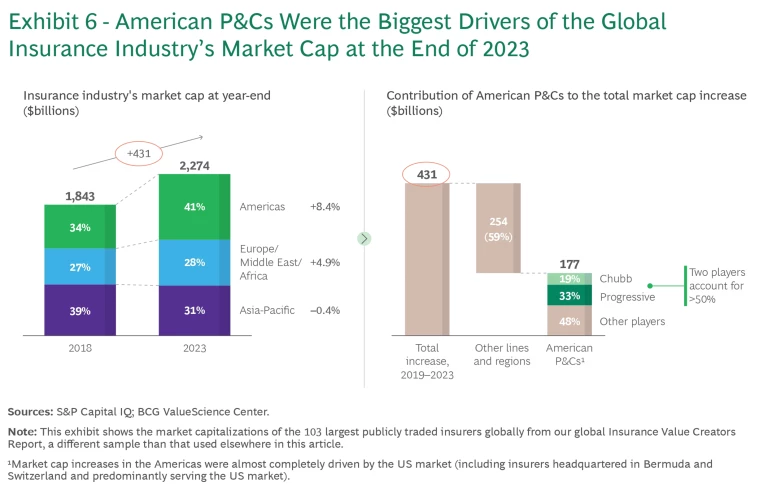

We’ve said it before, but the results still bear it out. In the property and casualty segment of the US insurance industry, profitable growth generates superior shareholder returns. In 2023, in generally rising equity markets, US P&C insurers generated annual TSR that outperformed many other industries and represented around 40% of the shareholder value produced across the global insurance industry . Top-quartile US P&C insurers produced 23% annual TSR, fueled by superior underwriting results.

Whether US P&C insurers can build on this record is an open question. Performance has been strong, but it’s likely to come under attack from multiple developments in both personal and commercial lines. High-performing insurers need to fortify their positions. Weaker competitors have even bigger challenges to surmount, many in the same areas.

Value Creation in P&C

There are plenty of areas in which insurers can improve, and for some it’s a matter of urgency. Among the most important are developing greater underwriting expertise and more sophisticated and nimble pricing capabilities, managing the increasingly challenging exposures to weather (not only in catastrophe-prone states but also in the much larger regions exposed to convective storms), hiring and retaining talent with the skills needed today, and applying new technologies, such as artificial intelligence and generative AI . But the evidence is clear that leaders—the insurers producing the biggest shareholder returns over time—first get the fundamentals right.

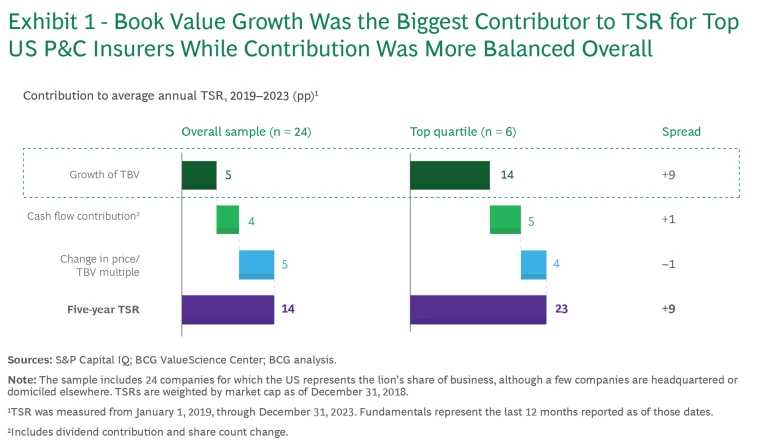

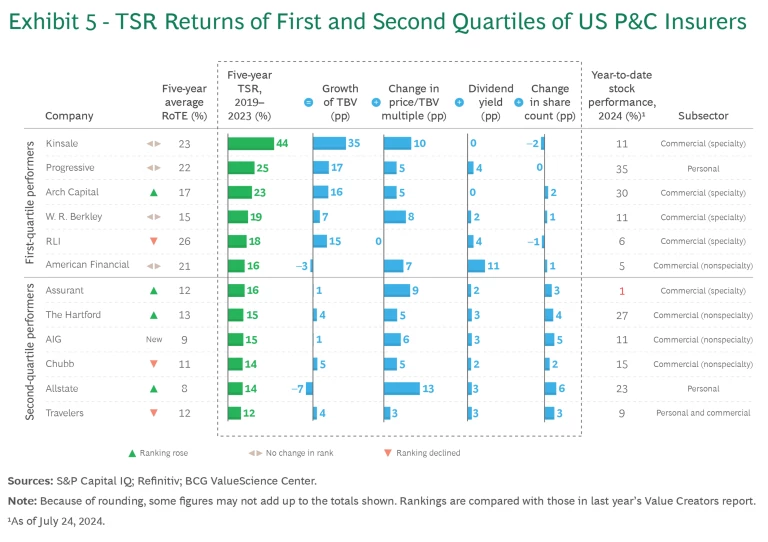

US P&Cs’ average annual TSR of 14% for the five years from 2019 to 2023 increased 4 percentage points from the previous five-year period—beating the 12% all-industry TSR average. The 23% average annual TSR for companies in the top quartile was up from 20% and almost double the all-industry average. The primary driver was growth in tangible book value (TBV), the result of strong underwriting, which contributed 14 of the 23 percentage points, compared with an average contribution of 5 percentage points for the full sample of US P&C companies. (See Exhibit 1.)

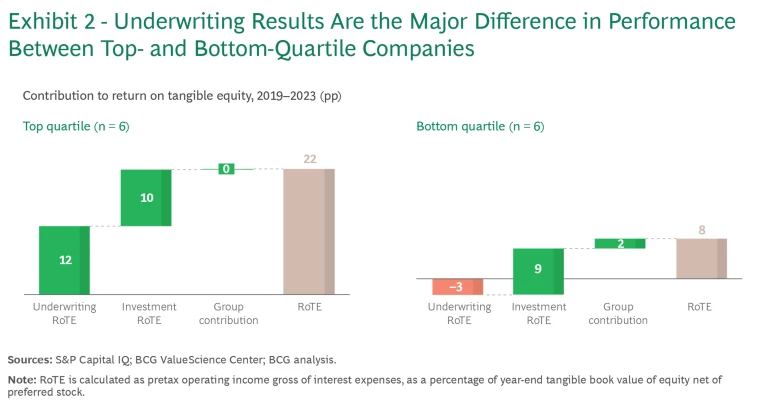

The distinction becomes even more stark when comparing top- and bottom-quartile performers. (See Exhibit 2.) Underwriting gains contributed 12 percentage points of return on tangible equity (RoTE) to top-quartile performers, while bottom-quartile companies delivered underwriting losses.

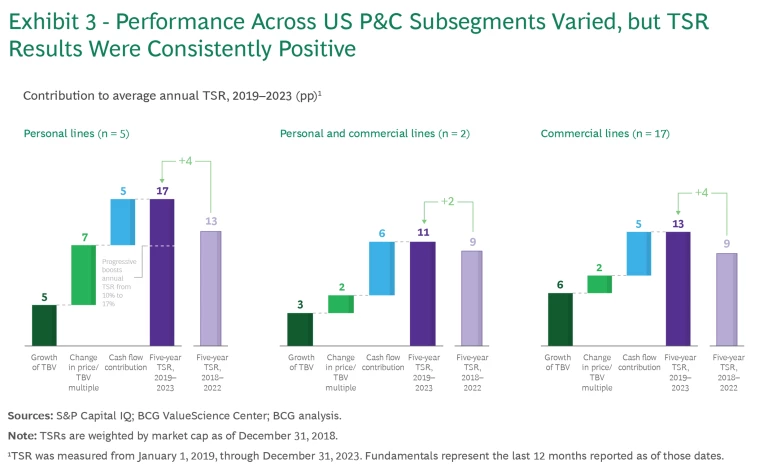

Segment-wide performance was consistent across personal and commercial lines, although the presence of Progressive skewed personal lines because of the company’s size and the strength of its underwriting results. (Progressive was among the first to spot rising loss costs and adjust rates, leveraging its ability to monitor market signals and nimbly respond.) Growth in TBV was 5% for personal lines as a whole, but excluding Progressive, book value contracted 7%. (See Exhibit 3.)

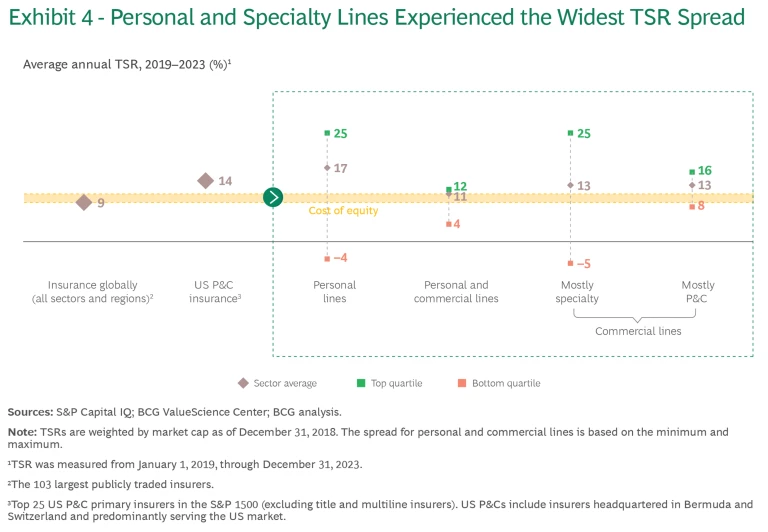

The widest spread in TSR occurred in personal and specialty lines. (See Exhibit 4.) Progressive pulled the spread in personal lines upwards for the reasons described above. Underwriting results in specialty lines can vary widely depending on the market niches that individual insurers focus on. Commercial lines performed strongly across the board, driven by the hard market.

The power of getting the basics right can be seen in the TSR results for the top two quartiles of US P&C companies (See Exhibit 5.)

Success also begets success. Rising returns helped drive the expansion in market cap of the US P&C segment compared with the other segments of the global insurance industry. (See Exhibit 6.)

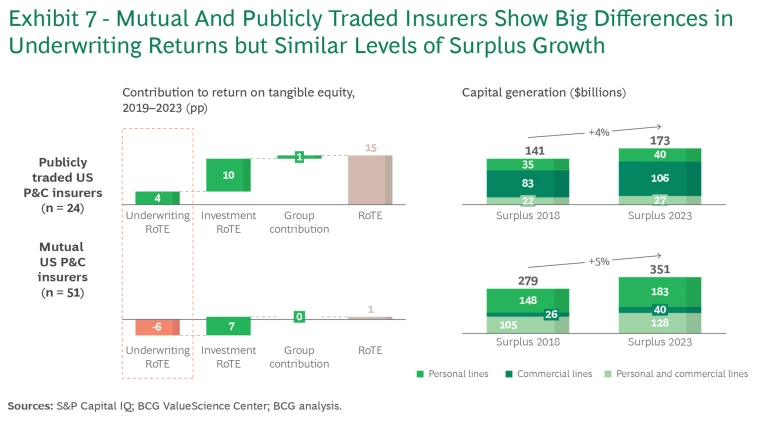

The US P&C market has a large share of mutual companies. (See Exhibit 7.) Five of the top ten personal lines insurers by premium volume are not publicly traded. Mutuals are a significant competitive force for other insurers to contend with, in part because of their size and share but also because they play by different rules. They can be oriented more toward the long term, as they are not subject to investor expectations for quarterly earnings. They do not have access to the capital markets, but they are not under pressure to return “excess capital” to shareholders. This typically translates into mutuals maintaining or growing their capital position and having different approaches to pricing and investments—focusing on different asset classes than stock companies, for example.

If they calculated RoTE, from 2019 through 2023, US mutuals would have generated returns of 1% a year. Underwriting’s “contribution” was –6%. Since mutuals compete in the same markets (principally homeowners and auto), their approach to pricing puts added pressure on stock companies looking to produce a positive underwriting result.

C-Suite Priorities

Looking ahead, P&C insurers face some big challenges, which will vary by segment. (See “Big Changes Loom.”) C-suites should move now to either address fundamental needs or position themselves to build on their already solid performance.

Big Changes Loom

Here's our assessment of the likely developments.

Personal Lines. In addition to macro factors, such as weather, inflation, and litigation, personal lines insurers face big segment-specific challenges in pricing and rate agility. A handful of trends will keep price differentiation front and center for these companies. These include:

- More shopping, especially in light of recent price increases (auto and homeowners lines are currently seeing churn rates of 10% to 20%)

- Increased penetration of online comparative raters, particularly affecting the independent-agent channel

- Growth in the digital direct channel, not only in auto—where digital direct is already well established, with about 30% of the market—but also in homeowners, where digital direct is expected to continue to grow from a current base of about 15%

Commercial Lines. The prolonged hard market of the last 24 consecutive quarters looks set to soften, but at different speeds depending on the line of business. For example, property rate increases are slowing, while directors and officers liability rates have been declining for several quarters.

Like personal lines companies, commercial insurers must address a set of segment-specific trends that will affect their continued growth and profitability. One of these is the murky outlook for reinsurance capacity, which is showing signs of tightening, in part because of the impacts of climate change. This will affect pricing across many lines of business and geographies at the primary level.

Another issue is the growing distribution dilemma. Insurance intermediaries, especially retail brokerages and managing general agents, are capturing a growing share of the industry’s profits—and skilled people. Many commercial insurers have no choice but to be more deliberate about their distribution strategy and find ways to effectively compete with brokers and MGAs for talent.

To manage the transition to a softer market, insurers need to remain vigilant about risk selection and underwriting profitability. The transition will likely trigger a variety of changes, including recalibration of risk appetite, terms and conditions, and approach to reinsurance. Portfolio steering and exposure management will be critical for all weather-exposed business, for which capacity restrictions are likely to remain in place.

Leading performers in commercial insurance are weathering these challenges by doubling down on underwriting expertise. A trio of capabilities—strong business-steering processes, nimble decision making, and access to the right data—enable sophisticated risk management and dynamic capital allocation. Underwriters at these companies have ownership of their books of business, but they are also subject to the robust portfolio steering required for the organization to meet its risk-adjusted return targets.

We see several near-term priorities for personal lines. The first is building (or strengthening) their pricing and state management functions that focus on risk segmentation and agility to deploy adequate rates in the market. Second, companies need a technology stack that supports rapid and seamless underwriting and pricing processes and practices. They should also be embedding a culture of continuous improvement in underwriting, distribution, and claims management. This requires a comprehensive approach to data access, management, storage, and deployment. Finally, managing the profitability of top-of-the-funnel activities by balancing customer acquisition costs against lifetime value will become even more important to generating profitable growth.

Commercial insurers need to build (or strengthen) a high-performance underwriting culture that emphasizes in-depth, specialized expertise. They need a fit-for-purpose talent and compensation strategy to attract, develop, and retain expert underwriters and effectively compete with managing general agents for talent. Technology and data designed to support specialized underwriting processes and broker engagement are also priorities. In addition, a nimble and regular capital allocation process, operating on a foundation of strong underwriting discipline, and active risk management at the portfolio and account levels are keys to maintaining (or improving) profitability.

US P&C companies cannot rest on their laurels. Some still need to work on the basics. All need to have a clear-eyed view of the future and move forward decisively on building the capabilities required to manage the rapidly evolving risks.

The authors are grateful to Jürgen Bohrmann, Teresa Schreiber, Angjelo Koca, Martin Link, Jacob Palmer, Raphael Troitzsch, and Pablo Segovia Smith for their research and contributions to this article.