For centuries, the rules of the insurance business were set in stone. Insurers develop sophisticated products that protect customers from unfavorable events, and insurance agents help customers navigate the complexities of the market.

In recent years, insurance agents have become more digital, and a growing share of insurance products are being sold online. This is forcing insurers to transform themselves by investing in digital technologies, becoming more customer-centric, and hiring fresh talent to meet the needs of an increasingly digital marketplace.

Yet, one blind spot remains. Most insurers see themselves as the only ones serving customers’ protection needs, but what if this self-perception is keeping insurers from acknowledging an alternative reality? What if risk protection, especially in property and casualty insurance, is destined to become just a small piece of a larger whole? What if this shift radically alters the strategies that insurers must deploy in the future?

The Shift to Insurance Inside

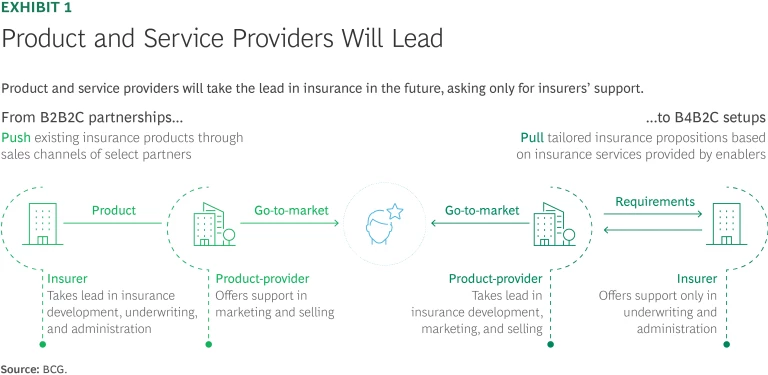

The new world is “embedded insurance”—the blending of insurance into non-insurance products or services. So far, most executives don’t believe that it is a major change. They are convinced that it’s only the next stage of their existing B2B2C (business to business to consumer) partnerships rather than a move to B4B2C (business for business to consumer) setups. (See Exhibit 1.)

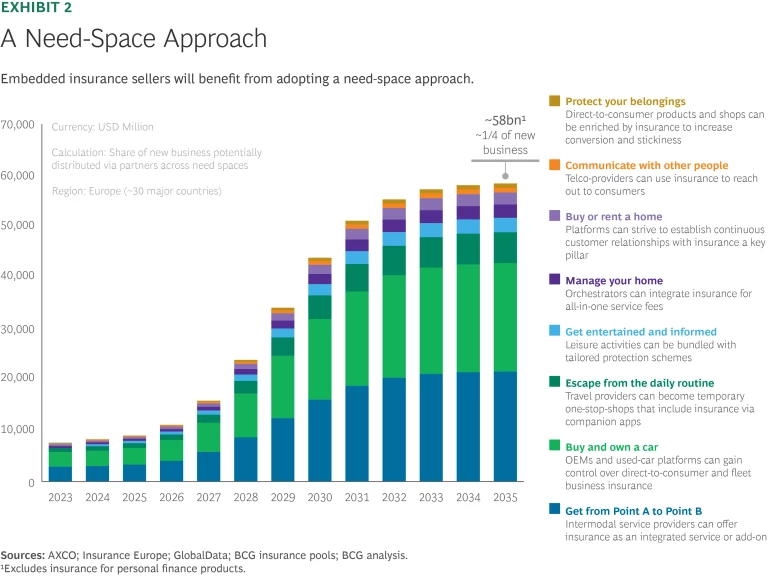

In our experience, though, the effect of embedded insurance could prove to be a major disruption, not just another way by which insurers can sell products. BCG studies suggest that by bundling insurance with product sales, non-insurance product and service providers could control up to a quarter of the new property and casualty insurance business. If this comes to pass, it will pose a serious challenge to traditional insurers.

The new world is “embedded insurance”—the blending of insurance into non-insurance products or services.

Selling embedded insurance, by entering into partnerships with product and service providers, will force insurers to reposition themselves to meet the needs of non-insurance companies that will want to use insurance to their advantage. This will have grave consequences for the insurance industry in general and for second-tier insurers without strong customer bases in particular. Few insurers appear ready to cope with this looming challenge.

When Every Company Is an Insurer

As customers increasingly value the convenience of buying integrated offerings, sellers are likely to relieve them of the burden of connecting the dots. They’re likely to combine complementary products and services into integrated offerings that they can provide at proprietary touch points. Already, online retailer Amazon offers everything from household products, services, and movies to music, groceries, and pharmaceuticals. Technology company Apple has entered the health, well-being, and financial services industries. And automobile manufacturers such as Mercedes, GM, and BYD are working on offering consumers a portfolio of in-car amenities that range from location-based services to gaming.

These vignettes provide a glimpse of what’s likely to happen in the digital era. Companies will no longer fulfill just a single need; rather, they will take a broader need-space approach.. And because the need for protection follows the purchase of a product or service, embedded insurance is likely to surge in popularity. (See Exhibit 2.)

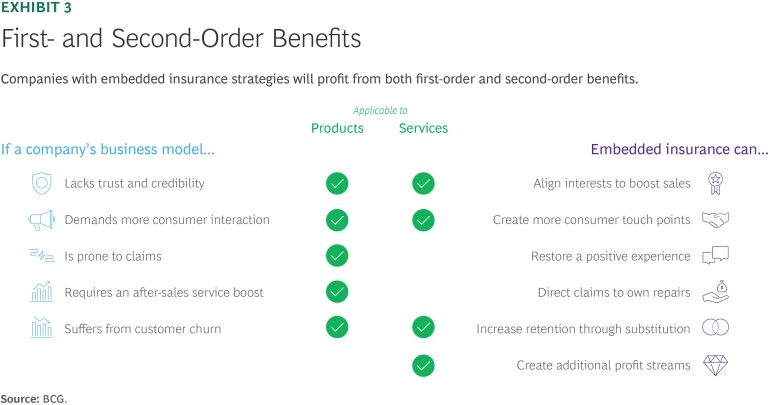

Customer centricity won’t be the only driving force; the financial benefits that stem from the second-order effects of embedding insurance into products will matter too. (See Exhibit 3.)

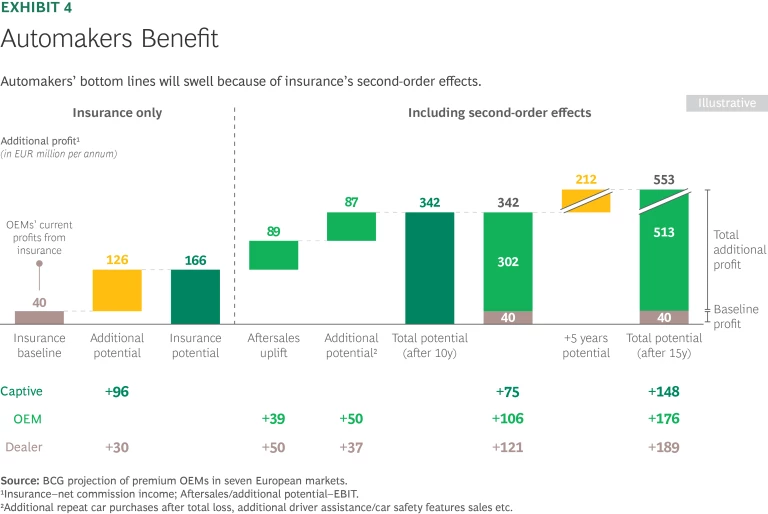

The ways of capturing those advantages will be specific to the industry. In the case of automobile makers, embedded insurance will provide financial upside, especially for aftersales. For mobility service providers, it will help boost demand by reducing the risk of customers getting stranded. And telecom service providers will be able to lower churn by increasing customer stickiness. (See Exhibit 4.)

As more non-insurance companies realize the potential of embedded insurance, they will come to regard insurance as a key part of their core business. Winning in insurance then will no longer be an option, but a strategic ambition for them.

To realize their goals, these companies will have to outdo traditional insurers on experience, products, and pricing. They will have to develop more tailored offerings based on existing customer insights, sell more efficiently through existing channels, provide more seamless experiences on the back of existing processes, and offer more attractive prices based on real-time customer behavior. Moreover, given the benefits coming from second-order effects, they could well afford to run their low-cost, legacy-free insurance operations at below-average profit margins.

As more non-insurance companies realize the potential of embedded insurance, they will come to regard insurance as a key part of their core business.

All of that will require non-insurance companies to take greater control of the insurance value chain themselves. This may seem like a lot to learn to do well, but the digital era makes it possible. Rather than developing or acquiring the capabilities they will need, product and service providers can take advantage of the insurance-as-a-service offerings that players, new and old, will provide. We call it the shift from a B2B2C sales tactic to a B4B2C enablement strategy.

Emboldened by new embedded-insurance players such as Belgium’s Qover and Germany’s Movinx, companies will be able to benefit from the insurance business without having to deal with its complexity themselves. It isn’t clear when that will happen at scale, but it’s time insurers started preparing for the opportunities and challenges of the B4B2C insurance era that will dawn sooner or later.

Ten Principles for the B4B2C Insurance Age

As insurers rethink their business, they should keep in mind the following ten principles. None of them individually guarantees success but, collectively, they increase the chances of incumbent insurers becoming product and service companies’ partners of choice.

Change Your Mindset. Moving away from the traditional proprietary insurance business to a help-others-become-insurers approach will demand a fundamental change in mindset. To strike successful B4B2C partnerships, insurers will have to acknowledge that future success will come only by helping companies become better insurance providers than they will ever be. While they will have to pay the price of yielding customer ownership, they will be able to more than make up for it by gaining access to companies’ customer bases, becoming an integrated part of their sales journeys, and gaining access to consumer data.

Define Your Playing Field. Embedded-insurance strategies will vary by industry. Partnerships with automobile manufacturers could span many countries, whereas alliances in the home space will most likely remain local.

Some partnerships will need physical interactions to provide integrated experiences while others will use digital processes. A one-size-fits-all approach toward embedded insurance won’t work. Instead, clearly defining target segments and carefully analyzing the requirements will be central to understand where to play, whom to partner with, and how to win.

Do the Math. Evaluating the attractiveness of embedded insurance plays will be crucial to identifying the financial guardrails. Sticking to a product-centric tack won’t be enough; insurers must adopt a need-space approach when evaluating potential opportunities. A need space will offer more than one kind of demand and require selling more than one product. For instance, travel providers will find an appetite for not just cancellation insurance, but also for flight delay, travel health, and car rental insurance. While zeroing in on their focus areas, insurers must keep in mind the breadth of protection needs that they will have to satisfy.

Rethink Your Value Chain. While many companies have created multinational structures, insurers tend to operate in national silos. However, B4B2C partnerships will require insurers to mirror their partners’ geographical footprints. Companies will want to use the best risk carriers and service providers in each country, which no insurer can currently claim to be.

Insurers will have to design new structures, creating standardized risk carrier-agnostic processes across markets with only a few interfaces to reduce complexity and facilitate integration. They can execute conceptual tasks—such as product development and pricing—on a central platform while local or other standalone entities can manage risk taking and local operations including customer-facing tasks. Doing so will force insurers to disaggregate their value chains like managing general agents (MGAs) do in order to satisfy their partners’ needs for scalability and localization.

Think Fees, Not Premiums. For the platform plays that will result from disaggregated value creation, fees instead of gross written premiums will be the primary source of income. Even though the size and profitability of the premium pools underwritten will remain a key metric, especially for risk carriers, B4B2C businesses will run on a commission basis.

For the platform plays that will result from disaggregated value creation, fees instead of gross written premiums will be the primary source of income.

Insurers can use two levers to grow their B4B2C activities. One, they can work with more partners and increase insurance penetration rates through each partnership. Two, and more important, they could increase the value they create on their B4B2C platforms until other entities provide only risk-taking and local operations. B4B2C businesses will then generate almost all the margins themselves, and, over time, grow them by industrializing their processes.

Understand Each Partner’s Business. Insurers seeking B4B2C partnerships must understand their would-be partners’ key challenges and how resolving them will affect bottom lines. Indeed, insurers should refrain from making insurance products the centerpiece of discussions with potential partners and start by understanding the latter’s business models. For instance, reducing the mobility companies’ driver churn rates will lower driver acquisition costs and boost profits. Understanding the driver base will therefore help develop insurance products that will make drivers stay longer with the platform while protecting them from unfavorable events. That’s how Singapore’s Grab and ZA Tech came to develop an insurance product that protects the former’s driver-partners from losing income when they fall ill or have an accident. (See “Grab Wins with Embedded Insurance.”)

Grab Wins with Embedded Insurance

Grab distributes standalone insurance products such as personal accident and travel insurance. In addition, the company works with local insurance companies to create scenario-based, single-use, opt-in insurance products that are embedded in its core products and services. For example, Grab distributes a critical illness pay-per-trip policy to its drivers, the premium for which is automatically deducted from their earnings. The product’s fractionalized premiums not only make insurance more accessible, reducing drivers’ protection gaps, but also increase driver retention.

When new regulations in Malaysia stipulated the need for commercial motor insurance for ride-share vehicles, Grab risked losing a large number of drivers. Buying an expensive insurance policy every year simply wasn’t economical for part-time drivers. So, Grab worked with local insurers to quickly introduce Grab daily e-hailing motor insurance, a 24-hour insurance policy that’s automatically issued whenever one of its drivers logs into its app.

Grab uses A/B testing and experimentation, as well as refinements in coverage and pricing, to increase penetration rates. Partnering with over 20 insurers that underwrite its operations, Grab uses ZA Tech’s digital platform to integrate with them, which is akin to a managing agent strategy. The platform enables Grab to focus on the buyer experience and its value proposition rather than depending on the legacy systems and processes of incumbent insurers, which have been cut out of the loop.

Reduce Your Cost Base. A legacy-free cost base will be an insurer’s optimum B4B2C starting point. While insurance products typically need to cover a variety of legacy costs from outdated IT systems, redundant coverage schemes, physical distribution networks, and manual operations, B4B2C partnerships’ cost structures will need to be different. Many partners are operating their businesses in a digital-first fashion and will demand that insurers do the same. Not only will they be unwilling to pay the costs of outdated insurance business models, but second-order effects will result in higher claims that will need more financial wiggle room.

Streamline Your Governance. Companies will require insurers to keep pace with their decision-making processes across countries and regions. Waiting for insurers to resolve internal conflicts or grant local approvals, as is often the case today, won’t be an option. So, insurers must streamline internal governance processes and put disputes over partner relationships and premiums behind them. Internally, they could give a group-level team the authority to manage partner and platform activities. Depending on their competitiveness, the insurers can manage local operations and customer-facing processes, or tie up with partners to do so.

Ready the Tech Stack. Most insurers have designed their existing technology stacks to support their current insurance operations, but tomorrow’s B4B2C digital platforms will need to meet more requirements. For one, their partners’ emerging needs will force insurers to develop new insurance propositions in a fast and flexible fashion. For another, the various new sales and service touch points on the journeys of their partners will demand seamless integration and leverage of (real-time) data with insurance systems in order to assess risk, provide quotes, or manage claims.

Above all, the number and the international footprint of potential partners will require a high-performing and secure multi-partner environment as well as a multi-country and multi-currency setup. B4B2C insurers will need to either adapt their technology platforms or enter into partnerships with technology providers.

Become More Agile. Most insurers’ operating models are designed for efficiency. Their product portfolios undergo less frequent changes, sales channels are mostly hardwired, and they don’t need to make decisions at short notice. However, the B4B2C business will force insurers to change. Partnership opportunities will emerge without warning, fresh challenges will require collaboration in new ways, and the complexity of managing many partners will necessitate more responsibility down the line. Insurers that wish to succeed in the B4B2C era should make agility the norm and enable executives to make decisions quickly. Otherwise, the differing speeds at which companies and insurers function are bound to cause promising partnerships to fail.

Embracing the B4B2C business will create opportunities for insurers that dare to change. Instead of acquiring one customer, they will gain access to entire customer bases. Instead of overspending on marketing and sales, they will benefit from digital platforms’ economies of scale. Instead of being limited by national boundaries, they will be able to grow globally.

Insurers will have to change their mindsets, shifting from selling insurance products to helping product and service providers leverage insurance to their advantage.

But insurers will have to change their mindsets, shifting from selling insurance products to helping product and service providers leverage insurance to their advantage. The trend may initially portend a setback, but entering into long-lasting partnerships eventually will prove to be a winning strategy. Insurers that take one step back today to support product and service companies tomorrow will leap ahead by several steps in the B4B2C insurance era.