humira, which took nearly 18 months to gain meaningful adoption. With the dust settling around adalimumab, biosimilar companies have learned valuable lessons about the new rules of the game for pharmacy benefit products.

Against this backdrop, the overall trend toward greater and faster biosimilar adoption remains strong, thanks to evolving policy changes and increased physician confidence in these products. Reference brands worth roughly $200 billion will lose exclusivity and be eligible for biosimilar entry over the next ten years. This is great news for US patients who rely on these life-saving therapies and for the US health care system overall, since biosimilars reduce the cost of care.

Reference brands worth roughly $200 billion will lose exclusivity and be eligible for biosimilar entry over the next ten years.

Increasingly lower hurdles for biosimilar development won’t immediately open the flood gates of competition. Going forward, we expect the US biosimilars market to resemble complex generics, such as complex peptides and inhalation therapies, rather than commodity generics such as oral solid doses. For biosimilars manufacturers, it is critical to have a clear strategy for pipeline choices, internal development versus business development, and go-to-market capabilities.

US Biosimilars Markets Followed Clear Patterns Before Adalimumab

Like small molecule generics, biosimilars markets form when reference brands lose market exclusivity as their patents expire. The US biosimilars market is not as mature as the European market. The European Medicines Agency clarified the regulatory pathway for biosimilars nearly a decade before the FDA. In addition, reference brands often have longer patent runways in the US than do the major markets in Europe. On average, biosimilars markets for a reference biologic brand form three to four years later in the US than in Europe. So far, out of 12 biologic brands with biosimilars offerings, only two of them saw biosimilar entries in the US before in Europe. As a result, there are much more patient data in Europe than in the US.

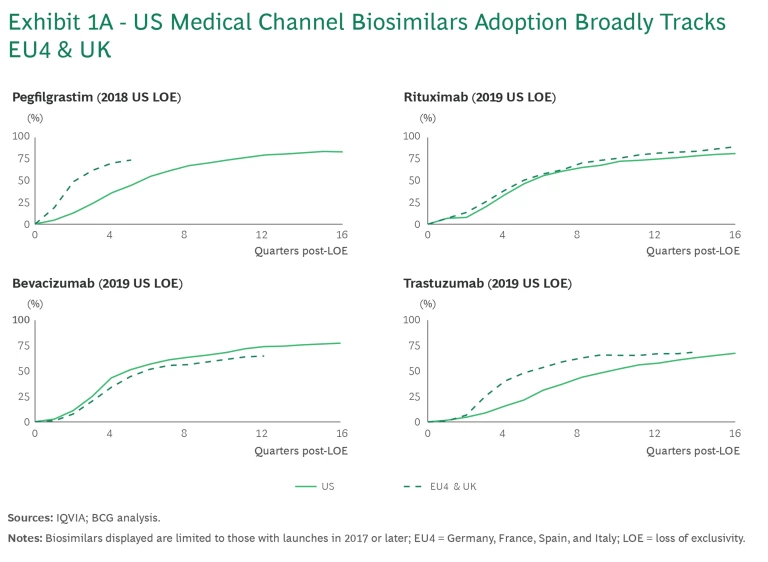

Despite these differences, biosimilars’ adoption between the US and EU for molecules launched before 2022 has been largely comparable. This is particularly true for oncology products, which are administered in physician offices and reimbursed as medical benefits in the US. (See Exhibit 1A.) This rapid uptake is driven by the aligned incentives across the value chain for all parties involved, including prescribing physicians.

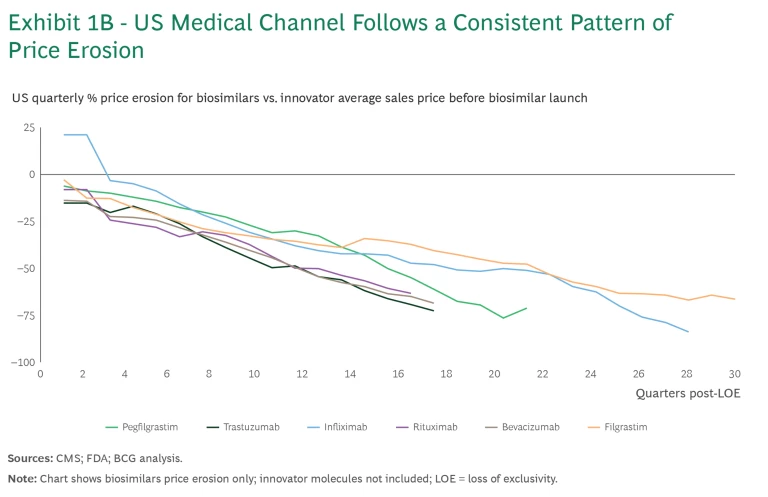

These medical benefits biosimilars also follow a similar pattern of price erosion. (See Exhibit 1B.) Products have typically seen a 10% to 20% discount to the reference brand price immediately after market formation, and 10% to 20% annual erosion in price thereafter. While the initial discount is typically larger in Europe at 30% to 50%, the annual erosion that follows is relatively consistent.

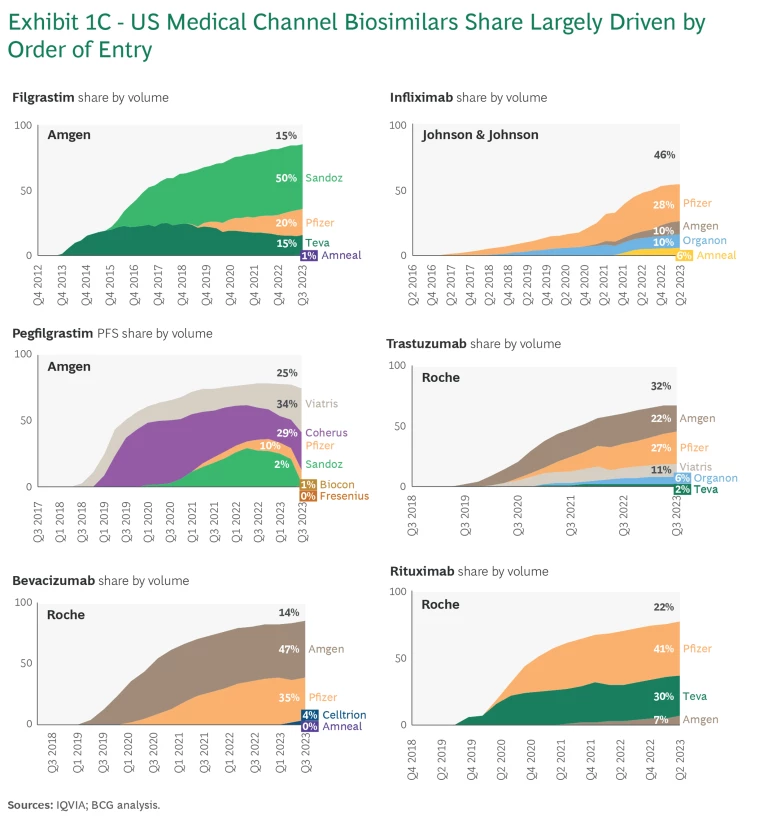

Another interesting pattern emerges in the market share distribution across biosimilar products for a given molecule. In most cases, there is a significant advantage for early entrants. While many molecules over time see five to six biosimilars offerings, the first two to three manufacturers who enter the US market typically capture more than 90% of market share. (See Exhibit 1C.)

Adalimumab Presented a Shock to the System

Biosimilars for adalimumab have drastically deviated from familiar market patterns. The reference brand for adalimumab is AbbVie’s Humira, a monoclonal antibody used to treat rheumatoid arthritis, Crohn's disease, psoriasis, and several related diseases. All eyes have been focused on adalimumab for many reasons, including:

Biosimilars for adalimumab have drastically deviated from familiar market patterns.

- Involvement of Pharmacy Benefit Managers. Adalimumab was the first pharmacy benefit biologic to lose exclusivity. This means the involvement of PBMs, which have been under scrutiny for their roles in US drug pricing.

- Unprecedented Reference Brand Size. In 2022, the year before biosimilars launched, Humira brought in $21 billion in net revenue, 37% of AbbVie’s total revenue. Previously, the biggest biologics loss of exclusivity was for Remicade, with $7 billion in net revenue, representing 10% of Johnson & Johnson’s total pharmaceutical revenue.

- Unmatched Level of Competition Among Biosimilars. Nearly all biosimilars manufacturers invested in developing their own adalimumab biosimilar in the hope of capturing a piece of this megablockbuster market. Within six months, there were already eight biosimilar competitors available and two more awaiting FDA approval. Before adalimumab, the most competitive biosimilar was pegfilgrastim, with six competitors six years after the initial loss of exclusivity.

The adalimumab biosimilar companies have tried to differentiate themselves in various ways. Some offer particular product attributes such as high or low concentrations, versions that are free of latex or citrate, or that have a patient-friendly injector. Some have received a formal FDA designation of interchangeability. This makes them the only biosimilars eligible to negotiate deals with specialty pharmacies for potential automatic substitution if the physician prescription does not request “dispense as written” for the reference brand Humira.

Within six months, there were already eight [adalimumab] biosimilar competitors available and two more awaiting FDA approval.

Some biosimilars won coverage from major US payers. Some introduced dual wholesale acquisition cost (WAC) pricing to thread the needle between payers who prioritize low net cost and PBMs who prioritize high WAC and high rebates. Some offer cash pay options through alternative channels such as Mark Cuban Cost Plus Drugs.

Meanwhile, AbbVie aggressively discounted for Humira to retain share by offering larger rebates to PBMs.

In the 18 months after the first adalimumab biosimilar launched, only one biosimilar company, Sandoz, managed to meaningfully penetrate the market and did so seemingly overnight. (See Exhibit 2.) The breakthrough came when CVS Caremark removed Humira from its major national commercial formularies, and Cordavis, a new wholly owned subsidiary of CVS Health, launched private labels of Humira and Sandoz’s biosimilar Hyrimoz.

The private labels will likely become a “must-win” for future pharmacy benefit biosimilars. With increasing consolidation, either by ownership or by exclusive partnership, three pairs of payers/PBMs manage more than 75% of products reimbursed under pharmacy benefit either directly or indirectly. Biosimilar companies will likely need to compete to win these private label deals, similar to competing in the national tenders in the UK and Germany, on one-year or multiyear cycles.

Policies Are Evolving to Support Further Adoption

While the slow uptake of adalimumab represented a setback, the US biosimilars market continues to move toward increased and faster adoption thanks to the exciting moves made by regulators and policymakers.

In June 2024, the FDA proposed guidance that biosimilars that seek an interchangeable designation will no longer be required to conduct switching studies, as was previously recommended. The change codifies what has already been implemented in practice on a case-by-case basis. Nine of 13 approved interchangeable biosimilars have not been required to conduct switching studies.

In June 2024, the FDA proposed guidance that biosimilars that seek an interchangeable designation will no longer be required to conduct switching studies, as was previously recommended.

At the same time, the Centers for Medicare & Medicaid Services announced that biosimilars can be substituted as part of regular formulary maintenance changes, regardless of interchangeable status. This move could potentially accelerate biosimilar penetration in the Medicare and Medicaid populations.

On another developing front, the FDA is open to discussing Phase III trial waivers on a case-by-case basis if pharmacokinetic and pharmacodynamic data sufficiently support clinical similarity. So far, only the UK has officially discontinued the requirement that all biosimilars undergo Phase III confirmatory efficacy trials.

With all these enacted or pending policy changes aimed at lowering barriers to entry, keep in mind that the cost and timeline to bring biosimilars to market will remain high. (See Exhibit 3.) We do not expect the biosimilars market to face the same level of commoditization as oral solid dose products, where there can often be more than ten suppliers by the end of the first year. Instead, the US biosimilars market will likely resemble complex generics dosage forms such as inhalation therapies or complex peptides, where first entrants could experience periods of sole supply, with three to five players entering in the first one to two years.

Capitalizing on Upcoming Biosimilars Opportunities

Over the next ten years, approximately $200 billion in revenues across 150 molecules will face loss of exclusivity. The competitive intensity likely will be particularly high for nine molecules whose expected annual brand revenue exceeds $5 billion, which represents 45% of the revenue pool.

This is exciting for US patients, who will benefit from gaining access to a greater number of lifesaving therapies at much more affordable prices. Similarly, US payers will also benefit from lower costs for some of the most expensive drugs in US history.

Over the next ten years, approximately $200 billion in revenues across 150 molecules will face loss of exclusivity.

For biosimilars manufacturers, the rules of the game for both medical and pharmacy channels are getting clearer. We anticipate that for each biologic molecule, only a few biosimilars manufacturers will likely have attractive economics. It will be critical to be in the first wave of manufacturers to capitalize on a large share of the market while the price is still high. In order to improve their odds, companies must have a very clear pipeline strategy for which molecules to pursue and whether to do that through internal development or business development.

Supply reliability and a competitive cost base will also be critical as the market becomes more competitive over time. Biosimilars won’t be as commoditized as the oral solids market, where customers can easily shift volume to other suppliers with excess capacity. Customers will want to work with manufacturers with reliable supplies in addition to meeting the cost reduction goals over time.

Finally, it is time to rethink the go-to-market capabilities. Contracting capabilities will be critical going forward. The importance of having a field presence will likely continue to diminish, especially for pharmacy channel products. It is crucial to begin adapting to that change.