For several years the COVID-19 pandemic dominated business considerations among companies across the globe. As vaccines rolled out, Government financial stimulus waned, and border restrictions lifted, a post-COVID reality began to emerge.

Over the course of 2023 the post-COVID ’new normal‘ took shape in New Zealand, but its emergence was marked by a large amount of continued uncertainty. Inflation and interest rates rose without a clear consensus on when the rise would stop or if (much less when) rates would return to pre-pandemic levels. Supply chains recovered from pandemic gridlock but did not snap-back to familiar pre-COVID configurations. Cross-border migration skyrocketed, but no one knew if this was a new steady state or just pent up demand. All this uncertainty was underscored by the looming election and potential for change in Government and associated policies. In this uncertain context, the value of optionality for New Zealand businesses remained high over the course of last year.

However, we believe a clearer picture of the ’new normal‘ has emerged, setting up New Zealand businesses to make decisions on how to compete in the coming years. This article presents the Top 10 areas of focus for New Zealand’s executives in 2024 and explores what organisations will need to consider in their response.

The Top 10 areas of focus for New Zealand Executives in 2024:

1. The decade of ultra-low interest rates is over

2. Productivity is the only no-regrets move in an inflationary environment

3. Consumer spending will remain stretched

4. The ‘brain drain’ remains real and persistent

5. GenAI is reaching a tipping point; early adopters will leap ahead in 2024

6. The most important geopolitical bellwether for NZ remains China/US

7. Global supply chains are (permanently) resetting for a ‘tripolar’ world

8. More risks are under-insured or, worse, un-insurable

9. It is time to start budgeting for carbon

10. 2024’s investments will determine whether or not NZ will meet its 2030 targets

1. The decade of ultra-low interest rates is over

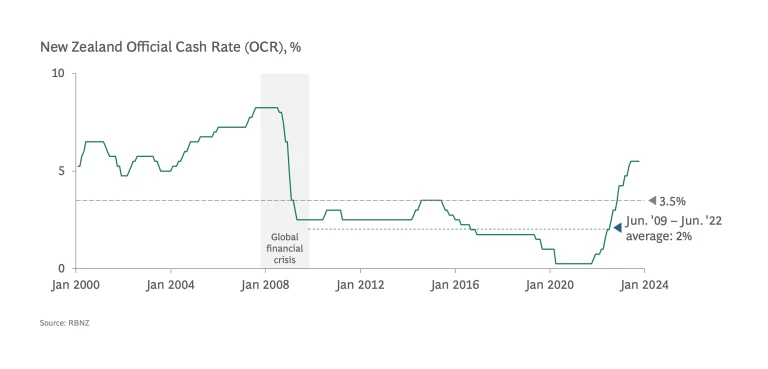

The Official Cash Rate (OCR) has risen to 5.5% after more than a decade below 3.5% and an average of ~2% between mid-2009 and mid-2022. While maintaining optionality in case interest rates returned to ultra-low levels made sense in 2023, a consensus has emerged that interest rates are unlikely to return to the levels seen in the 2010’s in the foreseeable future. This means it now makes sense to adjust business models and capital decisions to a market with higher interest rates, and executives accustomed to the abnormally low interest rates since the global financial crisis will need to quickly adapt to this environment.

Most acutely, companies refinancing debt at higher rates will see debt servicing eat into margins and, in some cases, pose liquidity threats. Year-on-year New Zealand business defaults were up in the property/rental sector (+35%), retail trade (+20%), hospitality (+16%), construction (+16%), and transport sectors (+10%) in July 2023 according to Centrix.

Access to capital will also change. Equity capital availability – already a challenge in New Zealand – will decrease as investors shift portfolios toward a more attractive bond market, and companies with investment-grade balance sheets will see a magnified benefit of lower borrowing costs.

In this environment of lower access to and higher cost of capital, leaders will need to devote extra scrutiny to capital projects as hurdle rates grow higher and the opportunity costs of safe financial investments offering moderate interest income increase.

Key takeaway for leaders: Higher rates are here to stay, and even though some investment decisions will carry greater risk, it will be costly to remain idle. Focus your capital investments where rigorous business cases, aligned with your strategy, provide high rates of return.

2. Productivity is the only no-regrets move in an inflationary environment

Inflation has driven significant cost increases for New Zealand companies since increasing from ~1.5% in March 2021 to peaking at ~7.3% in June 2022 according to Stats NZ. Wage rates in particular have risen ~14% in the last year. Even if the rate of inflation subsides as expected, costs will remain structurally higher in 2024 than in previous years. The nation-wide, cross-industry nature of the impact of inflation means productivity improvements are no-regrets investments for every company in 2024.

However, not every company will measure productivity in the same way. It will be critical to understand what measures of productivity are most important for your organisation (e.g., optimising use of input materials, ensuring employees are focused on value-generating activities, allocating capital to the highest return projects), and take steps to adjust your operating model to improve margins despite a higher cost base.

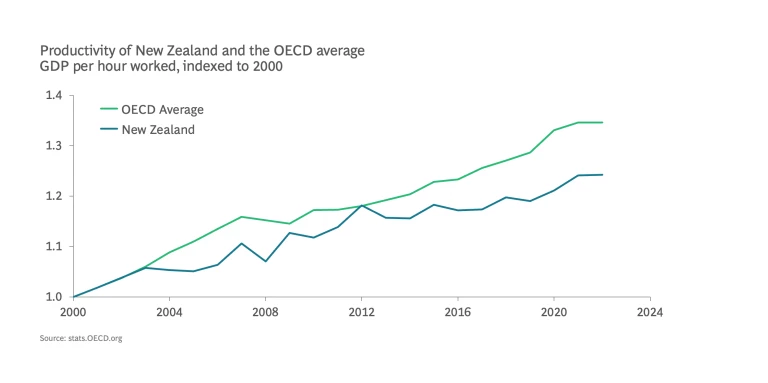

Leaders should also look outside of their companies for productivity improvement opportunities. The Productivity Commission has studied how other Small Advanced Economies (SAEs) like Denmark, the Netherlands, Sweden, and Switzerland have outperformed New Zealand on productivity improvements. They identified an increased rate of innovation and export of high-value, distinct goods and services when compared to New Zealand firms as a primary, driving factor. Innovation and moving up the value chain, they found, can be supported by partnerships with other complementary companies in the same ‘ecosystem’ and Government engagement.

Key takeaway for leaders: Understand and pursue improvement in the productivity measures suited to your company, and look for potential partnerships or Government engagement to drive innovation and international competitiveness.

3. Consumer spending will remain stretched

The cost of living has jumped almost 16% over the last year, growing faster than the 14% rise in wages. A primary driver of the growth in cost of living is housing expenses. As interest rates have increased, so too have mortgage repayment and rent costs. For example, while house prices have fallen since the end of 2021, the median rent is still ~43% of the median income, meaning households are spending more on rent than they ever did before 2020 according to rental data from the Ministry of Business Innovation & Employment.

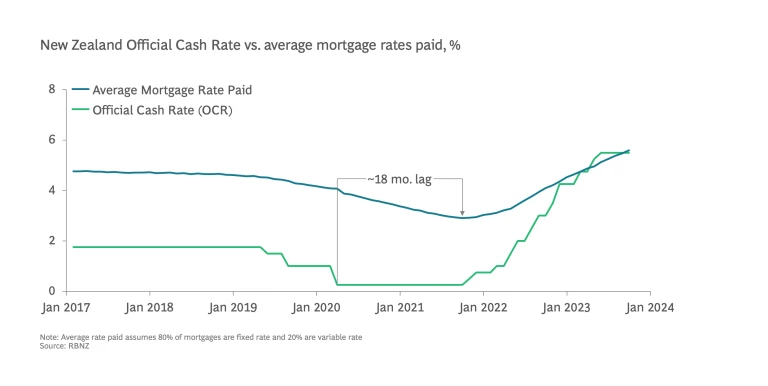

This rise in overall housing costs will continue into 2024. Over 80% of New Zealand mortgages have fixed rates, with a large majority favouring ~1-3 year fixed terms. This creates a meaningful lag between changes in the Official Cash Rate, mortgage interest rates offered by banks, and the average interest rates actually paid on outstanding mortgages. This delay was observed as the OCR hit a long-term low of 0.25% in March 2020, but the average paid mortgage rates did not bottom out until ~18 months later. Further, mortgage rates paid in a steady state tend to be roughly 3 percent higher than the OCR whereas currently the OCR and rates paid are nearly identical.

As a result, consumers (as a group) are likely to become even more price sensitive in 2024 and limit discretionary spending further. BCG’s third consumer sentiment survey found that ‘value for money’ was by far the top driver of purchase decisions in New Zealand, and this will continue to get more important as housing costs continue to rise in 2024.

Key takeaway for leaders: Despite the view that the Official Cash Rate may not rise further, mortgage and rent expenses for consumers will continue to rise in 2024. Companies need to prepare for further pressure on disposable income and even higher consumer price sensitivity.

4. The ‘brain drain’ remains real and persistent

Many recent headlines have reported record levels of New Zealanders leaving the country alongside simultaneous record-breaking net incoming migration over the last year.

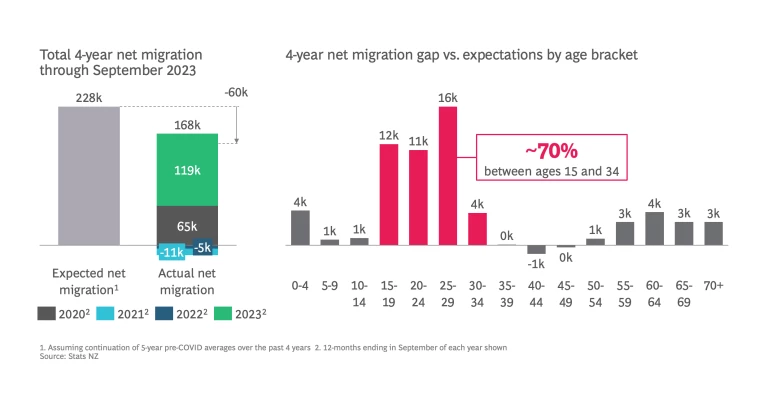

To examine this question, we compared the total aggregate migration statistics for the four years ending September 2023 to the numbers one would expect if each of those years had statistics matching the 5-year, pre-COVID average. Instead of focusing on record high volumes since the boarders re-opened (and omitting record lows when boarders were closed), this methodology lets us compare the total aggregate migration over the last several years versus what we might have expected if boarder closure and re-opening had not caused wild swings in immigration statistics.

This methodology reveals that the ‘brain drain’ is real: New Zealand currently has a ~60,000-person gap in total net migration over the last 4 years compared to what we would have expected if pre-COVID trends had continued. This gap is overwhelmingly driven by fewer arrivals (~58,000 fewer than expected) as opposed to more departures (~2,000 more than expected). Concerningly, 15-34 year olds contribute ~70% of this gap, potentially impacting workforce availability for years to come if net migration inflows do not continue at higher than historical rates, filling the deficit caused by boarder closures.

Deeper investigation of the ~60,000-person net migration gap reveals key learnings across arrivals and departures (Note: the numbers below will sum to more than 60,000 as there are examples of categories of arrivals and departures that exceeded pre-pandemic average expectations, giving a “negative gap”):

- Comparing actual vs. expected arrivals by visa type for the four years ending September 2023, almost 44,000 fewer students arrived in New Zealand vs. what we would have expected had pre-pandemic trends continued – more than half of the difference in expected arrivals. The first classes of students impacted by the pandemic will graduate at the end of 2023 meaning companies recruiting out of New Zealand universities next year may face challenges due to a smaller pool of local graduates.

- New Zealanders are not returning to the country at the historical rate. More than 20,000 fewer New Zealanders have returned to New Zealand in the four years ending September 2023 than had pre-COVID trends continued. At least half of this number can be attributed to fewer New Zealanders returning from Australia. April 2023 changes accelerating the path to Australian citizenship for New Zealanders may contribute to this trend.

- More than 10,000 fewer migrants arrived on work visas in the four years ending September 2023 vs. pre-COVID trend expectations. By country of last permanent residence, the largest contributors to this gap were from the UK (-11k), Australia (-5k), South Africa (-5k), and the USA (-2k). Notably, arrivals on work visas from India (+10k) and China (+4k) exceeded expectations based on pre-pandemic averages.

- The reported mass exodus of New Zealand citizens from the country may be overstated. Almost 7,000 fewer citizens have departed New Zealand in the four years ending September 2023 than if pre-COVID trends had continued.

Key takeaway for leaders: Despite high recent rates of incoming migration, New Zealand still faces a gap vs. what we would expect based on pre-pandemic trends. Do not expect the war for talent to subside. If your company hires international students graduating from New Zealand universities, expect next year’s recruitment cycle to be particularly competitive.

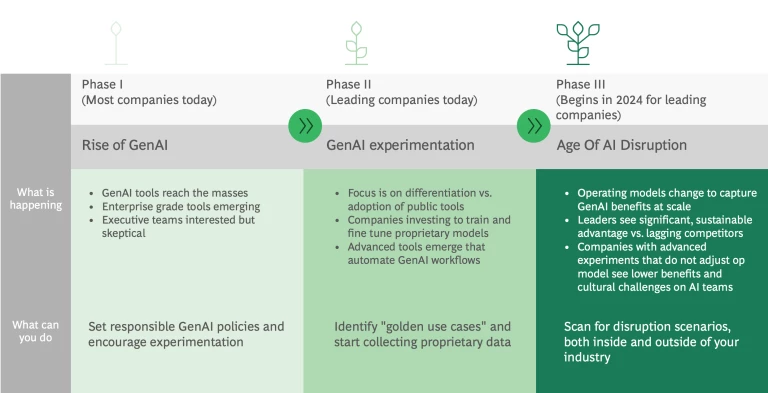

5. GenAI is reaching a tipping point; early adopters will leap ahead in 2024

In 2023, Generative AI usage soared, with Chat GPT alone adding 180m users, far surpassing the adoption rate of other technologies. While initial uptake was driven by curiosity, its commercial value is now evident. Companies are using the technology in customer service, knowledge management, marketing copy creation, software development co-piloting, operational decision-making, and many other areas. For example, Octopus Energy is using Generative AI to develop personalised marketing emails, streamlining tasks equivalent to ~250 people, while improving customer satisfaction.

2024 represents a tipping point where leading companies go beyond experimenting with GenAI and integrate it into their operating models at scale. Organisations that do so will see a significant advantage in terms of value delivered compared to competitors that lag behind.

Truly embedding Generative AI into an organisation, however, will require a re-assessment of both traditional operating models and a re-engineering of traditional processes. A true integration of GenAI will be similar to the beginning of the Internet – it’s not just about having a physical catalogue available on the internet, the complete business model needed to be reimagined, from revising supply chain to rethinking user experience.

Key takeaway for leaders: To unlock the majority of the value promised by GenAI, organisations will need to transform their operating models to leverage the technology at scale. Companies that do this successfully stand to create sustainable competitive advantage.

6. The most important geopolitical bellwether for NZ remains China/US

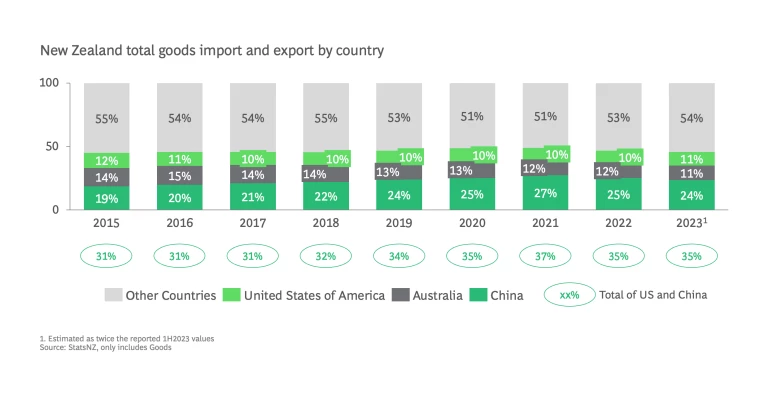

Global geopolitical tensions have increased in recent years, demonstrated most starkly by the Russian invasion of Ukraine and the Israel-Hamas war. While these and other events have important humanitarian and political implications for the country, the key driver for New Zealand, economically, is potential for increased tensions between the US and China, two of New Zealand’s three largest trading partners.

The United States’ trade relationship with China has been troubled since the 2018 ‘trade war’, and significant tariffs remain, despite the change in administration after the 2020 US election. Currently two-thirds of imports from China to the US are under tariff, and 58% of US goods face import tariffs when entering China.

Key takeaway for leaders: New Zealand firms should consider how potential changes in the U.S. – China relationship could impact their business and integrate these potential impacts into their strategic decision-making.

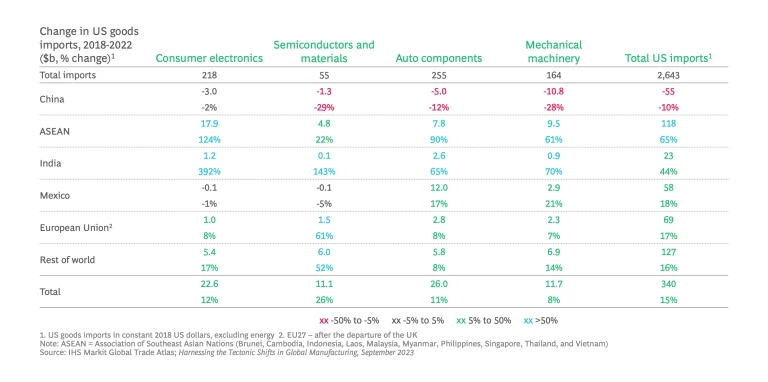

7. Global supply chains are (permanently) resetting for a ‘tripolar’ world

Supply chains were disrupted during COVID-19 and the scarcity of critical assets such as vaccines and ventilators demonstrated how countries might make distribution decisions along geopolitical lines. Now, rather than returning to pre-COVID levels of global integration, geopolitical forces are reconfiguring supply chains for resiliency a tri-polar world. Those focused on the US (and allies), those focused on China, and those trying to stay neutral.

Key examples include the United States’ CHIPs Act, which provided ~$280b USD to boost domestic research and manufacturing of semiconductors, and the Li-Bridge initiative, aiming to develop a domestic supply chain for lithium batteries. Both aim to reduce the United States’ reliance on supply chains connected to China. Many US companies are shifting from Chinese manufacturing to supply chains in Mexico. Similarly, many companies in the European Union are moving manufacturing from China to Eastern Europe. Across the Tasman, Australia appears to want to remain neutral – while the AUKUS submarine deal clearly aligns Australia to a US-centric security position, trade minister Don Farrell recently touted discussions at the November 2023 Asia-Pacific Economic Cooperation (APEC) meetings to remove all remaining trade blocks with China stemming from a 2020 diplomatic dispute regarding the origins of COVID-19 by year-end.

New Zealand is in a particularly precarious position, as it has limited large-scale manufacturing capability and is geographically isolated from the rest of the world. It is unlikely that New Zealand will be able to onshore end-to-end supply chains for many important products. New Zealand must rely on other countries for critical goods and services, and therefore the country and organisations within must actively consider geopolitical forces.

Importers need to fully expose their supply chain and understand its resiliency in a less globally connected world. This means assessing where components along the supply chain originate, any associated risks (e.g., natural disasters, health incidents, geopolitical risks), and where they sit in the hierarchy of customers if demand outpaces supply, as it did during the pandemic. Similarly, exporters should assess potential customers and the importance they place on reliability. This allows traders to monetise the guarantee of supply, which New Zealand organisations may be globally competitive given the relative isolation of the country.

Key takeaway for leaders: Evaluate the resiliency of your supply chain in a ‘tri-lateral’ future with more re-shoring/on-shoring/friend-shoring and less global connectivity. Importers must assess supply chain resilience, considering risks and hierarchy of importance, while exporters can leverage reliability to compete globally, given New Zealand’s unique position.

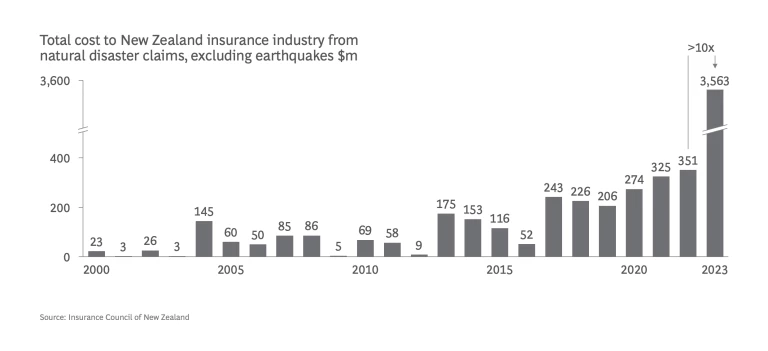

8. More risks are under-insured or, worse, un-insurable

Organisations need to be conscious of cyber, social, and climate risks going into 2024. The Optus and Medibank cyber attacks from 2022 and 2023 cost the organisations $140m and $46m, respectively. Events resulting in the loss of social trust in Qantas and Optus by the public contributed to early departures of both CEOs.

In New Zealand, the impact of climate risk is becoming increasingly acute. The January-February floods and Cyclone Gabrielle is costing insurers ~$3.5b, 10x the extreme weather total in 2022.

Key takeaway for leaders: Increasingly, business leaders cannot simply rely on purchasing insurance to manage risks. Leaders need to assess potential cyber and social risks and address them through their operating model. As physical risks increase due to climate change, leading companies will use geoanalytics and partner with insurers to assess extreme weather risk during development. Having a perspective on what public-private partnership structures would be in the interest of your business may become valuable if certain risks become un-insurable in the private market.

9. It is time to start budgeting for carbon

Carbon emission reporting and costs will become more explicit in 2024. The inaugural International Sustainability Standards Board (ISSB) standards – IFRS S1 and IFRS S2 – go into effect in 2024, standardising reporting across companies and nations. Australia, Canada, Japan, Hong Kong, Malaysia, Nigeria, Singapore, the UK, and New Zealand, among others, are moving toward adoption of the ISSB standards.

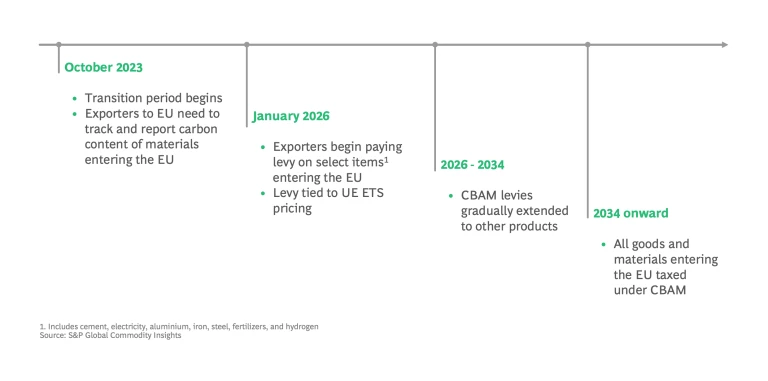

The world will also continue to move beyond reporting to levying a cost of carbon. 2024 will be the first full year that the EU Carbon Border Adjustment Mechanism (CBAM) is in place, requiring reporting on imports of carbon intensive products such as cement, electricity, aluminium, iron, steel, fertilisers, and hydrogen (CBAM levies take effect in 2026 with additional products to be included through 2034). Additionally, and more immediately impactful for New Zealand, marine shipping emissions will be included in the EU Emissions Trading System (ETS) starting in January 2024.

As carbon costs become more explicit, firms are taking action. For example, financial traders at a large European Union-based institution now must trade within risk-weighted asset and carbon budgets.

Despite the price of emissions becoming more explicit, emissions often go unbudgeted in New Zealand. Companies will benefit from developing an internal view of the direct and indirect costs of carbon. This view will help inform decarbonisation decisions (e.g., via marginal abatement cost curves) and the impact carbon pricing could have on margins. This will be particularly important for firms in hard-to-abate sectors like airlines, cement, and agriculture or for firms that export lower-margin commodity productions internationally.

Key takeaway for leaders: Creating a robust view of the cost of carbon will help support cost-efficient decarbonisation and preserve margins – exporters of lower-margin, commodity products may seek ways to increase value-add of products to preserve margins. Consider expanding the CFO role (or introducing a new role) to maintain a ‘carbon P&L’ and ‘carbon balance sheet’ to actively manage the carbon budget.

10. 2024’s investments will determine whether or not NZ will meet its 2030 targets

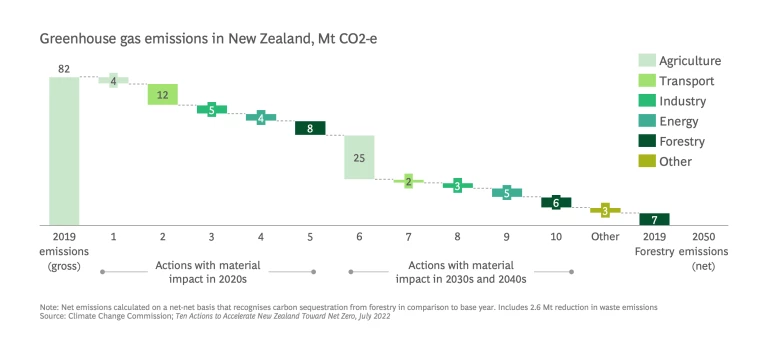

New Zealand has committed to reducing its net emissions (gross emissions minus new carbon absorbing activity, such as trees planted) by half by 2030 from a 2005 gross emissions baseline, and achieving net zero emission by 2050. Both targets exclude biogenic methane which has its own reduction targets of 10% by 2030, and 24-47% by 2050, both from a 2017 baseline.

In mid-2022, BCG published an article outlining how to accelerate the transition to net zero: Ten Actions to Accelerate New Zealand Toward Net Zero, July 2022. Half of the actions identified will deliver material benefits in the 2020s and the other half represent laying foundation now for material reductions through the 2030s and 2040s.

As we enter 2024, companies should double-down on actions that will drive materials reductions in the 2020s:

- Agriculture: Use first-generation feedstock additives and adopt regenerative agriculture where feasible

- Transport: Electrify road transport

- Industry: Transition low- and medium-temperature (<400C) processes to electricity and biomass

- Energy: Rapidly scale up renewable electricity

- Forestry: Plant trees on land unsuitable for farming (exotic afforestation)

Companies also need to invest in laying the foundation for what will drive large reductions in the 2030s and 2040s:

- Agriculture: Turbocharge R&D efforts in next generation feedstock additives and methane vaccines

- Transport: Decarbonise heavy transport; scale up sustainable aviation and marine biofuels

- Industry: Transition high-temperature heat (>400C) processes to electricity and hydrogen; reduce direct manufacturing emissions

- Energy: Phase down fossil fuels; scale up renewable fuels

- Forestry: Identify opportunities for native afforestation

Key takeaway for leaders: While a clear path to delivering the required emissions reductions by 2030 and beyond exist, many of the steps will take years to fully implement. These timelines mean that if sufficient action is not started by next year, we risk missing 2030 reduction targets. Organisations need to accelerate their emissions reduction actions and proactively engage the Government to ensure public support for their decarbonisation journeys.

What do executives need to do?

New Zealand executives should perform a zero-based review of their businesses to understand how their strategies, operating models, capital structures, etc. will fare in the expected environment. Leaders will find that some areas of their business portfolio will be fundamentally challenged and need to be reconstructed to ensure continued competitiveness. Conversely, there will be new opportunities identified in other areas where new sustainable advantages could potentially be developed.

Fundamentally, we believe 2024 is a year where the value of maintaining optionality decreases from extreme highs of the last several years. Businesses that evaluate the considerations presented above, make tough decisions about the future of their businesses, and take decisive action will have a head start competing in the latter half of the 2020’s and beyond.

Acknowledgements

Richard Hobbs, Principal; Leonore Tauber-Clack, Principal; Emily Wu, Project Leader; Liz Zhu, Project Leader; Ashley Revell, Project Leader; Alex Palmer, Project Leader; Matthew McQueen, Project Leader; Mattia Maver, Consultant; Catherine Vanasse, Consultant; Chinmay Agarwal, Consultant; Leander Schubert, Associate; Katie Davis, Associate; Jo Brady, Office Manager; Maree Greenhough, APAC Finance Coordinator; Esmé O’Neill-Dean, ANZ Teaming@BCG Coach; Riana Loong, Executive Assistant; Pavla Stamenovic, Principal Assistant