It’s no secret that progress on sustainability is lagging among companies in virtually every industry. Shareholders are putting less pressure on companies to improve their sustainability. Customers have yet to show much willingness to pay a premium for sustainable products and services. And CEOs are facing a range of competing priorities as the global economy stagnates and the need to invest in capital projects begins to take precedence.

The telecom industry is no exception. The results of this year’s Telco Sustainability Index, based on our analysis of official corporate publications from 2023 and confirmed in discussions with telco management teams, show that compared to the considerable advances the industry has made since our first study in 2019, progress on increasing sustainability has stalled.

Telcos are facing a range of competing business and operations pressures. The global economy is mixed; interest rates, while falling, are still high; and data traffic transported by telcos continues to grow at double-digit rates. As a result, sustainability has lost ground among the issues that most concern telco CEOs.

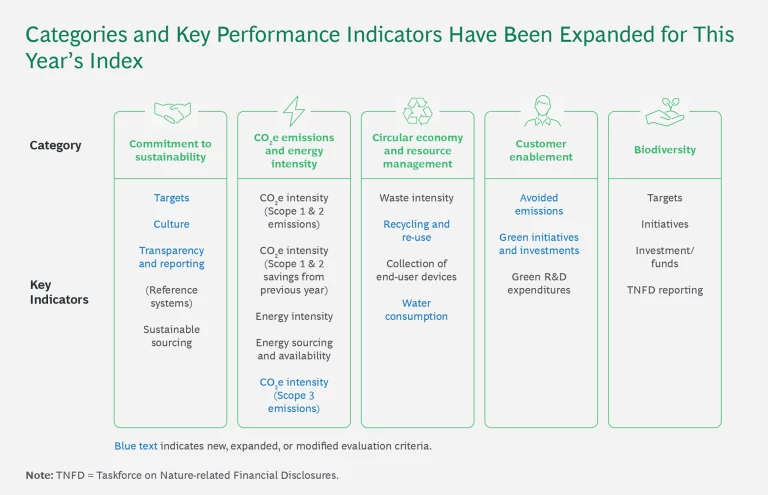

There are bright spots, notably in telcos’ increased participation in the circular economy. But other categories in our index—commitment to sustainability, emissions and energy, and customer enablement—have either shown no gain or fallen. And the results of our new biodiversity category indicate that the telecom industry is only now becoming aware of the significant impact it can have on this emerging issue. (It is important to note, however, that this year’s results reflect higher reporting standards as well as new KPIs and changes to current KPIs in select categories. In effect, the bar has been raised since we first launched the index, given the progress telcos have made since then.)

We believe that telco executives should see these results not as a problem but as an opportunity. Telcos that maintain their focus on sustainability will find themselves well positioned to benefit as the need to mitigate the causes of climate change and the resilience required to adapt to the impact of severe weather events becomes more pressing. We expect, for example, that as demand for AI capacity increases, regulators will soon begin ramping up the pressure on data center operators, including telcos, to reduce their environmental and emissions footprint.

In this article, we examine the results of this year’s survey in light of both where progress has slowed and where the opportunities lie.

The Sustainability Slump

Given the many challenges facing companies in the telecom industry, it is perhaps no surprise that efforts to increase sustainability are stagnating. In the midst of a slowing global economy and the ever-accelerating increase in the amount of data traveling across their networks, telcos’ core business is coming under increasing pressure. Yet securing the funds to make investments in new infrastructure and networking technologies such as fiber and 5G has become more difficult, as the cost of the capital needed is often higher than the return on these investments.

Stay ahead with BCG insights on technology, media, and telecommunications

At the same time, new opportunities are competing for funding and resources, such as generative AI, where the business case for payoff is potentially faster and more assured than it is for gains in sustainability. And the high level of competition among telcos, particularly in Europe, limits their ability to raise prices to help pay for these investments.

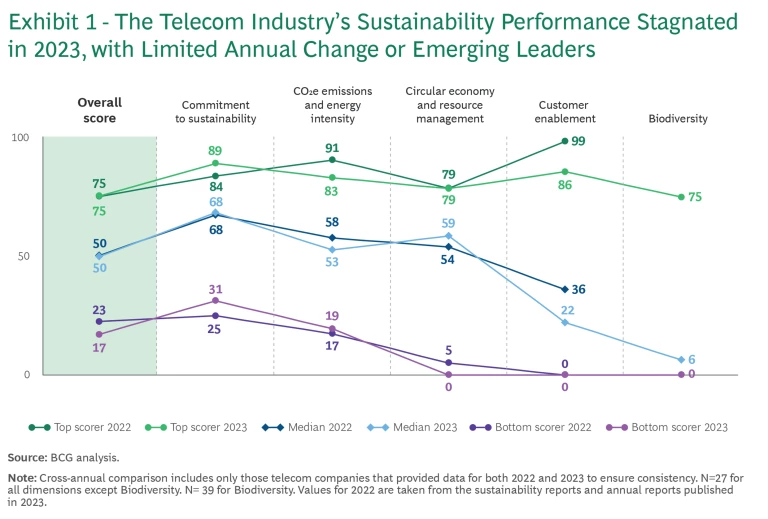

The impact of the business challenges facing the telecom industry can be seen clearly in the results of this year’s index, which covers 2023. As Exhibit 1 shows, the overall median score across four of the sustainability categories was unchanged since 2022, at 50. (Note that the biodiversity category is new this year.) That’s a considerable slow-down since 2022, when the overall score rose by 9 points above the prior year’s average. The top scorer, too, remained the same, while the bottom scorer declined by 6 points. (See “Methodology.”)

Methodology

Methodology

To determine a rating for each key indicator, we assess and score various qualitative and quantitative metrics specific to the indicator, including annual progress across those metrics and the company’s published commitments to sustainability. We score each key indicator on a scale from 0 to 100, and we use the results to create a weighted overall score for the entire dimension. Individual weightings vary by key indicator on the basis of the included criteria. We then calculate an overall score for the industry, with each dimension given an equal weighting of 25%. (The overall score does not include the new biodiversity category, since it was not included in last year’s index.)

The KPIs for the Telco Sustainability Index have been updated for this year’s index to align with current trends and reporting standards, leading to more granular and expanded KPIs. For example, Scope 3 emissions are now fully integrated into the emissions category and weighted equally with Scope 1 and 2 emissions, and KPIs covering recycled materials, mobile phone collection, and water consumption were added to the circularity category. Cross-annual comparison includes only the telecom companies that provided data for both 2022 and 2023 to ensure consistency; 2022 values are taken from the companies’ sustainability reports and annual reports published in 2023.

Reporting methodologies and standards have changed for many telcos, and this has required us to adjust some of this year’s results for accurate comparison with the previous year’s. For example, we changed the customer enablement dimension to measure avoided emissions. Other dimensions include several new metrics, which has caused calculations for the dimensions to change slightly.

Results across the five individual dimensions were also mixed. The only area in which telcos improved was the circular economy category, where the median score rose 5 points. Telcos’ commitment to sustainability showed no change, while the remaining two categories—CO2e emissions and energy intensity and customer enablement (which measures the degree to which telcos are helping customers become more sustainable through use of telecom services)—fell considerably. It’s also noteworthy that the only category in which the top scorer gained ground was commitment to sustainability; this is encouraging, but more telcos need to show results beyond public promises to improve.

We introduced the new biodiversity category this year to assess efforts by telcos to measure and mitigate the environmental impact of their infrastructure activities, including the towers and data centers they build and the underground and undersea cables they lay, as well as their use of telecom services to help others monitor biodiversity. This is clearly an emerging area for the industry—the median score, at just 6 points, is very low. On the bright side, however, the top company in the category scored 75 points, showing that telcos can lead in this essential category.

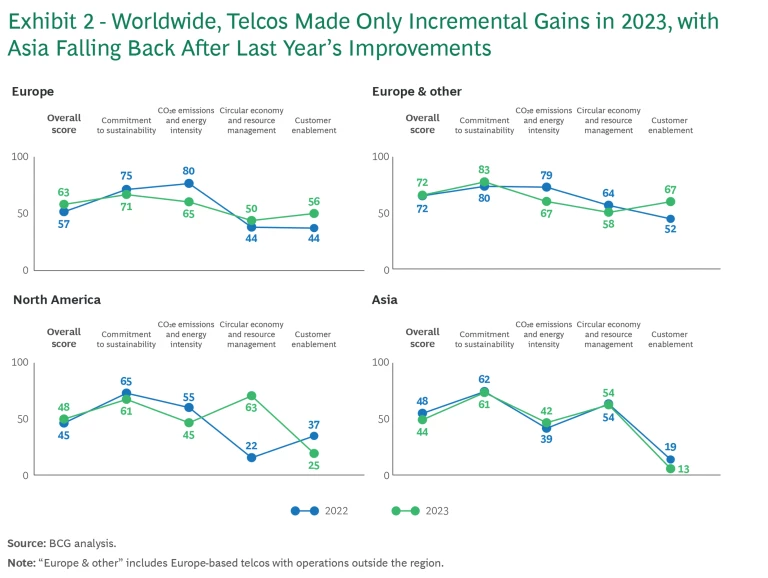

As they have done in the past, European telcos and multinational telcos based in Europe continue to lead the way in sustainability, the result of their more mature and long-standing sustainability efforts. As in 2022, however, these companies only made incremental gains in 2023. North American telcos, too, gained little in 2023, although the evidence suggests that their sustainability initiatives are beginning to take effect. As for Asian telcos, they fell by 3 percentage points in 2023 after making considerable gains in 2022, and they continue to lag. Despite their recent progress, telcos in Asia need to continue to execute on their sustainability ambitions. (See Exhibit 2.)

Taken together, the 2023 results make clear just how little progress the telecom industry has made in its efforts to boost sustainability. Interest in doing so has waned in nearly every category and every region. Looking more closely at the data in each category will help reveal why progress has stalled and where telcos can make the gains needed to prepare them for a more sustainable future.

Commitment to Sustainability

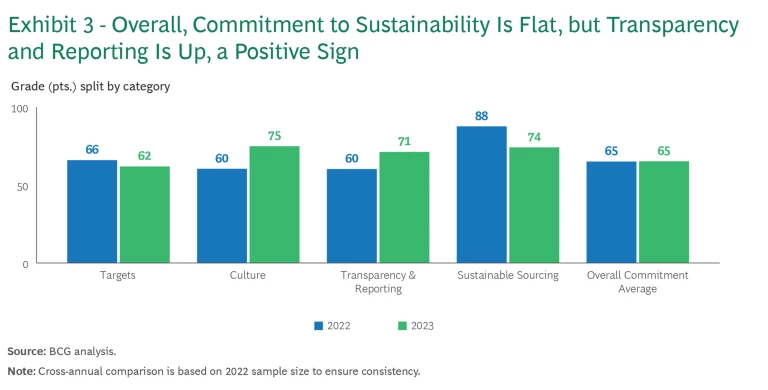

The degree to which telcos are committed to sustainability remains the highest of any of the categories we track. But the devil is in the details. After increasing considerably in 2022, the 2023 results have not improved at all. Moreover, the 2022 index saw real improvements in all four individual metrics that make up this category, but in 2023 these results varied. (See Exhibit 3.)

- Emissions targets. Despite the increased transparency, the proportion of companies setting emissions targets has declined by 4 percentage points. Many telcos have committed to net zero targets but still lack comprehensive long-term roadmaps and interim milestones that could help guide their progress—in part because short-term incentives for detailed climate plans are lacking, despite growing regulatory pressure.

- Culture. This category has also improved, as sustainability KPIs and incentives have begun spreading beyond the C-suite.

- Transparency and reporting. This subcategory has improved considerably over 2022. Telcos are increasing their level of reporting detail, providing more recent data, and seeking external assurance of the results. Scope 3 reporting, too, has increased, although coverage remains mixed; not all telcos report on this and many omit select categories.

- Sustainable sourcing. Telecom companies must inevitably maintain long, complex supply chains, not just for the smartphones they sell but for the networking and infrastructure equipment they must buy as well. The considerable decline in this subcategory is especially discouraging, as it suggests that telcos are still not fully committed to taking positive actions to improve sustainability.

The degree of commitment to sustainability is a valuable first indicator of the sustainability intentions of the telecom industry and how companies might adapt their operating models to realize their targets. In fact, the most ambitious companies are already climate neutral; KPN, for example, has maintained climate neutrality since 2015. Deutsche Telekom is aiming for climate neutrality in its Scope 1 and 2 emissions by 2025 and is targeting a 55% reduction in total emissions by 2030, compared to 2020 levels.

Still, unlike the other four categories, targets and commitments should not be seen as hard evidence for achievements in sustainability. In fact, despite their willingness to set targets, the lack of improvement in these results suggests that many telcos do not have a clear path to reaching them.

CO2e Emissions and Energy Intensity

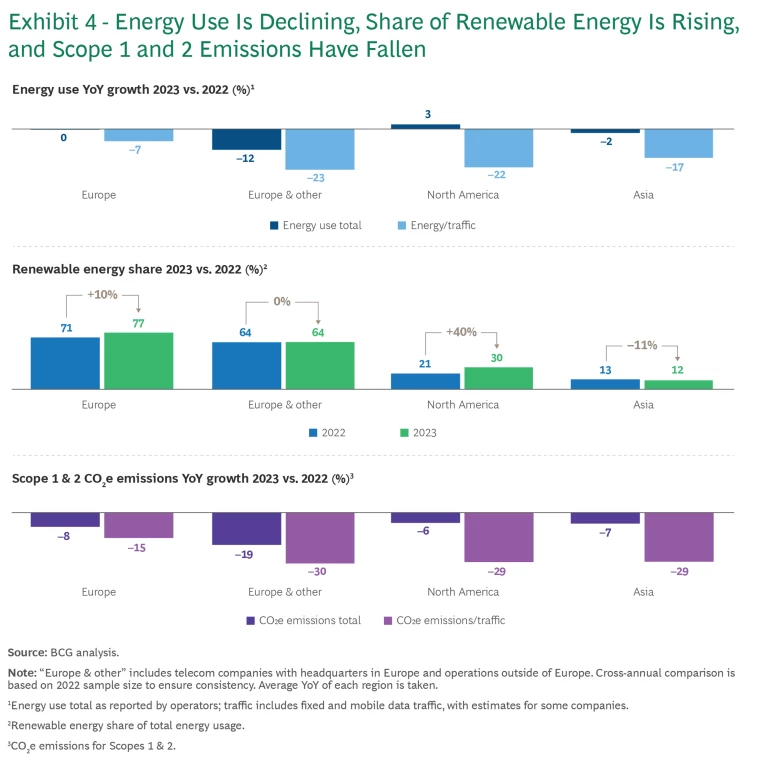

The telecom industry is a significant source of greenhouse gas (GHG) emissions, around 3% to 4% of the global total. So among the most encouraging news in the index is that the industry’s Scope 1 and 2 emissions fell considerably. This is in large part because the share of energy from renewable sources, already high among European telcos, increased further, especially in North America, and Scope 2 emissions made up 16% of the industry’s emissions, compared with just 3% for Scope 1 emissions. (See Exhibit 4.)

These trends were especially impressive in light of the continuing rapid rise in data traffic. Networking improvements, including the move away from legacy networks to more energy-efficient technologies such as 5G, as well as better management of energy demand, have enabled telcos to significantly increase the efficiency of their networks.

So why has the overall median score in this category fallen by 5 points? Primarily because of the industry’s Scope 3 emissions, which accounted for 81% of the industry’s total emissions. Few telcos were able to reduce their Scope 3 emissions, and reporting on some key Scope 3 emissions categories—notably leased upstream and downstream assets—was weak. Scope 3 emissions data is not yet especially accurate today given the low confidence in reporting and variance in methodology. These variances include measurement methodology, the type of suppliers, the data suppliers provide, and the sheer amount of effort telcos must devote to the task to assure high-quality data.

We attribute the reporting challenge not just to growing pressure on other aspects of telcos’ operations, as noted above, but also to the sheer complexity of their upstream and downstream value chain. Telcos are heavily dependent on various suppliers from industries such as chip-making and other high-tech equipment that also struggle to manage and report on their emissions. It’s very difficult to track the rare metals that go into chips and phones, especially when sourced from regions that do not require much in the way of sustainability reporting.

Circular Economy and Resource Management

As with Scope 3 emissions, the telecom industry continues to struggle to provide accurate data on its participation in the circular economy and the amount of waste they produce and recycle. That’s a problem given the different kinds of waste they produce, including mobile phones, home networking products, and various kinds of equipment and materials used in building and maintaining fixed and mobile networks. Much of it is e-waste, which can contain valuable but toxic metals and components.

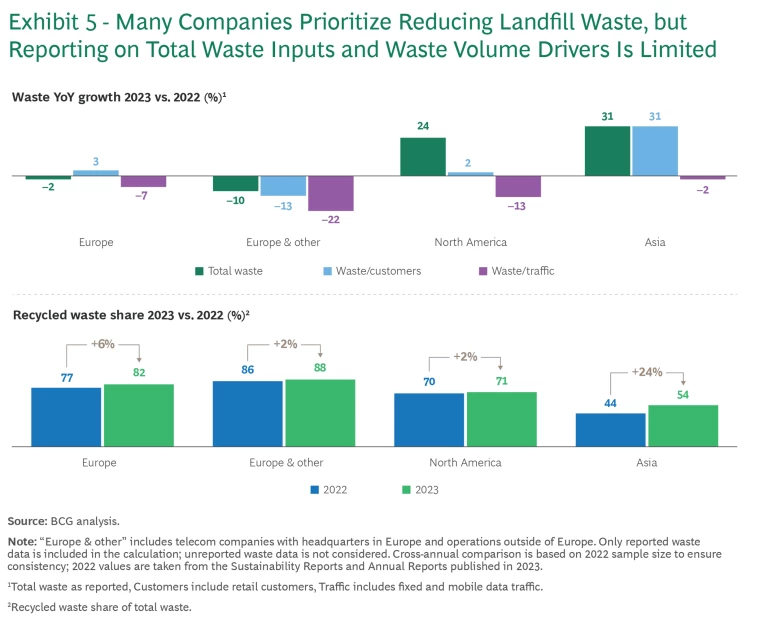

It is heartening that the overall median score in this category rose by 5 percentage points over the prior year’s results. (See Exhibit 5.) This improvement was largely the result of telcos reporting on waste and the amount of that waste that was recycled—which grew by an average of 8%, and by 24% in Asia—as telcos increasingly prioritized the recycling of infrastructure materials and equipment through collaboration and partnerships with downstream users in the value chain. (See “Telefónica’s Virtuous Circle.”) Yet reporting on this category remains inconsistent from region to region and from company to company; it remains unclear, for example, whether telcos are actually recycling more waste or if they are simply reporting on more waste.

Telefónica’s Virtuous Circle

Telefónica’s success in this area can be attributed in part on its willingness to set highly ambitious targets and then work hard to meet them. According to its 2023 annual report, for example, the company is determined to send none of its waste to landfills by 2030—and managed to come close to that goal in 2023, when it reused or recycled 97% of waste, including 4.5 million pieces of electronic equipment. Similarly, the company targeted 90% of consumer premises equipment for reuse by 2024, and by 2023 had succeeded in reusing 88% of it, thus avoiding the need to purchase 3.7 million pieces of new equipment.

Mobile phone collection remains a challenge for Telefónica, as it does for the entire telecom industry. The company has targeted the collection of 20% of the phones it sells or distributes by 2030 but collected just 11% of the total in 2023. Still, it succeeded in reusing or recycling 99% of the almost 500,000 mobile phones it did collect.

By leading the way in circularity, Telefónica has both benefitted economically and put itself in a strong competitive position as the need to meet environmental standards grows in importance.

Meanwhile, despite modest gains, mobile phone collection remained low in 2023, with no significant increase relative to revenue, highlighting the need for stronger consumer incentives. And while telcos vary considerably in the amount of waste they collect, total waste per revenue has stagnated, indicating no major reductions despite revenue growth, pointing to missed opportunities in operational efficiency.

Customer Enablement

In addition to telcos’ internal efforts to reduce their impact on the environment, the industry has the potential to help both its business and retail customers join the fight against global warming. This category tracks the extent to which telcos can enable their customers to lower their own emissions and thus boost avoided emissions. By connecting customers to a range of products and services that can monitor and manage their own decarbonization efforts, telcos can help them improve efficiency, reduce energy use, raise productivity, and allocate resources more effectively. These offerings can also help customers assess their own environmental impact and support the financing via green bonds of sustainability initiatives, such as onsite renewable generation or renewable energy investments.

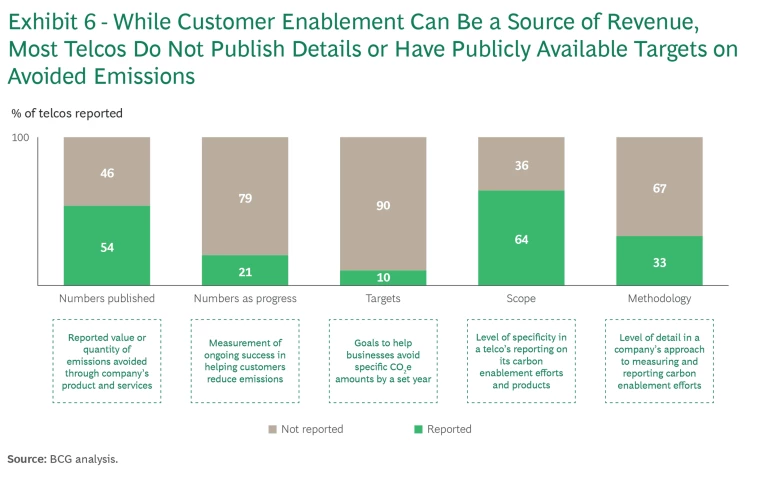

Yet despite its potential as a growth business for telcos, this category remains a weak point, with the overall median score falling 14 percentage points since 2022. This is especially discouraging given that the 2022 score showed a huge increase over the prior year. Only 10% of telcos, for example, say they have targets for helping businesses avoid specific amounts of emissions by a set year. Just over half of companies report on the value or quantity of the emissions they help customers avoid. And only 21% measure their ongoing success in helping customers reduce emissions. (See Exhibit 6.)

On the bright side, the number of telcos issuing green bonds to finance projects and solutions that could help customers avoid emissions, such as onsite renewable generation or renewable energy investment, has increased, bringing the value of these bonds to more than 15% of the industry’s total revenue.

Given the potential for revenue growth through customer enablement, it is surprising that telcos haven’t taken greater advantage of this opportunity. Every telco should be pursuing this goal and doing a better job setting targets and tracking results.

Biodiversity

Biodiversity reporting is an emerging area, particularly in industries such as consumer packaged goods, where its impact is especially direct. Concerns about biodiversity may not seem immediately applicable to telcos, but the need to build physical networks, the growth of data centers, and requirements for the land used to power these assets can have a real impact on the surrounding environment. This year, we began tracking the telecom industry’s progress on biodiversity to emphasize the important role telcos can play in protecting ecosystems and preserving natural habitats.

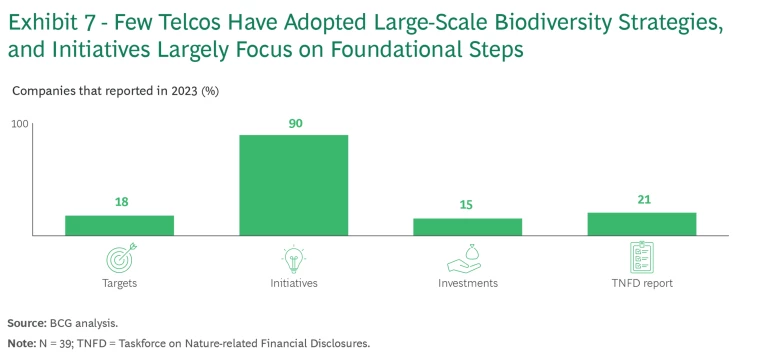

Judging from the results, the industry is just beginning to make progress in this area. While 90% of telcos point to specific biodiversity efforts they are making, fewer than 20% provide data on targets or investments in biodiversity. (See Exhibit 7.)

Yet telcos have been working to improve biodiversity in several important ways. Some are evaluating the impact on biodiversity of infrastructure such as towers, cables, and data centers to identify and mitigate any adverse effects. Others are using digital technology to monitor changes in biodiversity and conservation efforts through clear performance metrics. And some are extending the tracking of their efforts to include the impact on biodiversity of producing materials and components that make up their upstream supply chains.

Canada’s Telus Communications, for example, has set a goal to become a zero-waste, carbon-neutral company by 2030. As part of that effort, the company has established several programs to support biodiversity. Through Veritree, it is helping to restore marine ecosystems through seaforestation (planting kelp, reducing plastics, and protecting species protection). Its Shakti subsidiary has planted almost 5.5 million trees in Canada and is developing digital forestry systems to monitor landscape recovery and biodiversity using Telus equipment. The company is also providing seed money and equipment to Flash Forest to promote its efforts to help forests recover from the effects of fires, including the planting of 500,000 trees.

Catching Up

The overall results of the 2023 index make clear both the telecom industry’s stagnating progress on sustainability and the challenges it faces in accelerating sustainability efforts. The inability to overcome these challenges will soon become a problem for the industry, just as global concerns and actions to improve sustainability become critical.

As the world approaches 2030 and the effects of global warming, excessive waste, and biodiversity loss accelerate, efforts to mitigate and adapt to the impacts will only increase. Policymakers will tighten regulations and demand more reporting and action. Financial institutions, investors, and customers are expected to put more pressure on telcos both to improve their sustainability results and to expand customer enablement efforts. As these initiatives ramp up, telecom industry laggards will find themselves at a real competitive disadvantage in the next few years.

In response, every telecom company must rise to the challenge. To that end, we offer several recommendations relevant to each index category that companies should consider taking.

Commitment to Sustainability

Build a detailed climate transition plan by setting phased targets and collaborating with other stakeholders across the entire communications and technology ecosystem to mitigate climate risks. Expand Scope 3 data collection and reporting through greater collaboration with supply chain partners to cover all categories.

CO2e Emissions and Energy Intensity

Accelerate the transition to renewable energy. Advocate for favorable energy policies and adopt Power Purchase Agreements (PPAs) to secure renewable energy sources, and perhaps consider building your own renewable power generation capacity where possible. Strengthen Scope 3 reporting, especially in partnership with suppliers and emerging regulatory markets such as Asia by aligning with global regulations to improve reporting across the value chain.

Circular Economy and Resource Management

Boost the take-back of mobile phones by shifting from weight-based measurement to device-specific tracking and incentivizing consumer participation with further rewards. Encourage the design of network and customer premises equipment to move towards a more circular philosophy for the entire telco value chain. Take circularity (as well as emissions and biodiversity) into account when making purchasing decisions. Finally, telcos should implement innovative cooling systems in their networking operations. Those with considerable data center operations should manage their cooling systems, including resources such as water, as efficiently as possible by recycling water through closed-loop or alternative systems.

Customer Enablement

Increase transparency into the sustainability footprint of all telco services. Develop and promote clear, easy-to-use frameworks and methodologies for measuring avoided emissions, and track and report on the results. Issue green bonds to develop services that help customers reduce their emissions by measuring the sustainability footprint of the telco services they buy (including customers’ Scope 3 emissions) and addressing the direct energy consumption of the customer operations.

Biodiversity

Develop comprehensive biodiversity strategies, including clear targets and KPIs for tracking progress and aligning with biodiversity goals. Use standardized reporting frameworks such as the Taskforce on Nature-related Financial Disclosures (TNFD) to increase transparency and accountability in biodiversity efforts.

Despite the lack of progress in this year’s index, we believe that the telecom industry still has time to get on the right path to a more sustainable future. Improvements in key areas, notably transparency and reporting, GHG emissions, and recycled waste, among others, demonstrate that the industry can make real gains in sustainability in areas that matter most.

Already, industry leaders are showing that telecom companies can make significant contributions to creating a more sustainable future. And those that do will find themselves well-positioned to succeed in an increasingly competitive business environment—one where sustainability matters more than ever.