US farm owners and managers are often skeptical of new technology solutions that are supposed to improve farm economics by maximizing yields, for example, or reducing the need for manual labor—and with some reason. Many growers have been disappointed by solutions that overpromised and underdelivered.

Adopting a leading-edge technology solution can also add risk for what is often a low-margin industry that contends with economic challenges. Farm owners and managers have only a handful of opportunities each year to turn their crops into cash. Faced with weak agricultural commodity prices and high interest rates, US growers are more inclined than ever to purchase technology solutions that they know and trust, rather than take a chance on something new.

So, how can agribusiness players better engage with growers and get traction for their innovations? To answer this question, we partnered with Ag Access to survey roughly 1,000 US growers.

We found that agribusiness companies could do more to consider the individuals behind each purchasing decision. By taking a more granular approach and identifying the factors that motivate different types of buyers, agribusiness players could develop more effective go-to-market strategies and position their product development pipelines to align with customers’ diverse needs.

What Really Matters to Growers

To understand what drives growers’ purchasing decisions about agriculture technology solutions, we surveyed owners and managers of farms larger than 250 acres across the US that primarily produce corn, soy, wheat, or cotton. We asked participants about ten technology solutions. Each solution had a high degree of awareness among growers, although the newer ones had far lower adoption rates than more established solutions had.

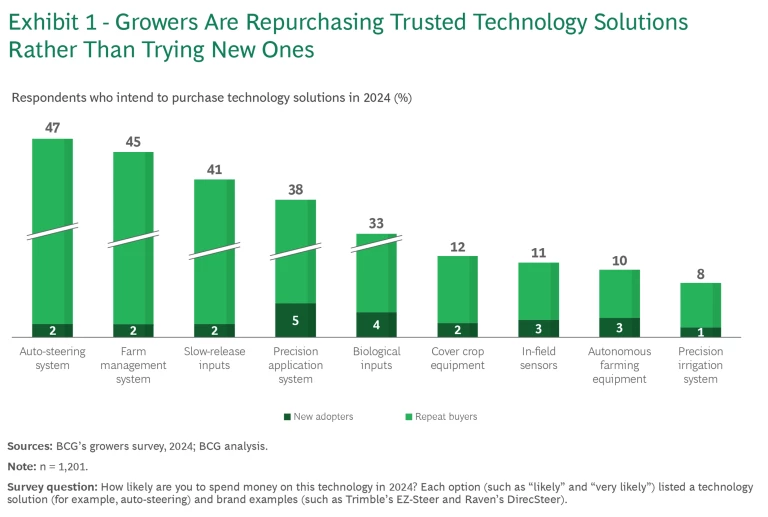

When we asked growers about their buying intentions for 2024, most said that they are planning to repurchase the technology solutions that they have used before rather than try new ones. Of the more nascent technology solutions, growers are most likely to try precision application equipment for the first time. (See Exhibit 1.)

We then examined the market for agricultural technology solutions using our proprietary Demand Centric Growth (DCG) methodology to hone in on the underlying needs that drive individual growers’ purchasing decisions. (See the sidebar “Understanding DCG.”)

Understanding DCG

Our application of the DCG methodology typically involves three phases. First, we survey customers to understand what drives differences in needs and how those needs impact their purchasing decisions. Second, we identify where a company should focus based on the market potential in each product space and the company’s right to win. Finally, these insights are incorporated into a strategic plan that includes changes to the company’s go-to-market, communication, and innovation processes.

Agribusinesses typically segment their target customers by farm size, location, or the crops they grow. By taking this approach, they inadvertently assume that decision makers growing the same crop on similarly sized farms in the same region have similar needs and, therefore, act in a similar way. Our analysis showed, however, that growers’ functional and emotional needs play a key role in their decision to purchase agricultural technology solutions, and these needs aren’t evident when assessing customers by farm size or crop type.

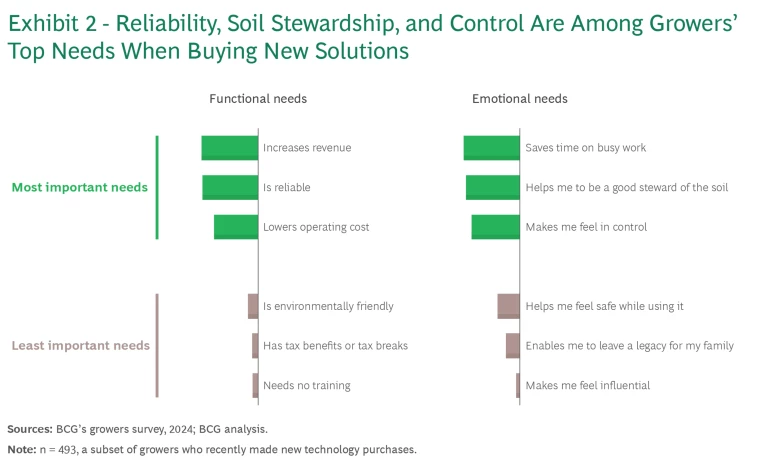

We found that growers’ top three functional needs for new technology solutions are an increase in revenue , reliability, and a reduced operating cost. (See Exhibit 2.) This result is no surprise: agribusinesses already recognize the importance of these needs and regularly emphasize yield and return on investment in their product pitches and value propositions.

However, our analysis also explored the emotional needs that influence growers’ purchasing decisions. These needs reflect how an individual wants to feel when buying and using a product. Among the US growers we surveyed, the top three emotional needs are saving time on busy work, being a good steward of the soil, and feeling in control. Products that address these needs see a higher market share and greater adoption than products that do not.

Agribusiness companies that can systematically identify growers’ functional and emotional needs—and then apply these findings to their product development, marketing, and sales processes—can create a deeper connection with their customers and overcome barriers to the adoption of new technology solutions.

Taking a Segmented View

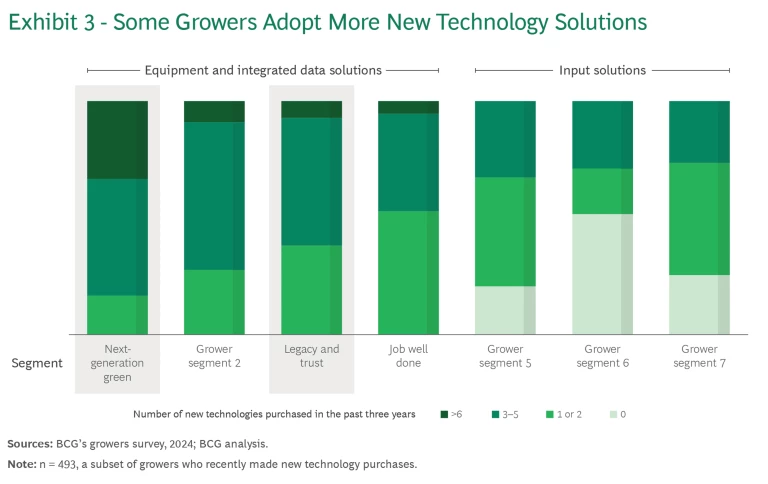

Growers aren’t all the same; different growers have different needs and priorities for agricultural technology solutions to address. When we delved into the differences, we found that the growers we surveyed fall into seven distinct segments.

For example, one segment, which we call next-generation green, prioritizes caring for the soil, making a strong return on investment, and maximizing tax benefits when buying new technology solutions. These growers are looking for solutions that make good business sense and appeal to their belief in the importance of environmentally friendly practices. They care about these priorities more than growers in any other segment do; it is what differentiates them from the average grower. Understanding their needs and priorities is the key to influencing them in the most effective way. The next-generation-green segment contrasts with the segment we call legacy and trust, which may also care about such priorities but puts more emphasis on supplier quality and availability, along with saving time on busy work.

Each of the seven segments has a different attitude toward adopting new technology. The next-generation-green segment, for example, purchases more new technology solutions than the legacy-and-trust segment does. (See Exhibit 3.) However, the legacy-and-trust segment is about twice as big.

Each segment is also influenced by different stakeholders and, therefore, makes decisions in different ways. Next-generation-green growers listen to agronomists, while legacy-and-trust growers listen to family and friends. Growers in these two segments also have different education profiles. Given these significant differences, it’s clear that it takes two distinct value propositions to appeal to the growers in each segment.

It’s not enough for companies to know that these segments exist; they need to know which customers fit in which segments to enable stronger go-to-market efforts and, ultimately, better outcomes. Our research revealed several typical characteristics of individuals in each segment that can help companies identify which segment customers may fall into and, therefore, their needs when they are buying new technology solutions. Agribusinesses can identify these characteristics in everyday interactions. For example, companies can ascertain the characteristics of individual customers—such as their age, succession plans, and attitude toward sustainable farming practices—through relationships between growers and frontline sales staff.

Consider the two segments we’ve mentioned. Next-generation-green growers are under the age of 65. They plan to pass their farm to their children, and they believe strongly in the importance of sustainable farming practices. Growers over the age of 65 are far more likely to be in the legacy-and-trust segment if they plan to pass their farm to their children. And growers who have no plan to pass their farm to their children are in a third segment, which we call the job-well-done segment, with needs that are different still. The typical rule of thumb used by agribusinesses is that the type of crop or total acreage indicates a grower’s needs. By contrast, our research reveals that age and whether or not a farm will pass to the children are more telling indicators.

Driving Technology Adoption

In this challenging US agricultural market, driving technology adoption will be an uphill battle. Agribusinesses should adopt a data-driven approach to gain a deeper understanding of the factors that influence growers’ purchasing decisions. Taking a segmented view and a fresh perspective on why growers buy will help forward-thinking agribusiness companies gain an advantage in their product plans and go-to-market strategy.